When ISAs were first introduced in 1999 by the then chancellor, Gordon Brown, they had a maximum allowance of £7,000. Now the allowance is £20,000 and currently more than 11 million UK investors are sheltering in excess of £67.5 billion in tax efficient ISA accounts.

As the April deadline for this years ISA season draws closer, it’s one of the busiest times of the year for investors with as much as half of all ISA investments occurring in the last three months of the tax year and 15% in the final two weeks alone.

There are 4 main ISA options available with a stocks and shares ISA the most popular with investors. But not everyone who invests their ISA allowance is making their money work as efficiently as it could, and many will make ISA decisions this year without a suitable strategy.

In this report, we detail all the main ISA options as well as identify a selection of high quality, top performing fund options for this years ISA season.

ISA Basics - The Options Available

An Individual Savings Account (ISA) is a special type of tax efficient account. There are different types of ISAs and the annual allowance is currently £20,000 for the 2021/2022 tax year.

You are not allowed to put money into more than one of the same type of ISA in the same tax year and the allowance cannot be carried forward to the next tax year so it is important to use as much of it as you can each year.

There are 4 main different types of ISAs that are available in the UK.

Cash ISA

Cash ISAs are available to anyone over the age of 16 and are similar to a standard bank or building society account. The key difference with a cash ISA is that any interest earned within the ISA is always tax-free.

Stocks and Shares ISA

A stocks and shares ISA allows you to invest your money across a variety of markets and sectors, offering wider investment opportunities and greater potential for growth when compared to a cash ISA. All income and growth within a stocks and shares ISA is tax-free. A Stocks and shares ISA is an investment, and should typically only be considered as part of a medium to long-term strategy of at least 5 years.

Lifetime ISA

A Lifetime ISA or LISA is open to individuals aged between 18-40. It’s aimed to help younger savers accumulate a deposit for their first home or for people looking to save for later life.

You can contribute to it up until your 50th birthday and you can opt to save into stocks and shares, cash or a mixture of both. The annual LISA limit is £4,000 and the government will add a 25% bonus to the amount you save. The bonus will be added to your LISA the month after the deposit.

If you do not use your LISA for a home deposit, you can access the funds penalty-free from your 60th birthday.

You are still able to access your LISA funds before you turn 60, but unless it is for a first house deposit you will pay a 25% withdrawal penalty, in effect losing the government bonus and some more, so you must be content to lock your money away for a significant length of time.

Both the LISA and the H2B ISA (Help to Buy) offer the 25% government bonus and the chance to accumulate a deposit for your first home. The H2B ISA is no longer available for new subscriptions.

However, the bonuses are added in a different way and you can only use the 25% bonus from one of these vehicles to buy your first home.

Junior ISA

Junior ISAs or JISAs were introduced in November 2011, replacing the Child Trust Fund.

A Junior ISA can be opened at birth and is controlled by a parent or guardian until the child turns 16. You can invest the annual allowance into stocks and shares, cash or a mixture of both. You cannot make payments into stocks and shares JISA and a cash ISA in the same tax year. The current annual allowance is £9,000.

NB: Any child holding a Child Trust Fund (CTF) can’t have a JISA opened for them unless the CTF is first transferred to a JISA and the CTF closed.

Identifying The Best Funds To Build A Robust and Top Performing ISA Portfolio

We believe that the funds that invest in quality businesses and have a proven history of comparatively strong performance within their sectors are more likely to perform better in the medium to long term than their peers. By utilising such funds to fit within a suitable asset allocation model we believe will help investors to maximise their portfolio growth potential.

If using a financial adviser to build and manage your ISA, make sure that you are partnered with someone that has performance knowledge and who can demonstrate that easily. As fund performance is not a regulated requirement of financial planning, financial advisers are not required to research the performance of funds. As a result, a large proportion of advisers have a poor level of knowledge in relation to fund performance. By ensuring your portfolio contains quality funds, within an asset allocation model suitable to your risk profile, you have covered the 2 main aspects of maintaining an efficient portfolio.

