- Poor performance for investors who hold a Standard Life pension.

- 104 of the 135 funds analysed consistently performed worse than at least half of their peers and were classified as poor performing 1 or 2-star funds.

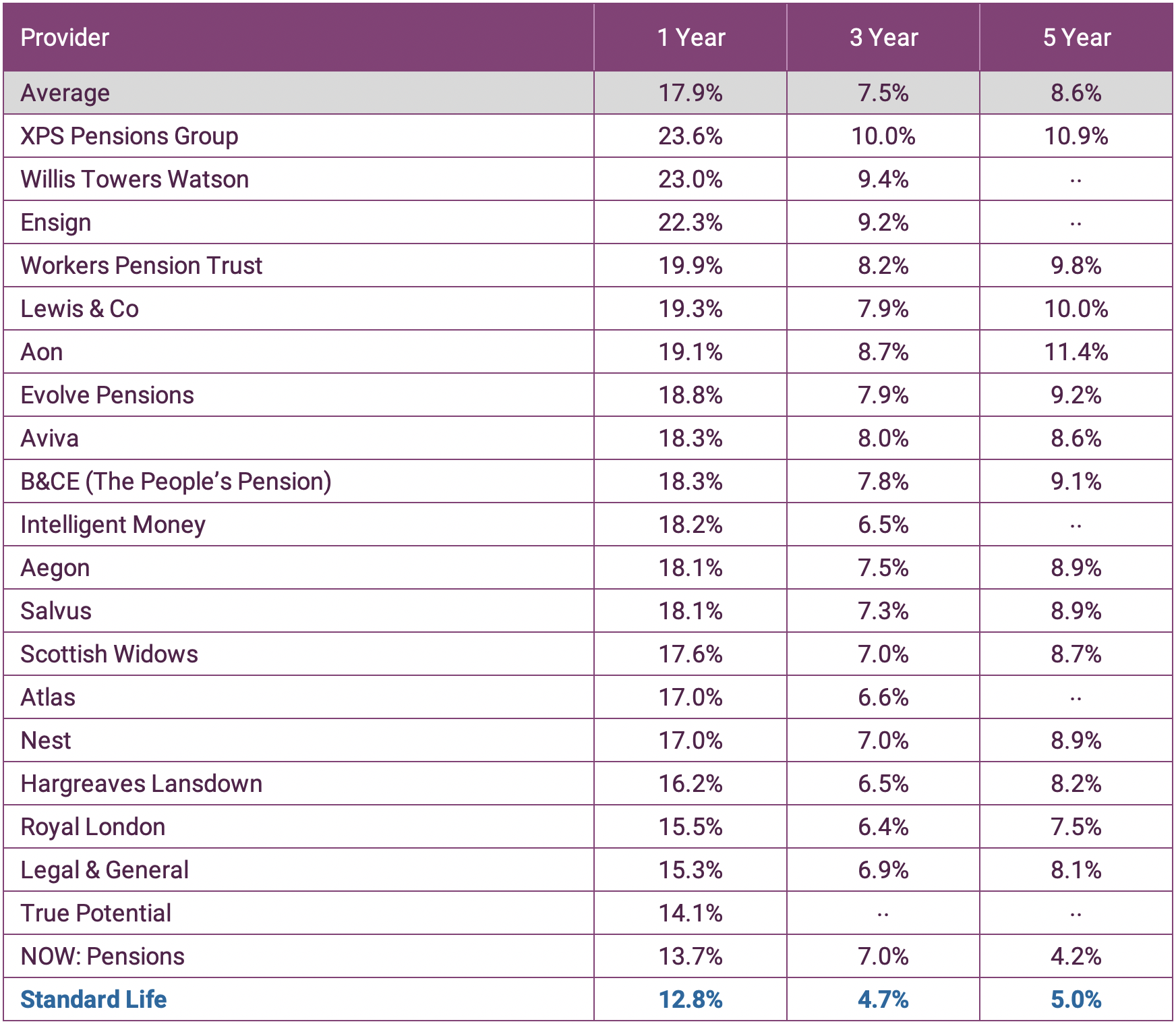

- Research from Nest, who is a government body set up especially for auto-enrolment, shows that the Standard Life default workplace pension fund has been one of the worst performers when compared to other main default workplace pension funds.

- From the 135 Standard Life funds analysed just 5.92% received an impressive 4 or 5-star performance rating.

Standard Life has a long heritage and their brand continues to have strong recognition with investors as a high quality pension provider. This has helped them become one of the largest workplace pension providers in the UK, managing £46.3 billion of pension savings on behalf of 2.4 million personal workplace pension plan holders.

However, Standard Life Assurance Limited, formerly part of Standard Life Aberdeen group, recently became part of the Phoenix Group with Phoenix also purchasing the “Standard Life” name over the course of 2021. What implications this will have on Standard Life funds remains to be seen but a change may add further value as our analysis of Standard Life pension funds identifies widespread underperformance.

In this report we analysed the performance and sector ranking of 135 Standard Life pension funds and found that some 77% of their funds have consistently performed below the sector average and with some ranking among the very worst in their sectors.

Download the full Standard Life Pension review

Standard Life Pension Fund Performance

Our analysis of the 135 Standard Life pension funds identified that 4 received a top-performing 5-star rating with a further 4 funds rating as good 4-star performing funds. However, 104 of the 135 funds analysed consistently performed worse than at least half of their peers and were classified as poor performing 1 or 2-star funds.

The Standard Life Default Workplace Pension Fund Struggles For Performance

Research from The Pensions Regulator shows that more than 95% of workers stay in their pension scheme’s default fund. So it’s essential that your chosen pension provider delivers the best possible outcomes for their members.

