Technology funds have topped the buy lists of fund platforms for the past few years and this has only accelerated during the pandemic.

Large technology companies such as Amazon, Microsoft and Google-owner Alphabet have consistently risen strongly year on year, contributing to the outperformance of many technology focused funds. Investors have been quick to reposition portfolios to reflect the new business trends in a world of social distancing, home working and online entertainment.

Innovation has pushed the technology sector forward in recent years and the pandemic has forced many companies to utilise technology at a faster rate than they ever planned. As a consequence, the technology focused funds have been consistently among the top growth funds on the market - but is the momentum of the technology sector going to continue and translate into growth for investors or are there risks that could derail this growth?

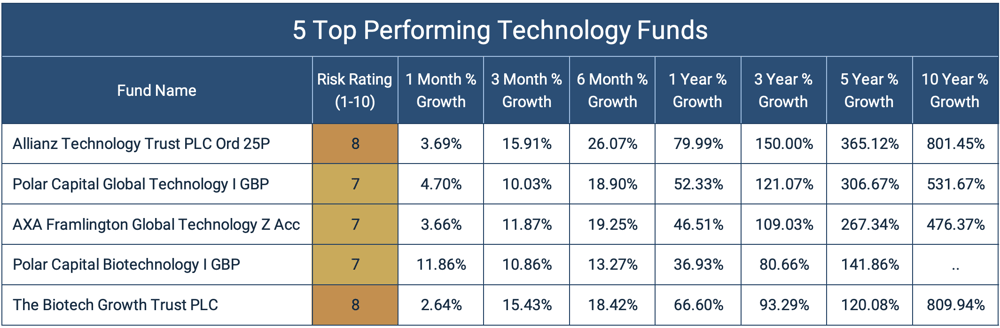

In this report, we assess the technology sector and also feature 5 technology funds that have continually excelled and delivered huge returns for investors.

The Growth of Technology Funds

The Nasdaq 100 Index is a basket of the 100 of the largest most actively traded U.S companies and the majority of which are technology themed companies. Since the market crash in March 2020, the index has risen by 71%, which shows just how fast-growing areas of technology are. In contrast, other sectors such as the FTSE 100, which contains no large internet or technology businesses, grew by 25% over the same period.

The Growing Technology Trends

The pandemic had many impacts, but one of the broadest effects has been an acceleration of technology adoption at work and at home. This of course was driven by the needs of people in lockdown and the pivot by many companies to working virtually. The tech sector received a big boost as a result, and we can reasonably expect those positive effects to linger well into 2021 and beyond. When there is a more concerted effort to get workers back in office, usage of services like Zoom Video Communications, Inc. may drop but too many people have realised that a video call can replace a costly business trip for the trend to fully reverse.

Also, the demand for click and collect as well as food deliveries has surged during the pandemic with online takeaway delivery app Just Eat reporting a 46% increase in trade in 2020. Such demand is likely to continue even after the pandemic as convenience services maintain their popularity.

The Risks Facing The Technology Sector

Although the technology sector has thrived and grown exponentially in recent years it is not without its risk, particularly for the tech giants with governments across the world concerned about the sheer scale and influence of many of these companies. Most recently, Google threatened to pull its search engine from Australia after the Australian government made it clear that they intended to impose a media tax tariff that would cost Google billions each year.

One of the main targets for reform is social media platforms, whose power and influence was particularly prominent in the aftermath of the US election which culminated in the ban of the then President Donald Trump from their platforms. This led to German Chancellor Angela Merkel to call the move “problematic” and breach of the “fundamental right to free speech”. France, also condemned the move with various governments now actively looking at financial measures such as tax or tariffs as well as the implementation of law that would regulate the autonomous power of social media platforms. The implementation of such measures would undoubtedly prove costly for such platforms but whether or these measures would be implemented in the near future and to what extent is not yet clear.

But with the rise in litigation against Google and social media platforms it is all the more likely that some form of punitive legislation will be rolled out. The severity of which will likely depend on the outcome of pending litigation - some of the most prominent topics raised in recent litigation cases are listed below:

- Is Google a monopoly in search, and is it actively working with other large players to maintain dominance?

- Is Amazon using its platform sales data to clone successful third-party sellers' products for its Basics line?

- Is Facebook using acquisitions and its size to eliminate competition in social media platforms?

- Are social media platforms like Facebook, Google (YouTube), and Twitter using the guise of platforms to grab ad revenue that should be going to the original content creators and publishers?

- Are social media platforms responsible for the content being shared using their platforms, similar to how newspapers are liable for content they publish?

The answers that come out of the courts on these questions could reshape large parts of the tech sector. Given the complexity and importance of the answers, however, investors shouldn't expect too many of them to be resolved in 2021.

Another threat comes from debt ridden governments desperate to raise money to pay for efforts to keep coronavirus at bay. The largest companies with the most significant revenue are likely to enter their crosshairs, especially if they are seen to have ‘done well’ from the crisis. Taxation and regulation could ultimately impact earnings. The tech giants are mature companies with vast earnings and great resilience but the more they grow, the greater the risk of political backlash.

Will The Momentum Continue?

