- Fund manager brand diversification & sector/asset diversification key to success

- Investors set to miss growth cycles and experience losses in 2024

- Investors taking excess risk being tied to one fund management brand

- Diversification required to maximise protection under Government FSCS protection

In 2023 the Yodelar team analysed more investment portfolios via our free portfolio analysis service, than any other year. Alarmingly we found that an increasing proportion of investors (advised and non advised) are ignoring risk management completely, and simply chasing recent growth sectors, without applying an asset allocation model to their portfolio.

Our team identified that more investors than ever before are taking significant and unknown risks that will be detrimental to their wealth should certain sectors take a downturn.

We found a growing number of mis-informed investors are abandoning a diversified asset allocation model in favour of chasing returns and overloading into sectors that have in recent years performed well, ignoring sectors that have not lately performed as well, but who statistically are more likely to be entering growth cycles.

In this article, we have conducted a thorough analysis of the performance history of 20 main investment sectors. Our aim, to assess the performance cycles within each sector and highlight the potential risks and losses associated with concentrating solely on sectors that have lately performed well. We have also emphasised the importance of not overlooking sectors that may not have performed as well in the past, but are statistically positioned at the beginning of their growth cycles.

This article serves as a comprehensive guide to risk management fundamentals and emphasises the significant role that proper risk management and asset allocation play in efficient investment growth.

Diversification & Performance

There are 2 fundamentals to investing efficiently - (1) applying a diverse asset allocation model to match your risk profile, and (2) identifying fund managers that are suitable, efficient and knowledgeable within the relevant sectors of a suitable asset model.

There are several core global regions and investment sectors that are included in the asset allocation of well diversified portfolios. What percentage is allocated to what region or sector is decided based on an investor's risk tolerance and investment objectives. This balanced, strategically weighted approach is widely recognised as the most risk efficient manner to achieve growth while managing risk effectively.

At Yodelar we are seeing more and more investors and restricted advice firms neglect this diversification principle in favour of making investment decisions that are led by past trends. For example, a particular sector may be experiencing a downturn, while another is on the up. Self investors or advice firms under pressure from clients are re-adjusting portfolio(s) to weigh more heavily in the regions or sectors that at the time are performing well, ignoring sectors that may be exiting a downturn cycle, and statistically due to commence an upturn cycle.

