- In just 10 years the amount invested in multi asset funds has grown from £77.8 billion to £233.8 billion.

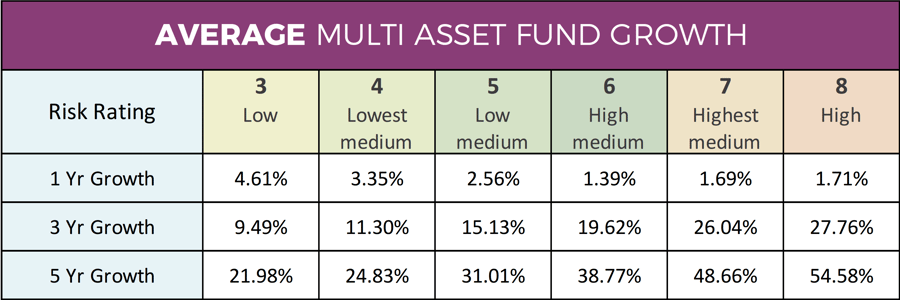

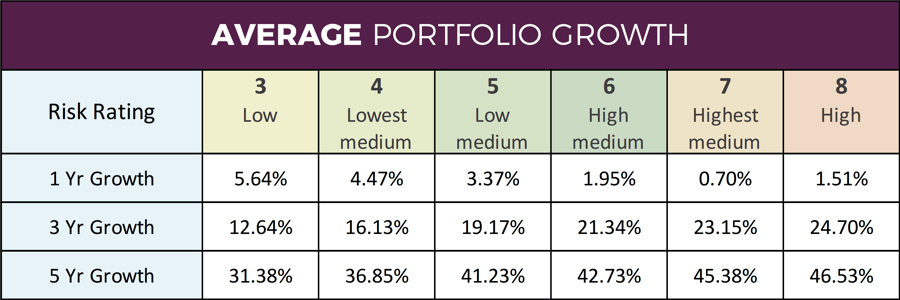

- The average growth returned by multi asset funds over the past 1, 3 & 5 years was lower than the average growth returned by similar risk portfolios containing mediocre performing funds.

- 4 of the top performing multi asset funds manage a combined £11.4 billion of client money, which is 4.9% of the total invested across all multi asset funds.

The popularity of Multi asset funds has grown exponentially in just a few years with the amount under their management recently reaching £233.8 billion, which equates to a 16.5% share of the UK investment industry.

For several years Multi Asset funds have been among the top sellers in the industry with more fund managers adding to their range in order to meet the growing demands of investors who continue to drive inflows into these convenient, risk rated solutions.

With a growing number of investors and advisers embracing the use of these all in one funds, some believe they represent the ‘evolution of investing’. But are Multi asset funds merely an easy option that ultimately fall short for investors?

In this report, we explore why multi asset funds have become such a popular investment solution. We will factually demonstrate why multi asset funds are still no match for a suitably balanced portfolio of consistently top funds.

Why Multi Asset Funds Are So Popular

Multi-asset funds offer investors exposure to a range of assets within one fund. The idea is that these different asset classes behave at least partly independently of one another, so that a drop in one asset class will not put all your investments in danger. In essence, multi asset funds act as ready-made portfolios for investors, automatically rebalanced and continuously monitored to fit a pre-set risk model.

For self-investors in particular, risk rated, multi asset solutions can be hugely beneficial. Among the biggest pitfalls faced by self-investors is a lack of diversification with some unwittingly sacrificing diversification and portfolio stability in favour of investing in popular, high growth funds that often share a similar composition. But with Multi Asset funds, the asset allocation is already taken care of by the fund’s manager.

Why Asset Allocation Is So Important

Asset allocation is basically the decision of how to weight stocks, bonds and cash in a way that provides the potential for a suitable return within the appropriate level of risk you’re willing to accept. Setting these targets is a critical first step in portfolio construction. Too much in bonds or cash will ensure lower volatility and lower risk but may not produce enough returns to meet your objectives or keep ahead of inflation. Conversely, a heavy weighting in stocks can yield higher rates of return over time but can also be subject to large swings in value over shorter periods.

