- 4 of the 5 Aegon workplace pension funds have underperformed over the past 1, 3 or 5 years, some of which have been among the very worst performers on the market.

- 72% of their lifepath funds have consistently ranked in the top 25% of their sector for performance.

- The 7 Aegon Core portfolios have an annual charge ranging between 0.21% and 0.26%, with their performance on a par with the Aegon Select portfolios which have an annual charge ranging between 0.69% and 0.86%.

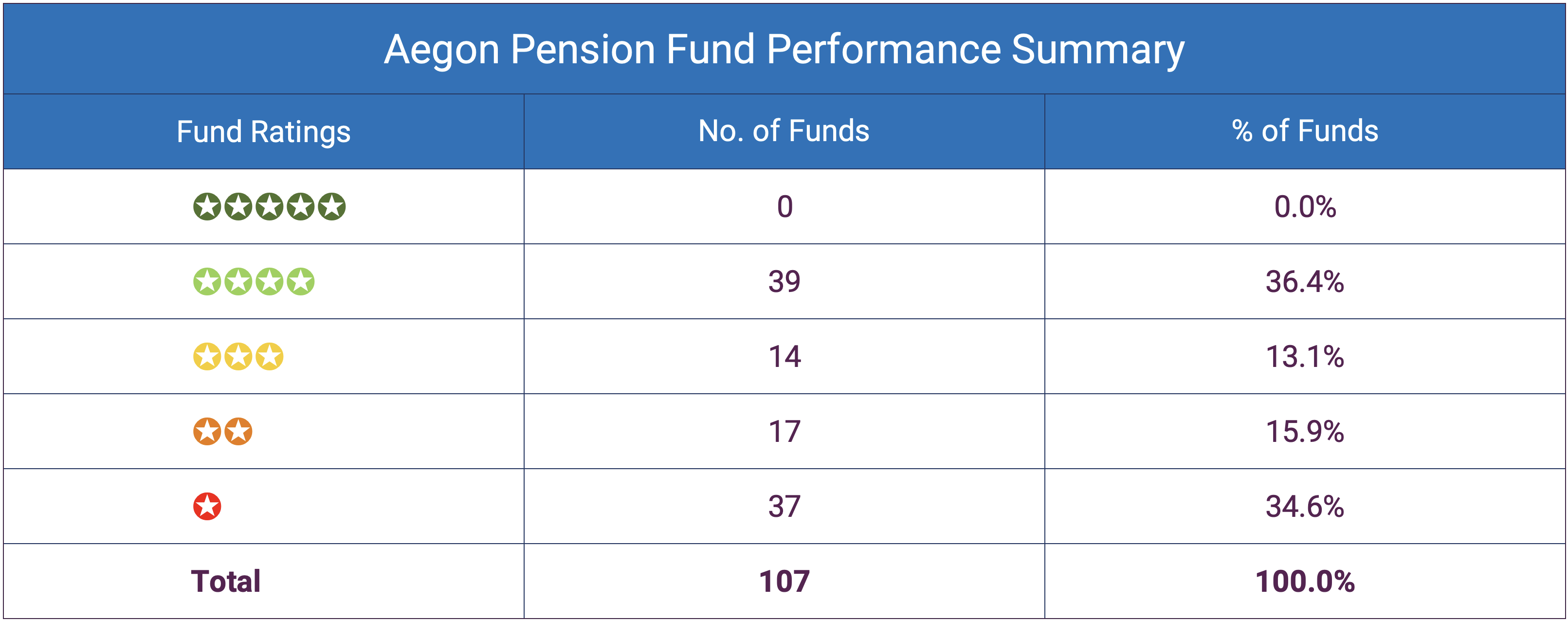

- In total we analysed the performance and sector ranking of 107 Aegon funds and identified 39 that have consistently outperformed.

Every month our research team complete a large number of pension performance reviews for Aegon pension holders, many of whom are invested in their range of readymade pension schemes, of which a proportion have consistently underperformed.

In this report, we analyse the performance and sector ranking for each of the funds within the 5 Aegon pension schemes and identify that 50% of the 107 funds analysed have a poor performance rating when compared to other pension portfolios that have delivered considerably better returns.

If you have a pension with Aegon, and would like to avail of our complimentary portfolio analysis then upload your latest statement, or spreadsheet today and get a free performance analysis.

