The 2 most important elements of investing are asset allocation and fund selection.

For most UK investors, their portfolios are primarily made up of a range of investment funds, each of which are typically classified within a particular investment sector based on the type of asset, region or industry in which they invest. Each sector represents different growth potential and different levels of risk. How you spread your portfolio allocation across these sectors dictates the level of risk you are willing to assume.

The asset allocation model of your portfolio will reflect your overall investment objectives and the level of risk you are willing to take to reach your objectives.

But for a large proportion of investors, their portfolios lack efficiency as they contain underperforming funds and/ or the asset balance is out of sync which can significantly impact on their long-term investment objectives. In this report, we identify key areas for consideration that investors can utilise to maximise portfolio efficiency and improve investment outcomes.

Efficient Investing

1. Asset Allocation

The asset allocation model of any portfolio is the single most important aspect of investing and is critical to ensuring your portfolio does not assume more or less risk than you are comfortable with. Investing in funds across varying asset classes allows you to diversify, minimising the impact on your portfolio should one sector take a dip.

Once your asset allocation model is defined, it is important to regularly review your portfolio and rebalance if required. Rebalancing is the process of realigning the weightings of assets in your portfolio when one sector grows more than another, shifting the percentage you have invested within particular sectors.

In our experience, the vast majority of self investors who manage their own portfolio do not manage the asset allocation and associated risk of their portfolio well. However, some advice led clients are also paying advice firms without receiving a regular rebalance.

2. Fund Selection

Selecting funds that consistently outperform their peers and fit within a suitable asset allocation model will help investors to maximise their portfolios growth potential.

If your portfolio is managed by a financial adviser you want to make sure you are partnered with someone with a knowledge in fund performance. There are financial advisers who demonstrate great expertise and knowledge when it comes to fund selection. However, fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrate a poor level of knowledge on fund performance or the actual quality of funds they recommend.

By ensuring your portfolio contains only consistently top performing funds, within an asset allocation model suitable to your risk profile, you have covered the 2 main aspects of maintaining an efficient portfolio.

Whether you prefer to manage your own portfolio or have someone do it for you, Yodelar is an essential knowledge base suitable for all investors. As a subscriber, investors have access to all factual fund performance and ranking reports, including the top performing funds report, detailing all funds that have consistently maintained top quartile sector performance over the last 1, 3 & 5 years. These factual and independent reports enable investors to clearly identify which funds are top or poor performing, and help investors to make more informed investment decisions.

Does Your Risk Profile Suit Your Long-Term Goals?

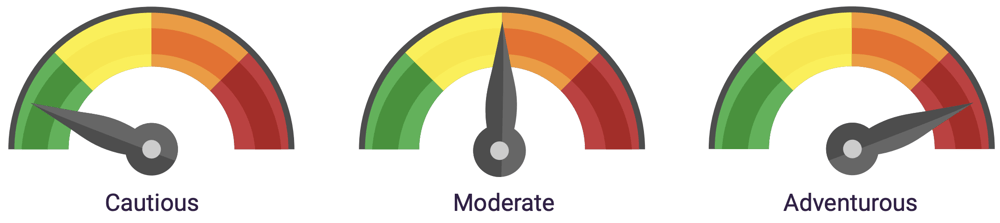

The level of investment risk you are comfortable taking will define the balance of assets within your portfolio. Over time your risk profile and your acceptance for loss will vary. Therefore it is important to regularly review your risk profile and the underlying assets in your portfolio.

The importance of having a portfolio that is continuously aligned to your risk profile is more than protecting against decline, it will also have a sizeable influence on your portfolio growth.

A study by the CFA Institute on ‘determinants of portfolio performance’ found that as much as 90% of an investment’s return can be down to asset allocation. Although there are many different asset allocation models available, they are each defined by risk. More specifically, what level of investment risk we are willing to tolerate in the pursuit of returns.

An efficient portfolio will provide the appropriate blend of risk and reward. But maintaining an efficient portfolio requires continuous monitoring and rebalancing.

What Determines Investment Risk?

Every investment can be described in terms of the amount of risk associated with it. Higher-risk investments tend to experience greater volatility, which means they are likely to go up and down in value more often and by larger amounts than lower-risk investments. In return, higher-risk investments have the potential to produce higher returns over the long term.

The level of risk associated with a particular investment or asset class typically correlates with the level of return the investment might achieve. The rationale behind this relationship is that investors willing to take on risky investments and potentially lose money should be rewarded for their risk.

For example, investments such as cash deposits and bonds issued by the UK Government (known as gilts) are considered low risk. Property, corporate bonds are considered medium risk. In the case of global bonds, generally those which pay a higher income are riskier than those which pay a lower income level. Shares in companies in the UK and other developed markets are considered higher risk, while shares from companies in emerging markets are considered very high risk. You can reduce the overall risk in a portfolio by using 'diversification' – in other words, spreading your money across different investments.

