- The coronavirus pandemic has resulted in some fund management firms to lose almost half of client funds under their management.

- BlackRock managed £130 billion of assets on behalf of UK clients at the start of the year. In just 3 months this has reduced by 17.3% to £107.9 billion

- The iShares UK Equity Index fund experienced one of the largest declines in size since the beginning of the year with its total funds under management reducing by £3.1 billion.

The coronavirus pandemic has hit the fund management industry hard with fund providers left watching on as billions are wiped off their books with markets experiencing one of the biggest declines on record.

But how much has the coronavirus pandemic cost the fund management industry and which fund managers experienced the biggest decline in funds under management?

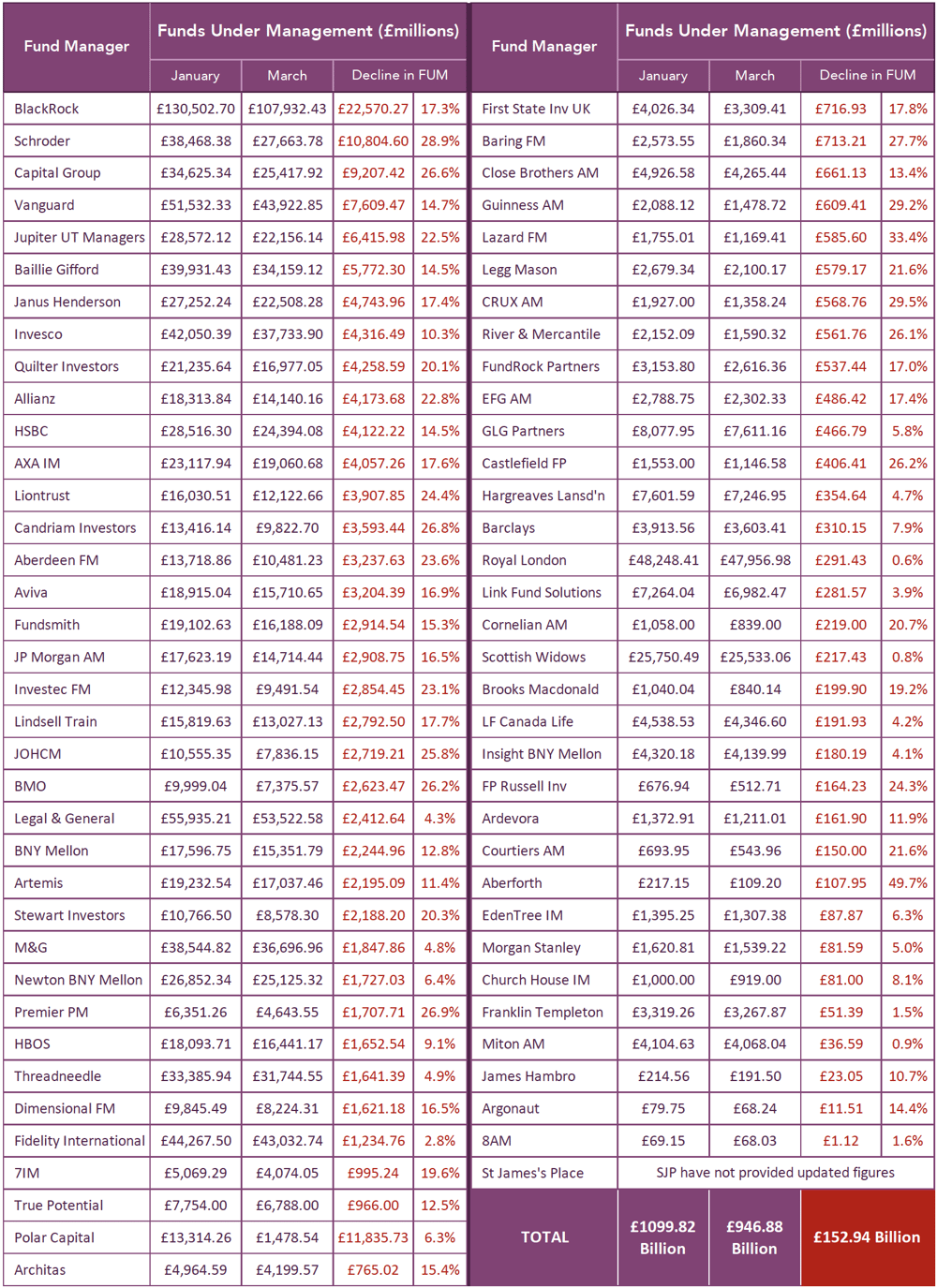

We reviewed 70 of the largest fund management firms in the UK and identified that the amount of client money under their management had reduced by more than £152 billion since the start of the year from a combination of losses as markets fell and panicked investors moving their money into lower-risk cash products.

In this report, we identify the level of decline in the size of funds managed by each of the 70 firms in the first quarter of 2020. We also feature the 10 funds that have declined in size the most during the first 3 months of the year.

Coronavirus Costs Fund Managers £1.1 billion In Fee Revenue

The investment fund industry in the UK has been left licking its wounds in the aftermath of a torrid few weeks which saw billions wiped off the value of funds under their management as the coronavirus pandemic hit with ferocity.

The firm with the largest losses was BlackRock who saw the amount of client funds under their management fall by a huge £22.5 billion since the start of the year.

The sheer scale of this drop is unprecedented and will have a significant bearing on the bottom line of these fund management firms, as a large slice of their revenue comes from ongoing fees which are driven by the amount of client funds they manage.

