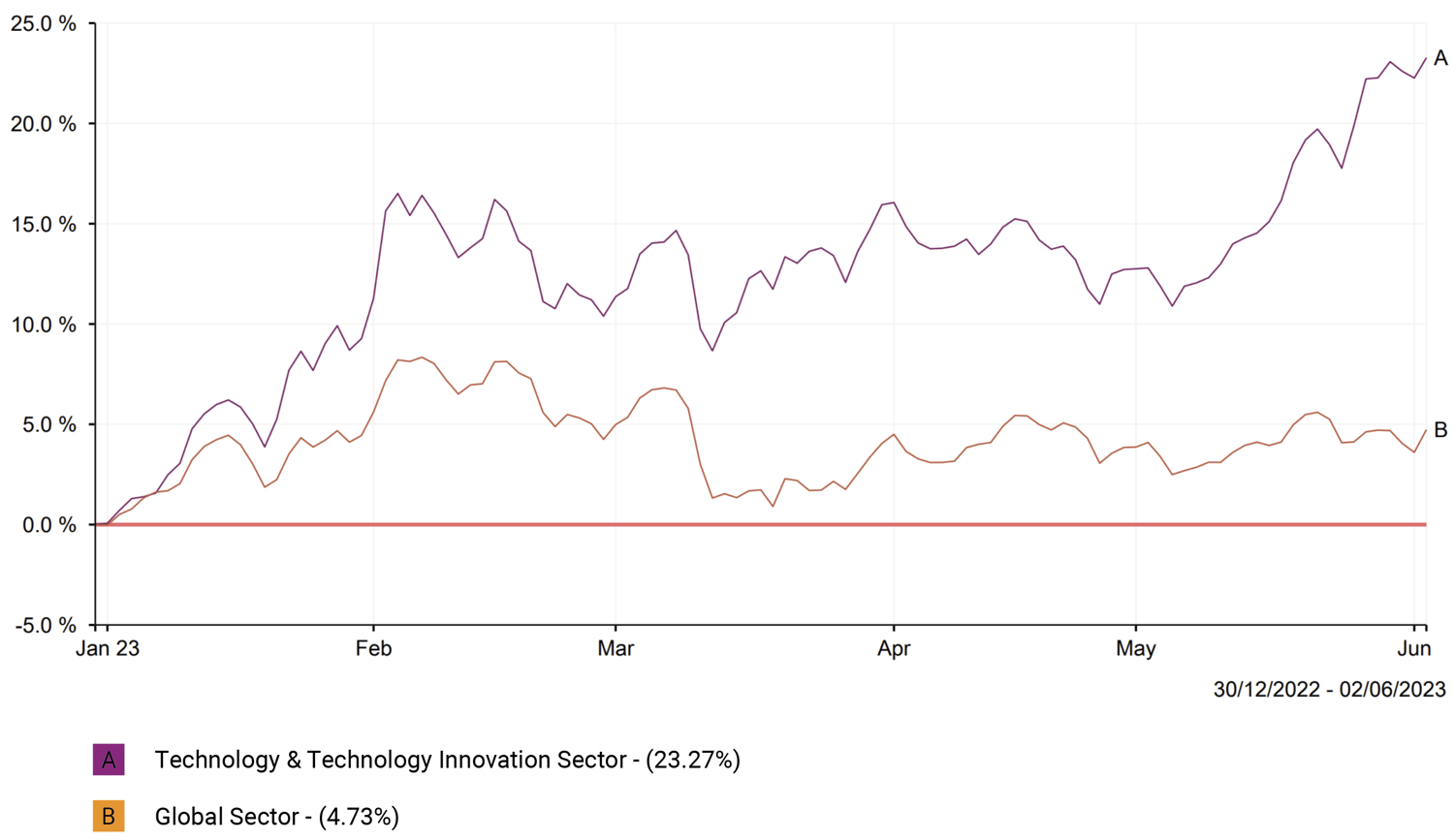

- There are growing signs technology funds are entering a bull market. In May alone, the sector averaged growth of 9.39%.