Aegon Review

With a 190 year history, Aegon is one of the longest serving financial institutions in the UK. Initially branded as Scottish Equitable, Aegon have now established themselves as a brand synonymous with pension and protection plans. Through their range of retirement and workplace pension schemes they currently manage in excess of £179 billion on behalf of 3.9 million UK clients.

In this report, we analyse the performance of 5 different pension products from Aegon which contain a combined total of 107 funds.

Aegon Default Pension Funds

Although Aegon provides five different pension portfolio solutions, many of their clients are invested in their default pension funds through their employee pension schemes. Through such schemes the employer has a regulatory obligation to ensure their default fund remains appropriate for their scheme.

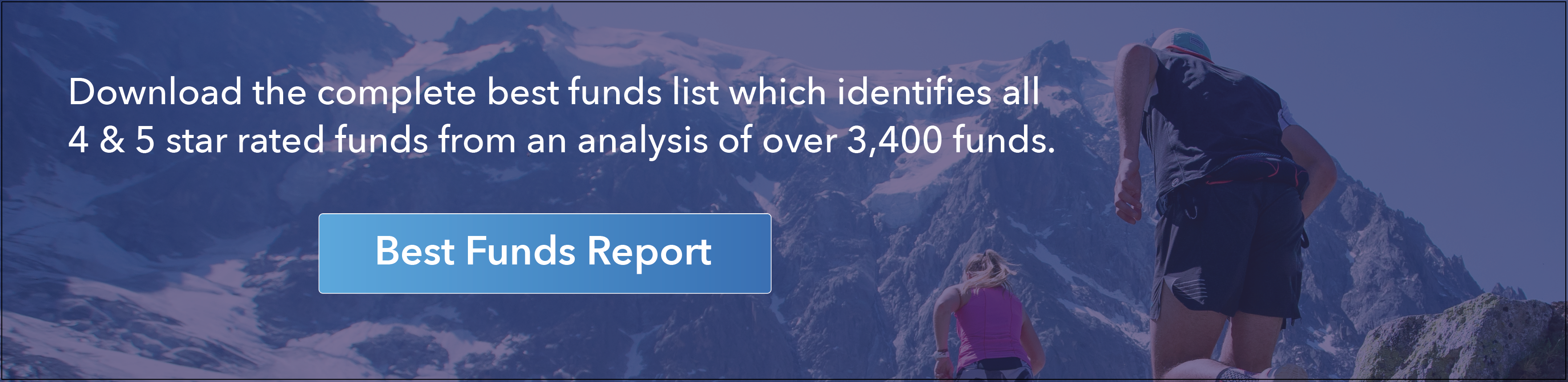

As identified in this report, their default workplace pension fund ranks among the best in the sector over the past three years, but it is a relatively new fund and there are consistently better performing alternatives available.

Pension schemes will have a default fund which offers an appropriate investment strategy for people who can't or don't want to make their own pension decisions. Research from The Pensions Regulator shows that more than 95% of workers stay in their pension scheme’s default fund.

Book a 'No-Obligation Call' with one of our Financial Advisers & discuss your pension.

The below table from Nest, the government body set up especially for auto-enrolment, shows the annualised returns for some of the most used default funds up to December 2019.

*Calculations by Defaqto using monthly data, net of fees.

