- 58.14% of the 129 Aberdeen Standard funds have regularly ranked among the worst performers in their sectors.

- Over the past 5 years, the ASI UK Responsible Equity fund returned growth of 83.84%, which was better than 98% of funds within the same sector.

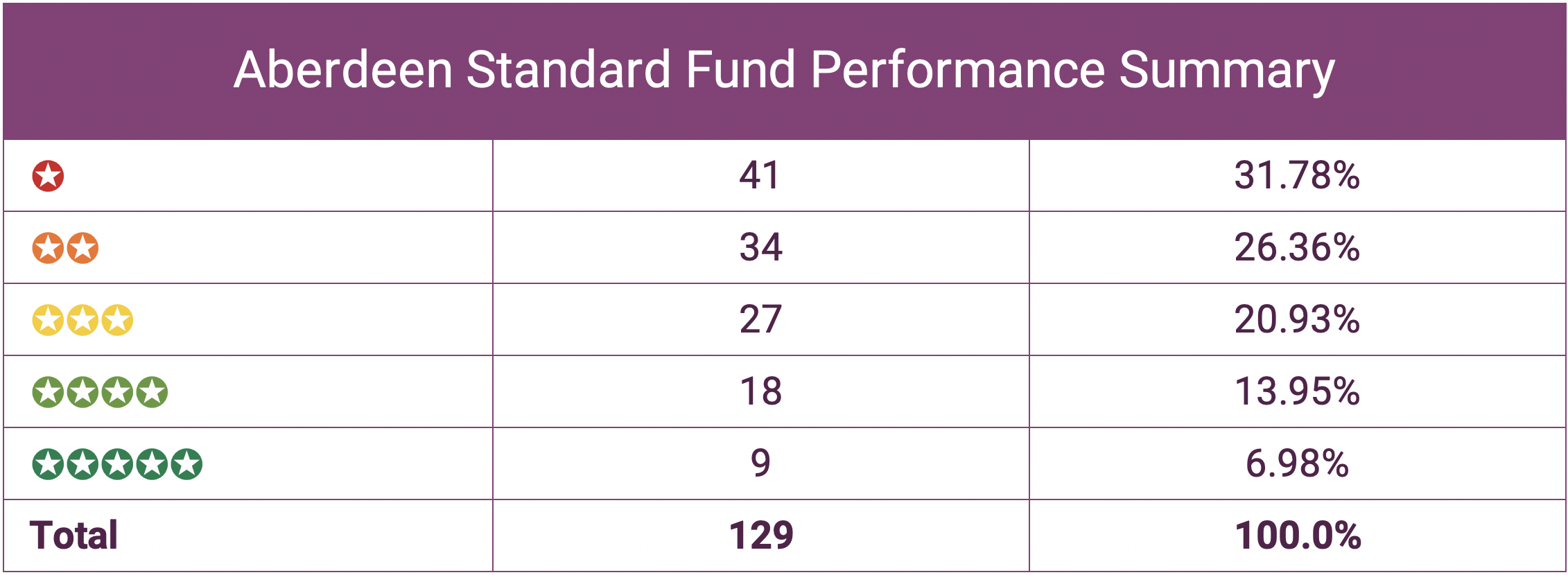

- From the 129 Aberdeen Standard funds analysed 21% received an impressive 4 or 5-star performance.

The £11 billion deal to merge fund management giants Aberdeen Asset Management and Standard Life resulted in the creation of the UK’s largest and Europe’s 2nd largest fund manager.

Rebranded as Aberdeen Standard Investments, the merger saw their combined funds under management reach £670 billion. But the merger was not viewed favourably by investors who withdrew their assets in their droves and in the first 6 months since the merger outflows hit £45 billion. Aberdeen Standard were then hit with further outflows of £100 billion as a previous contract with Scottish Widows to manage £100 billion of client assets was terminated by Lloyds after their purchase of Scottish Widows. Today, the total assets under their management is at £455.6 billion.

It has been a tumultuous time for the wealth management giant but as Stephen Bird takes over as CEO they are confident they have now in place the foundations that will see inflows return. But for investors to return it is important that the funds managed by Aberdeen Standard are competitive.

In this analysis, we feature the performance and ranking of all 129 Aberdeen Standard funds and identify their best performing funds and those that have particularly struggled for competitive performance.

Aberdeen Standard Investments Fund Performance

Our analysis of the 129 Aberdeen Standard funds identified that 15 consistently outperformed at least 75% of funds in their sectors over the past 1, 3 & 5 years, with a total of 27 of their funds receiving a strong 4 or 5-star performance ranking. In contrast, 14 of the 129 Aberdeen Standard funds analysed consistently performed worse than three-quarters of their peers with a total of 75 or 58.15% of their funds receiving a poor 1 or 2-star performance rating.

The Best Aberdeen Standard Funds

From the 129 Aberdeen Standard funds analysed 20.93% received an impressive 4 or 5-star performance rating. Each of these funds has consistently been among the best in their sectors for performance. Among these funds are”

ASI Europe ex UK Equity Fund

The £258.7 million ASI Europe ex UK Equity fund has consistently been one of the top-performing funds in the Europe excluding UK sector. The Fund invests in a broad spread of European companies which offer good prospects for capital growth.

Over the recent 1, 3 & 5 years this fund returned growth of 15.05%, 40.44% and 104.08%, which were well above the sector average of 11.01%, 17.58% and 68.25% for the periods.