- Over the past 6 months the technology sector has averaged the highest returns from all 56 investment association sectors

- Technology sector funds averaged growth of 23.27% in the first 5 months of 2023, recovering most of the losses of 2022 (-27.46%)

In the midst of a highly volatile 2022, many investors chose to dump technology stocks in favour of less volatile and more stable value-oriented funds. This was driven by concerns surrounding overvaluation and a perceived downward trajectory of technology funds. But the landscape is rapidly changing and recent data shows that now is the time for such investors to reassess this decision - and quickly.

Over the past six months, the technology sector has bounced back and averaged the highest growth among all 56 investment association sectors. Market analysts and economists alike, now see the end of 2023 as a period where markets enter into a bull market phase, and while this will be rewarding for all investors, it will be those with a weighting in growth oriented technology funds that are more likely to see the highest returns.

In this article we will explore the performance data that indicates an imminent resurgence in the technology sector and identify the top performing funds in the sector.

Technology Funds On The Cusp of A Bull Market

2022 presented significant challenges for technology stocks, with various headwinds impacting their performance. However, it is becoming increasingly evident that technology stocks are now about to enter a bull market.

Over the past 6 months the Technology & Technology Innovations sector has averaged growth of 14.39%, which was the highest of all 56 investment association sectors. The performance over the past 6 months has been so strong that the sector now ranks as the top performing over the recent 1 year, even though in the first half of this period the sector averaged losses of -0.41%. The strength of recent performance further reaffirms the fact that technology stocks are beginning to re-establish a strong upward growth trend.

For investors who abandoned technology stocks when they fell out of favour in 2021/22, now is the time to seriously reconsider their strategy.

Despite the current high interest rate climate and U.S recession concerns, the return to growth of technology based funds suggests that prices are only going to rise. Therefore, there is a real risk that any savings gained by investors who chose to remove technology funds from their portfolios when they were on a downward trajectory will quickly be eroded as they are increasingly likely to recover at a rapid pace.

