In the first quarter of 2021 there were concerns among some that the huge growth of technology companies over the past several years had caused their valuations to peak. This feeling quickly spread across stock markets and created panic that prompted many investors to sell-off high quality funds in their portfolios due to their weighting in these technology funds.

This reaction meant many investors sold funds that have consistently outperformed the markets over the short, medium and long-term in favour of funds with a greater weighting in sectors that had been hit hardest by the pandemic even though many lack quality and had a longterm history of underperformance.

One of the funds investors sold off was the consistently exceptional Baillie Gifford American fund. This fund has continuously topped the sector rankings for performance by a wide margin with its heavy weighting in technology companies a big factor in its performance. Despite the proven quality of the fund it was one of the most sold funds in the first quarter of the year with investors choosing to ditch the fund in favour of lower quality funds that had a different strategy that they believed may better suit the current market - in essence, trying to time the market.

However, the problem is that it is impossible to predict exactly when, by how much, and for how long a fund may drop in value. In most cases panic decisions are made after the primary market movement has occurred. So, when investors do sell a fund, it is often after it has experienced the initial, and often sharpest drop in value and not when its value has ‘peaked’. In this instance, once sold, many investors bought funds that were perceived as ‘value’ funds, which apart from a few, were typically low quality, under performing funds that had holdings in companies that might have been hit hardest been hit hardest by the pandemic. The belief being these funds had greater growth potential as the pandemic and restrictions subsided.

Making such decisions is in essence trying to time market movements. It is a risky strategy that can prove extremely costly.

Timing Investment Markets

For some investors the initial decision to sell off the funds that had performed the best in favour of lower quality ‘value’ funds may have seemed like the right decision as in the short term they saw a rise in growth compared to technology heavy funds that were experiencing a drop in growth. This only fuelled the belief that selling the funds for lower quality ‘value’ funds was the right strategy.

But what has been missed by many, is that the industries and sectors that have driven growth in the medium to long-term have done so as they best align with what people want which has been guided by the increasing dependency on technology and convenience based services. These industries have made the world a very different place to how it was even 2 decades ago, as our lives are now reliant on such services, which makes their continued advancement all but certain.

To ditch the top funds ingrained in these sectors in favour of deficient funds that have stumbled into a period of growth, is unlikely to be a strategy that will yield the best results in the short, medium or long-term.

The Cost of Trying To Time Investment Markets

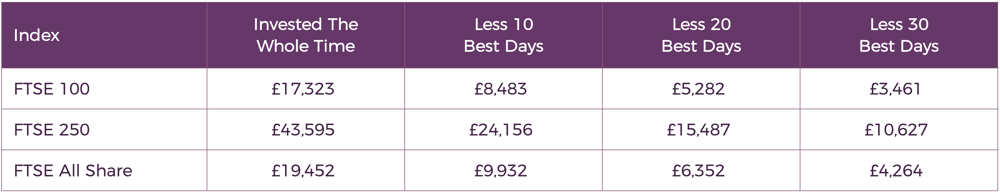

Investment managers Schroders have researched the performance of three indices that reflected the performance of the UK market, the FTSE 100, the FTSE 250 and the FTSE All Share.

They found that if you had invested £1,000 in the FTSE 250 in 1986 and left the investment untouched for the next 35 years it might have been worth £43,595 by January 2021.

However, the outcome would have been very different if you had tried to time your entry in and out of the market. During the same period, if you missed out on the FTSE 250 index’s 30 best days the same investment might now be worth £10,627, or £32,968 less, not adjusted for charges or inflation. Over the last 35 years your original £1,000 investment in the FTSE 250 could have made:

→ 11.4% per year if you stayed invested the whole time

→ 9.5% per year if you missed the 10 best days

→ 8.1% per year if you missed the 20 best days

→ 7% per year if you missed the 30 best days

The 1.9% difference to annual returns between being invested the whole time and missing the 10 best days doesn’t seem much. But the compounding effect builds up over time, as shown in the table below. If you had invested in the FTSE 250 it could have cost you more than £19,000 during that time.