Why So Many Investment Portfolios Out of Sync

In the pursuit of growth, some investors fail to implement an adequate asset allocation model, with some investing all or the majority of their money in one single asset class. The problem with this approach is that if the asset class were to experience a sharp decline then so would the value of the client’s overall investment portfolio with potentially catastrophic results.

Another reason for an out of sync portfolio is when the asset allocation model becomes as-cue due to a failure to ensure a portfolio maintains a suitable balance. Over time, different assets perform better or worse than others which if left unattended can shift a portfolio’s asset weighting which can result in an investment portfolio assuming more or less risk than intended.

For example, someone who is a 'middle of the road' or a balanced investor may initially have 5.5% of their portfolio invested in higher risk 'Global Emerging Markets' funds (funds that focus on capital growth by investing in companies within emerging market countries). As a higher risk sector, it has the potential to deliver greater growth than lower risk sectors such as the 'Money Markets' sector, which is focused on capital protection. If the funds within the emerging markets sector grow more than other sectors the initial 5.5% held in these funds may now be much greater which will alter the allocation of a portfolio and may result in a balanced investor unwittingly assuming a more aggressive investment profile with more associated risk /downside.

There are a number of reasons why a portfolio could end up in an unintended risk bracket. In the majority of cases, this can be attributed to a poor spread of asset classes, which is a problem typically associated with inexperienced self-investors not rebalancing, or worse investors who pay for advice and are not receiving the regular rebalancing from their advisory firm.

To ensure your portfolio maintains the correct asset allocation, it is vital to regularly rebalance your portfolio.

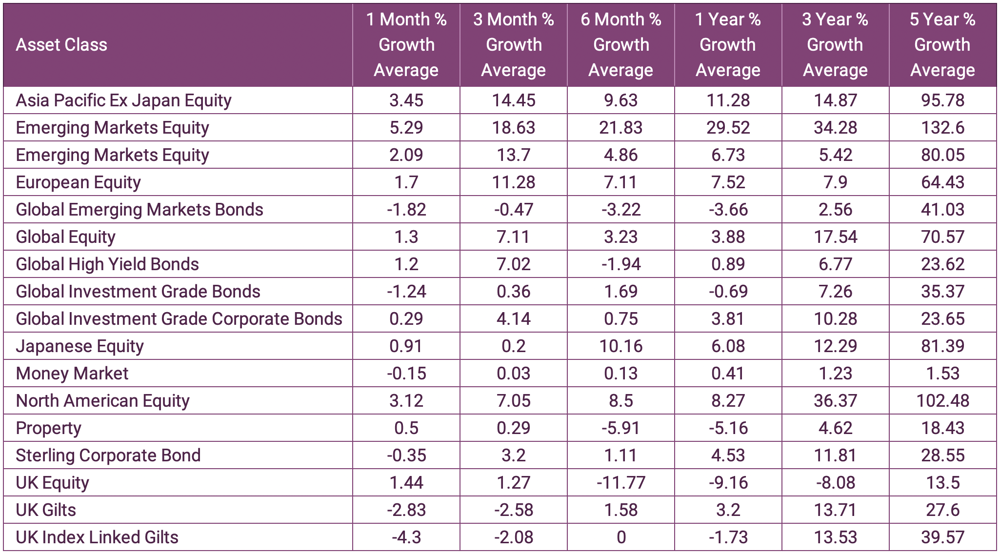

* Averages cumulative up to 1st October 2020

An Efficient Portfolio Will Only Remain Efficient If It Remains Suitably Rebalanced

Disciplined rebalancing is an insightful strategy for all investment seasons. It provides a means for investors to keep spreading their risks and opportunities.

There are a number of alternative rebalancing practices that investors can use to trigger the rebalancing of their portfolio's asset allocation, focusing primarily on three:

Time-only: With this approach, the only consideration is time – not how much a portfolio has drifted from its strategic asset allocation. For instance, investors following this approach might rebalance, say, annually or at set times during a year.

Threshold only: Under this strategy, a portfolio is only rebalanced when a portfolio has drifted from its strategic asset allocation by more than a predetermined percentage, such as 5%. One of the drawbacks of the "threshold only" approach is that the portfolio would require consistent monitoring.

Time and threshold:

With this approach, the portfolio is rebalanced at a scheduled time, such as annually or biannually.

Fund Choices Based on Facts

There are three critical elements to fund selection that can help investors improve their fund choices that make up their portfolios.

1. Comparative Performance.

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares can identify the quality of the fund and the competence of the fund manager.