Technology Funds On The Rise

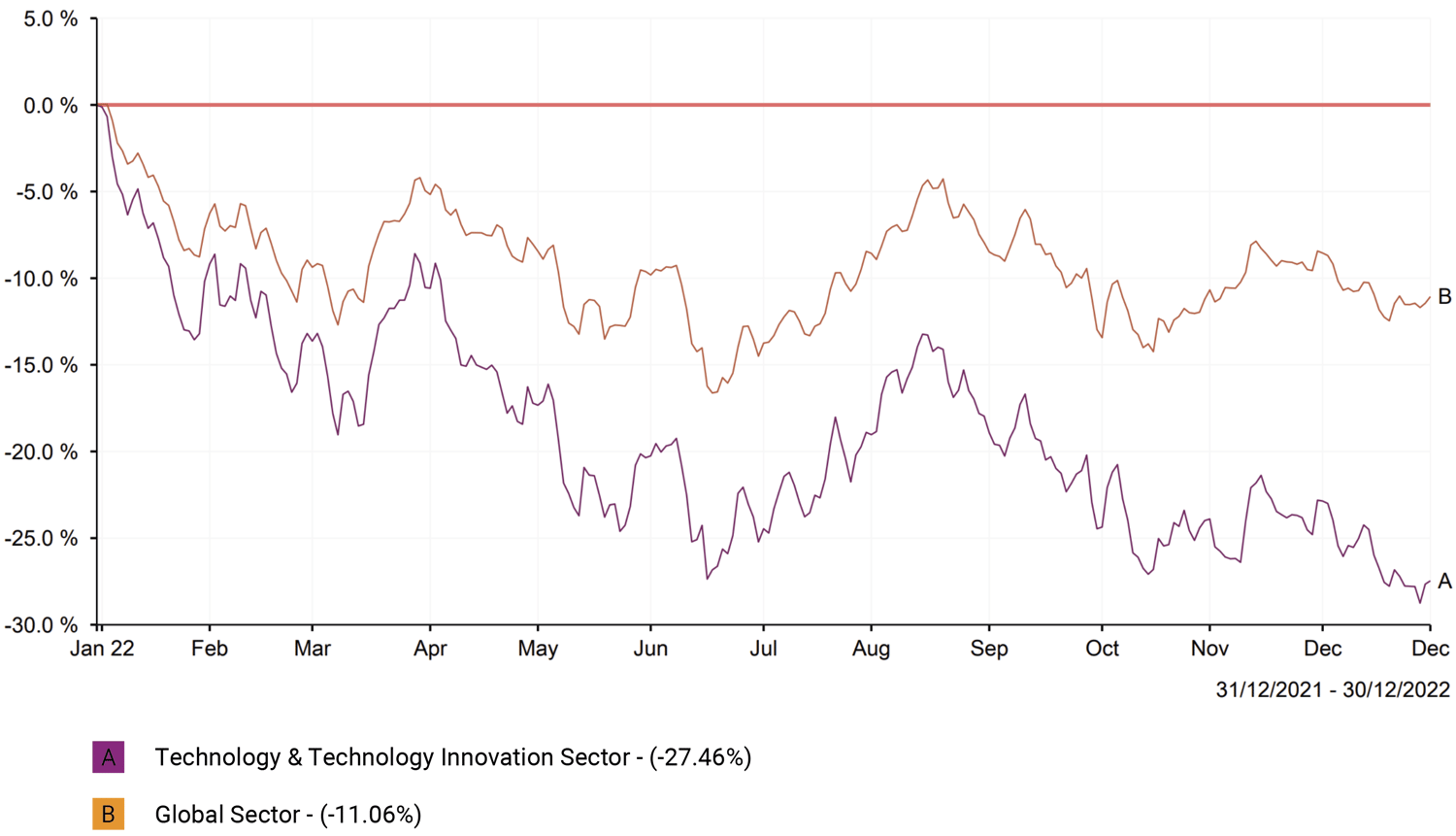

Last year was a bad year for almost all investment sectors, with none suffering more so than the Technology & Technology Innovations sector. The sector finished the year with negative average returns of - 27.46%, which was considerably worse than the Global sector which also endured a rough year.

The sector finished the year with negative average returns of - 27.46%, which was considerably worse than the Global sector which also endured a rough year.

Since the end of 2022, Technology funds have rebounded and in the past 5 months alone the sector averaged growth of 23.27% - and this continues to climb.