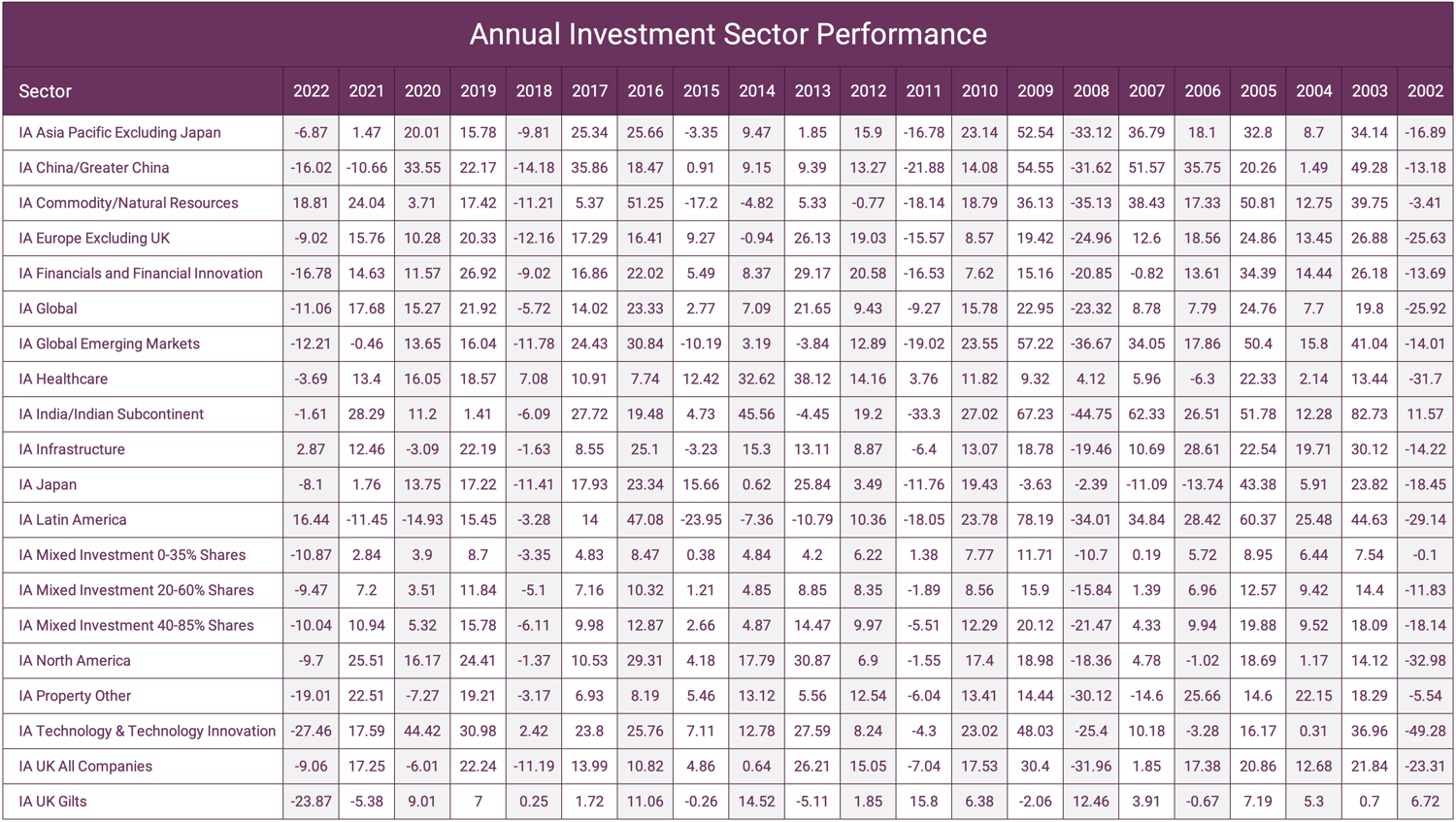

The table below shows how 20 of the most popular Investment Association sectors, and how they have performed each year over the past 20 calendar years.

For the majority of the past 20 years most of the sectors averaged annual growth, but as can be seen in the below table, there have been several years that resulted in large losses for many, with 2022 being the most recent with all bar 3 sectors in negative territory.