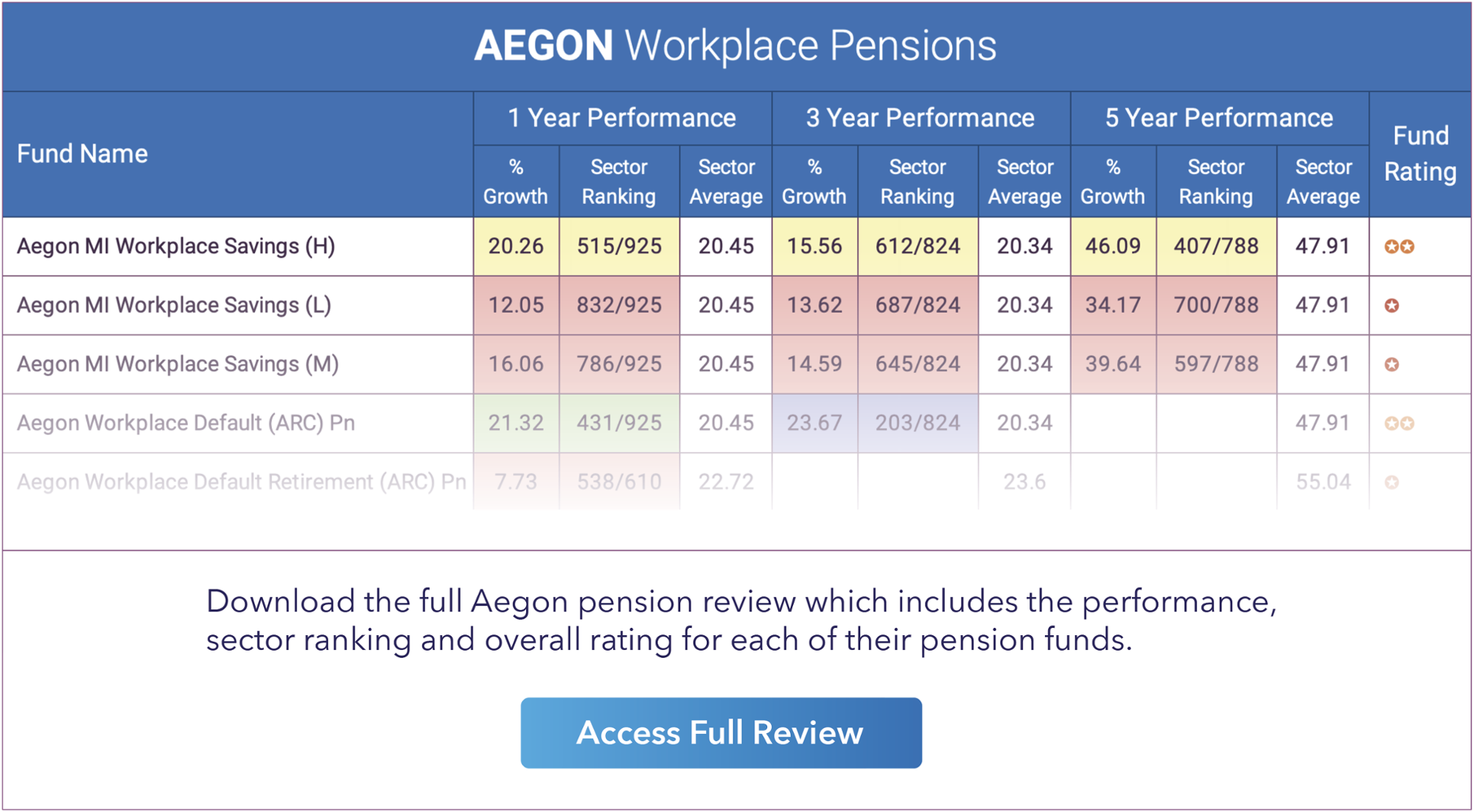

Aegon Workplace Pension

With the exception of their main default workplace pension fund, 4 of the 5 Aegon workplace pension funds have underperformed over the past 1, 3 or 5 years, some of which have been among the very worst performers on the market.

The Aegon MI Workplace Savings (L) fund has a limited number of clients and it currently manages just over £35 million, but for the small amount of people invested in this fund they have not enjoyed competitive returns. Over the past 1, 3 & 5 years this fund's performance has been worse than at least 83% of the funds within its sector.

