The outbreak of the coronavirus pandemic has sent global stock markets spiralling downwards as panicked investors worry over the long-term implications of the epidemic after witnessing their portfolio value tumble in a matter of days.

In response, many of the world's governments have announced unprecedented aid packages to large and small businesses across most industries as a means to tackle imminent cash flow concerns, dampen panic and provide much needed support to battered financial markets.

The announcement offered many hope as markets temporarily bounced back. But are these measures enough to spark a sustained market correction and a return to normality for investors?

In short, the answer is no.

We are in the midst of a global event like no other and the unfortunate reality is that investors are likely to see further market slumps and more losses before any kind of stability returns.

The Worst Yet To Come For Investors?

The sudden and extreme global impact from the coronavirus pandemic has been compared to other recent traumatic events like September 11 or the 2008 financial crisis. But the reality is, by the time COVID 19 dissipates, it will have had a much bigger impact.

The announcement of a 3 week lockdown in the UK to help curb the spread of the virus triggered a sharp fall in UK equity markets despite the recent announcement of a £330 billion rescue package for UK companies.

Government data suggests that 3 weeks in lockdown will not be enough to quell the spread of the virus making a longer lockdown much more probable. This will likely have a sizeable impact on markets with further drops expected.

In America, Donald Trump, fearing an economic catastrophe ahead of the November election, is hoping to swiftly remove the severe restrictions imposed to fight the coronavirus pandemic. On the back of announcing an unprecedented $2 trillion rescue package, he has said that he wants the United States "opened up and raring to go by Easter."

This is highly unlikely, as the reality is the US has yet to face the full impact of the virus with scientists warning that they are on course to become the epicentre of the pandemic. These warnings are backed up by government data which shows the exponential spread of the virus from state to state which has prompted 40% of registered voters in America to recently poll their support for a nationwide quarantine.

How far away is America from announcing a lockdown? From what has been seen from the relentless spread of the virus in Italy and Spain the prospect of a lockdown across America is becoming increasingly likely if not inevitable – and should this materialise, it would have a seismic and instant impact on investment markets.

How Equity Markets Have Been Affected

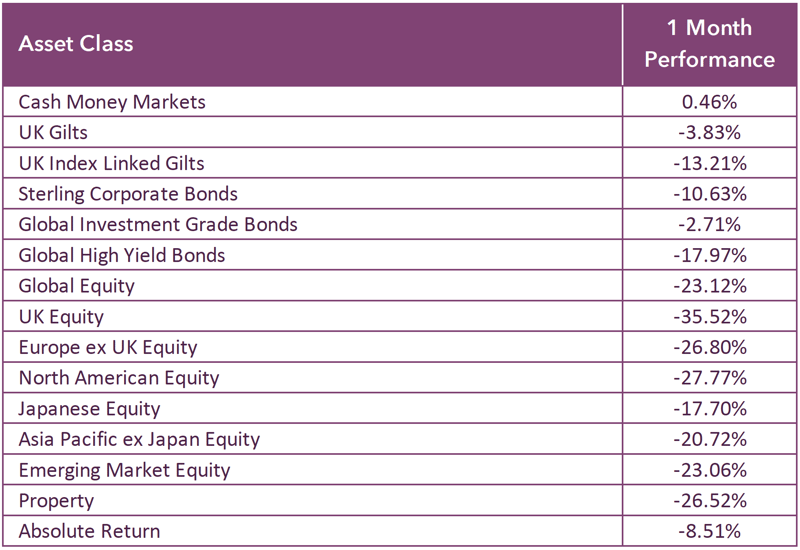

In the month up to 23rd March, UK Equity markets have been the worst affected so far with a fall of 35.52%. North American equities have been the 2nd most affected asset class experiencing a drop of 27.77% over the same period as only money markets managed to deliver positive returns.

*figures up to 23rd March 2020

Recession Incoming: More Trouble Ahead

Economists are in agreement that a global recession is inevitable in the wake of the pandemic but there was huge uncertainty over the depth of the coming recession and the speed of the subsequent recovery.

Some predict the downturn will be short and sharp, but fear that like a decade ago, there will also be a painful transition to a persistently weaker path for economic growth.

The purchasing managers' index (PMI) surveys, compiled by the financial intelligence and data provider IHS Markit in partnership with the Chartered Institute of Procurement & Supply, provide a monthly snapshot of economic activity.

They are designed to give an insight into business conditions across the economy and are compiled from the results of questionnaires sent to business executives about changes in, for example, their order book, their selling prices, their costs and the number of people they currently employ. The responses are distilled into a reading which, if it is above 50, points to expansion in the economy and, if it is below 50, points to contraction in the economy.

Chris Williamson, chief business economist at IHS Markit, said "The surveys highlight how the COVID-19 outbreak has already dealt the UK economy an initial blow even greater than that seen at the height of the global financial crisis. "With additional measures to contain the spread of the virus set to further paralyse large parts of the economy in coming months, such as business closures and potential lockdowns, a recession of a scale we have not seen in modern history is looking increasingly likely."

Allan Monks, economist at JPMorgan has also said “the worst is yet to come.”. He warned "This contraction is likely to become more severe with time. "In 2008-09 there was a four month lag between the trough in the output and employment readings. "Government measures to support employee salaries will limit the employment decline but we expect the worst is yet to come."

With the government replacing up to 80% of lost earnings in its job retention scheme for many private sector workers, the income side of the national accounts might not look that awful, according to Prof Coyle. But for the Office for National Statistics, she said working out the impact on GDP would be “bloody complicated”. Any drops in GDP in the sorts of ranges now predicted by economists would devastate the public finances in the short term.

Why A Quick Recovery Is Unlikely For Investment Markets

Earlier this month, it took only 15 days for the US stock market to plummet into bear territory (a 20% decline from its peak) – the fastest such decline ever.