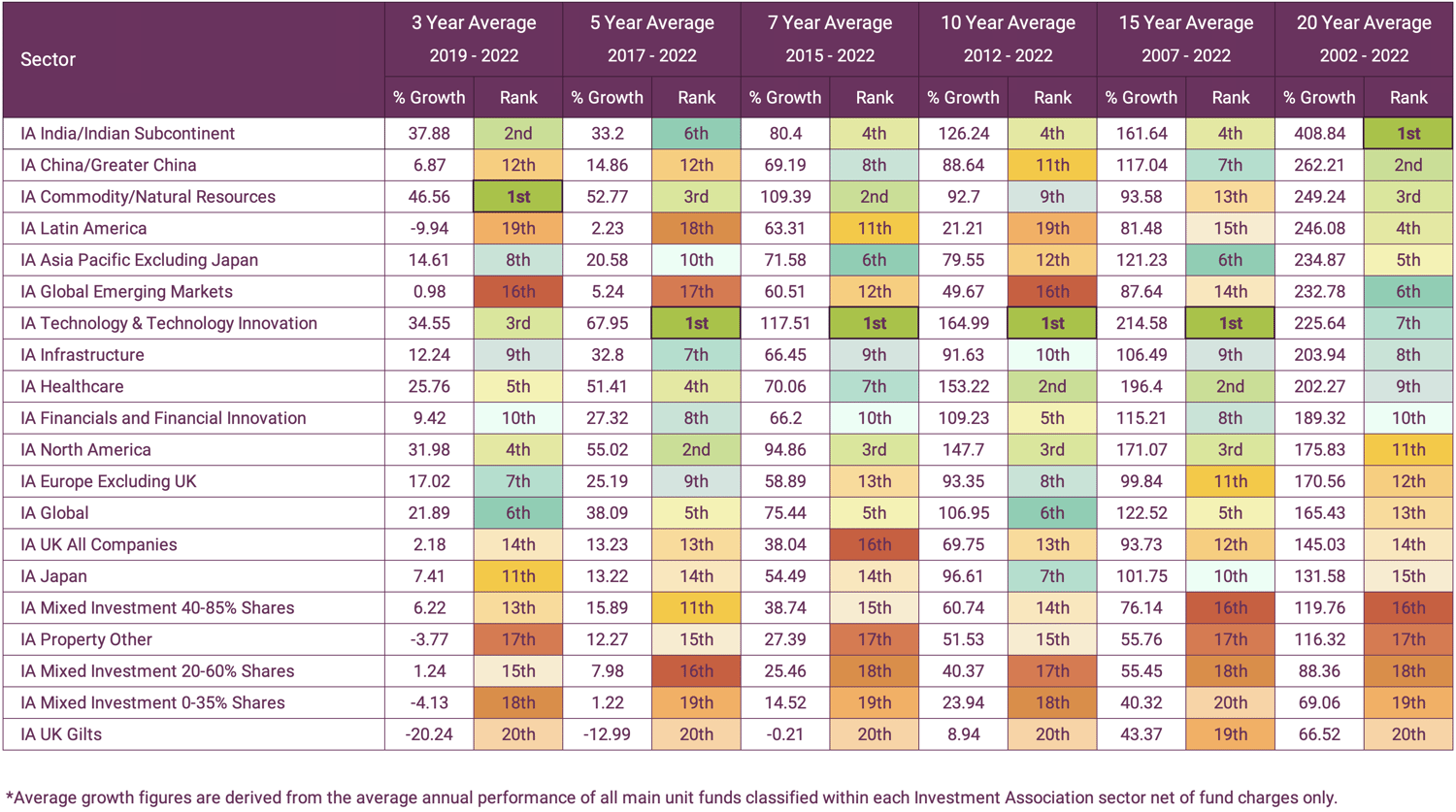

Furthermore as demonstrated in the table below, the technology sector has consistently delivered some of the highest returns over the past 15 years, with India the region that has the highest average returns over 20 years. The below table shows that over different periods different regions and sectors have experienced differing results, highlighting the importance of diversification.

Technology has driven investment growth over the past 2 decades with the 'IA Technology & Technology Innovation' sector returning the highest sector average over 4 of the 6 periods analysed. Despite the strong performance history of technology funds, many investors chose to offload technology focused funds from their portfolios in 2021/22 after their values took a significant drop. This resulted in many investors selling off funds with a history of strong performance cheaply after much of the valuation drop had already occurred and moving into funds whose holdings were in sectors such as consumer staples that were perceived as safer during that period.

However, the technology sector quickly recovered and ended 2022 with the 3rd highest average return. In 2023, the sector was the top performer. In contrast, many of the fund's investors replaced the technology focused funds with were hit hard by the subsequent rise to inflation and interest rates, resulting in a double blow.

This is a recent example of how investors try to time markets by buying after growth, selling after losses, moving across asset classes at the wrong time, missing any upturns and end up facing multiple downturns.

The Trap of Overloading

In the pursuit of growth, it can be tempting for investors to neglect a diversified asset allocation model and direct money towards sectors or regions that are performing well. But this can result in overloading (when a portfolio becomes heavily weighted towards one asset class). Such an approach can unwillingly lead to a portfolio assuming a significantly increased level of risk. Although the intention is to benefit from that particular market's current performance it would result in exaggerated losses should that one region or sector experience a downturn.

Overloading has become increasingly prevalent in the investment portfolios of UK investors. But this is not solely a result of decisions made by investors. It is also common for advisers to recommend funds that have a Global investment strategy, such as multi asset funds or funds classified within the Global sector such as the Fundsmith Equity fund. Such funds are often heavily weighted towards one region and lack diversification with the above 2 funds containing 70%+ in North America alone.

