- How efficient is your pension/investment portfolio?

- Are you invested in underperforming funds?

- Assess the ranking of every fund you are invested in

- Free service used by over 30,000 high net worth investors

In this article, we explain why YODELAR's free portfolio analysis service is an essential resource for every investor. Being able to transparently see the performance of your funds and the overall quality of your portfolio allows you to make informed decisions that will help deliver better longterm investment outcomes.

No matter the end objective, investing is a significant financial commitment that requires many years of patience and trust to mature. Yet despite its obvious importance, investors are often in the dark as to how well their investments are performing and whether or not they are investing efficiently.

For many investors, the reality is that the funds in which they entrust their money are often of low-quality, and as a consequence, their portfolios lack efficiency and deliver diluted returns.

In declining markets all funds can go down, and in growth markets all funds can increase. An objective for efficient investors is to drop less in declining markets and grow more in growth markets. To do this efficiently you must be confident in the fund managers you have chosen.

While past performance does not guarantee future returns, being able to clearly see how the funds within your portfolio are performing and how they compare to similar sector peer funds, investors have the means to identify if their portfolio contains funds which underperform.

Why Analyse Your Portfolio

There are approximately 4,000 funds available to UK investors that have been provided with a sector classification by the 'Investment Association', who are the trade body for UK investment/fund managers.

While there is no shortage of options available, our analysis of each fund found that a huge 87% have a long term history of poor performance. These poor performing funds are currently responsible for managing approximately 60% of the total £1.4 trillion held in investment association classified funds.

This statistic highlights the reality that the investment industry is littered with poor performing funds. As a consequence, most investors will have a large proportion of their money invested in low quality funds, funds that are limiting the growth potential of their investment portfolios and making it more difficult for them to meet their overall investment objectives. It is also important to highlight that a large proportion of these poor performing funds, often have higher annual charges when compared to the better performing same sector alternatives.

If we are unaware of how our funds rank within their particular sector, then the likelihood is we are not invested efficiently, and are losing out on potential growth within our investment and pension portfolios.

How Confident Are You With Your Portfolios Performance?

Whether or not you believe your portfolio has delivered competitive returns, its true performance can only be established by comparing the performance of the funds that make up the portfolio to that of all other same sector funds.

How Yodelar Rate Fund Performance

The unfortunate reality is that the vast majority of investors could achieve greater growth from their investments, without increasing risk or cost, by making more informed fund decisions and investing in funds/ fund managers that have proven their quality consistently over different time periods. Our free portfolio analysis service will clearly identify how efficient your portfolio has performed, and which funds (if any) are underperforming and limiting your portfolio's growth potential.

What You Will Learn From Our Portfolio Analysis Service

Our portfolio analysis service will highlight the performance of your portfolio. It will provide a clear insight into how each of your individual funds is performing while grading your entire portfolio based on its overall performance - making it easy to identify areas to improve.

It is a unique and complimentary service that provides investors with a detailed view of their portfolio, helping them in making more informed investment decisions.

What our portfolio analysis will identify:

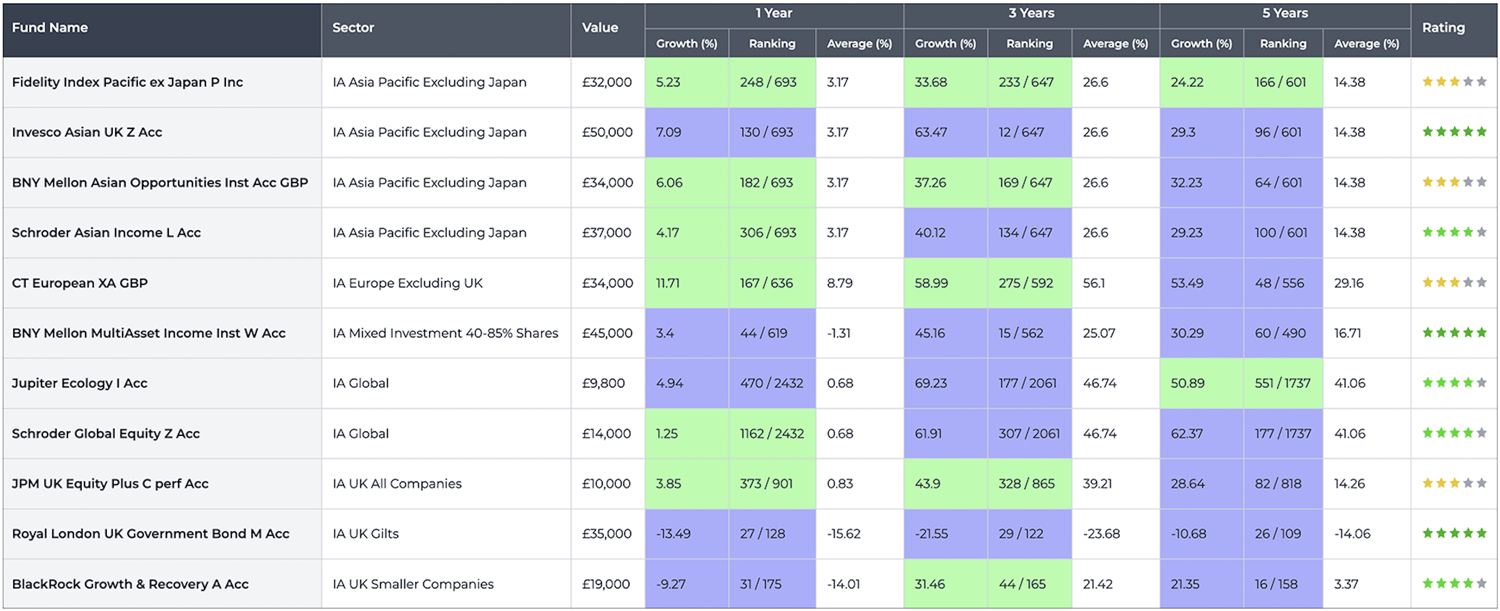

- The performance of each fund you are invested in.

- How each fund ranks within its sectors over 1, 3 & 5 years.

- Yodelar performance rating for each fund you are invested in (1 to 5 stars).

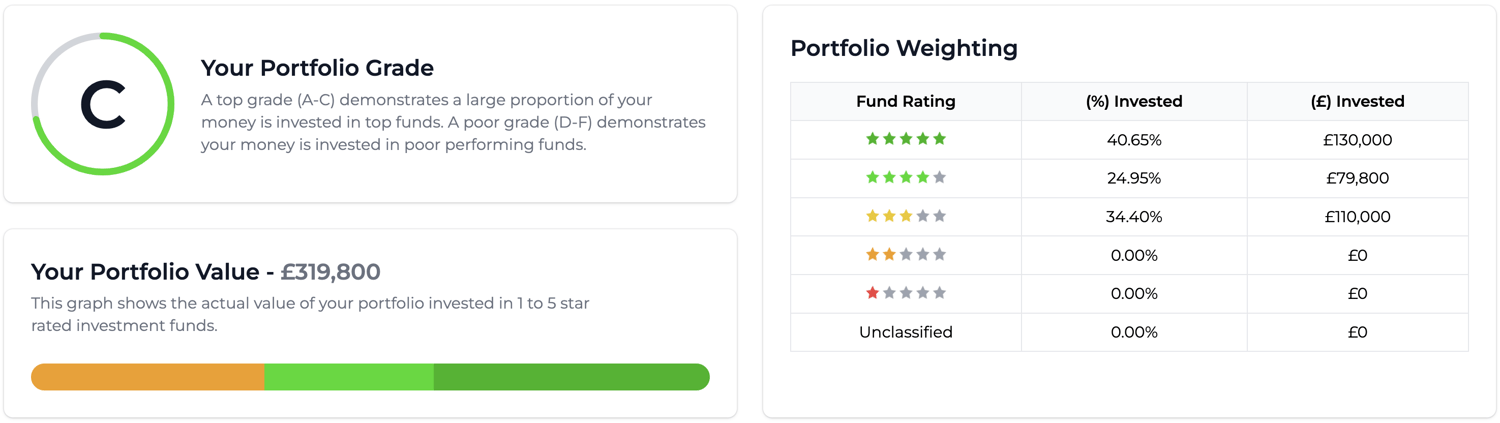

- What proportion of your portfolio is invested in 1 to 5 star rated funds.

