Investment trusts were relatively unheard of several years ago but as their reputation for delivering high returns grew, so too did their popularity. The upsurge in demand has reached record levels, and in 2017 the total assets under the management of Investment Trusts hit an all-time high of £174 billion.

Although still eclipsed by unit trusts in both size and popularity, the benefits of investment trusts are catching the attention of growth seeking investors. According to statistics from the Association of Investment Companies (AIC) who are the trade body that represents investment trusts, in most sectors Investment Trusts have beaten open-ended funds over the medium and long-term.

What are Investment Trusts?

An investment trust is a public limited company (PLC) traded on the London Stock Exchange, so investors buy and sell from the market. It invests in other companies, seeking to generate profit for its shareholders.

The key difference between Investment trusts and unit trusts is that unit trusts are open-ended and investment trusts are closed ended.

When a fund is open-ended there is no limit to the number of units available – as more people invest, more units are created. By contrast, in a closed-ended investment trust there will only ever be a set number of shares available.

Like unit trusts, investment trusts are grouped by the geographical area and type of investment with which they are involved. The AIC lists more than 30 different sectors, ranging from UK Growth, Global Growth, Europe, Asia Pacific, Infrastructure, Property and Private Equity.

However, Investment Trusts are typically more volatile than unit trusts, and their inclusion in a portfolio can have significant bearing on that portfolios level of risk.

Lower charges & higher growth?

Investment trusts are typically thought of as cheaper in terms of management fees than open-ended funds. However, recent research has demonstrated that this differential may have shrunk, as regulatory changes in 2013 have placed a growing emphasis on fee transparency, which has predominantly resulted in lower fees for unit trust & OEIC funds.

Investment trusts also have reputation for delivering better returns than unit trust & OEIC counterparts, and although a significant proportion have delivered exceptional returns, recent performance figures show that a number of investment trusts have underperformed in comparison.