When challenged such fund managers will highlight that North America has some of the greatest businesses in existence today. That may be the case, but that does not make them impregnable to market downturns. Using the above example, North America has experienced 6 bear market periods alone this century.

North America is and will always be a major investment region but a portfolio's weighting in this asset class should be suitably balanced as part of an overall risk model and investment strategy.

In a well defined asset allocation model an exposure to North America in a risk profile 7 out of 10 (10 being the highest risk, 1 being the lowest) should be no more than 25% according to many of the leading risk analysts. It is important to understand the underlying holdings of all your funds, to ensure this is not exceeded. The above mentioned funds may be good performing funds but should be best considered as a part of an overall portfolio not as an entire portfolio.

Our findings identified that when investors are proportionally invested in one asset class they are also likely to be invested with one fund management brand. Taking into account the Woodford debacle , this should be a red flag to any investor. It is worth remembering that under the Governments Financial Services Compensation Scheme, investors are only protected up to £85,000 per brand name.

Some forecasts are predicting a recessionary period in North America with the risks of a downturn. It would therefore be prudent for investors (particularly those with limited time horizons) who are overweight in this region to re-evaluate their portfolios to mitigate against the potential risks from overexposure.

No single equity style, sector, country or region will outperform all of the time. Diversification remains the single most important aspect of investing. Global diversification spreads a portfolio's weighting across different countries and currencies to offset the risk of investing in just one region or country. Globally-diversified portfolios are vital to long-term investment success as such an approach will mitigate the impact from inevitable market movements.

Book a no obligation call with a Yodelar Investments adviser to find out more about our range of quality, risk modelled and fully diversified portfolios.

Chasing Poor Performance

Successful investing is not reliant on chasing or reacting to current trends, but from maintaining a strategically risk balanced portfolio of high quality funds over a medium to long term investment horizon.

Throughout history, many global regions and markets have experienced a sharp performance reversal without a clear catalyst - such as the tech stock crash in early 2000. Many investors had overloaded in North American funds with a high weighting in technology stocks in the late 1990s only to find themselves overexposed when the bubble burst, leading to painful losses.

Even when markets fall, if a portfolio contains high quality funds that are managed by consistently top sector ranked fund managers, losses will recover provided investors remain in the market over a sufficient time frame. Investors who make decisions based on short term trends will be negatively impacted and will experience significant losses for 2 reasons:

(1) Overloading increases the pain when that market experiences a sharp downturn as an overweight portfolio will lose a greater percentage of its value.

(2) Investors who overload into trending asset classes are more likely to abandon the asset class they were over-reliant on if it does drop in value. This locks in any losses and relinquishes the potential gains from a market the recovery.

Missing Growth Periods

Historically, timing markets and investing based on short term trends is a sure strategy for missing the best days or correction days in the various sectors/ markets.