Top Performing Technology Funds

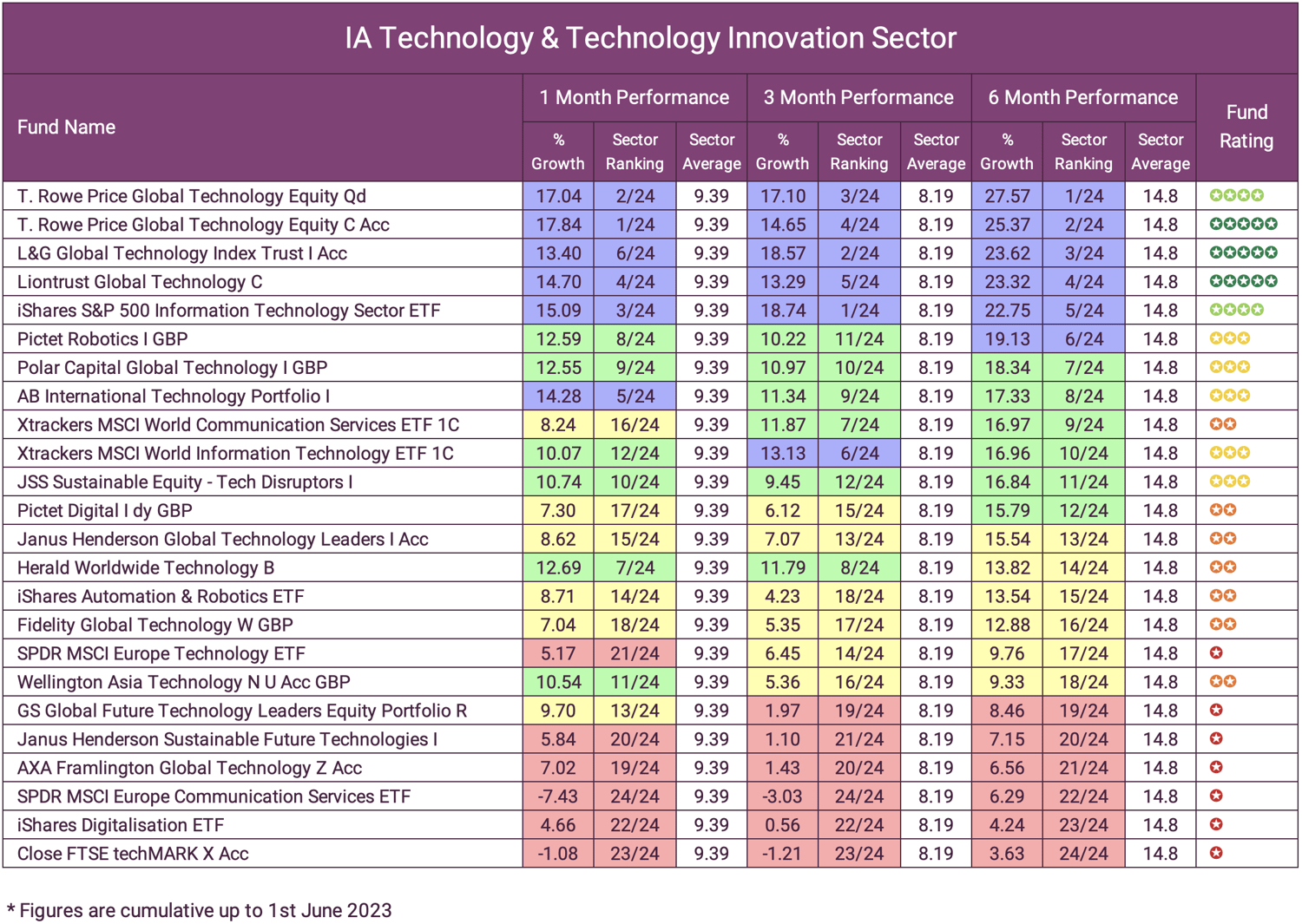

The table below details the performance, sector ranking and 6 month rating for all main unit funds classified within the IA Technology & Technology Innovation sector.

When analysed alongside all 4,715 sector classified funds from 56 different sectors, 12 of the highest growth funds over the past 6 months are from the IA Technology & Technology Innovation sector. Over the past 1 month, 9 of the 10 highest growth funds are from this sector.

History Shows Technology Funds Recover Quicker

For the past 50 years, technology stocks have been a nearly unstoppable force in the market. During that same stretch, technology products and services have increasingly dominated our lives.

As a result, funds with a heavy weighting in technology stocks have developed a tendency to bounce back quickly when the sector gets hit hard.