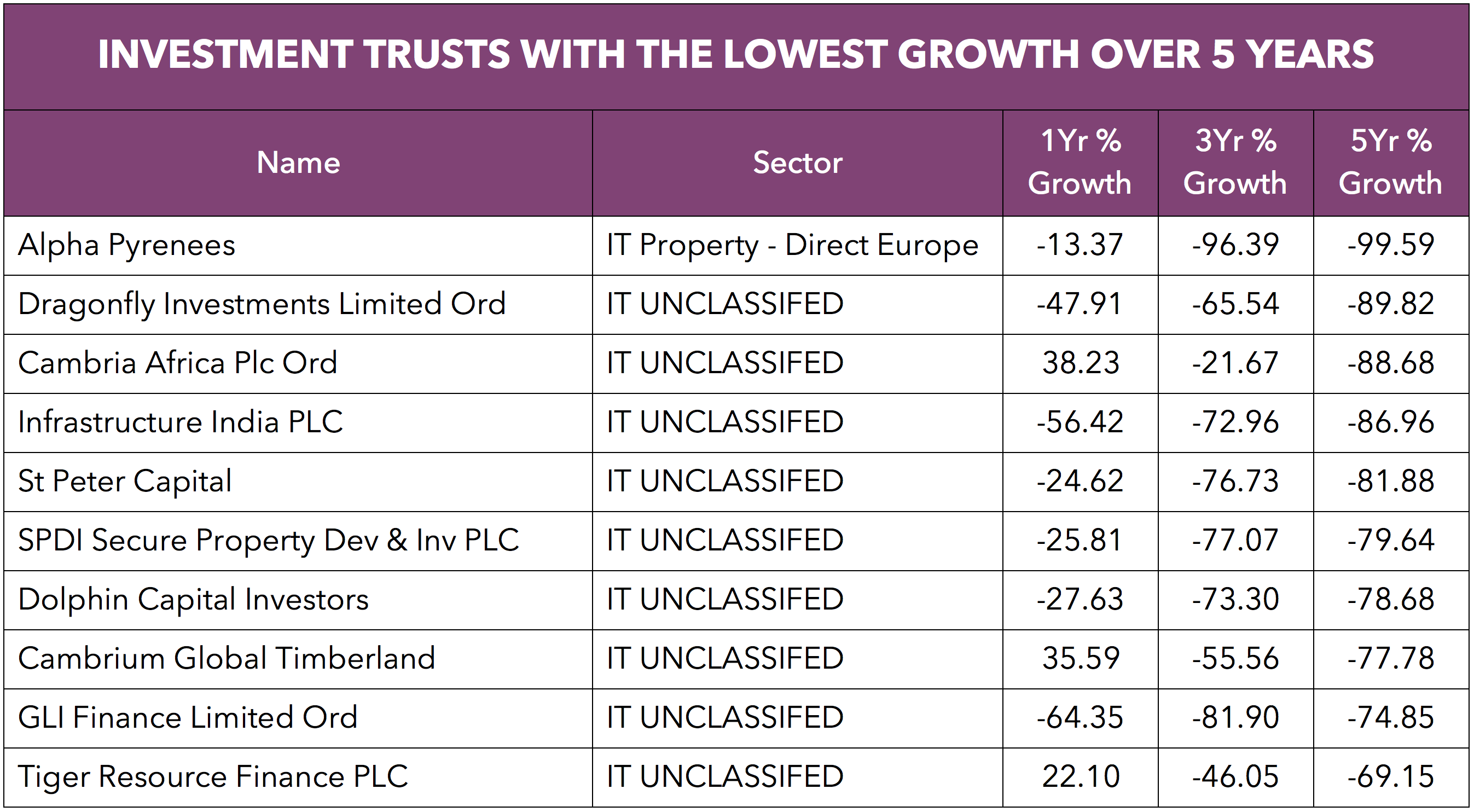

In fact, 20% of investment Trusts have returned negative growth over the recent 12 months with 13% returning negative growth over the past 5 years. These figures are not insignificant, and are cause for concern for many investors. In comparison, 5% of unit trusts returned negative growth over the recent 12 months and 1.5% delivered negative growth over the recent 5 years.

The above table lists the 10 worst Investment trusts based on their recent 5-year growth. In contrast to the top performing trusts below, each of the 10 trusts above have returned significant losses - highlighting the large divide in performance within these often volatile investments.

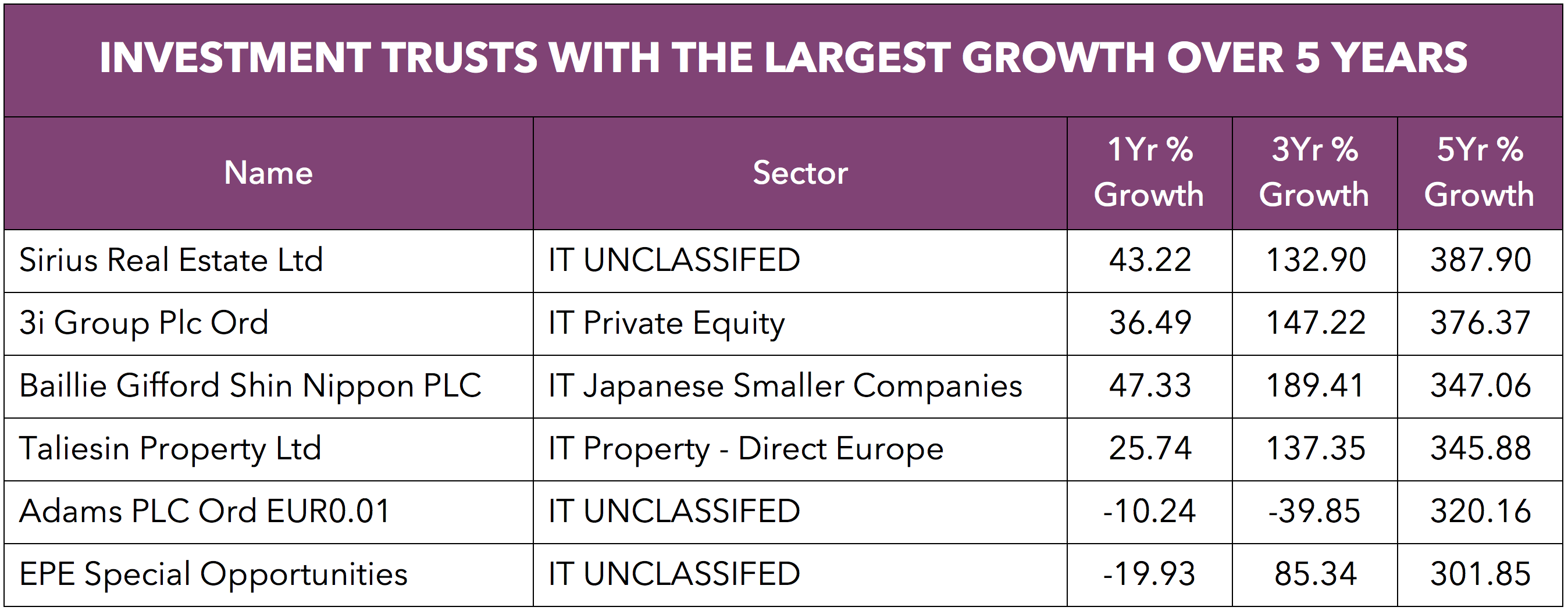

The above table identifies the best Investment Trusts for growth over the recent 5-year period.