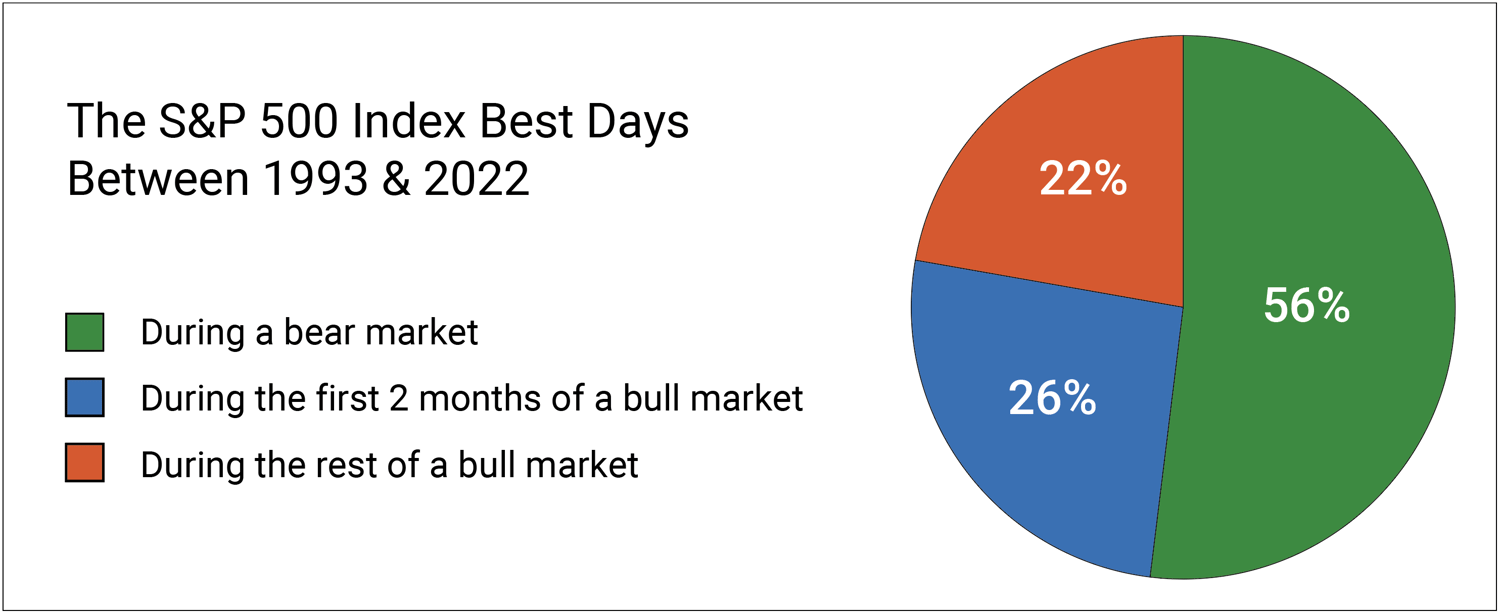

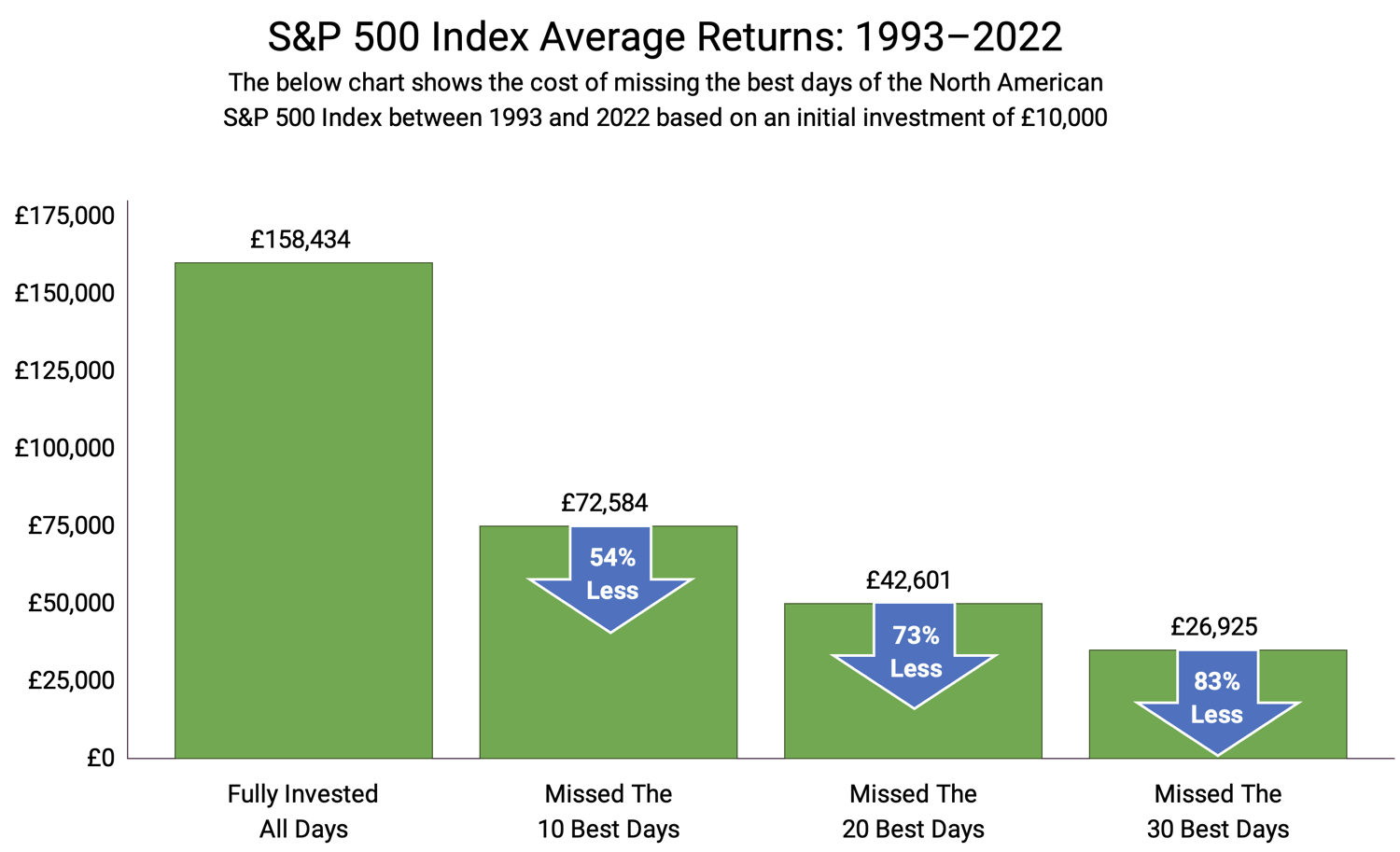

The below chart shows 78% of the S&P 500 Indexes best days occur during a bear market or during the first two months of a bull market.

If you missed the market’s 10 best days over the past 30 years, your returns would have been cut in half - and missing the best 30 days would have reduced your returns by 83%.

Many Investors Have Abandoned China - Will They Miss Out?

One of the major regional asset classes that many strategies have abandoned in recent times is China. This may seem unsurprising as the region has endured sizeable sustained losses since 2021.

Chinese equities peaked in value in February 2021, but since then they have experienced a prolonged period of decline with values dropping by 53% up to 13th December 2023. Whilst this represents a significant valuation shift, it is not uncommon during bear markets and periods of extreme volatility.