This analysis shows just how costly trying to time the market can be.

The Secret To Investing

There are 4 key elements that form the foundation of an efficient investment plan.

1. Defined Objectives

Understanding your investment objectives and what level of risk you are will to take to achieve your investment goals is critical to all investment strategies. Investment objectives are influenced by factors such as our financial background, needs, time horizon and risk tolerance level, with each investor having different objectives. Making reactionary investment decisions based on current events can be a costly mistake, which is why a defined strategy should always dictate investment decisions.

2. Asset Allocation

The asset allocation model of any portfolio is the single most important aspect of investing and is critical to ensuring your portfolio does not assume more or less risk than you are comfortable with. Investing in funds across varying asset classes allows you to diversify, minimising the impact on your portfolio should one sector take a dip.

Once your asset allocation model is defined, it is important to regularly review your portfolio and rebalance if required. Rebalancing is the process of realigning the weightings of assets in your portfolio when one sector grows more than another, shifting the percentage you have invested within particular sectors.

3. Fund choice

Selecting funds that consistently outperform their peers and fit within a suitable asset allocation model will help investors to maximise their portfolios growth potential. By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have covered the 2 main aspects of maintaining an efficient portfolio.

4. Remove Emotions

The long term success of a portfolio is primarily reliant on defining a strategic model that best fits your needs and objectives and sticking to it, knowing when to make fund changes and when to reassess your portfolios risk balance. Investing should be devoid of emotion, it is not personal, it is a process of making your money work with the aim of making it grow over time which should be done by following a defined strategy, whether you manage your own investments or receive investment advice.

This may seem obvious, but often investors become protective of their investment choices and can develop attachments to investment brands. This is an emotional form of investing which can lead to feeling they have a duty of loyalty to a fund, fund manager or financial adviser. Investment decisions should be made based on a strategy that is influenced by performance, consistency, diversification, risk and target objectives.

Emotional Investing

Volatility is part and parcel of investing and there will be times when our investments experience a dip whereas at the same time some investors following a different strategy may experience a rise. This does not mean that they have better investments, it simply means that the market conditions of the moment favour their strategy. Such fluctuations can be sharp and it can cause concern among some investors but they are often very short lived, with quality investments much more likely to perform better over the short, medium and long-term.

Time In The Market

There is always going to be some risk when investing but trying to avoid the inherent risk of investing through timing the markets can open up even more risk.

Watching your investments decline in value will naturally make you want to take action but in the significant majority of cases the best action to take is to be patient and trust in your investment strategy and fund selection. As an investor, the only time that you should consider changing strategy or investment providers is if your portfolio is consistently underperforming.

Some years will inevitably be worse than others but time in the market is more significant than timing the market. A long-term investment strategy is likely to win out over dipping in and out.

Timing Markets Will Never Beat A Good Long Term Strategy

Investing can prompt panic decisions that are rarely in the medium to long term best interest of investors. Indeed, in recent weeks, any advantage many of the most bought ‘value’ funds gained this past few months have already eroded as quality funds regain their footing. As an example, the Baillie Gifford American fund, which experienced one of the biggest panic sell-offs of any fund in the UK, grew by 15.39% this past 3 months compared to the sector average of 7.49%. Of course, no one can predict the future, which is precisely why timing markets is not a good strategy, but by having a portfolio of funds that have proven their quality over different market conditions investors can improve the efficiency of their portfolios.

Timing the market will only work if it is timed right, but timing it right requires luck, which should never be a strategy.

Even if forecasts show a market shift is increasingly likely, changing strategies too early can result in a period of prolonged losses until that shift occurs - if it occurs.

The fact is, throughout any given year there will be many Global and region specific social, political and economic events that influence investment markets, trying to time market reaction to such events will in very small cases add medium to long-term investment gains.

Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who do not deviate their strategy during periods of change or uncertainty but simply ensure they invest in proven, high quality funds that fit a defined asset allocation and risk model.