View the Top 10 Performing investment Trusts

On average Investment Trusts outperform unit trusts

Despite the poor performance of a proportion of Investment Trusts and the fact they are typically more volatile and assume more risk than unit trusts, there are a selection that have delivered exceptional returns for their investors.

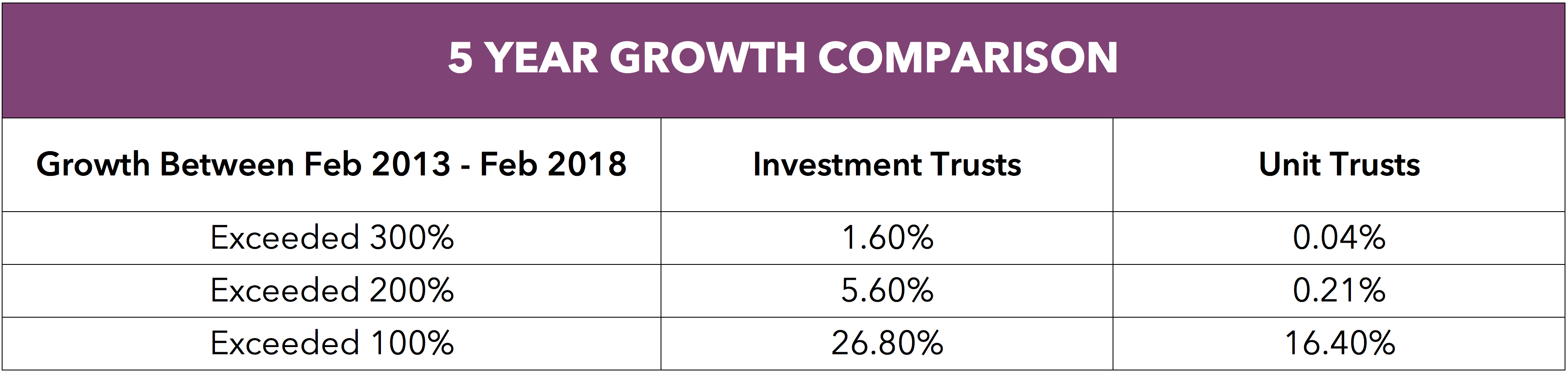

Currently there are 373 investment trusts available to UK investors that have at least 5 years history. 6 of these have returned growth over the recent 5 years that exceeded an eye watering 300%.

In comparison, out of the 2,346 unit trust funds available to UK investors that have at least 5 years history only 1, the Legg Mason IF Japan Equity fund returned recent 5 year growth that exceeded 300%.

5.6% of investment Trusts exceeded 200% growth over 5 years and 26.8% returned 5 year growth that was greater than 100%.

In contrast, 0.21% of unit trusts exceeded growth of 200% over the recent 5 years and 16.4% returned 5 year growth that was greater than 100% Investment trusts are fast growing in popularity and their inclusion within a suitably balanced portfolio could help to deliver higher returns. But the pursuit of higher returns often comes with an increase in risk and as Investment trusts can be significantly more volatile than unit trusts, their inclusion can alter the balance of a portfolio leaving it overexposed to excess risk.

Like any form of investing careful consideration is recommended before making any investment decision.

Investment trusts are not for everybody, but for the more adventurous investors who seek to supercharge the growth of their portfolio, investing in the right investment trust could bring significant long-term gains.

If you are unsure whether Investment Trusts or any form of investment is right for you then it is always better to seek advice from a professional.

Yodelar members have access to a panel of top IFA's and wealth managers assessed by our research team. Our adviser panel are fully qualified and regulated in order to give advice. They differ from the majority of advisers, as they have a deep knowledge of funds and their performance history. They go to great lengths to maximise their clients portfolio growth within their suitable risk profile. Register as a Yodelar member and gain access to our panel advisers and become a more efficient investor.