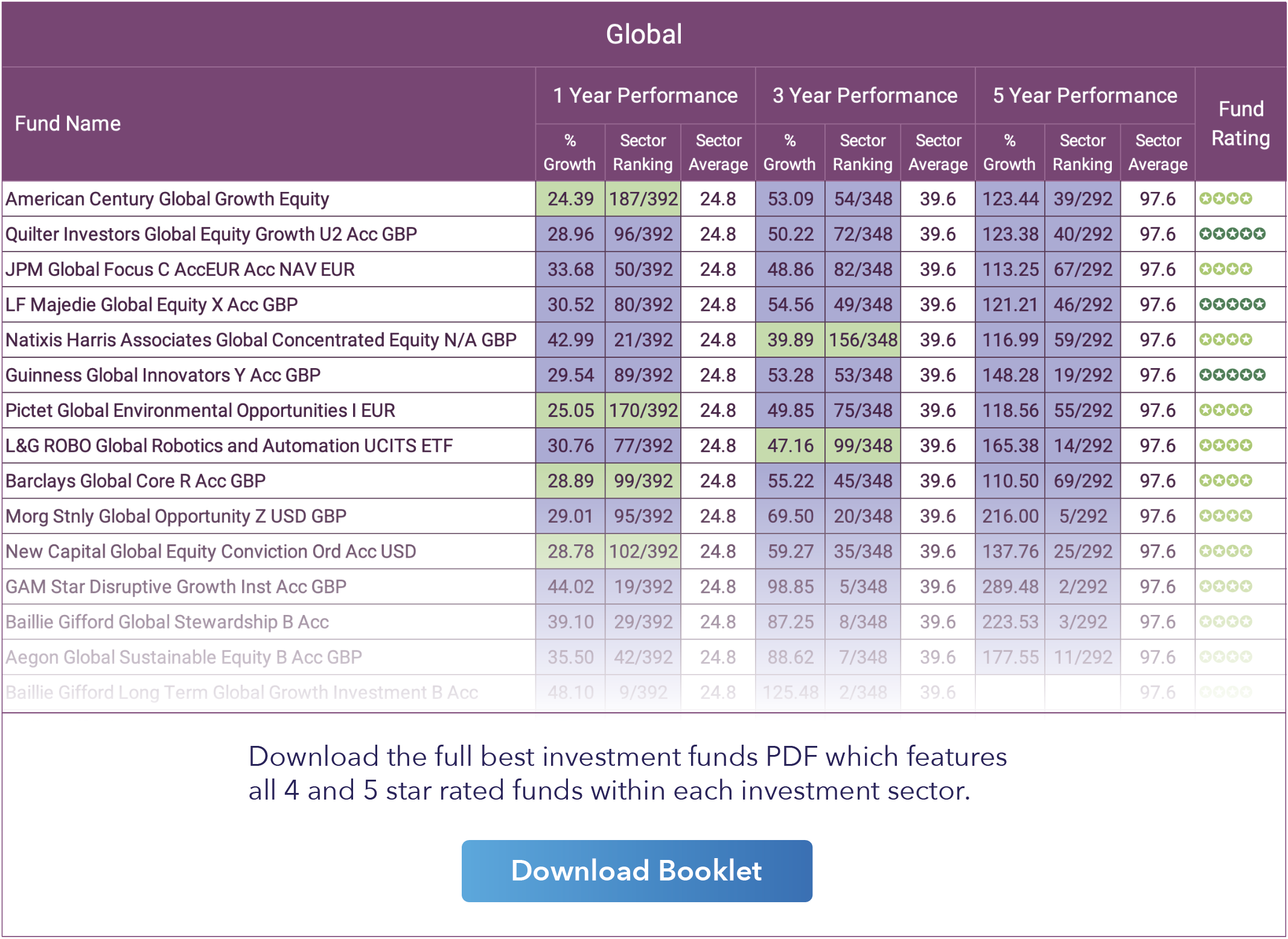

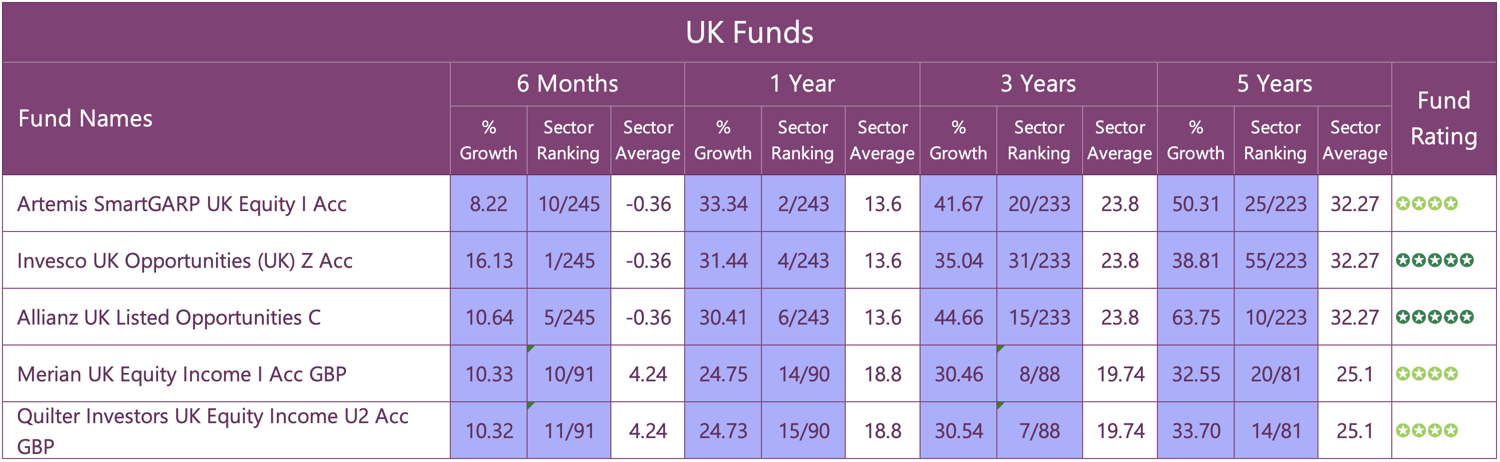

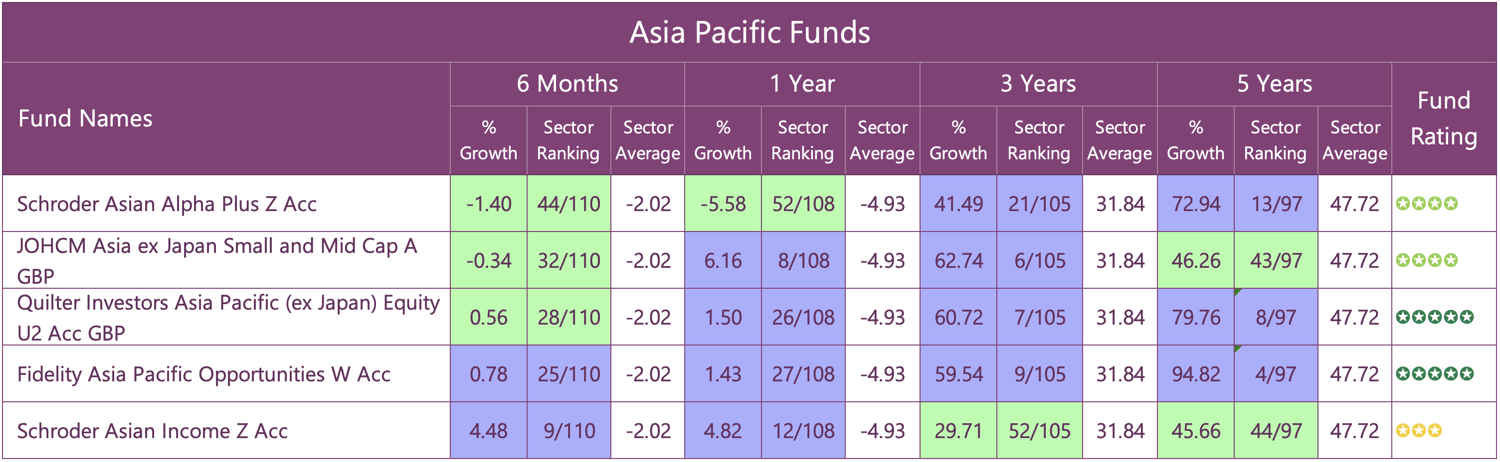

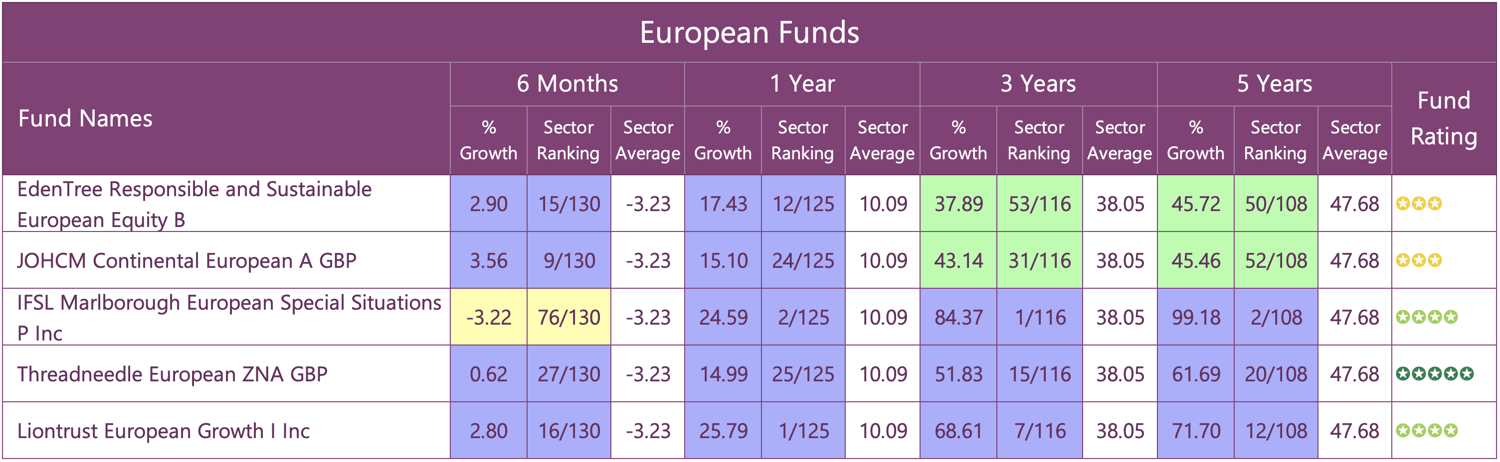

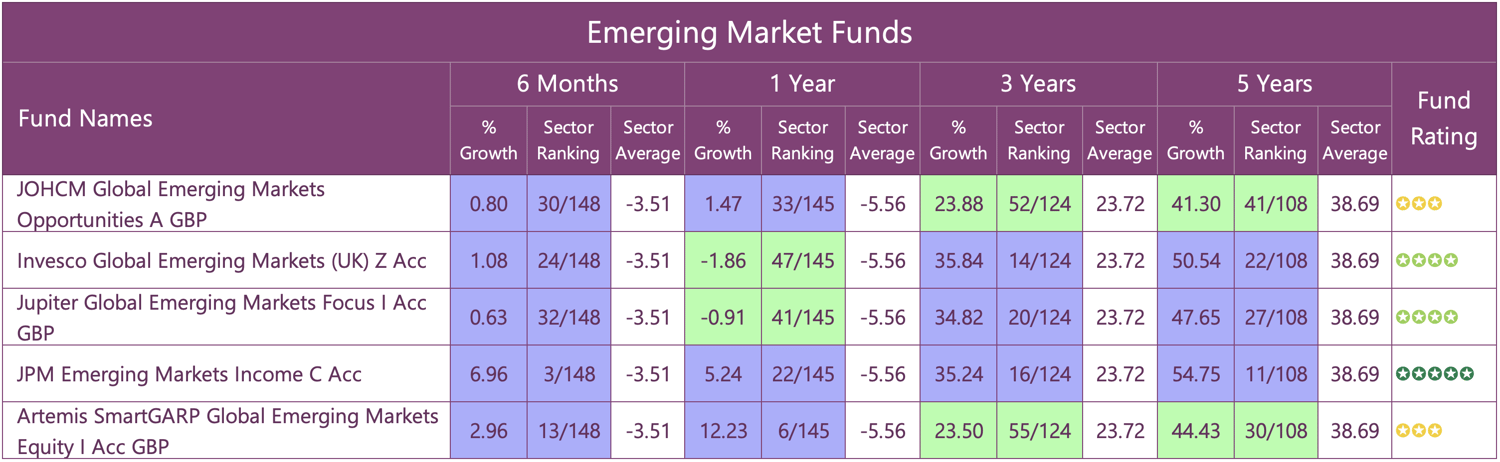

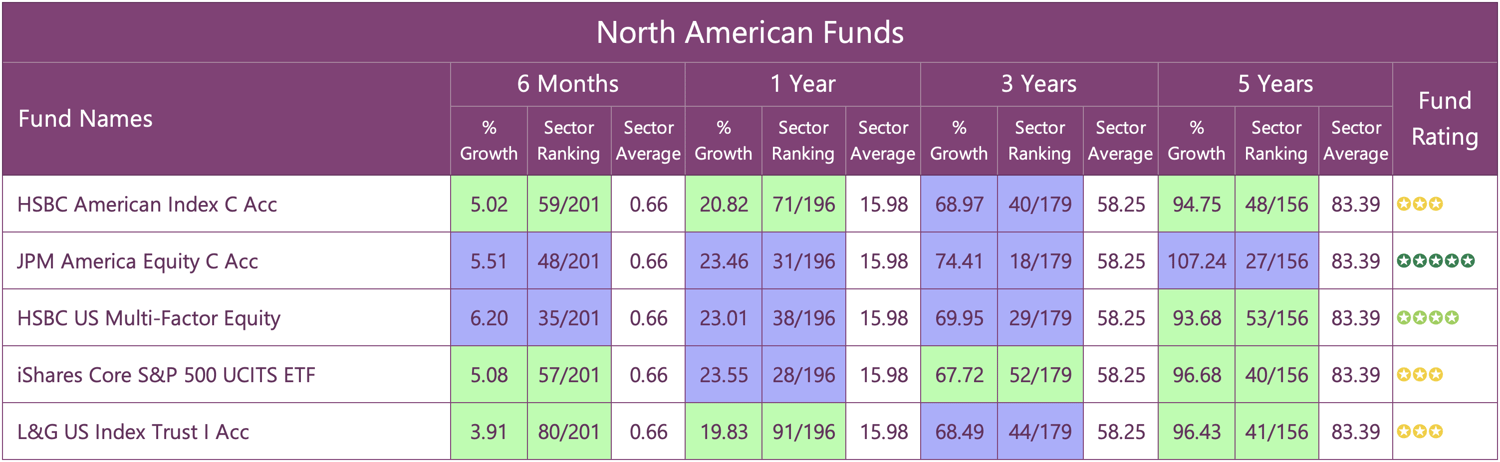

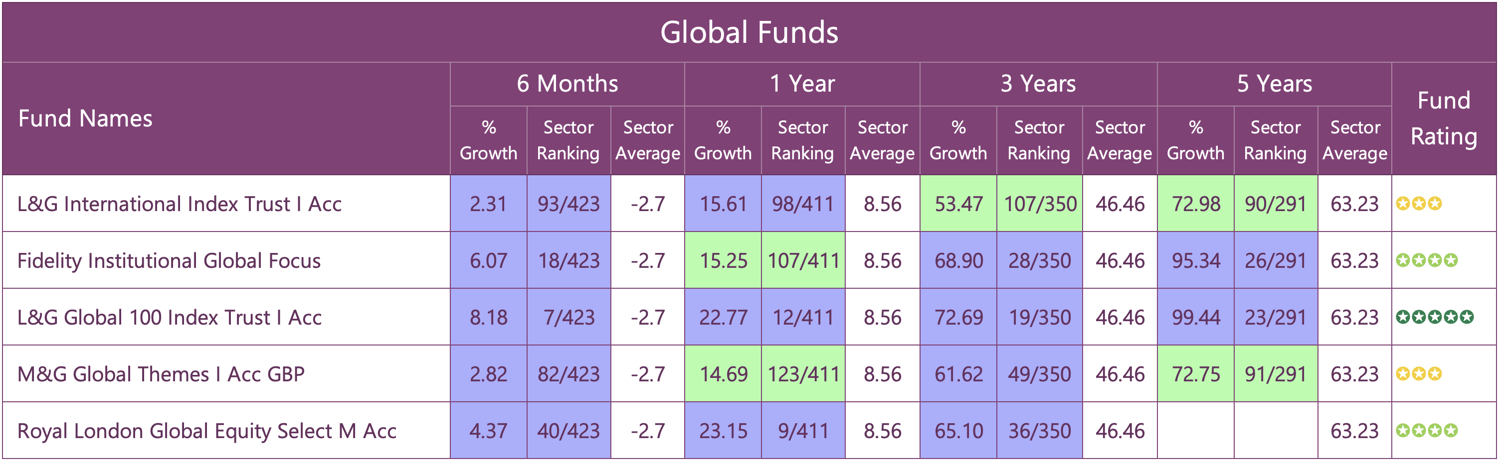

With so many investment options available, it can be difficult to know which ones to select as you look to make your money work for you. The tables below identifies a selection of high quality funds across a number of major sectors that have consistently performed well and may offer exciting investment opportunities for ISA investors.

Identify All The Best Funds

Our most recent best funds report was compiled from a performance and ranking analysis of over 3,400 funds and features all funds that received a 4 & 5 star performance rating. Click on the button below to download your copy of our best funds report.

If Investing Your ISA Choose Quality Over Cost