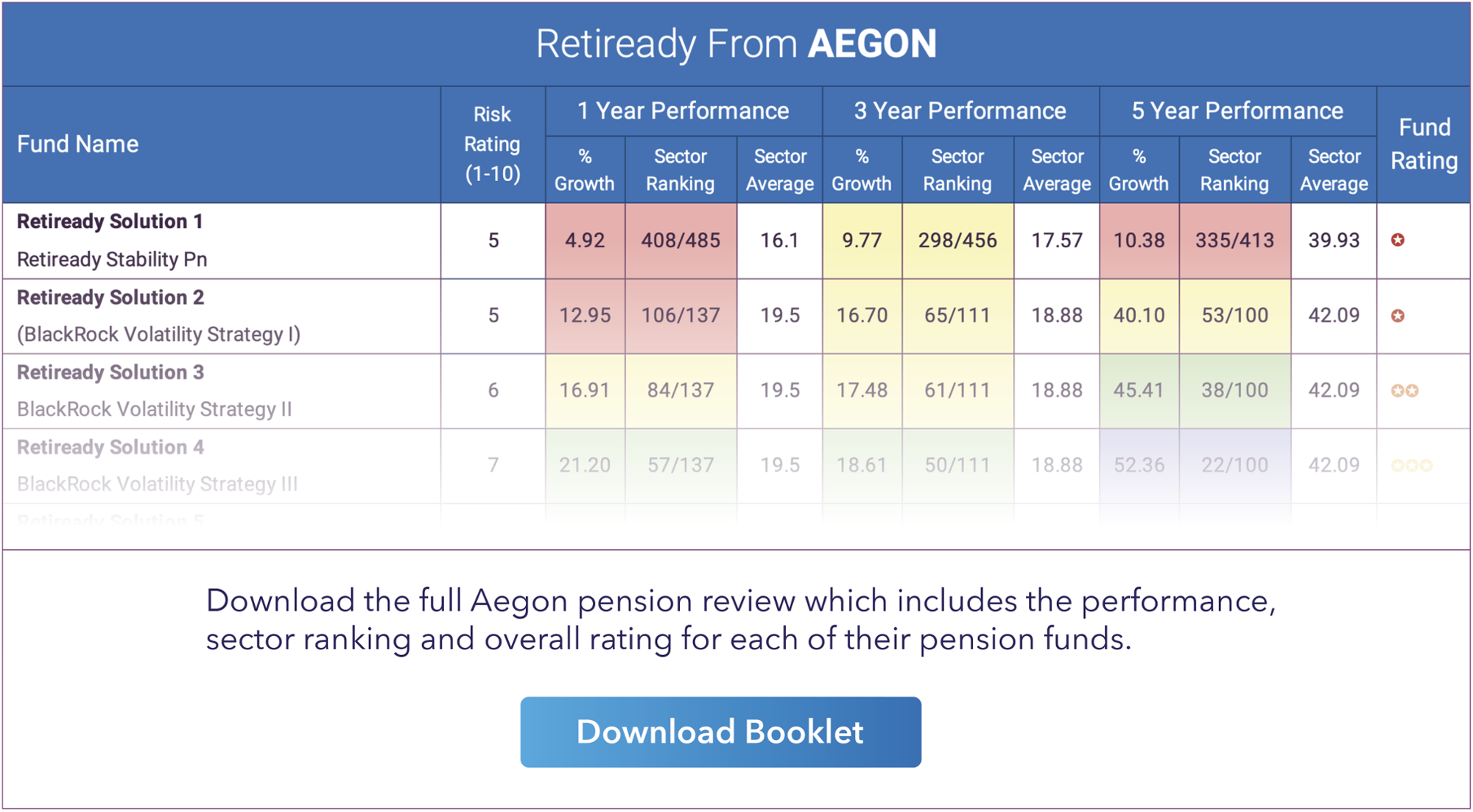

Aegon Retiready Pension

In early 2014 Aegon published ‘The Aegon UK Readiness Report’ which they compiled from research obtained from speaking to 4,000 people from across the UK. The purpose of the report was to assess how effectively people were saving for retirement and it identified that only 7% of UK pension savers were close to saving enough to pay for the lifestyle they wanted in retirement.

Shortly after publishing this report, Aegon launched its Retiready platform which was designed to provide investors with free online planning tools and supporting materials aimed at investors who had an interest in taking greater control of their pension. To coincide, Aegon also launched 5 Retiready investments portfolios each designed to cater to different risk profiles.

