Global stocks are now in a bear market. For the year to date, they are down -26.15% (FTSE All World Index).

It goes without saying that 2022 has been a trying year for investors, but what are the reasons pushing global markets down? And what can investors do to protect their investments?

In this report, we feature why inflation and rising interest rates are impacting portfolio values and what action investors can take to improve their portfolio performance.

Inflations Role In The Drop In Portfolio Values

In a nutshell, inflation can have a negative impact on portfolio values as it increases costs and reduces spending power. This in turn squeezes the profitability of companies and industries, which causes funds that have holdings in these companies/industries to decline in value.

Why the huge rise in inflation in 2022?

Economists typically classify inflation into two broad categories:

Demand-pull inflation - When the availability of an item is limited and people want it, the price of that item will usually rise. This happens because people are willing to pay more for that item and because the manufacturers of that item know they can charge more for it.

Cost-push inflation - In this case, the rising cost of doing business increases due to the rising price of raw materials and/or labour. As a consequence, companies have to pass along price increases to their customers to remain profitable.

It is the latter category that we are currently experiencing. In a recent interview former Bank of England Governor Lord King of Lothbury observed that the inflation we are now experiencing was sparked by a misdiagnosis of the problem at the height of the Covid pandemic back in March 2020.

Attempts were made to stimulate demand by further Quantitative Easing when the issue was not weak demand but the lack of supply. The pandemic and global lockdowns caused disruption in the supply of energy as well as products such as fertilizers, plastics, metals, glass, agricultural commodities like palm oil and essential components like microchips, and even the supply of labour, with a huge decline in active workforce numbers, which was compounded by the inability for migrant labour to travel. This is forcing employers to offer higher wages to fill vital roles.

The removal of Covid lockdowns and the reopening of industry was quickly followed by the war in Ukraine which also significantly increased gas/oil and food prices, exacerbating inflation, which has now led to the biggest rise in interest rates in years.

Raising interest rates is now a necessity. This will eventually quell demand. It may take a while to become effective because consumers were quite liquid given the lack of certain types of spending opportunities during the pandemic. However, higher interest rates will do nothing to correct the continuing supply problems in commodities, semiconductors and just about everything else so it may also take some time and high interest rates for demand to become depressed enough for the supply to exceed it and so start to moderate price inflation.

How Long Will Inflation Last?

The Government cap on energy bills means that the Bank of England (BOE) expects inflation to rise only a bit further from where it is now. The rate of inflation is currently about 11% in October. After that, the BOE believes it will stay above 10% for a few months, before starting to fall.

Higher interest rates should naturally favour companies with strong balance sheets with access to alternative pools of finance, such as larger companies who are leaders in their fields - which our portfolios hold in abundance.

Investors can expect markets to be more stable than they have been but a return to the levels of growth required to reverse the year's losses is still several months away.

Once inflation starts to recede it will naturally yield much better economic conditions which can be expected to translate into real returns for investors.