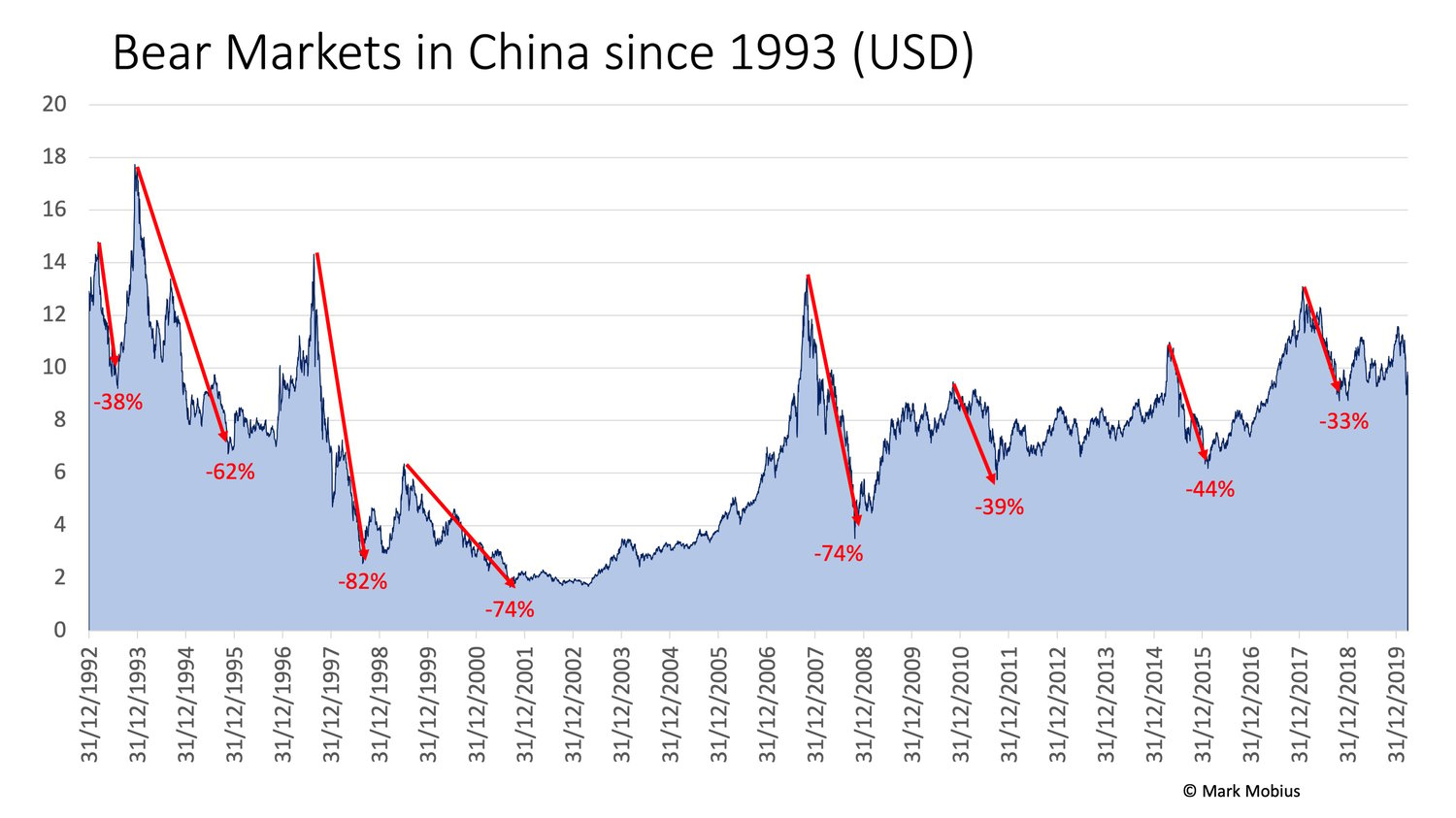

We found that over the past 30 years the Chinese equity market had experienced a total of eight bear markets prior to the current one, averaging a decline of 56% and ranging between a low of 33% to a high of 82%. The average length of time was 14 months with the longest period being more than two years and the shortest five months. The current Chinese bear market is almost 2 years long.

Based on past market history, the current Chinese bear market may be nearing its end, which could represent a huge upswing for investors in the region, an upswing that those who have abandoned the asset class will miss. Analysts from Goldman Sachs believe that Chinese equities may be set for the first index gains in years in 2024.

History shows that when Chinese markets recover, they recover fast so whilst the current period is undoubtedly an uncomfortable one for investors in the region there is significant potential for recovery and growth. It is important to note that over the past 20 years the sector has averaged growth of 262.21%, which is the 2nd highest of all 20 sectors analysed in this report.