ASI Global Smaller Companies Fund

The ASI Global Smaller Companies fund invests at least 70% in small-capitalisation equities and equity-related securities of companies listed on global stock exchanges. Their primary focus of this fund is on identifying companies where the management team have a different view of a company's prospects than that of the market, and which align with their views regarding future economic and business conditions.

Since its launch 5 years ago the ASI Global Smaller Companies fund has delivered growth of 136.13%, which was almost double the sector average and higher than 92% of funds within the same sector. The fund has consistently been one of the top-ranked funds in its sector and represents one of Standard Life Aberdeen’s best performing funds.

ASI UK Responsible Equity Fund

The Fund invests 80% or more of its total net assets in UK equities. As well as choosing companies on the basis of their financial record, management and business prospects, the Manager will also consider environmental, social and other relevant criteria. Where the Manager believes that practices relating to these criteria are lacking they will encourage the company to adopt more responsible practices. The fund currently invests in industrials and financial services companies and has holdings in Experian, Prudential and the London Stock Exchange Group.

Since its launch on 9th May 2006 until 1st January 2021, the ASI UK Responsible Equity fund returned growth of 142.88% and over the recent 1, 3, & 5 years it has consistently been one of the top-performing funds in the IA UK All Companies sector.

ASI European Smaller Companies Fund

The Fund invests 70% or more of its total net assets in equities from European smaller companies. These companies are generally those valued at less than €5 billion at the time of investment. The Fund's equity investments can include equities and equity-related securities that are issued by companies that are incorporated, or generate a significant part of their earnings, in Europe.

Over the recent 3 & 5 year periods this fund returned growth of 46.32% and 117.23% which were the highest in the entire IA European Smaller Companies sector.

ASI UK Mid Cap Equity Fund

The UK market has been one of the hardest hit in recent times with the culmination of the pandemic and Brexit uncertainty resulting in high volatility and negative returns for many UK equity funds. However, despite the challenges faced by UK Equities one of the most consistent top performers has been the ASI UK Mid Cap fund. This fund currently manages £206 million of client assets, and over the past 1, 3 & 5 years it has returned growth of 5.47%, 34.76%, and 76.62%, which were among the highest in the sector.

Underperforming Aberdeen Standard Investment Funds

58.14% of the 129 Aberdeen Standard funds analysed have regularly ranked among the worst performers in their sectors with consistently better-performing alternatives available to investors.

ASI Global Focused Equity Fund

The ASI Global Focused Equity fund is a Global fund and shares the same sector as some of the most popular funds in the UK such as Fundsmith Equity and the Lindsell Train Global Equity fund. However, whereas the Fundsmith Equity fund returned growth of 138.44% over the past 5-years, and the Lindsell Train Global Equity fund returned 130.54%, the ASI Global Focused Equity fund returned just 55.98% which was worse than 90% of all the funds in the IA Global sector where the average growth for the period was 91.32%.

ASI Diversified Income Fund

The Fund invests more than 50% of its total net assets in worldwide equities and bonds, with the remainder invested in other asset classes such as cash, property and infrastructure. In recent years this fund has been one of the worst performers in its sector with 1, 3 & 5-year returns of 1.26%, 3.39%, and 28.32%, which were all well below the sector average.

ASI Emerging Markets Bond

The ASI Emerging Markets Bond invests 70% or more of its total net assets in corporate bonds or government bonds based in emerging market countries. The fund has persistently struggled and over 5 years this fund returned growth of 32.75%, which was well below the 44.13% sector average.

ASI MyFolio Multi-Manager Fund

The ASI MyFolio Multi-Manager I fund is part of the MyFolio Multi-Manager range, which consists of five funds with different expected combinations of investment risk and return levels. The fund is risk level I, which aims to be the lowest risk fund in this range. The range, in general, has been disappointing as they have delivered some of the lowest returns in their sector with the ASI MyFolio Multi-Manager I fund ranking 93rd out of 95 funds in its sector for growth over the past 5-years.

ASI UK High Income Equity Fund

The fund aims to provide long term growth and is designed for investors who are looking for exposure to UK equity markets. The fund is actively managed and its aim is to exceed the Investment Association UK Equity Income Sector Average return over 1 year and to be top quartile over three years or longer. But unfortunately for those invested in this fund it has fallen someway short of these targets. Over the past 3-years the fund returned losses of -14.95%, which ranked the fund 79th out of 87 funds in the IA UK Equity Income sector. Over 5-years it has done even worse at its 5-year cumulative returns of 5.45% was worse than 97% of its peers.

Aberdeen Standard Review

The big money merger between Standard Life and Aberdeen has resulted in the formation of the UK’s largest active fund manager, but unhappy with the merger, many of their investors decided to move elsewhere with outflows exceeding £40 billion in 2018.

A financial update in August 2020 said assets under management and administration fell 11.7% year-on-year as it struggles to re-stabilise after the merger as well as a result of the settlement with Lloyds Banking Group, who upon their acquisition of Scottish Widows terminated a contract with Aberdeen for the management of £100 billion of client assets.

Despite the challenges faced by Aberdeen Standard in recent years, the real concern for investors is in the performance of the funds they manage, and as identified in our analysis a large portion of the funds they manage have consistently fared well when compared to their rivals, with some of their funds consistently ranking at the top of their sectors.