The crash of 2008 caused massive losses that hit the investment industry hard. Almost overnight, investor confidence turned to fear. Long-standing financial institutions went under, and many others battled for survival.

Ten years on, the markets have rebounded, and a bull market remains in full swing, but the after-effects of the financial crisis have reshaped the landscape. Fear of losses from poor fund management has fuelled the growth of ETFs and index tracker products, whose low-cost models have helped put cost rather than performance at the top of the investment decision-making process.

But is today's cost focused investor missing out on bigger opportunities and better returns?

The Rise of Cost Focused Investors

Wary from the financial, economic and political events of the past decade more investors have adopted a cautious approach with their investments, and as a result, greater emphasis has been placed on advice costs and product fees.

The financial industry has quickly adapted to profit from this trend with low-cost, passive investing and discretionary fund management services rapidly populating.

One of the biggest influencers was the Retail Distribution Review (RDR) of 2012. Brought in to tackle the mis-selling of products and the conflict of interest caused by the commission payments made to advisers, it completely changed how advisers got paid. As a result, advisers now have to charge their clients a fee which is agreed upon upfront. This has made the issue of costs even more pertinent and in an attempt to become more competitive more advisers are cutting costs and improving efficiency by gaining discretionary powers or by outsourcing their clients’ investment portfolios to discretionary fund managers.

ETFs Lead The Way In Low-Cost Investing

Among the products to come to the forefront has been Exchange Traded Funds (ETFs) - which have experienced a meteoric rise in popularity, and worldwide they now hold more than $4.4 trillion of assets under management. One of the biggest beneficiaries of this trend has been fund management giant BlackRock, who in 2009 purchased the iShares ETF brand which has since amassed a staggering $1 trillion of assets under management in a growing range of 800 plus ETFs.

In contrast, Baillie Gifford, who are one of the UK's longest standing and best performing active fund management houses, and recently ranked number 1 in our fund manager league table, have experienced outflows as their investors move to lower cost passive funds. This is despite the fact that the majority of Baillie Gifford’s funds have consistently and significantly outperformed their passive counterparts, with their extra growth dwarfing any fees their investors would have saved by moving to lower cost passive products.

As cost becomes ever more important to investors, Baillie Gifford has witnessed underlying outflows of 10% per year from its pension fund clients, which account for 60% of their business and they are no longer experiencing enough inflows from retail investors to make up the shortfall.

Cost is driving investment decisions as investors lured by the savings on offer continue to pull money out of more expensive, yet often better performing active funds. This further emphasises the vast shift in investor focus in recent times and poses a real problem for UK asset managers, whose core customers are turning against even the best-performing active fund houses in favour of lower cost passive funds.

Low-Cost Funds Continue To Thrive, But There Are Concerns

In 2017, the European ETF market grew by 40% as index-tracking products continue to thrive off the back of record growth from global markets.

Comforted by their returns, the perceived cost saving advantages of passive products has proven to be even more attractive to investors and advisers in the current investment climate. Indeed, competition to attract the business of cost-conscious investors has ramped up as big ETF providers like BlackRock’s iShares, Charles Schwab and Fidelity look to cut fees even further.

However, as the rise of low-cost passive investing coincides with the market growth of recent years, have their investors have experienced the best such products have to offer? And what happens when the markets encounter turbulence?

As these products track the index when the index experiences high volatility or negative growth so too will the fund tracking it. Indeed, many industry insiders have voiced their concerns that ETFs could cause the next financial crisis. However, as ETFs are such a huge industry, they continue to gain momentum with an increasingly growing number of investors won over by their appeal.

Performance Is More Valuable Than Cost

Indeed, index-tracking products such as ETFs are perceived by many to provide better performing alternatives to the higher priced, ‘actively’ managed funds, with various research concluding that on average passive funds deliver better returns and offer better, more secure, long-term investment opportunities.

This classic academic view of active management was proposed by Professor William Sharpe, who argued that “after costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar.”

