- A report carried out by ILC and supported by Royal London found that those who received professional financial advice between 2001 and 2006 were more than £47,000 better off, on average, by 2014/16 than those who took no advice.

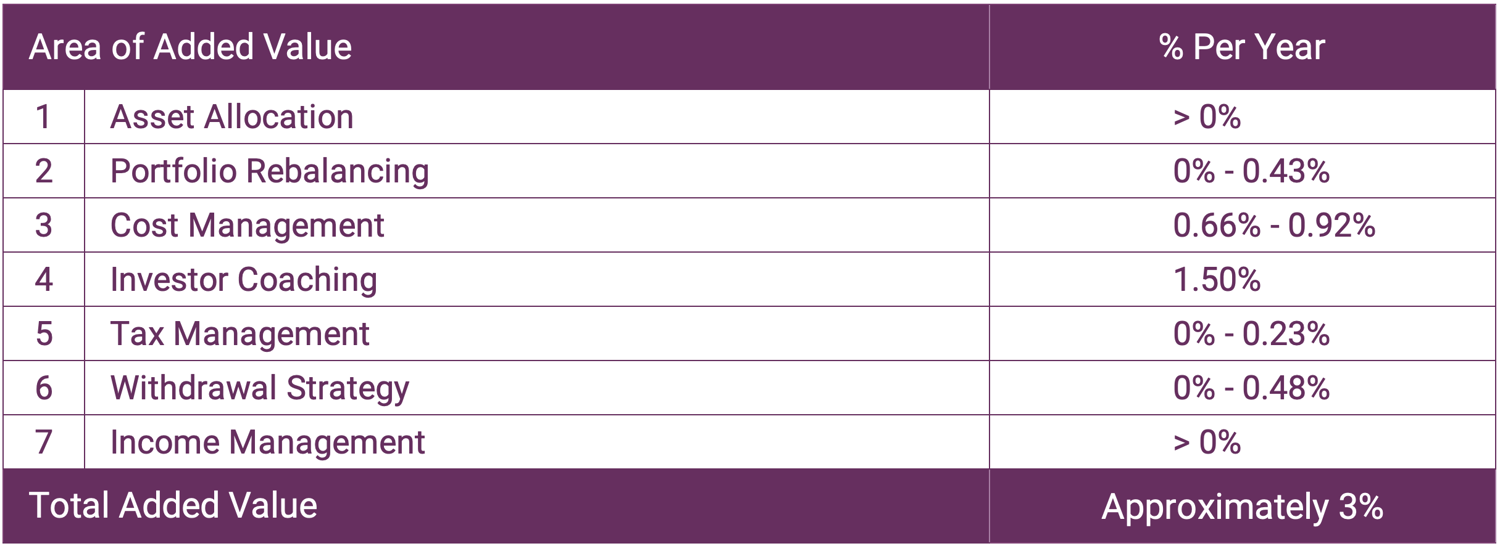

- A recent study carried out by Vanguard found that investors with a financial adviser on average earned about 3% per year more than DIY investors without an adviser.

- A report by the Financial Conduct Authority (FCA) analysed the behaviour of self investors identifying 3 primary traits that can lead to poor investment choices.

- In this report we identify the most common traps many DIY investors fall into and how they can be avoided.

With the rise of free online trading platforms and investment apps, more investors in the UK are building and managing their own investment portfolios without professional guidance or expertise.

But while "do-it-yourself" investing provides greater control and reduced fees, it also comes with significant risks that the average retail investor often underestimates.

Lacking the skills and institutional discipline of professional money managers, DIY investors are more prone to emotionally-driven decisions, lack of diversification, insufficient rebalancing, chasing fads, and other behaviours that can profoundly damage long-term returns.

In this article, we will explore the most common pitfalls DIY investors face and how even small investing missteps can compound over time and derail an individual's financial goals. We also identify why financial advice - even though it may not be the preferred option for DIY investors - is often the one that yields the best results.

Below we detail 6 pitfalls that many DIY investors fall into and how they can be avoided.

1. Misjudging Risk

Getting the balance of risk and return right can take some consideration and depends on several factors – investment goals, timescale and the requirement for income. It will also be shaped by how much volatility (the extent of ups and downs) you are prepared to accept – and this could change over time.

Take too little risk and your invested money may not grow as much as you need it to; for instance, having a large weighting to low risk areas in your pension in your twenties and thirties would seem a wasted opportunity. However, take too much and you could become a victim of market volatility at just the wrong moment. This is particularly relevant for investors looking to cash in or draw upon their investments in the shorter term.

Diversification, owning a variety of assets whose returns are independent of each other, is the cornerstone of sensible portfolio management. Having all your eggs in one basket might make you a fortune, but it might lose you one too.

Aligning investment objectives with the most appropriate risk strategy and time horizon is a crucial element of investing that is unfortunately often mismanaged by DIY investors.

2. Overlooking Diversification

To ignore diversification is to ignore risk. Any portfolio that does not diversify is much more likely to fail in meeting any long term investment objectives - poor diversification is one of the most common mistakes DIY investors make.