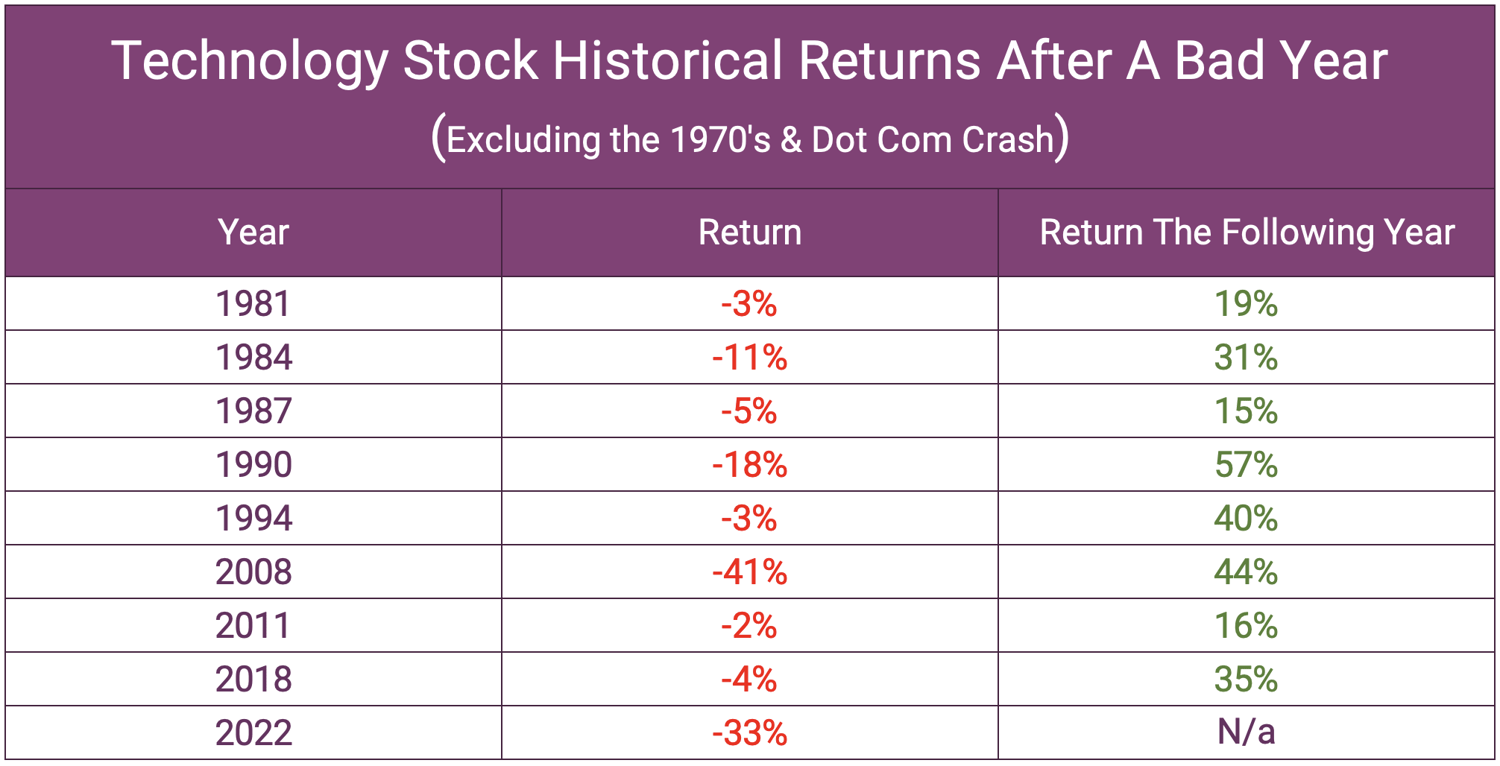

Since 1970, whenever technology companies have had a bad year, they almost always rebounded vigorously the following year.

- In 1984, the tech-heavy Nasdaq dropped 11%. The next year, it popped 32%.

- In 1987, the Nasdaq fell 5%. The next year, it rose 15%.

- In 1990, the index shed 18%. The next year, it soared 57%.

This was repeated for 1994/95, 2008/09, 2011/12, and 2018/19. Pretty much every time the Nasdaq (American stock exchange and home to the world's largest tech companies) drops in any given year, it rebounds in a huge way the following year.

The only exceptions were in the early 1970s and early 2000s. But in the early 1970s, technology stocks declined in back-to-back years because of rising inflation. But the key difference now is that inflation has peaked and beginning to fall.

