- 9 out of 10 investors are unaware they are invested in poor performing funds

- Our free analysis identifies the sector ranking of each fund you are invested in

- As well as assessing each fund, the analysis also compares your portfolio performance to the performance of a similar risk rated Yodelar portfolio

- This article explains what is included in our portfolio analysis service, and how you will benefit from this free service

Understanding how your current funds rank and how they perform compared to their same sector peers is vital when it comes to understanding if you are invested efficiently, and doing the best you possibly can to maximise your portfolio growth within your suitable risk profile.

Whether you are a self investor or take advice from a restricted or whole of market (IFA) firm, understanding if you are invested in top or poor performing funds will change the way you invest forever

For self managed investors, knowing how the funds in their portfolio perform compared to similar funds in the same sector gives a clear view of whether their fund choices have been up to par whilst exposing areas that may need improvements.

For investors whose portfolios are managed by their adviser, they can see from an unbiased viewpoint the quality of the fund recommendations they have received. Having this clarity enables investors to make adjustments if needed - either replacing underperforming funds with better ones or assessing alternative advice recommendations to a more efficient portfolio.

In this article we identify how investors can obtain an unfiltered look into their portfolio performance and assess how their portfolio of funds have performed.

What A Portfolio Analysis Will Identify

- The performance of each fund you are invested in.

- How a fund ranks within their sectors for performance over 1, 3 & 5 years.

- Yodelar performance rating for each fund you are invested in (1 and 5 stars).

- What proportion of your portfolio is invested in 1 to 5 star rated funds.

- Portfolio growth comparison with a similar risk portfolio of top-performing funds.

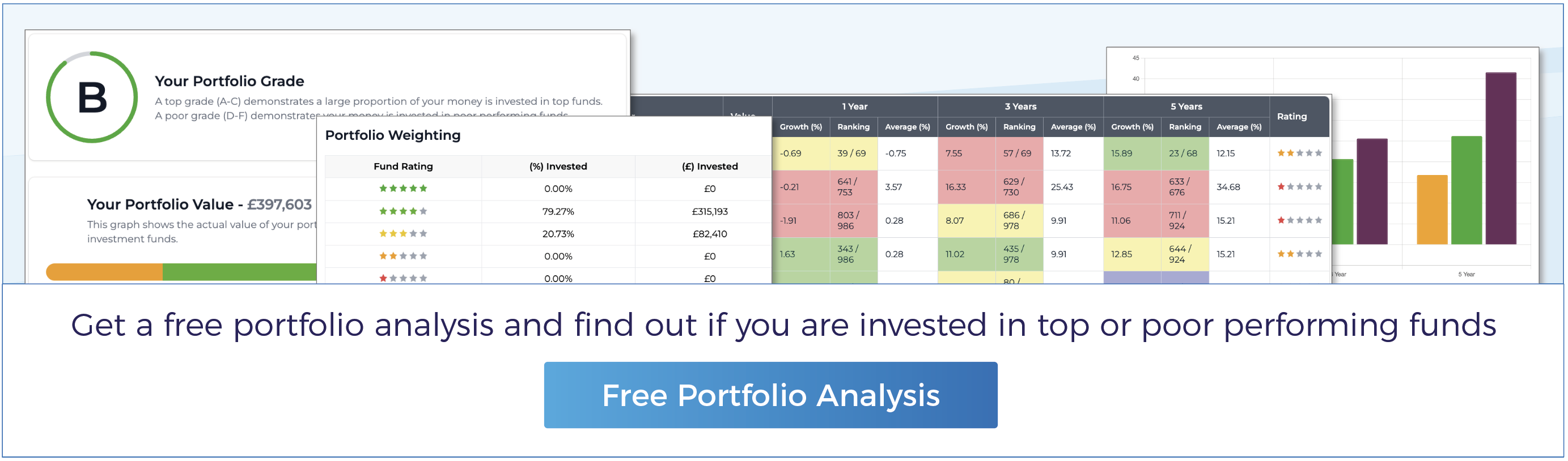

- Receive an overall Portfolio Grade (between A and F).

Our portfolio analysis is a unique service that provides investors with a panoramic view of their portfolio that helps to encourage more informed investment decisions, making it an essential resource for efficient investors.

Click here to access an example portfolio analysis

Many investors have the potential to significantly boost their portfolio growth by investing in established, well run funds that have consistently surpassed their same sector competitors.

The only way to determine how efficient a portfolio is performing is by comparing the performance and ranking of each fund within a portfolio to all other funds within their specified sector.

Upload your portfolio for analysis

Claim Your Portfolio Analysis

Yodelar offer one free portfolio analysis to all investors. It is an excellent exercise that provides a comprehensive, unbiased and factual overview of how each fund within a portfolio has performed compared to their competitors, and identifies any potential inefficiencies or areas for improvement.

It is a straightforward process that requires basic information for our team to complete.

To claim your no obligation complimentary portfolio analysis, simply upload the name of the funds and their individual values to https://www.yodelar.com/portfolio-analysis and our research team will complete the analyse on your behalf. The team will accept this breakdown in any format as long as the information contains the name of the funds, and the approx value invested in each funds. As an example popular formats we receive the information in are detailed below as an example:

- Hargreaves Lansdown and most platforms - Downloaded statement

- St James's Place - Downloaded Statement

- Aviva - Downloaded Statement or Excel/CSV

Investors can provide information on their portfolios by attaching a recent portfolio statement or alternatively by uploading a spreadsheet or a document that includes the funds and the amount held in these funds. By having this information we are able to identify the overall portfolio performance and what proportion of your assets are in 1-5 star funds.

