In the pursuit of growth, an increasing proportion of investors have become over-reliant on the success of one asset class. Over the past few years, North American equities have been the highest growth asset class with the funds within the Investment Associations North American investment sector averaging growth of 106% this past 5 years, even after the Covid19 induced market crash of March 2020.

The difference in growth compared to other investment regions has been so significant that investors have begun to disregard the balance of their portfolios assets and weigh their portfolios heavily in North American equities.

This approach, although potentially rewarding in the short-term, can greatly increase a portfolio’s risk and have costly implications. In this report, we identify why betting on one asset class over another is destined to fail and how diversification is key to an investment portfolio’s long-term stability.

The Importance of Global Diversification

No single equity style, sector, country or region outperforms all others all of the time. Global diversification spreads risk amongst countries and currencies to offset the risk of investing in just one region or country. As such, globally-diversified portfolios are vital to long-term investment success.

Being able to spread your risk across various countries shields investors from country-specific conflicts and regulations. In this way, if one country struggles economically due to regional issues, your portfolio will feel that it affects less.

Why You Should Not Bet On One Region Specific Asset Class

It’s nearly impossible to pick and choose which asset classes will be top performers at any given time. While one particular market may outperform others one year that doesn’t mean it will continue to do better than others over the long-term.

Nobody knows with any degree of certainty what asset classes and global markets will be the best performers next year. Therefore, the most efficient way for investors to capture the returns of the markets is to invest with diversity and spread their portfolios assets.

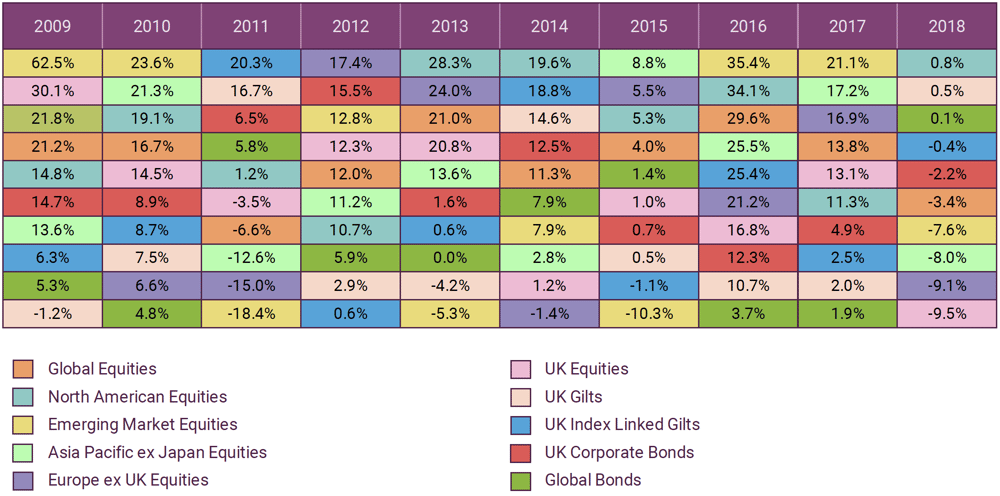

The figure below shows the performance of various asset classes over a 10 year period. For example, if you invested in emerging market equities in early 2011 following a period of strong returns the previous 2 years, you would have been disappointed to see the asset class fall to the bottom of the rankings that year.

Source: Vanguard calculations, using data from Barclays Capital and Thompson Reuters Datastream.

Failure To Spread Assets Can Greatly Increase Your Risk of Losses

A consequence of favouring one asset class and investment market such as North American equities is that over time, as the assets within your portfolio move to varying degrees the balance of a portfolio can shift.

For example, using the asset allocation of the popular Vanguard LifeStrategy 60% Equity fund, along with the average growth of the sectors within those asset classes over the past 5 years, if left unattended the portfolio’s weighting in North American equities would have shifted from the intended 28.05% to 42.95%.

This is just by using the average returns as a base, but if the North American equity portion was represented by the popular and consistently top-performing Baillie Gifford American fund, it would have shifted the portfolio’s balance in North American Equities from 28.05% to 43.68% in just 1 year. This shift in balance would have a notable impact on the portfolio’s risk rating.

The 3 main asset classes Defined

The 3 primary asset classes that oversee the majority of a portfolio’s asset allocation are:

1. Cash / Money Markets

2. Fixed Interest / Gilts & Corporate Bonds

3. Equities

Cash / Money Markets

Cash / Money Markets are a low-risk form of investing with their relative safety the main attraction. However, interest rates on cash investments are at historically low levels, and this low interest can be further eroded by inflation. So, while the absolute value of a cash investment may not fall, the real value – or its ‘purchasing power’ – could fall over time. For this reason, many see cash investments as a safer haven, primarily for the shorter term. Having an element of cash within a portfolio will help to reduce the portfolios overall risk, but it also reduces the portfolios growth potential.

Fixed Interest / Gilts & Corporate Bonds

Fixed interest investing is where the funds you invest in make a loan, either to a government or a company. In the UK, loans to the government are typically known as ‘gilts’ (UK government bonds) and loans to companies are typically known as ‘corporate bonds’. In a pension or an ISA we generally access these options by investing in a fund which then invests in a portfolio of underlying corporate bonds or gilts. The government, or company the fund you’ve invested in has lent money to, agrees to pay interest until the end of the loan term, at which point they aim to pay back the money lent to them.