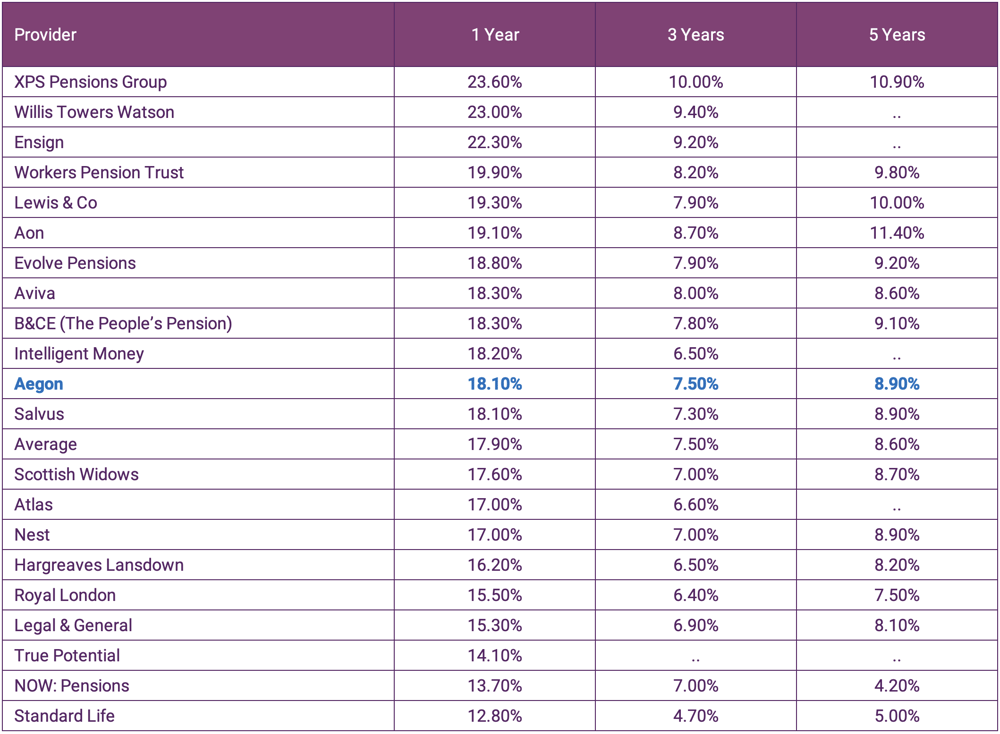

We analysed the performance of each Retiready portfolio and identified that only the 2 highest risk options had managed to maintain an above average sector ranking over the past 1, 3 & 5 years.

To provide a portfolio growth comparison the table below features the performance of similar risk rated portfolios from Yodelar Investments for the same time period.

*Performance figures up to 31st May 2021

Book a 'No-Obligation Call' with one of our Financial Advisers & discuss your pension.