One of the key tasks for an investor is to determine how much investment risk to take. Financial risk, in the context of your investments, is the risk of losing money. In order to grow your investments, you need to take on some element of financial risk.

Danger exists if the risk is not properly understood, managed or controlled, but with multi asset funds the risk element is already taken care of by the fund manager who balances the fund to ensure it fits a desired asset allocation model.

As a result of managing risk and asset allocation, multi asset funds can provide investors with a healthy level of return within a risk-controlled environment.

Are Fund Managers Using Multi Asset Solutions To Sell More of Their Funds?

Fund management companies are capitalising on the surge in demand for multi asset funds by using multi asset solutions to filter investor money into several other funds that they may own and manage.

They are doing this by using their own range of funds to form the underlying holdings of their multi asset solutions. This means the fund manager gets paid when investors invest into the multi asset fund, and they also get paid as the underlying funds used to form the multi asset fund typically incur transaction charges and management fees that the investor must pay, and of course, the more money held in a fund the more money that funds manager earns. Multi Asset funds are a win win for fund managers, but are they the best choice for investors?

Although Convenient, Multi Asset Funds Are Not For Everyone

For investors with a balanced and efficiently managed portfolio of funds that adhere to a suitable asset allocation model the appeal of Multi asset funds is significantly less.

There are many different asset allocation models for investors to follow, each of which can provide a suitable blend of risk and reward, and by making efficient fund choices to represent the required asset classes investors can end up with a risk rated portfolio that delivers competitive returns.

For experienced investors or for those with a quality adviser managing their portfolio, the main reason for using a multi asset fund does not exist According to our research, if investors simply ensure their portfolio is suitably balanced the chances are their portfolio will outperform even the best Multi Asset funds.

How Competitive Are Multi Asset Funds?

To provide an insight into their performance, we analysed 315 risk rated multi asset funds and compared their performance to a selection of portfolios with a similar risk rating, but with average returns.

The performance of these portfolios was calculated using the average growth across each asset class, which was weighted based on the asset allocation model of the UK’s leading risk profiler Dynamic Planner.

Our analysis found that a portfolio of funds with average returns, balanced using an industry standard asset allocation model, would have delivered better returns than the vast majority of multi asset funds on the market.

For lower risk portfolios with a risk rating of 3, 4, 5 & 6, a suitably balanced portfolio of average performing funds would have delivered better returns than the average multi asset fund. It was only for the higher risk 7 & 8 portfolios where multi asset funds averaged higher.

*Figures have been calculated using the average growth of 315 multi asset funds based on their risk rating.

*Figures have been calculated by determining the average growth of funds within each asset class which have then been balanced into 6 risk rated portfolios using the asset allocation model of the UK's leading risk profiler, Dynamic Planner.