The underlying gilt or bond may have a set loan term, but you don’t need to hold that investment throughout. You can typically invest or withdraw your money during the loan term, during which time the value of the gilt or bond can go down as well as up – driven by investor demand. So, while fixed interest investments are perceived to carry a degree of certainty when it comes to growth, they can also return losses.

Equities

Equities is another name for shares issued by companies. You can invest directly in one company, but for most investors, the favoured way to invest in equities is through a fund managed by an investment manager. Such funds can invest in dozens, even hundreds of different companies, which helps to spread the risk. Equities are filtered into particular sectors based on their regional allocation, for example, an equity fund that invests primarily in UK companies is classified as a UK Equity, one that invests in companies in developing countries is classed as an Emerging Markets Equity.

Therefore, In order to have a diversified portfolio, it is common to invest in a range of funds across different equity markets. Equities typically have the highest risk of the 3 asset classes but they also offer the greatest opportunity for growth.

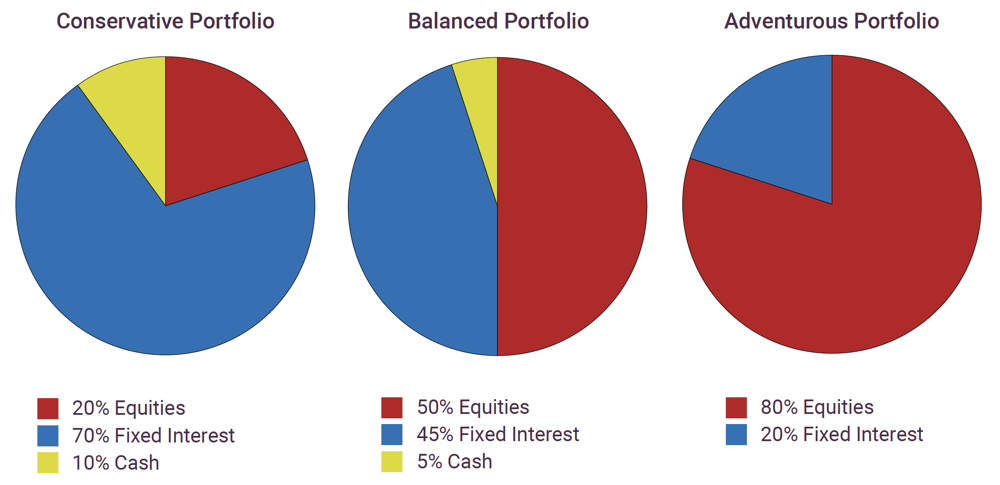

Defining A Portfolio’s Asset allocation Based on Risk

The chart below provides a hypothetical asset allocation for 3 different investment profiles. It’s important to note that there are many different types of asset allocation models each with their own merits. The illustration below is merely an example of 3 basic asset allocation models. They illustrate how an asset allocation mix may vary depending on each investor’s goals and their attitude to risk and are categorised into three portfolio types:

-

Conservative

The conservative portfolio has a low proportion of equities and may suit those with low-risk tolerance and/or a short time to invest.

-

Balanced

The moderate portfolio has a lower percentage of equities compared to bonds and may suit investors with medium risk tolerance and/or a medium investment time frame.

-

Adventurous

The adventurous portfolio, with a high proportion of equity-based investments, may suit investors with high-risk tolerance, and/or those with a long investment time frame.

Finding The Right Balance For Your Portfolio

For most, a broadly diversified portfolio of equities and fixed interest bonds, that is annually or semi-annually monitored and rebalanced will produce a reasonably structured portfolio that is both controlled and cost-effective. Cost efficiency is also important to consider as rebalancing often involves transaction and tax costs, which is why an annual or semi-annual rebalancing is the most common. However, much depends on the circumstances of each investor and the rebalancing strategies they adopt.

Efficient investment advice firms can add value by helping an investor set an appropriate strategy for periodically rebalancing their portfolios in a non-emotional, cost-effective and impartial way.

How to rebalance your asset allocation

Portfolio rebalancing can be an emotional decision for investors, requiring the selling of currently outperforming assets to buy currently underperforming assets. But it is essential to maintain a structured, planned investment strategy that is prepared for all conditions.

In order to rebalance your portfolio's asset allocation, you may need to sell some investments and buy others, to ensure the mix suits your goals and your attitude to risk.

You can rebalance your investment portfolio in three ways:

1. Reinvest dividends. Direct dividends from the asset sector that has exceeded its target into one that has fallen short.

2. Top-up. Add money to the asset sector that has fallen below its target percentage.

3. Transfer. Move funds between asset classes. Shift money out of the asset sector that has exceeded its allocation target into the other investments.

When you rebalance, you need to think carefully about the costs and tax implications. For example, when buying equities or bonds, you will have brokerage costs and with some pooled funds you may be asked to pay an entry or exit fee. You may also have a capital gains tax liability if a sale of assets means you go above your annual allowance. When deciding whether or not to rebalance, you and your adviser should weigh the benefits of adhering closely to your asset allocation strategy, with the costs of rebalancing too frequently.

Don’t Sacrifice Balance For Growth

Many investors spend substantial time defining their investment goals and selecting an asset allocation to help them achieve those goals while also being mindful of their tolerance to risk. To meet their objectives they must be able to stick with an appropriate investment plan in all kinds of markets.

But for some, the lure of performance can lead them to make investment decisions that can have huge implications. For instance, when a particular sector such as the North American or the Technology sectors performs strongly, investors without a disciplined rebalancing strategy may be tempted to abandon their strategic asset allocation to increase their exposure to these markets. But such an approach makes investors vulnerable to a market correction, which could have a huge impact on their chances of meeting their financial goals.