In reaching this conclusion, he assumed that the index represented the entire range of investment opportunities and that the same objectives motivated all participants.

In truth, for many investors, an index return may not coincide with the outcomes they are seeking.

Indeed, many claims purporting low-cost passive products to be more rewarding than active funds often derive from fund management firms which are heavily invested in the passive market. It is therefore not surprising that many active fund management houses have contrasting claims.

Nevertheless, such comparisons and theories are often misleading, and although it's undeniable that a proportion of active funds are poorly managed and underperform the fact is, the top performing active funds have consistently delivered higher returns for investors, despite often costing more than their passive counterparts.

The best fund managers: Download our most recent fund manager league table ⇒

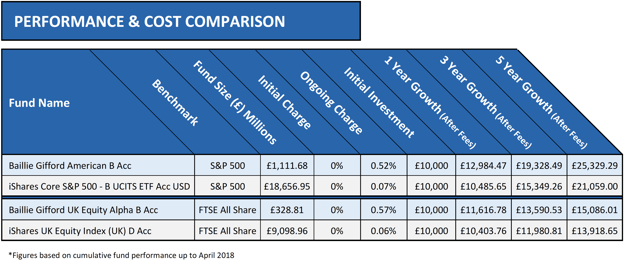

In the above table, we detail the 1,3 & 5-year monetary value, after costs, an initial investment of £10,000 in 2 of the most popular low-cost ETFs would be worth. To provide a comparison, we include the value the same investment in two popular, yet more expensive, actively managed funds would be worth over the same period.

The ongoing charges for the two actively managed Baillie Gifford funds are higher than the charges associated with the two passive iShares ETFs, which track the desired market index.

However, the net returns after fees generated from the two Baillie Gifford funds, which have consistently been among the best performing funds in their sector, has been considerably greater than the returns delivered by the two iShares funds, which follow the same benchmark.

Such examples are not uncommon as high quality actively managed funds strive to beat the benchmark, with the top performers delivering returns that quickly erode any savings gained through low-cost passive funds.

However, cost is still driving investment decisions as investors lured by the savings on offer continue to pull money out of more expensive, yet often better performing active funds.

Has A Cost-Centric Approach Actually Cost Investors More?

Lured by the savings on offer from lower-cost products, Investors continue to pull their money out of more expensive, yet often better performing active funds.

Financial commentator and former Merrill Lynch chief strategist Richard Bernstein has said, "Investors still do not fully appreciate the magnitude of opportunity cost they have paid to alleviate their fears that 2008 would repeat." He said, "Fear has caused 2017 to largely be another year of missed opportunities."

The fact is, investors who prioritise growth could have achieved better returns by investing proportionately in top performing active funds than they would have achieved by investing in low-cost index-tracking funds.

Equally, cost-centric investors could have secured significantly more in growth by investing in a suitable risk portfolio of top performing active funds than they would have saved by investing in low-cost passive funds.

Therefore, many investors who have followed the recent cost saving trend could have unwittingly sacrificed significantly greater net returns had they prioritised performance instead.

Why The Information Age Will Help Investor Efficiency

Depending on your goals and investment personality, discretionary fund management services or lower cost passive products could be the best and most suitable fit. However, the real concern is for the investors who, because of the cost focused trend, are making investment decisions and following a path that is detrimental to their needs, and which ultimately could cost them more in the process.

Of course, cost will and should always be a factor for investors. However, in order to get maximum efficiency from your portfolio it is important to rationally distinguish the value between a high quality, but possibly more expensive product, to one that is lower priced but may not offer the same growth potential.

Whereas this may have been difficult to do in the past, the information age has enabled Investors and financial professional alike to instantly access fund manager and fund performance information, which has made investors more informed and fund managers more accountable.

However, a collective mantra of the fund management industry has been to devalue such information. ‘Past performance is no guarantee for future success’ is a phrase that underperforming fund managers have hidden behind for decades. However, past performance is absolutely an important metric that investors and advisers should consider when making investment decisions, as its reasonable to expect managers who have outperformed in the past to outperform in the future.