Although 2020 was a challenging year, it was generally positive for the technology sector. The acceleration of tech adoption had a corresponding effect on the revenues and the business models of the companies offering that tech. The tech sector has the twin advantages of a revenue windfall and momentum going into 2021, increasing the probability that the broad sector strength will continue.

However, investors need to be aware that tech has a social license issue that has just started to come to the surface in 2020. In 2021 and beyond, we are going to see whether tech's future is one of unrestrained innovation and competition or whether regulation will come in to curb some of the excess.

5 Technology Funds That Have Thrived

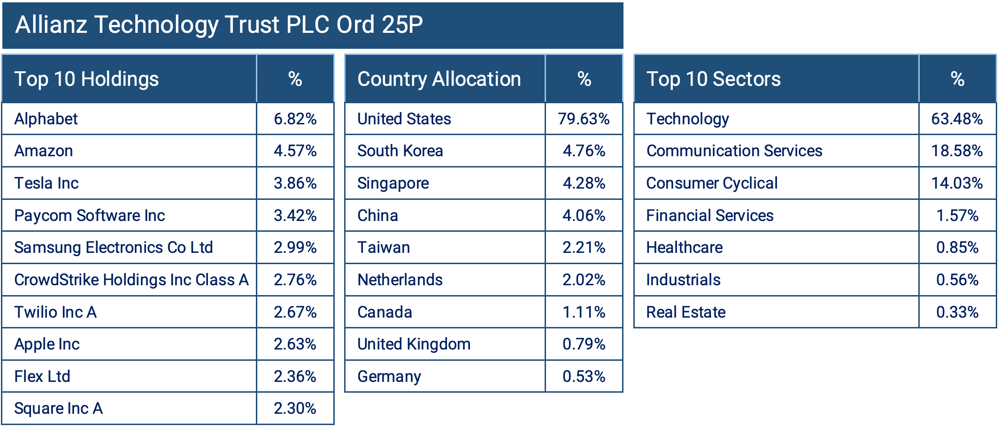

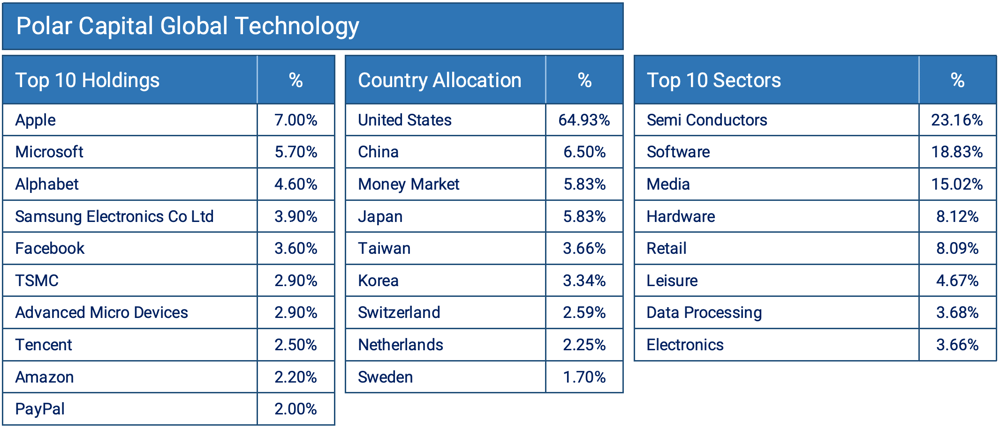

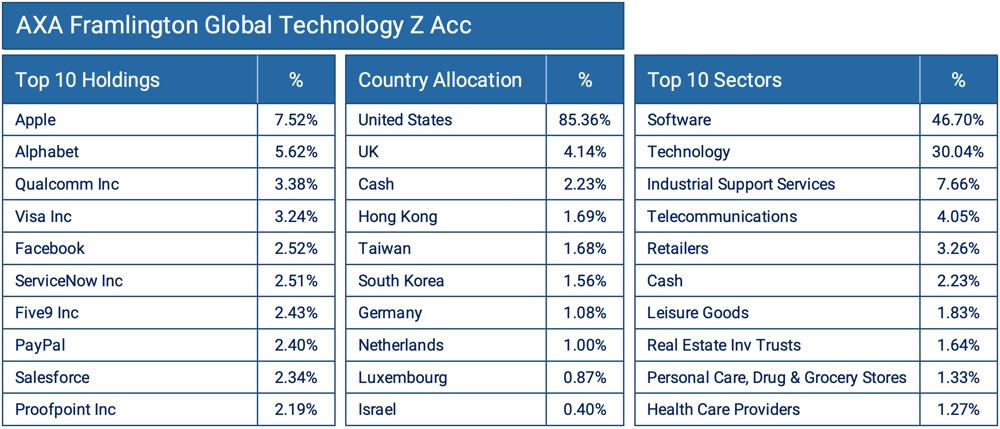

Despite the pending challenges facing the technology sector, over the past several years it has been responsible for some of the highest growth funds on the market. Of these funds, there are a selection that have consistently excelled in this competitive and high growth sector. Below we feature 5 technology themed funds that have continually delivered exceptional growth compared to their peers.