Sustainable and ethical investing was once seen as a niche for a smaller percentage of investors, but as social and environmental strategies have become growing financial commodities, academics, fund managers and economists are all in agreement that investors can benefit greatly from well-run companies that positively thrive under self-imposed environmental and social criteria.

For years, many investors felt that investing in sustainable funds meant sacrificing growth – but in its simple form, that is no longer the case, today the more profitable companies are adapting transparent policies, and, in many instances, investors can benefit from excellent returns. Companies that operate under ethical, environmental and social criteria are creating exceptional value. It appears that consumers are now more drawn to product and service providers that adopt ethical best practices.

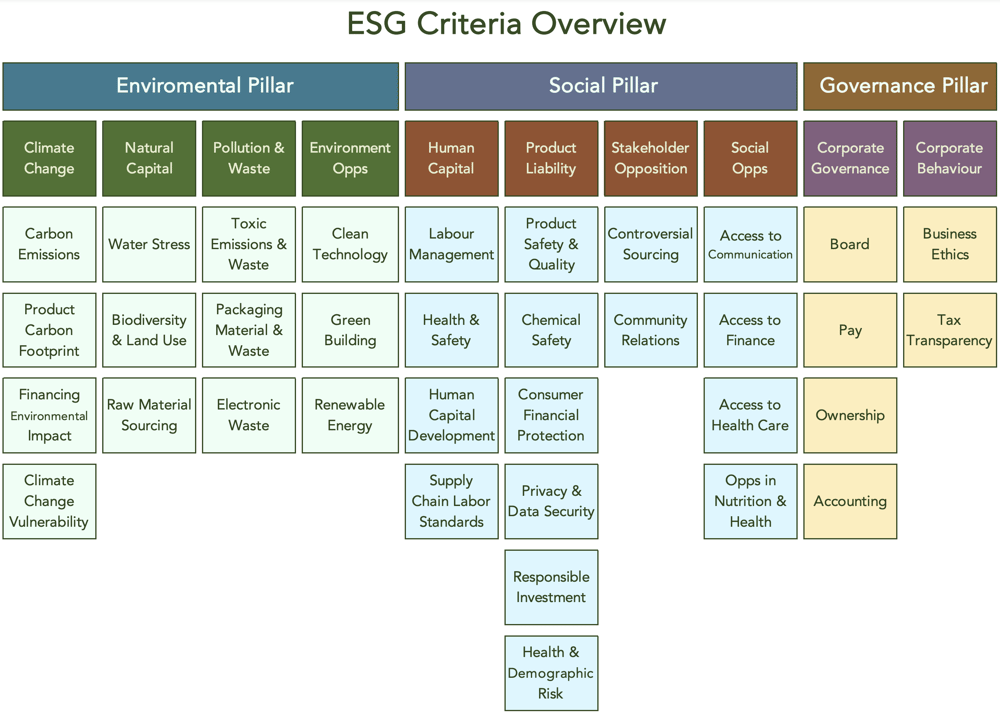

The ethical terminology criteria and self-scrutiny adapted by leaders in this area is referred to as ESG or environmental, social and governance. Due to advances in technology and communication, a firms ESG criteria is now closely linked to its future growth strategy and potential. Because of this ESG criteria is now a major factor in a fund managers decision making process. With more detailed data, clearer criteria and more sophisticated analysis tools it is possible for investors and advisers to offer diverse portfolios that are built for growth but also adhere to ESG factors for the purpose of long-term sustainability.

In this report, we evaluate ESG criteria and analyse the most efficient and top performing ESG funds. We will highlight why ESG funds are an opportunity for investors. We will also introduce our New Yodelar Investments ESG portfolios, 9 risk-based portfolios that offer significant future growth opportunities for investors.

What is ESG Investing?

Ethical and sustainable investing has been a topic of interest in the investment industry for years with numerous surveys among investors finding that many would consider investing in ethical funds. Yet only a small proportion of investors have actively maintained a portfolio that followed an ethical approach.

One of the main obstacles for investors has been the lack of clarity and general confusion as to what defines an ethical or sustainable fund. There has been a minefield of definitions and terminologies that have been used to screen and define a sustainable fund. But the recent development of better analysis tools and the acceptance of key criteria across the industry has led to the rise of the term ESG (Environmental, Social and Governance) - which has helped to improve the understanding of the topic.

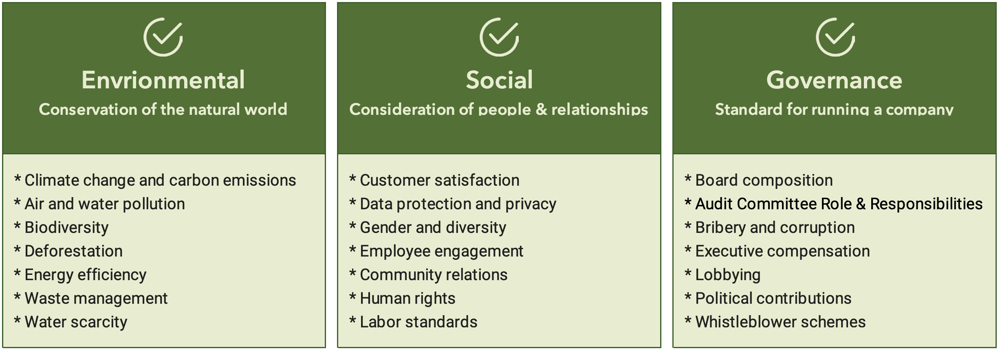

ESG covers the most common aspects of ethical investing but it is important to clarify that this criteria might still not suit some investors, particularly those who wish to invest only in funds that do not hold shares in particular types of companies even if they have good environmental or governance practices, such as gambling or alcohol related companies. For such investors their options are limited, and the tools available to identify these funds are not as developed as those now available for ESG qualified funds. However, the ESG framework covers a wide range of topics that is defined below:

Sustainable Investing

In recent years, many large companies have invested heavily in adapting their models and introducing sustainable processes. This is a preemptive move, in part to mitigate against the risk of future legal implications with pressure mounting on governments to introduce and enforce legislation to improve environmental practices among large industries.