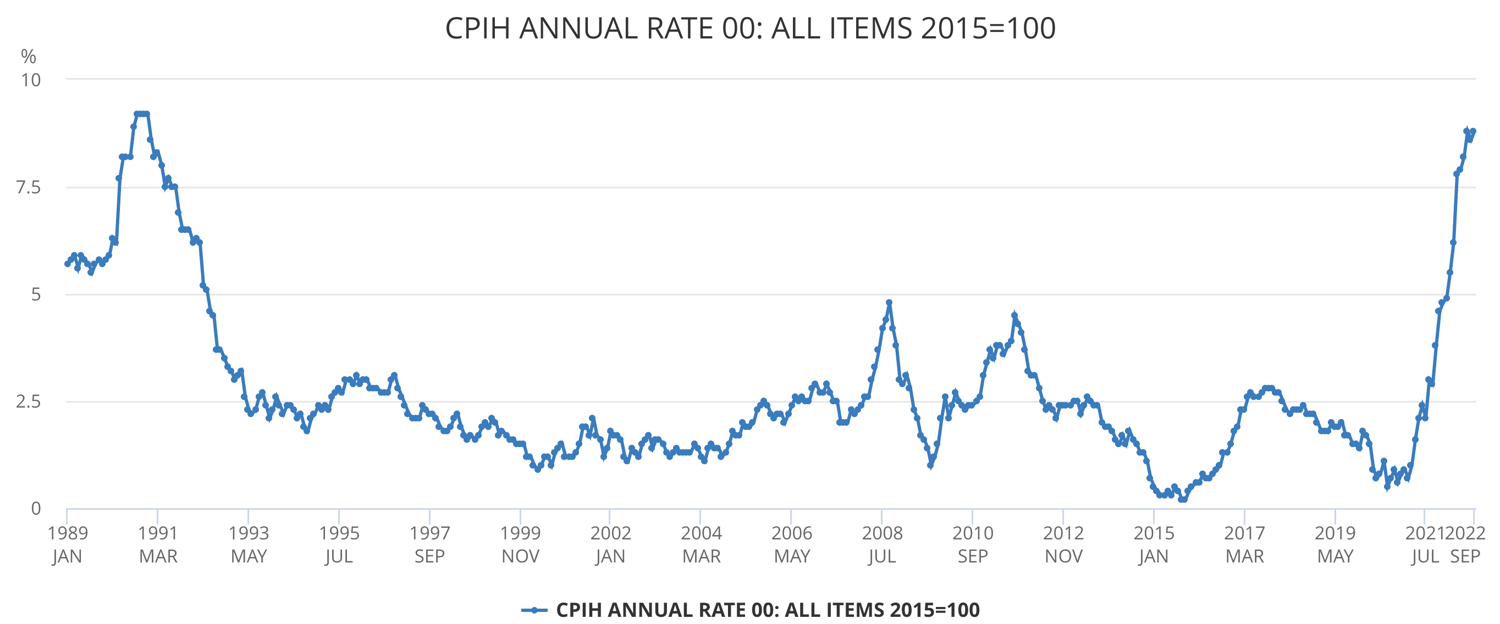

*Consumer Prices Index including owner occupiers’ housing costs (CPIH).

Source: Office for National Statistics.

The above graph shows the annual rate of inflation since 1989. With current levels matched only by those of 1990. It is worth noting that inflation dropped considerably after this peak. As mentioned, the Bank of England expects inflation to peak in the near future and enter a steady decline in 2023.

Find out if your portfolio contains top performing or poor performing funds with a free portfolio analysis

The Fallout of The Mini Budget

The doomed and short lived mini budget caused chaos in the investment markets resulting in a huge drop in portfolio valuations for investors. The budget was intended to promote growth by reducing the cost exposure to large business and thus entice them to adopt a growth strategy which would boost the UK economy, and thus reduce inflation quicker.

Whilst the objective was positive, it was an unrealistic model as the government simply didn’t have the means to fund the huge tax reduction without significantly increasing government debt.

The package included temporary spending measures such as energy support for households and firms but also permanent tax cuts. It is normal and desirable to borrow to cover the cost of temporary emergency spending. However, a permanent tax cut cannot be credibly financed in the future by borrowing. Markets clearly did not believe that the productivity boost of these measures would be enough to fund the tax cuts, leading to unsustainable levels of debt.

Also, the fact that the government rejected the Office for Budget Responsibility (OBR) offer to provide forecasts of the impact of the mini-budget was seen by markets as an attempt to ignore expert advice and disregard institutions.

Subsequently, foreign investors dropped Sterling leading to a depreciation against the US Dollar. But, more importantly, it led to a rapid decline in the market value of UK government debt. For a given interest on maturity on that debt, investors were willing to pay much less to buy it. In other words, for current generations to raise one extra pound to pay for the tax cuts, future generations would have to pay back much more than a pound.

Workplace pension funds also suffered as a consequence, due to their reliance on complex financial instruments that are in place to ensure they have the cash flow available to pay for their defined benefit schemes. As the price of government bonds dropped, banks required more collateral to offset the liabilities of pension funds which were forced to sell assets to raise cash. Unfortunately leading to a process known as “fire-sales”, where their price falls further, leading to the need for more sales to raise cash. Several funds faced serious liquidity problems which led to the rapid intervention of the Bank of England as a lender of last resort.