Often self managed investors think they can maximise returns by taking a large investment exposure in one security or sector. But when the market moves against such a concentrated position, it can be disastrous. Too much diversification and too many exposures can also affect performance. The best course of action is to find a balance.

While diversification could mean that you forgo superior upside in one shock event, the long-term benefit of the improved risk reduction outweighs any perceived short-term relative loss. It’s this delicate balance that necessitates an in-depth analysis of each asset class, each portfolio those assets support, and each possible future scenario.

Spreading your risk across various countries shields investors from country-specific conflicts and regulations. In this way, if one country struggles economically due to regional issues, your portfolio will feel that it affects less.

It is not uncommon for investors to become overly concentrated in specific sectors, such as IA Global and IA North America, and hold multiple funds within these sectors. However, this can lead to a duplication of underlying holdings and potentially double up transaction costs, without the investor even realising it. It is important to be aware of this overlap and take steps to avoid unnecessary expenses and risks in your portfolio.

A reputable financial advisory firm possesses the necessary tools and expertise to thoroughly analyse the underlying holdings of a recommended portfolio, a task that self-investors are unable to accomplish without access to regulated tools..

3. Lack of Tax Planning

Optimising an investment strategy to mitigate against unnecessary tax liabilities is something many DIY investors fail to properly address.

Not Using Tax-Advantaged Accounts - Many DIY investors fail to efficiently make use of their ISA allowance or pension benefits to shelter investments and maximise tax-free perks.

Lack of Tax Planning - Not proactively harvesting tax losses, deferring taxes, or choosing tax-efficient investments results in lost savings.

Complexity of Tax Rules - The complicated and changing nature of tax laws means investors often make simple mistakes or overlook available deductions.

Other common pitfalls include a lack of understanding and planning around capital gains tax and estate planning.

A quality financial advisor can help investors to identify strategies to improve tax efficiency and generate higher after-tax returns over time.

4. Making Impulsive Decisions

Fear and greed are the two most dangerous emotions that can cloud an investor's judgement. When markets plunge, the natural reaction is to panic sell to stop further losses. Conversely, surging prices can create a fear of missing out that tempts investors to chase returns and buy at the top. Such knee-jerk emotional reactions end up selling low and buying high - the exact opposite of prudent long-term strategies, and a trap many DIY investors have fallen into.

Self investors also lack institutional oversight and accountability. Portfolio managers have risk limits and reporting requirements that add discipline. Individuals face no such restraints and can act on impulses without a thorough and rational decision-making process.

Furthermore, DIY investing often occurs in a vacuum without the moderating influences of peer feedback and expertise. Many quality financial advice firms lean on research teams, risk analysts, and each other to test assumptions and remain grounded when emotions run high.

Without the necessary precautions and detached professionalism that comes from experience, DIY investors are far more susceptible to panicked selling, chasing fads, and other behaviours that destroy value. Staying disciplined amid market swings is difficult, underscoring the importance of controlling emotions and having a long-term plan.

5. Lacking Patience

Many people believe that knowing when to buy and when to sell is the secret of successful investing. The truth is that no one knows with certainty when markets will rise or fall. Trying to time the market is very seldom successful. It’s far better to use time to your advantage.

Warren Buffett said: “The stock market is a device which transfers money from the impatient to the patient.”

Patience will reward investors. In fact, it is viewed as the most important principle for successful investors. But it is often lacking among many DIY investors and a common reason for poor investment decisions.