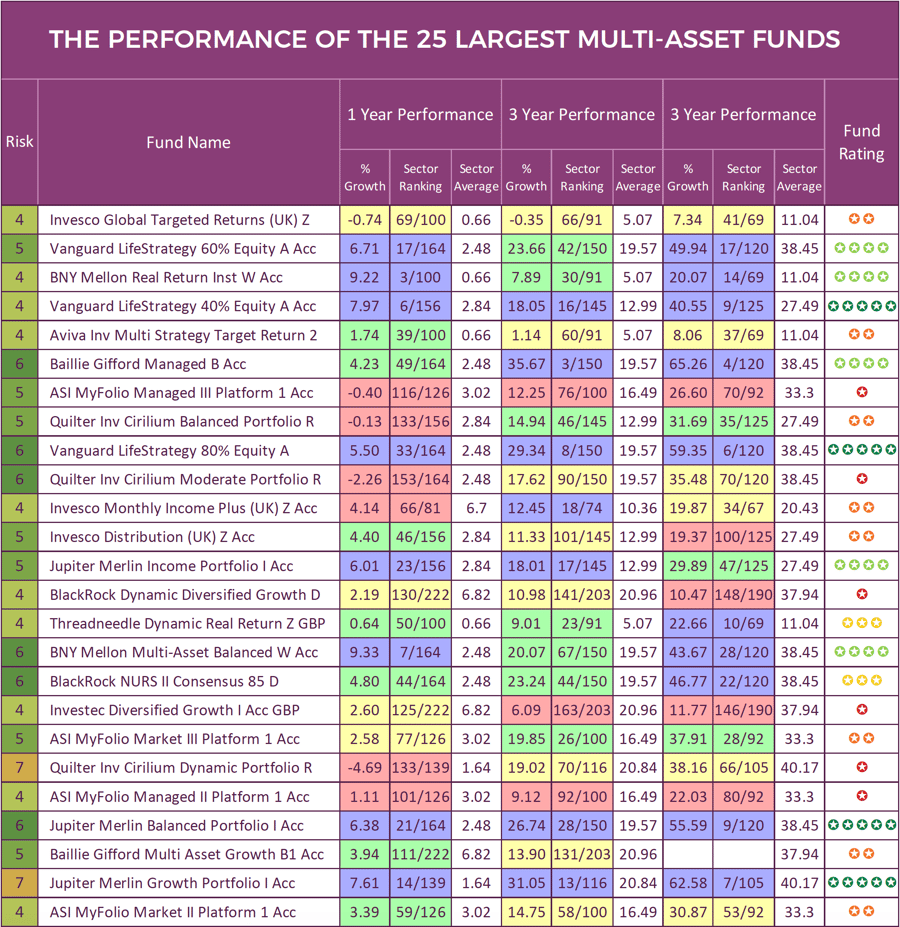

The 25 Most Popular Multi Asset Funds

The UK’s 25 largest multi asset funds are currently responsible for managing one third of the total amount currently invested in UK Multi asset funds. These 25 funds represent a significant proportion of the investor market and they range between a cautious risk rating of 4 up to a more adventurous 7.

Our analysis of these 25 funds identified 4 to have consistently maintained a top quartile sector ranking with each of these 4 funds delivering competitive returns that were well above average. It is unsurprising that these 4 funds are among the most popular multi asset funds on the market as combined they manage almost £11.5 billion of client money. These strong performers include 2 from Vanguards LifeStrategy range and 2 from the Jupiter Merlin portfolio range.

Vanguard LifeStrategy 40% Equity

With a risk rating of 4, the Vanguard LifeStrategy 40% Equity fund is unsurprisingly comprised of 40% equities - mainly US and UK equities. Over the recent 1, 3 & 5 years this multi asset fund returned growth of 7.97%, 18.05%, and 40.55%, as it ranked among the top performers in its sector.

Vanguard LifeStrategy 80% Equity fund

The Vanguard LifeStrategy 80% Equity fund is composed of approximately 80% by value of equity securities and 20% by value of fixed income securities as it aims to achieve its investment objective predominantly through investment in passive, index-tracking collective investment schemes. Over the recent 1, 3 & 5 years this risk rated 6 portfolio returned cumulative growth of 5.50%, 29.34%, and 59.35% respectively.

Jupiter Merlin Balanced Portfolio

The Jupiter Merlin Balanced Portfolio is an actively managed multi-manager fund that aims to achieve long-term capital growth with income. To do this it invests primarily in other funds from a variety of fund management groups, unlike Vanguard and many other multi asset providers whose funds are made up of a selection of their own funds. Similar to the Vanguard LifeStrategy 80% Equity fund, the Jupiter Merlin Balanced has a risk rating of 6. Over the past 12 months this fund returned higher growth than its Vanguard managed rival but over 3, & 5 years its returns were slightly lower.

Jupiter Merlin Growth Portfolio

The Jupiter Merlin Growth Portfolio is an actively managed multi-manager fund that aims to achieve long-term capital growth. To do this it invests primarily in other funds from a variety of fund management groups whom they believe to have the ability to produce superior returns over the medium to long term. The Jupiter Merlin Growth fund has consistently delivered some of the highest returns compared to competing multi asset funds with a risk rating of 7.

Over the 1, 3 & 5 year periods analysed this readymade portfolio returned growth of 7.61%, 31.05% and 62.58%. In contrast, one of its direct rivals, the Quilter Investors Cirilium Dynamic Portfolio, which is also featured in the top 25 largest multi asset funds, returned losses of -4.69 this past year and comparatively poor returns of 19.02% and 38.16% for the remaining 3 and 5 years.