The mini-budget resulted in a depreciation of the currency, an expected increase in interest rates affecting future mortgage rates, and financial instability. All of them would more than undo any benefits of tax cuts for working families. The plan was a disaster. It cost Kwasi Kwarteng his job as Chancellor and ultimately it cost Liz Truss her job as Prime Minister. However, as profound as these implications have been in the near term, the fact the decisions that triggered the crisis are all but reversed, means they will have little influence going forward.

Staying Calm - Look Beyond Current Market Conditions

Investing can trigger a wave of positive and negative emotions. At times, investing can be a relatively calm and uneventful journey, with values on a positive trajectory for long periods. But at other times it can be extremely uncomfortable, particularly when your portfolio value is lower now than it was last year. This can be very unnerving, and even induce panic decisions, as during times of fear, the urge to take action can be overwhelming.

There is plenty of fear in the markets which are currently experiencing a huge amount of volatility. But at times like this it’s important to remain calm and not react to short-term economic events.

Fear is the enemy of investing, it is an emotion that often supersedes rationale and increases the risk of making decisions that could negatively impact a medium to long-term strategy.

It is worth reminding ourselves every so often why we invest. This may seem somewhat obvious, but during times of investment stress it can help to avoid fear driven decisions and settle anxieties.

Most investors will have at least a 5 year investment horizon. (If someone's timeframe is lower than this then they should seriously consider other options or be in full acknowledgement of the risks with short term investments).

During times of investment stress it is useful to remember the following:

- The reason you invest a proportion of your wealth is so that over a defined period of time it grows in value to meet your investment objectives. This should be a long-term strategy (at least 5 years or more).

- During an investment journey you will experience periods where the value of your investments fall. This could be shorter or longer depending on conditions but it is an indisputable fact which will always be a part of investing.

- It is only the value of your portfolio AT THE END of the defined time period that matters. Anything in between, is all part of the investment journey. It can therefore be best to avoid checking your portfolio values constantly.

The important thing to remember is that despite all the noise and negativity - The markets will recover!

The stock market has experienced dozens of crashes and corrections over the decades, and it's bounced back 100% of the time to recover and grow further.

By holding your investments, you can simply ride out the storm and wait for prices to rebound. Again, you won't lose anything if you don't sell, and your portfolio will bounce back.

The key then is to make sure you're investing in quality long-term stocks. The best investments are the ones with solid underlying fundamentals, as they're the most likely to survive market volatility. By filling your portfolio with stocks from strong, healthy companies, it's very likely your investments will survive even the worst market crash.

The Best Investment Strategy Will Never Be A Short Term One

The old adage, “Time in the market is more important than timing the market.” is a strategy supported by famed investor Warren Buffett. It is true because it is impossible for anyone to know exactly when share prices might rise or fall.

Adopting a ‘buy-and-hold’ strategy means that you stay invested throughout market cycles, helping prevent you from making any knee-jerk reactions during turbulent times which could mean you sell at just the wrong time.

As you’re holding your investments for the long term, it also means you’ll pay less in fees as you’re making fewer transactions.

Get your digital copy of our most recent best funds report which features the top performing funds, and best ISA funds over the past 1, 3 & 5 years.

Best Investment Plan

Even the best investment plan will not outperform in every reporting period or every type of market condition. So, as much as we may not like it, it is important to expect some periods of underperformance.

If your portfolio was constructed using quality funds and follows a suitably diverse asset allocation model then sticking with it during periods of negative market conditions is likely the best option.

Of course, if your portfolio was underperforming during previous market cycles it is reasonable to assume it will be poor going forward, so in such circumstances reviewing your portfolio and its underlying fund performance would be beneficial in helping to identify whether or not alternative options need to be considered.

By reviewing your portfolio performance it can help to identify if your investments are performing well or underperforming compared to their peers and provide you with the insights that can help improve portfolio performance. Yodelar’s portfolio review service will help to identify how each of the funds within your portfolio perform when compared against similar funds within the same sectors. This can help identify whether your current strategy has inefficiencies.