While most commentators have been anticipating a V-shaped downturn – with output falling sharply for one quarter and then rapidly recovering the next – it should now be clear that the Covid-19 crisis is something else entirely. The contraction that is now underway looks to be neither V nor U nor L shaped (a sharp downturn followed by stagnation). Rather, it looks like an I: a vertical line representing financial markets and the real economy plummeting.

Not even during the Great Depression and the second world war did the bulk of economic activity literally shut down, as it has in China, the US and Europe. The best-case scenario would be a downturn that is more severe than the financial crisis (in terms of reduced cumulative global output) but shorter-lived, allowing for a return to positive growth by the fourth quarter of this year. In that case, markets would start to recover when the light at the end of the tunnel appears.

But the best-case scenario assumes several conditions. First, the US, Europe and other heavily affected economies would need to roll out widespread Covid-19 testing, tracing, and treatment measures, enforced quarantines, and a full-scale lockdown of the type that China has implemented. And, because it could take 18 months for a vaccine to be developed and produced at scale, antivirals and other therapeutics will need to be deployed on a massive scale.

Unless the pandemic is stopped, economies and markets around the world will continue their free fall. But even if the pandemic is more or less contained, overall growth still may not return by the end of 2020.

What Happens After The Coronavirus Pandemic?

COVID-19 is forcing companies to rethink and shrink the multistep, multi-country supply chains that dominate production today.

Global supply chains were already coming under fire economically, due to rising Chinese labour costs, Donald Trump’s trade war, and advances in robotics, automation, and 3D printing, as well as politically, due to real and perceived job losses, especially in mature economies. COVID-19 has now broken many of these links: Factory closings in affected areas have left other manufacturers as well as hospitals, pharmacies, supermarkets, and retail stores short of inventories and products.

On the other side of the pandemic, more companies will demand to know more about where their supplies come from and will trade off efficiency for redundancy. Governments will intervene as well, forcing what they consider strategic industries to have domestic backup plans and reserves. Profitability will fall, but supply stability should rise.

But even when the global public health crisis is under control and global supply chain disruptions caused by COVID-19 end, many large companies expect that business will not return to normal for between three to six months. As such, it could be some time before many industries regain stable profitability.

The Human Impact

The true scale of the impact on industries globally as a result of the pandemic is as yet uncertain and dependent on a number of factors such as how successful major economies such as the UK and America have been in containing the virus. As a consequence, it will be a number of months before there is a clearer economic outlook.

However, what could be even more difficult to quantify is the human impact of the virus and whether or not we will ever be able to go back to the way it was pre Covid19. The sheer scale and shock of the event will be hard to forget as will the newfound anxiety of crowded public settings or the panic buying that has led to the regular sight of empty supermarket shelves.

As a consequence of these factors consumers will be more methodical and less impulsive with purchasing decisions, with more thought going into the practicality or necessity of their purchases as consumers generally become frugal with their money. It is likely going to take a period of time for many consumers to gain confidence to be in crowded public settings which could slow the recovery for restaurants, bars and the high street, with a reduction in the number of advanced purchases such as package holidays also down through fear of a future with more lockdowns.

What Should Investors Do?

There is significant risk for investors to maintain their pre pandemic investment strategy until greater stability returns.

Markets are experiencing extreme volatility and sticking to an investment strategy geared for growth is likely to lead to further losses. Or course, sharp market bounce back could help investors recover large proportions of the losses they have suffered this past few weeks, but to do so, they must remain committed to a growth strategy.

Maintaining confidence in a long-term investment strategy during difficult market conditions is typically the most sensible plan, and one that is primarily recommended. However, these are extreme conditions the likes of which we have never faced before, and therefore, the risks are significant. There is potential for huge reward and huge losses but until there is greater clarity, a temporary strategy focused on protection could be the most sensible.

Markets will eventually stabilise, and growth will return but when this will happen is far from certain. In the meantime, as an investor you must ask yourself “Do I think markets could fall further before stability returns?” If the answer is yes, you must consider whether the risks of absorbing further losses by sticking to your current strategy is worth the risk.

As a gamble, there will always be more losers than winners from trying to time the markets. Although it is a difficult decision, shifting temporarily to a protection strategy to avoid further losses until markets stabilise is one that for many investors could be the most sensible - and should be seriously considered.

SafeGuard: Protecting Your Investments In Uncertain Times

Yodelar Investments have proactively put in place what we believe to be the most efficient strategy for navigating through the uncertainty thrust upon investment markets as a result of the coronavirus pandemic. Our SafeGuard portfolio is designed to maximise the protection of investor capital during these uncertain times. Investors will have the option to transfer to our risk-based portfolios when confidence is regained, and global stability is visible.

Our investment committee has created an investment portfolio designed to provide a high level of protection for investors during such uncertain times.

The Yodelar Investments SafeGuard portfolio has been developed to provide capital protection to investors during extreme volatility and market downturn resulting from the Covid 19 global pandemic. Our SafeGuard Portfolio invests in cash and low risk money market instruments to ensure comprehensive protection against the exposure to losses experienced by Global equity and bond markets.

The portfolio is weighted across multiple fund managers and providers to provide investors with maximum protection afforded by the UK Government's Financial Services Compensation Scheme (FSCS), which is the UK’s statutory compensation scheme for customers of financial products that have failed as well as protecting cash held in banks and building societies.

The Yodelar SafeGuard Portfolio is a low risk, low growth portfolio and as such, it is intended as a low-cost temporary investment strategy for investors until markets stabilise and we see signs of economic correction, improved consumer confidence, and general market improvements.

Click Here to Download Further Information On The Yodelar Investments SafeGuard Portfolio