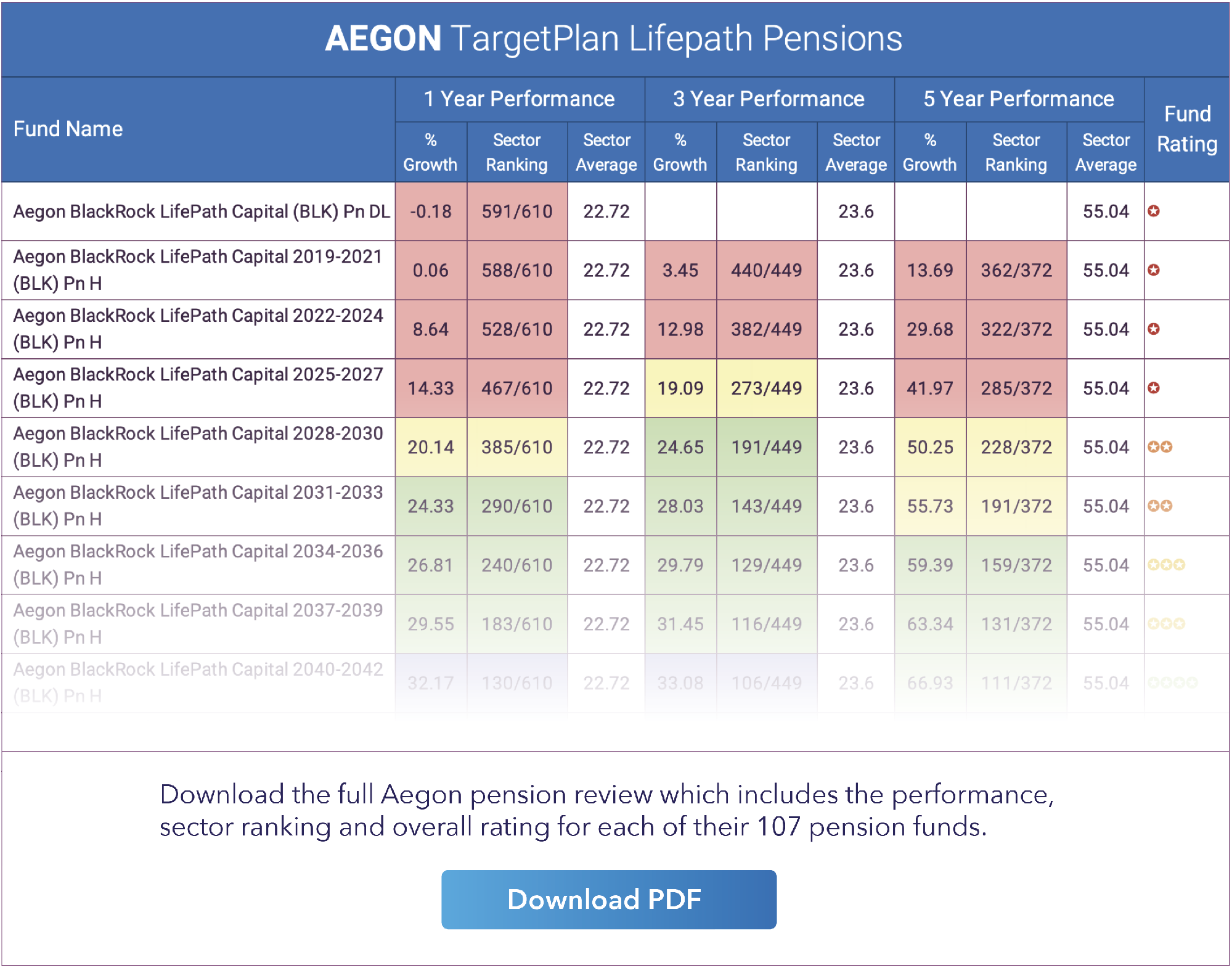

Aegon LifePath Pensions

The Aegon LifePath pension range of funds aim to provide investors with an investment solution that automatically and gradually moves their savings as they near their target year of retirement to reduce risk and to align the fund to the way they intend to draw their benefits at retirement.

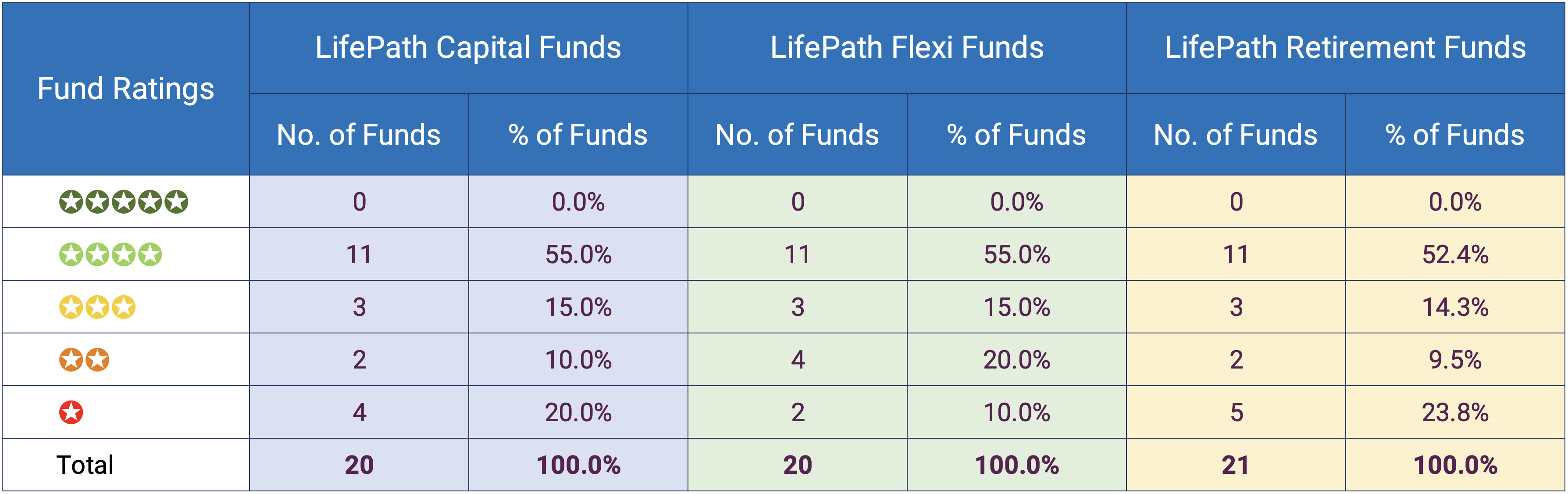

There are 3 types of Lifepath funds - the Lifepath Flexi, Lifepath Capital and Lifepath Retirement range.