Investing Is About The Destination, Not The Journey

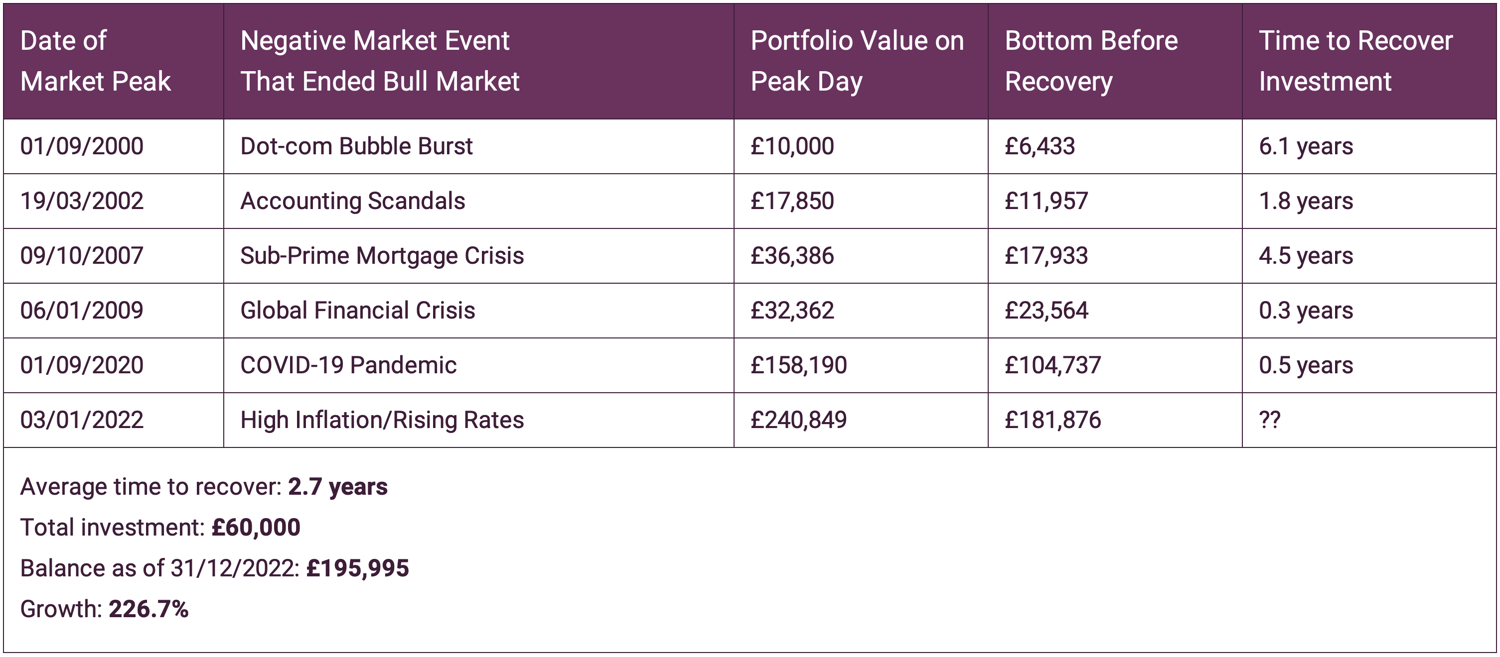

Successful investing involves diversification, patience and time. In the table below we show how remaining invested during all market cycles since the start of the century can result in profitable gains. For this example we reviewed the most recent bear markets in the S&P 500 Index.

As the table above demonstrates, even if you had the worst possible timing - meaning you invested £10,000 on each of the six peak days immediately before a bear market began - your investments would have lost value initially. However, they would have always recovered in time. The above table shows an investment of £60,000 over the course of the periods highlighted would have grown to £195,995 by the end of 2022.

Even if you had invested at the worst-possible times, the amount you invested would have more than quadrupled in time. Throughout history markets have always rebounded from previous downturns 100% of the time. Overloading into the best performing asset classes of the moment make such returns practically impossible.

In short, for long-term investors who have the time horizon to weather ups and downs, the length of time you’re in the market matters far more than the point in time at which you begin investing.

Conclusion

No organisation, expert, professional or amateur truly knows when markets will rise and fall. For that reason alone true diversification is the only way to maximise returns while managing risk effectively. Astute investors keep their eyes on long term outcomes through diversification and by weathering inevitable investment cycles rather than hopping in and out of sectors based on short-term performance that often prove fleeting.

At Yodelar, we have completed over 30,000 portfolio analysis and have witnessed first hand the proclivity for investors to shift the weighting of their portfolio towards asset classes that are currently performing well without the understanding that this will often unbalance their portfolio and increase risk.

Discipline and diversification matter most to grow wealth during bear and bull markets. History has demonstrated that the best outcomes come from resisting the temptation to abandon core markets or sectors that may be performing poorly in favour of loading into those that are experiencing, or worse have come to the end of an upturn cycle.