Why Multi Asset Funds Are No Match For An Efficient Portfolio

The single most critical element of investing is asset allocation, but a close second is fund selection, specifically the quality of funds used to represent each asset class. The quality of these underlying funds will have a huge bearing on a portfolio’s overall performance.

But as many multi asset solutions are built from a range of funds owned and managed by the provider, a proportion will likely have a history of poor performance.

We regularly review the performance of more than 100 fund management firms and the thousands of funds they manage. Our research continually identifies that at least 90% of these funds fail to maintain a top quartile performance ranking within their respective sectors over the recent 1, 3 & 5 year periods. As a consequence, there are no fund management firms with consistently top performing fund options across all asset classes. Therefore, the most efficient portfolios are likely comprised of a selection of funds from several different providers.

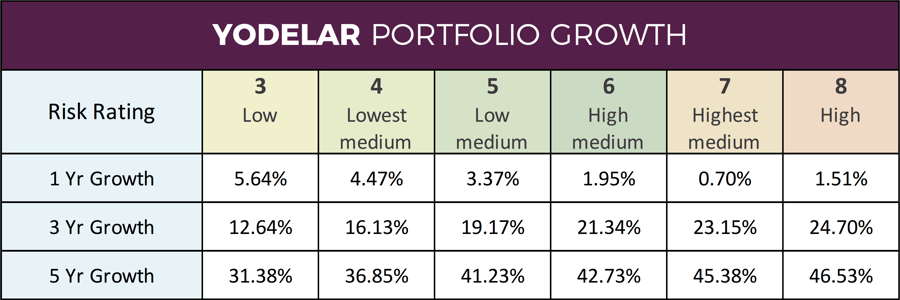

Investing In Efficient Top Performing Portfolios

Yodelar Investment Services offer 10 risk-rated portfolios that target maximum growth at low cost. Each portfolio contains top performing funds and represents the best in their class. Sector top performing funds are strategically weighted to produce a range of exceptional portfolios that have consistently outperformed some of the most widely used and popular portfolios currently on the market.

The development of our portfolios comes from years of research and analysis that includes the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research has enabled us to identify efficient processes and top-quality investment funds to create 10 strategically balanced, risk-rated portfolios that are built using only the top funds within each asset class, focused on offering investors efficient returns.

As identified in the above table, each Yodelar Investment Portfolio has performed exceptionally in comparison to average returns.

*Growth figures up to 1st October 2019

Multi Asset Funds Are Not The Answer

As investors we invest to achieve financial objectives. We wish to grow our money efficiently, within an acceptable level of risk. Although Multi Asset funds are effective in managing risk, when it comes to performance, the majority fail to deliver.

Investing requires a degree of flexibility which Multi asset funds lack because the majority of fund managers follow a restrictive approach of using a composition of their in-house funds to build their multi asset products, irrespective of whether these in-house funds are performing well or not, or if more suitable funds are available elsewhere.

Should investors wish to manage their own portfolios then multi asset funds could be regarded as a safe way to do so, but when it comes to optimising your portfolio for efficient growth, investing in multi asset funds will prove restrictive.

Our analysis identified below average returns for the majority of Multi Asset solutions with more suitable and better performing alternatives available.

Investment Portfolios Without Limitations

Our investment philosophy is to build efficient, top performing portfolios utilising funds and fund managers that have proven their discipline by consistently outperforming their same sector peers. This philosophy removes any bias and emotional decision making that can be detrimental to a portfolio’s objectives.

Unlike some investment providers, Yodelar Investment portfolios are not restricted, providing the freedom to make fund choices on merit and include only the funds and fund managers which we believe offer the best potential for future returns.

Each Yodelar Investment portfolio has been built to follow the asset allocation model as defined by the UK's leading asset allocation and risk profiler and contain a blend of consistently top-performing funds.

Top performance and quality portfolio management are key to truly successful investing. For the majority of high net worth investors multi asset funds are a lazy alternative to investing efficiently.