On average, the funds managed by the 70 firms in this report have an ongoing management fee of 0.75% per year, which means that for every £1 million they manage, they earn £7,500 in ongoing annual management fees.

Based on this assumption, the £152 billion reduction in client assets managed by the 70 firms analysed since the start of the year equates to a combined loss of over £1.1 billion in ongoing annual fee income.

This is a significant sum that fund management firms will be eager to recoup in both growth (by increasing the value of funds under their management through investment performance) and from attracting fresh money from new or existing investors. To help fuel this revival many firms and advice networks are encouraging investors to remain calm, commit to their investment strategy and avoid the temptation of encashing their investments until stability returns. However, for many investors, moving their money out of a growth strategy and into a protection strategy could be the most suitable option and one that they should explore.

On Average Fund Managers Experience A Decline of 15.8% In Funds Under Their Management

One of the sharpest declines in funds under management over the past 3 months was reserved for Schroders, who at the start of 2020 managed £38.5 billion of client assets in their range of unit trust funds, which was the 9th largest of any provider in the UK. In just 3 months, 29.5% was wiped off this value as Schroders funds under management tumbled by £10.8 billion down to £27.7 billion.

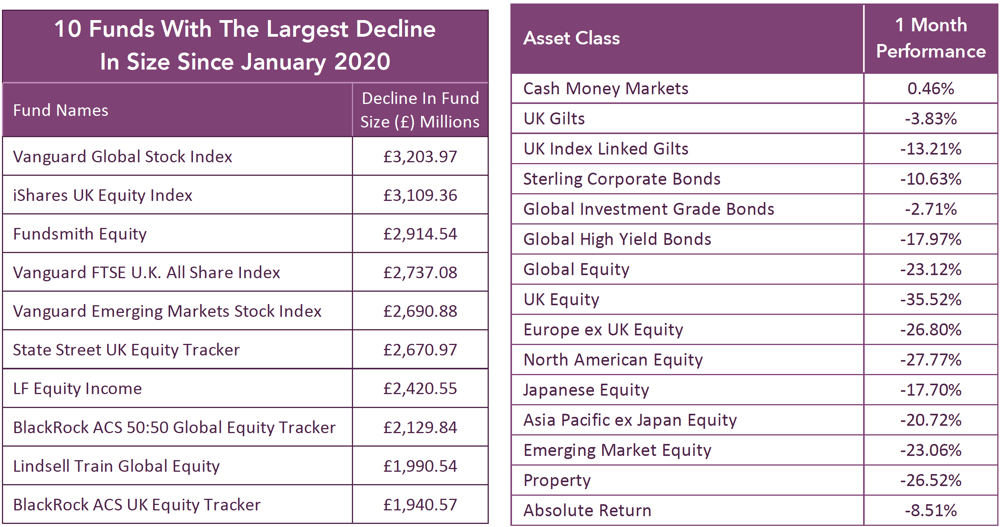

Terry Smiths, perpetually popular Fundsmith Equity fund is the largest fund in the UK and it’s currently responsible for managing £16.2 billion on behalf of investors. But until recently this fund was even larger. At the start of the year, the Fundsmith Equity fund managed £19.1 billion of client money, therefore, in just 3 months its overall size has dropped by £2.9 billion (15.3%).

This fall is an expensive blow for Mr Smith whose 1% annual management fee means that the £2.9 billion drop in fund size will cost him £29 million each year in ongoing revenue.

At the other end of the spectrum, Royal London experienced the smallest drop in funds under management as the value of their range of comparatively lower risk funds fell by just 0.06%. Similarly, Scottish Widows experienced a drop of just 0.8% in funds under management.

10 Popular Funds Saw Their Value Fall By £25.3 Billion

Combined, the 70 fund management firms analysed for this report manage 1,613 unit trust funds. From these funds, just 10 accounted for almost 17% of the total decline in fund value as together they fell by more than £25.8 billion since the start of the year.

3 of these 10 funds are from Vanguard’s range of passive funds, each of which tracks the performance of their desired index. The biggest drop in funds under management was by the Vanguard Global Stock Index fund, which went from managing £9.9 billion of client money down to £6.7 billion since the start of the year.

The Lindsell Train Global Equity fund was another fund to experience a hefty drop in size as it went from managing £8.59 billion at the start of the year down to £6.60 billion by the end of March – a drop of £1.99 billion. This was despite the fund performing better than 78% of all other funds within the same sector over the past 3 months.

The impact from the coronavirus pandemic on all but a few asset classes has been huge. With the exception of UK Gilts and money market sectors, every sector experienced a sharp and significant decline in performance that has resulted in sizeable losses for most UK investors.

How Efficiently Can Fund Managers Recover & The Opportunity This Brings For Investors

Although most fund management firms have lost significant sums in recent weeks, it has been due to an event never before experienced by investment markets, with a comparatively low percentage of these losses attributable to poor fund management.

However, for fund managers, their ability to define and utilise the most efficient opportunities within each particular market and industry will determine which funds recover the best from the shock of the coronavirus pandemic. It is during such challenging periods that fund managers are able to show their capabilities with quality quickly becoming apparent when markets begin to stabilise.

Markets will inevitably stabilise, and growth will return but like all industries, there will be those within the fund management industry who do a better job than others. Fund managers now have an opportunity to re-centre their strategies and put in place a plan for growth and recovery for investors. This is an important time to analyse and monitor the performance of funds across different sectors and asset classes as those who have a portfolio that contains the most efficient options will be much better placed to yield huge rewards when growth returns.