LifePath Flexi Fund – this fund is designed for those who plan to leave their retirement savings invested during their retirement and to draw an income or one-off amounts from their savings.

LifePath Retirement Fund – this fund is designed for those who plan to take 25% of their savings as a cash sum and to use the remainder to buy an annuity.

LifePath Capital Fund – this fund is designed for those who plan to take the whole of their retirement savings as a one-off cash sum.

Combined, there are a total of 61 LifePath funds, and as identified in our analysis, the majority have consistently ranked among the top performers in their sector over the past 1, 3 & 5 years. However, the majority of LifePath funds that are underperforming are those where their target retirement date is within the next few years, which is likely to be of concern to the LifePath members nearing retirement.

Our analysis of the Aegon LifePath pension funds identified that 31% rated as poor performing 1 or 2 star funds with the majority, 54.1% consistently ranking among the best in their sectors with a 4 star performance rating.

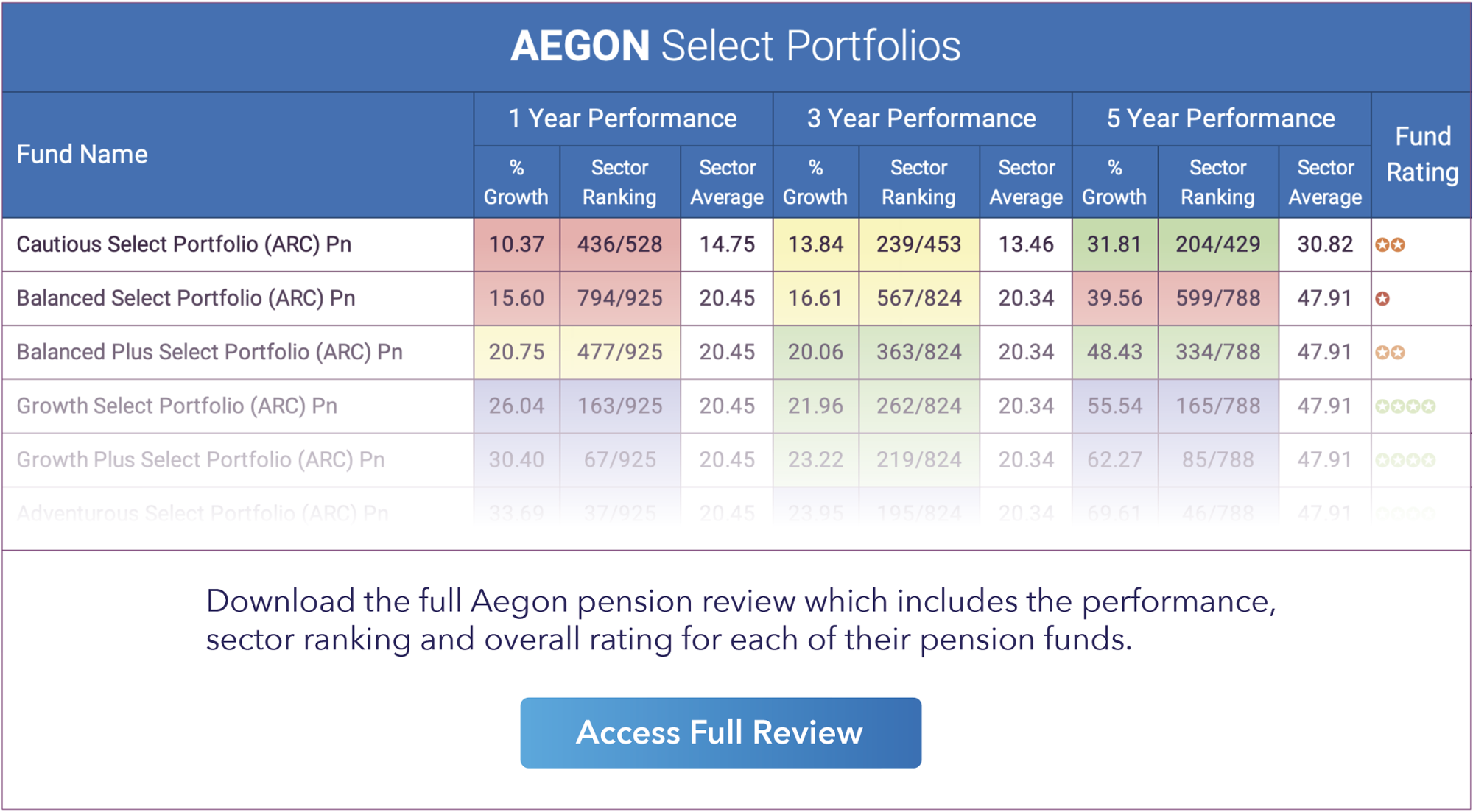

Aegon Select Portfolios

The Aegon Select portfolio range consists of 6 risk-rated funds that have been created for those where performance rather than cost is their primary focus. As a result, the majority of the funds that make up these portfolios are actively managed, but as these blend of funds have been selected entirely from Aegon's own fund range, it restricts the options available to the portfolio managers and limits the growth potential of the portfolios.

As identified in the table below, the performance of these portfolios has a wide range, with the lowest risk in the range naturally returning the lowest growth and the highest risk model returning the highest growth. However, when analysed alongside their same sector competitors, the Cautious Select and Balanced Select portfolios have both consistently underperformed ranking worse than 75% of other funds in their sectors over the past year and worse than 50% over 3 years.

The higher risk rated Growth Select, Growth Plus Select and Adventurous Select have all compared significantly better. Over the past 1 and 5 years each of these portfolios has ranked among the top 25% of performers within their sectors.

Aegon Core Portfolios

Similar to their Select range, the Aegon Core range provides a selection of risk-rated portfolios, however, they are quite different in their structure and objectives. The Aegon Core portfolios are focused on costs, specifically keeping costs to a minimum, as opposed to the Select portfolios which prioritise performance.

To keep the costs low, the 7 Aegon Core portfolios are made up entirely of low-cost passive funds, with the total annual charge for these portfolios ranging between 0.21% and 0.26%. In contrast, the total annual charges for the Aegon Select portfolios range between 0.69% and 0.86%.