Peak Inflation Tends to Spark Massive Rallies for Technology Funds

One of the biggest reasons technology funds had such a tough 2022 was because of the sharp rise in inflation. But inflation has now peaked, and that should help propel a major tech stock rebound in 2023.

In the past, technology stocks have always soared during the 12 months after “peak inflation” in an inflationary cycle.

The U.S economy has undergone three hyper-inflationary periods over the past 50 years: The mid-1970s, the early 1980s, and the early 1990s. Each time, when inflation peaked in that cycle, tech stocks soared over the next 12 months.

- Inflation peaked in November 1974. Over the following 12 months, tech stocks rose by about 25%.

- Inflation peaked in March 1980. Over the following 12 months, tech stocks rose by about 70%.

- Inflation peaked in October 1990. Over the following 12 months, tech stocks rose by about 60%.

The pattern is clear. When inflation peaks, tech stocks soar.

Inflation peaked in this cycle in 2022. History says that tech stocks should soar in 2023 - which is exactly what we are now seeing.

One of the best reasons why technology funds are so attractive is because the large negative returns of 2022 has left them with low valuations. Whenever technology funds do get this cheap, the odds are highly favourable that they’re going to push higher in a big way. For this reason alone, investors who ditched tech funds last year must seriously reconsider their strategies.

Why Funds With A High Weighting In Technology Companies Are Poised To Deliver Huge Returns

The sharp upswing in technology fund performance has caught some by surprise but there are a number of reasons other than peak inflation as to why this has happened:

Strong Fundamentals and Earnings Potential:

Despite the setbacks in 2022, many technology companies maintained strong fundamentals and exhibited robust earnings potential. Market analysts' reports highlight the resilience of established technology giants and the emergence of promising startups. As these companies adapt to market conditions, refine their strategies, and capitalise on evolving trends, their earnings potential is expected to fuel a resurgence in the technology sector.

Technological Advancements and Innovation:

The technology sector thrives on innovation, and despite the challenges faced in 2022, technological advancements continue to rapidly emerge. The emergence of technologies such as artificial intelligence is revolutionising industries and creating new growth opportunities. Companies at the forefront of such advancements will drive the next wave of growth.

Investor Sentiment and Positive Outlook:

Investor sentiment plays a pivotal role in driving market trends. Despite the challenges faced last year, reports indicate a growing positive sentiment towards technology stocks. Investors recognise the potential for future growth, given the sector's track record of innovation, resilience, and long-term value creation. This optimistic outlook, combined with increasing investor confidence, sets the stage for a bull market in the sector.

Huge Growth Opportunities Ahead

Last year, UK investors exhibited caution by shifting away from technology stocks in favour of less volatile value-oriented funds. Concerns surrounding overvaluation and a perceived downward trajectory led to the abandonment of technology funds. However, as identified in this article, recent data shows that the time for such investors to reassess this decision is now.

As identified in this article, the technology sector has bounced back and averaged the highest growth among all 56 investment association sectors over the past 6 months. Analysts and economists alike now see 2023 as a period where we enter into a bull market phase, and while this will be rewarding for all investors, it will be those with a weighting in technology funds that are more likely to see the highest returns.

Getting The Most From Your Portfolio

Where there's a crisis, there’s also opportunity. The stock market was hit with a major crisis in 2022, but there are now major opportunities ahead. As the global economy recovers, technology companies are poised to lead the way, driving growth, innovation, and value creation. Investors who recognise the potential of technology stocks and position themselves strategically stand to benefit from the anticipated bull market.

However, it's important not to put all your eggs in one basket. Diversification is essential to maximising opportunities and maintaining efficiency. Research has shown that having a diverse portfolio of high quality funds across different markets and asset classes improves long term portfolio returns. Through continuous research and data analysis Yodelar provides investors with the opportunity to invest in suitably risk rated portfolios created to maximise opportunities efficiently.

Book a no obligation call with one of our advisers to find out more about our portfolios.