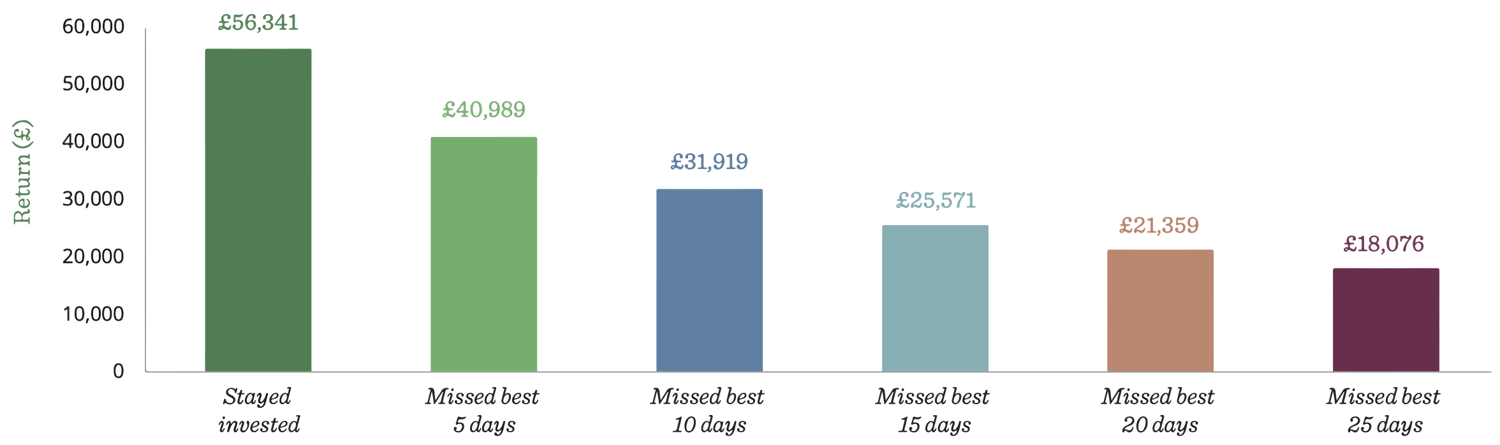

The table below shows just how costly it can be to miss out on the best days in the 20 year period between 31st December 2001 and 31st December 2021. It shows that if you had stayed invested in global equities over the entire period, you could have had a potential return that was three times greater than that of an investor who missed the best 25 days during the same period, based on both investing £10,000.

6. Overestimating Ability

Another common pitfall that many DIY investors fall into is overestimating their own abilities. It is natural for us to focus on our successes and conveniently forget about our past mistakes, leading to an inflated sense of confidence. This overconfidence can lead to taking on excessive risks in our portfolios.

Avoiding overconfidence and seeking professional financial advice can help investors gain a more objective perspective and make informed decisions about their portfolios.

Many investors, for example, will focus on their successes and try to forget the mistakes they’ve made, consistently confirming their personal views rather than maintaining objectivity. One particular shortcoming for many DIY investors is overconfidence. We naturally put up barriers that allow us to forget the mistakes we’ve made in the past. Similarly, we tend to focus on the successful investments we’ve made—which makes us overly confident. This may lead to taking on excessive portfolio risks.

For example, our research team recently analysed a portfolio for an investor through our free portfolio analysis service, who classified themselves having a mid level investment risk strategy. Our analysis identified recent performance that was comparatively high, which reaffirmed their confidence in their investment ability. However, when one of our senior advisers discussed the analysis with the investor they were able to identify that the portfolio of funds were limited to one asset class and industry sector. The portfolio performance is therefore reliant entirely on this sector doing well. Naturally, when it does well the rewards will reflect that sector's growth but when it declines, which all markets and sectors inevitably experience, then the entire portfolio value will drop resulting in concentrated losses. As such, the portfolio did not assume a mid level risk strategy as intended but rather a very high level of risk.

Why DIY Investors Should Consider Financial Advice

The value of investment advice has always been a topic that has divided opinion among investors. Some see great value in advice service whereas others see it as an unnecessary expense. The value of investment advice is also now challenged by convenient, lower cost self investor platforms which have pushed more investors towards managing their own portfolios. Yet despite the challenges posed by self managed platforms and the perceptions of high advice costs, research from Vanguard shows that investment advice on average increases portfolio values by 3% per year.

Quantifying The Value of Financial Advice

Vanguard recently commissioned an independent study to understand what is the value of working with a financial advisor. It found that clients with a financial advisor on average earned about 3% per year more than those without an adviser.

Other studies confirm these findings. For example, the well renowned DALBAR study finds that the DIY investor underperforms by around 3% per year through poor decision making.

Added Value From Financial Advice

A report carried out by ILC and supported by Royal London found that those who received professional financial advice between 2001 and 2006 were more than £47,000 better off, on average, by 2014/16 than those who took no advice.

Good Advisers Take Care of Risk

Over the past several years, Yodelar has analysed thousands of self managed portfolios and we have identified a common theme - one that can have major implications for long term portfolio values. Diversification and risk management of self managed portfolios is often poorly maintained or simply neglected completely.

One of the main advantages of using a quality financial adviser is the expertise and knowledge they can add to investment planning. A good investment adviser will have an understanding of financial markets, and other complex topics that can be difficult for the average person to navigate.

In a study published in the Journal of Financial Counselling and Planning, researchers found that working with a financial advisor can also lead to increased financial well-being and reduced stress.

Harnessing the Power of Quality Advice to Unlock Investment Potential

While the key factors for good investment advice can add value to any investment portfolio there are a number of additional factors that most advisers don't utilise, factors that can add even more value to investors.

Quality advice and portfolio management firms understand fund and fund manager performance and are able to use this knowledge to identify the best options and build efficient, top performing portfolios. It is this process that distinguishes the top advice firms from the rest.

The development of our portfolios come from years of research and analysis that include the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research continues to identify that a small proportion of funds and fund managers consistently delivered top performance, with more than 90% of the portfolios we review containing funds that continually underdeliver. This research has enabled us to identify efficient processes and top-quality investments which we have utilised to create 10 strategically balanced, risk-rated portfolios that are built using only the top funds within each asset class and offer investors phenomenal potential for growth.

Yodelar provides a regulated whole of market advice and information service that is changing the way investors think.

Book a no obligation call with our team today and find out how we can help you grow your wealth efficiently.