Despite the lower cost, the Core portfolios have performed on a par with the select portfolios.

The Best Pension Funds

Many pension investors are unaware of the wide ranging options they have for their pensions, and limit their investments to a selection of pension schemes put in place by large pension providers such as Aegon.

As identified in this analysis, a proportion of the pension options provided by Aegon have performed comparatively well within their sectors, but when compared to a diversified portfolio of funds the difference in growth has been significant.

Based on the asset allocation model, that best fits your objectives investors have a wide range of high quality options to choose from when investing for their pension. Download our best funds report to view the top performing high quality pension funds across numerous sectors and asset classes that can provide the foundation for constructing an excellent pension portfolio.

For investors with an objective of investing efficiently in a diversified portfolios Yodelar Investments have in place a range of 10 risk-rated portfolios with a focus on growth & risk management. Each portfolio contain funds with a history of above average performance and represent some of the best investment opportunities in their asset class.

The Yodelar portfolios are not restricted to a limited selection of funds. They include funds from different fund management brands that have an excellent performance history and have been deemed by our investment committee to have excellent future growth potential. Combining this strategy with a defined asset allocation and risk model has helped our portfolios to deliver growth that is significantly greater than Aegon and other providers.

Find out more about Yodelar Investment Portfolios

Alternatively chat to a member of our team now to arrange a no obligation call with an adviser.

Book a 'No-Obligation Call' with one of our Financial Advisers & discuss your pension.

Aegon Pension Performance Summary

In total, we analysed the performance of 5 different pension products from Aegon which contain a combined total of 107 funds. The performance of the 107 Aegon pension funds were compared with all other same sector funds from the 8.660 funds that are classified within the pension universe.

In total, we analysed the performance of 5 different pension products from Aegon which contain a combined total of 107 funds. The performance of the 107 Aegon pension funds were compared with all other same sector funds from the 8.660 funds that are classified within the pension universe.

Our analysis identified that a strong 36.4% of the 107 Aegon funds analysed ranked among the best in their sectors over the past 1, 3 & 5 years. However, for investors where growth takes precedence over the convenience of pre-packaged products, there are other options available that potentially could yield significantly greater returns over the medium to long term.