Further research from Nest, who are a government body set up especially for auto-enrolment, shows that the Standard Life default workplace pension fund has been one of the worst performers when compared to other main default workplace pension funds.

The Best Standard Life Pension Funds

From the 135 Standard Life funds analysed just 5.92% received an impressive 4 or 5-star performance rating. Although these funds represent only a small proportion of their pension fund range, they are funds that have consistently been among the best in their sectors for performance.

Stan Life Index Linked Bond Pn Fund

The Stan Life Index Linked Bond pension fund aims to provide long term growth from a combination of income and capital growth by investing predominantly in index-linked stock issued by the UK government. It is an actively managed fund and actively invests in corporate index-linked bonds, corporate bonds and overseas bonds to try to take advantage of opportunities as identified by the funds manager.

Over the recent 1, 3 & 5 years this fund returned growth of 2.36%, 17.72% and 44.47%, which were above the sector average of 1.55%, 14.38% and 37.43% for the periods.

Stan Life Japanese Pn Fund

The Stan Life Japanese pension fund is designed for investors who are looking for exposure to the Japanese equity market by investing in shares of companies listed on the Japanese stock markets.

The fund has been a popular fund with investors and it currently manages in excess of £2.5 billion of client assets. The fund has consistently been one of the top-ranked funds in its sector and represents one of Standard Life best performing pension funds.

Stan Life SLI European Smaller Companies Pn Fund

The fund is invested in the Standard Life Investments Global SICAV European Smaller Companies Fund which aims to provide long term growth by investing predominantly in the shares of smaller companies listed on European stock markets, including the UK.

Since its launch in 2012, the fund has only managed to attract investment of £32 million, making it one of the smaller funds in its sector. Despite its size, it has consistently been one of the top performers in its sector. Over the past 1, 3 & 5 years this fund has returned growth of 20.52%, 35.03% and 104.07%.

Stan Life Long Lease Property Managed Pn Fund

This fund is only open to UK registered pension schemes and it designed to complement an existing diversified portfolio and enhance returns relative to deferred and current pension liabilities. Given the current environment of low interest rates and low-yielding government bonds, investors view long income real estate as a welcome and reliable source of yield.

The Fund is a High Lease to Value Property Fund investing in a diversified portfolio of assets let to strong financial covenants, and maintaining a minimum average unexpired property lease length of 15 years. The Fund aims to outperform the FT All Gilt Index by 2% per annum over rolling 5 year periods.

Over the recent 1 & 3 year periods this fund has ranked 1st in a sector of 152 funds with growth of 4.36%% and 18.16%. In contrast, the UK Direct Property sector average losses of -4.35% and -0.58% for the same 1 and 3 year period.

Underperforming Standard Life Pension Funds

58.14% of the 135 Standard Life funds analysed have regularly ranked among the worst performers in their sectors with consistently better-performing alternatives available to investors.

Stan Life Passive Plus Pension Funds

Standard Life Passive Plus Funds were introduced as a lower cost option for workplace pension schemes by investing mainly in tracker funds. Designed to offer a lower-cost investment solution, the Passive Plus funds invest in a portfolio that is mainly made up of tracker funds from Vanguard. For more specialist areas, they include actively managed commercial property and high yield bond funds.

There are 5 Standard Life Passive Plus funds that range from the Standard Life Passive Plus 1 funds, which represents the lower risk fund in the range to the Standard Life Passive Plus 5 fund, which is the highest risk fund in the range.

Our analysis identified that all 5 of these funds have performed poorly. Over the past 12 months, each of these funds performed worse than at least 50% of competing funds within the same sector with the Standard Life Passive Plus 4 fund outperformed by 76% of its competitors.

Stan Life Active Plus Pension Funds

The Standard Life Active Plus selection of funds are each actively managed although they only invest in funds managed by Aberdeen Standard Investments. The investment process for the funds’ strategic asset allocations is the same as for the Passive Plus range however has the additional benefit of Tactical Asset Allocation, which aims to take advantage of shorter-term investment opportunities. Tactical Asset Allocation is carried out by Multi-Asset Solutions.

Similar to their Passive Plus range, the Standard Life Active Plus funds range from 1 to 5, with 1 being the lowest risk and 5 the highest. The Standard Life Active Plus funds 3, 4 & 5 have been relatively competitive, each delivering returns that were better than the sector average, but for their lower risk Standard Life Active Plus 1 and 2 funds, their performance has disappointed.

Stan Life MyFolio Funds

In 2010, Standard Life launched a range of multi-asset funds called MyFolio. These funds have proven to be very popular with investors with the pension version of these funds currently holding in excess of £8.8 billion.

The Standard Life MyFolio Funds mainly invest in Aberdeen Standard Investment funds, with the manager having the ability to select alternative investments from the rest of the market. Currently, there are 4 ‘at retirement’ MyFolio funds and 6 ‘pre retirement’ funds. Our analysis identified that each of these popular funds have consistently underperformed. Each and every one has returned growth over the past 1, 3 & 5 years that was below the sector average and among the worst in the entire sector.

Standard Life Pension Review

Standard Life is one of the largest providers of pension funds in the UK, with their range of pension products proving to be a popular choice with advisers and investors, and their workplace pension funds regularly selected as the default pension option for small and large companies.

Despite their scale and popularity, our analysis of their pension funds shows widespread underperformance across their range with less than 6% ranking among the top performers in their sectors. A large proportion of ‘new business’ secured by Standard Life in recent years has been through the governments Auto-Enrolment initiative where Standard Life pensions were often selected as the preferred provider. However, as identified in this report, their default workplace pension fund has yielded some of the lowest returns in comparison to the default funds of their main competitors.

With so much choice available for workplace pensions and personal SIPPs, there are significantly better performing alternatives to Standard Life which over the long term, could help investors meet their pension objectives more efficiently.