The above example portfolio was uploaded as a spreadsheet for analysis. It contains all the basic information required for an analysis to be completed, however, additional information can be included but it is not a requirement.

Grade Your Portfolio

Once completed, the analysis will provide a performance grade for your portfolio and a summary of what proportion of assets invested in the portfolio are held in good (4 & 5 star), moderate (3 star) or poor performing (1 & 2 star) funds. Based on the proportion of assets across each fund rating your portfolio would be provided with an overall performance grade between A and F.

The example portfolio composition above shows that the majority (50%) of the portfolio's assets are held in funds with a poor performing 1 or 2 star rating. Therefore, the overall portfolio received a poor F grade.

How Yodelar rate fund performance

Fund Performance & Ranking

The portfolio analysis table displays the recent 1, 3 & 5-year performance of each fund within the portfolio along with their sector ranking and the average returns of all funds in that sector.

Based on their performance and sector ranking, each fund receives a rating between a poor 1-star performance rating up to a top-performing 5-star rating.

For easy identification, each fund will have a performance colour which is based on the quartile their performance ranked within their sector.

The easy to identify colour analysis identifies if an investment portfolio contains underperforming and inefficient funds that are diluting a portfolio’s overall performance.

Portfolio Performance Comparison

The analysis will provide a 1 , 3 & 5 year overall portfolio performance comparison to similar risk rated Yodelar model portfolios, which are available portfolios that are built using industry leading asset allocation and risk modelling and contain quality funds with a strong performance history.

Knowing Your Fund Performance

Evaluating fund performance is a crucial metric for investors and reputable advisory firms. Understanding how your funds are performing will help to identify if you are entrusting your money to fund managers who are delivering competitive returns. While past performance does not guarantee future results, research shows that fund managers who have consistently outperformed their peers across various time horizons are more likely to do so going forward than those with a history of underperformance.

There are 3 key benefits of understanding fund performance

Past Performance

Past performance is not an indicator of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform, over varying time frames, in the top 25% of performers in their sectors versus fund managers that perform in the worst 25% of performers.

Comparative Performance

Each fund’s performance can be compared alongside all other competing funds that are classified within the same sectors. How each fund compares over the medium to long term can identify the quality of the fund and the competence of the fund manager.

Fund manager accountability

Past performance exposes the effectiveness of funds and their fund managers. The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank low within their sector demonstrate a lack of quality and an inability to deliver competitive returns for investors.

Understanding Fund Performance

We define a top performing fund as one that consistently performs better than 75% of same sector funds (i.e. top 25%), yet the reality is that many portfolios on the market include funds that perform significantly below this percentage, with funds often ranking in the bottom 25%.

With more than 100 different fund management brands in the UK offering access to thousands of funds it can be a challenging task to find the best options. To add further complexity, new funds enter the marketplace each month adding to the thousands of funds that are already available.

Consistency is an important indicator of quality and success, and it is integral to our portfolio management philosophy. We believe consistency displayed by investment funds that maintain a high sector ranking over continuous periods reflects efficiency and expertise from the fund manager through their ability to deliver competitive returns for their clients over both the short and long term.

In the short-term with changing political and economic markets it is unrealistic for even the best fund managers to continuously maintain a level of performance from their funds that exceeds that of the majority of their peers. But analysing performance over a 1, 3 & 5 year period will take into account differing investment cycles and will help to identify the funds and fund managers that specialise and excel in a particular market.

DATA IS KING: An important point to make is that in an industry full of sharp marketing practices, brand prestige and sometimes misleading sales pitches it is of the utmost importance to be informed and have access to factual information. Investors need to be aware how the funds they are invested in rank within their particular sector in order to determine how efficiently they are invested

The funds that consistently rank highly in their sectors can reflect a level of expertise from the manager within that investment sector. Whereas, the fund managers whose funds continually rank lowly within their sector have demonstrated a lack of quality and an inability to deliver competitive returns for investors.

Ask yourself, would you as an investor want to be invested in a fund that continually ranks in the worst 25% of its sector, when so many more productive choices are available - often at a lower annual cost?

Good Advice Doesn't Mean Good Performance

Fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds. As a result, a large proportion demonstrate poor knowledge on the quality of funds they recommend, which ultimately results in investors owning portfolios that are littered with poor fund choices.

Top advisers want to ensure the portfolios they recommend use top fund managers, and for investors who make their own fund decisions, the same should apply. A portfolio analysis will provide complete transparency on just how efficient those fund choices have been.

Optimise Your Investments With Yodelar

Investing, like many aspects of life, isn't always straightforward and for some it can be more uncomfortable and stressful than others. As an investor, you will always be exposed to factors that can cause values to rise and fall. Investing can result in emotional decision making, but the investors who reach their objectives efficiently are typically those who have a disciplined and pragmatic approach to investing, and follow a structured, long term strategy. When this is followed better outcomes can be achieved.

Book a no obligation call with one of our advisers to learn more about your options and how we can help you maximise your portfolio returns.

Summary

Transparent, objective analysis of fund and portfolio performance empowers investors to make more informed decisions. Whether managing investments independently or relying on professional guidance, the level of oversight that is gained from a portfolio analysis is invaluable for optimising returns

Ultimately, having such clarity increases knowledge thus improving decision making and investment outcomes.

For these reasons and more a portfolio analysis is an essential exercise that all investors should utilise.