Investing by definition is about putting money to use by purchase or expenditure, in something offering potential profitable returns - Yet for some investors, growing their money is not the primary driver in their investment decisions.

In recent years in particular, the cost of investing has become more influential, with some investors focusing more on how much they can save in fees compared to the quality of investment products that offer the best potential for returns.

Such an approach can actually be more costly investors miss out on returns that significantly outweigh the savings from investing in low-cost portfolios.

Each sector will have consistently top performing funds when compared to all same sector funds. Those that prioritise experience and consistent performance first, and cost to invest second make use the better performing competitive funds, and generate better returns.

To achieve maximum efficiency from your portfolio it is important to distinguish the value between a high quality, possibly more expensive product, to that of a lower priced poor performing alternative. Cost and growth must be a balanced assessment based on factual information.

It is also important to recognise that low-cost portfolio providers are forced to maintain their low fee structure in order to maintain the viability of their business. As a consequence, they are forced to overlook many high-quality funds that do not fit their cost structure in favour of lower-priced, and often lower growth alternatives.

When it comes to investing, cost will and should always be an important consideration, but it should never be the dominant factor. Investing is about growth and although many low-cost portfolios do just that, they have a deep-rooted flaw that will always limit their potential. As a consequence, the real value from investing is not in the short term gain from saving on fees but from the long-term value of investing in portfolios that focus on quality.

Balance Quality Funds & Asset Allocation

The balance of investments across different asset classes is the primary driver of portfolio returns, but the funds used to create the correct balance are essential to maximising portfolio growth and efficiency. This is core to the strategy of Yodelar Investment portfolios.