2. Fund manager accountability.

Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank lowly within their sector have demonstrated a lack of quality and an inability to deliver competitive returns for investors. Past performance is not a guarantee of future returns, but it is an important indicator that holds fund managers accountable for their performance.

For those that have maintained a high level of comparative performance, it is reasonable to assume they can do so in the future.

3. Consistency.

A cycle of 1, 3 & 5-years exposes investments to different economic and political challenges.

How a fund and fund manager performs during such cycles reflects on their capabilities and overall quality.

One of the main distinguishing elements of our portfolios is that they are each composed of funds that have proven their quality and their ability to deliver top ranking sector performance on a consistent basis.

High Quality Funds Balanced For Improved Efficiency

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. We ensure all the funds we use to achieve this balance are consistently among the very best performers within their set asset class. Each fund selected is thoroughly evaluated by our investment committee and only the most suitable options are selected to be included in our portfolios.

All sector classified investment funds are made up of a selection of holdings in companies that fit within the funds sector classification. For example, funds classified within the UK All Companies sector are required to invest at least 80% of their assets in UK equities that have a primary objective of achieving capital growth. The remaining 20% can be spread across other asset classes that the fund manager deems appropriate to the fund’s overall objectives. The spread of this remaining amount can have numerous implications which we carefully analyse when composing our portfolios.

Formulating the appropriate blend of investment funds to fit a portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis. It is an important part of how we build our portfolios and it reveals an attention to detail that helps to distinguish us from our competitors.

Maintaining Portfolio Productivity

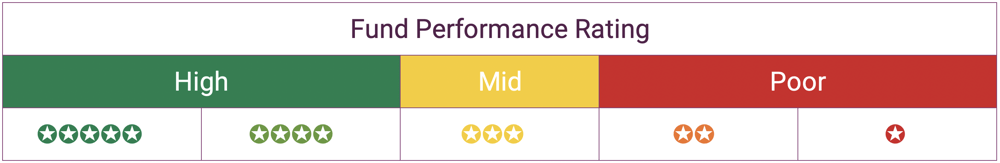

The Yodelar Investment Committee, who are responsible for the well being of client portfolios track and manage portfolio and fund performance via a process they refer to as their ‘traffic light system’. This is a 3-tiered fund grading model that promotes a pragmatic investment approach and ensures each portfolio continues to be scrutinised.

Green – Funds that have primarily maintained a level of performance that exceeds 75% of same sector funds over the recent 1, 3 & 5 year periods. Such funds are viewed as top performing within their associated investment sector or asset class and represent excellent investment opportunities.

Amber – Funds that have previously rated as green but recently experienced a decline in performance compared to other funds within the same sector. Amber funds can remain within the portfolio but are carefully monitored, typically over a 3-6 month period, to identify whether their performance has improved, remained stagnant or declined. If the fund’s performance has improved to a level that is better than 75% of competing same sector funds, it is returned to a green rating. If it remains stagnant, it will continue to receive an Amber classification for a period of up to 6 months. If no improvement is seen during this period, it will receive a red rating.

Red - The red traffic light signifies that some action is due. It may be that the fund is removed from a portfolio and replaced with a more suitable manager. Funds will be moved to a red rating if they continue to drop down the sector ranking over a 3-6 month period, or if they fail to improve six months after receiving an amber rating.

During each of these periods, our investment committee will maintain communication, and seek regular updates from the manager of each underlying fund.

Find Out How Efficient Your Portfolio Is

Our research has identified that the majority of investors are missing out on extra portfolio growth due to subpar fund choices and general inefficiencies in their portfolio. Inefficient investing will undoubtedly have adverse longterm consequences, which is why it is so important to be able to identify and correct any portfolio deficiencies.

Through our leading portfolio review feature investors can input their current portfolio and assess how their portfolio compares to a similar risk portfolio of top performing funds. It enables investors to identify how each of their underlying funds have performed and where they rank within their respective sectors. This unique feature provides measurable ratings that make it possible for investors to identify, with complete transparency, how good or bad their fund choices have been and whether or not their overall portfolio has been up to par.

By making use of our portfolio review feature investors gain detailed insights into the performance of their investments and identify how competitive they actually are.

Benefits Include:

- Identify the performance of each fund you are invested in

- Where each fund ranks within their sectors for performance over 1, 3 & 5 years

- Yodelar performance rating for each fund between 1 and 5 stars

- The proportion of your portfolio that is invested top, mediocre or poor performing funds

- Portfolio growth comparison with model portfolios that are built to a set asset allocation model and contain consistently top ranking funds.

- The monetary difference in growth over 1, 3 & 5 years between your portfolio and a similar risk model portfolio

- How your portfolio growth compares to a similar risk portfolio of top-performing funds Receive an overall performance grade for your portfolio between A and F