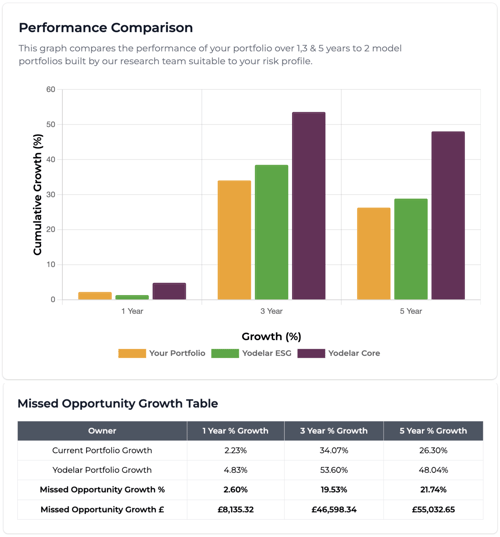

- Portfolio growth comparison with a similar risk portfolio of top-performing funds.

- Receive an overall Portfolio Grade (between A and F).

How You Can Get Your Free Portfolio Analysis

Our online portfolio analysis service is free to all investors. There are 2 options for an investors to avail of a performance analysis

Option 1 - Let us do it for you

Simply upload a portfolio statement or a document list with the name of the funds you are invested in along with the amounts held in each fund, and our team will provide you with a completed analysis typically within 1 working day.

https://www.yodelar.com/portfolio-analysis

Option 2 - Do it yourself

Register your free 7 day Investor Hub account with Yodelar using the link below, and search and upload your own funds, and build your own portfolio analysis. You will have the option to add your funds and their respective values to gain a comprehensive performance analysis.

https://hub.yodelar.com/register

By registering online for a free account you will also be able to access other features such as fund managers reviews, and top fund filters and our full range of investor magazines.

Why Fund Performance Matters

The performance of the individual investments within a portfolio is critical to the success of the overall portfolio. Poor-performing funds within an investment portfolio can have serious adverse effects for investors, both in the short term and long term.

Having a clear overview of a fund's performance empowers investors with the information needed to make informed decisions that can help increase portfolio efficiency, mitigate against excess risk and improve overall returns.

Fund performance is a reflection of a fund manager's skill in selecting which companies and industries to invest in and managing the associated risk of these equities. A fund manager's ability to generate returns that rank within the top quartile of the funds sector indicates a high level of expertise within that particular region. Such fund managers are skilled in identifying investment opportunities that boost a fund's effectiveness and as part of a suitably diversified portfolio, such funds can add significant value.

Your analysis will provide a retrospective overview of your portfolio's performance and although past performance is not an indicator of future success, it is a very important metric. Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors reflect a level of expertise/competency from the manager within that investment sector. Whereas, the fund managers whose funds continually rank poorly within their sector have demonstrated a lack of competency and an inability to deliver competitive returns for investors. Past performance is not an indicator of future returns, but it is important information that holds fund managers accountable for their performance.

What A Portfolio Analysis Will Identify

Fund performance

Individual performance of each fund within your portfolio. Each fund’s performance is graded from 1 star (lowest) to 5 star (highest) based on how they rank within their sectors when compared to all other competing funds.

Portfolio Grade & Allocation

Based on our rating criteria, the analysis will identify what proportion of your money is invested in top, mediocre or poor performing funds. It will also provide an overall performance grade for your portfolio.

Portfolio Performance Comparison

To assess the performance of your portfolio we compare its performance to that of a model portfolio based on the risk profile you select prior to the analysis. This provides a full overview of how the balance of funds within your portfolio translates into portfolio performance over the recent 1, 3 & 5 years and how this performance compares to two similar risk rated model portfolios.

Volatility Overview

The analysis will also provide you with a volatility overview of your portfolio for the past year. Volatility reflects the price movements of a portfolio of funds and can be used as a means to view a portfolio's risk levels. Higher volatility can mean the portfolio has greater risk exposure.

Claim Your Free Portfolio Analysis Now

The only way to determine how efficient a portfolio is performing is by comparing the performance and ranking of each individual fund within a portfolio. Your analysis will compare each fund in your portfolio against all other same sector funds, and give each fund a ranking based on performance.

Optimise Your Investments With Yodelar

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall. Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

Book a no obligation call with one of our advisers to learn more about your options and how we can help you maximise your portfolio returns.