For example, a fund manager might take on a strategy favouring particular industry sectors over others when constructing their fund. Even though the fund might invest primarily in industries such as travel or tourism it can have the same sector classification as a competing fund which has a similar asset class but instead the fund manager might prefer to hold greater weighting in technology or healthcare companies.

The outcome can be significant and one that can see a fund rank highly within its sector or one that sees the fund languish among the worst performers.

Formulating the appropriate blend of investment funds to fit your ISA portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis. It is an important part of our investment committee’s strategy and one which we believe provides investors with optimal investment portfolios for all market conditions.

ISA Efficient Investing

There are approximately 3,000 unit trust funds available to UK investors of which only 1 in 10 have a history of top performance.

The investment market is littered with poor products, and the limited information available relating to performance has made it difficult to identify the good from the bad. This has resulted in billions being placed in funds that have persistently underperformed causing many investors to miss out on growth with their ISA portfolios.

Formulating the appropriate blend of investment funds to fit a portfolio’s specified asset allocation model and optimise growth potential is a complex process that requires thorough analysis.

Our research has identified that the majority of investors are missing out on extra long-term growth due to subpar fund choices and general inefficiencies in their portfolio. Inefficient investing will undoubtedly have adverse long-term consequences, which is why it is so important to be able to identify portfolio performance and correct any deficiencies.

The funds featured in this report represent a selection of the funds currently available to UK investors that have proven their quality and offer what we believe to be exciting investment opportunities this ISA season.