As a consequence, many investors are unaware that they are now invested in funds that have good ESG practices in place.

This not only benefits the environment as well as working conditions and operational practices, but it also reinforces that companies value and gives them a competitive advantage over rivals who have yet to invest in restructuring their operations to meet ESG practices.

Organisations that hedge against potential future problems, increase their resilience and strengthen their position within their marketplace. The greater ESG adaptation for many Global industries has resulted in fund managers whose strategies were never influenced by ESG practices to now find themselves managing funds that meet recognised ESG criteria. Sustainable investing is only going to grow and it will become a driving factor in company valuations and therefore fund performance.

The Evolution of ESG Investing

ESG is growing in significance amongst both institutional and retail investors. The practice of ESG investing began in the 1960s as socially responsible investing, with investors excluding stocks or entire industries from their portfolios based on business activities such as tobacco production or involvement in the South African apartheid regime.

Today, ethical considerations and alignment with values remain common objectives of many ESG investors.

ESG Investing

Since the pandemic, ESG has become a more relevant factor in risk mitigation. Those companies with transparent ESG policies have demonstrated an increased ability to be agile and flexible to more modern work practices.

Globally, sustainable funds based on ESG themes pulled in a record-breaking £14.9 billion of new money in 2019 – almost four times the 2018 figure of £3.9 billion, itself a record.

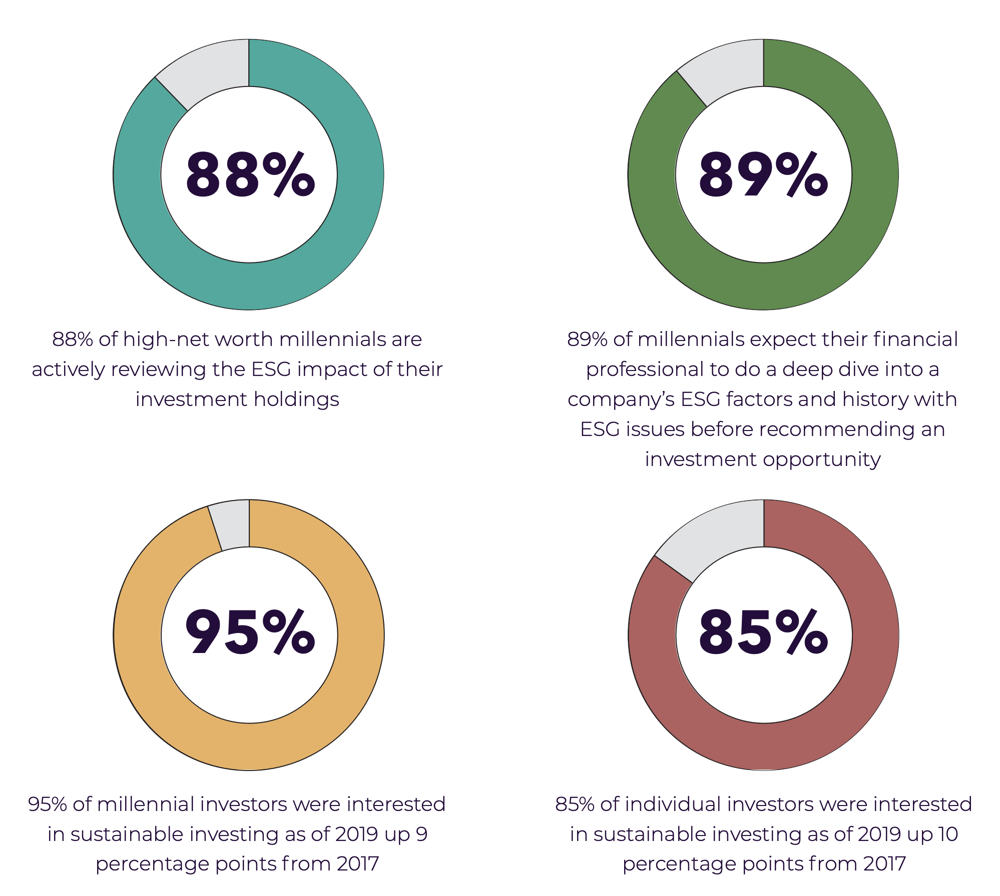

Morgan Stanley’s 2019 Sustainable Signals survey found that around 85% of investors are interested in sustainable investing, up from 71% since 2015.

An ethically centred approach to customers, employees and the world at large is increasingly seen as an indicator that a company is a good long-term investment. Since the COVID-19 pandemic, ESG has become even more important, highlighting the need not only to do well by society, but also a way to mitigate risk in the long term.

ESG funds are tied to powerful trends such as sustainability, demographic development or technology – and may grow faster than the wider economy. In turn, investors will be more likely to stick with them through difficult markets, benefiting from the rebound and avoiding losses.

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors. The past months have been a difficult one for many investors and indeed since the pandemic outbreak in 2020 markets have been volatile with fund performance up and down.

But as the world moves closer towards the end of the pandemic the outlook for funds with holdings in companies that have implemented ESG practices is brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth; and with greater accessibility to online fund performance and ESG rating tools as well as growth focused ESG portfolios, it has never been easier to invest in high quality, sustainable funds.

How To Find The Best ESG Funds

Environmental and sustainable practices have become so prominent in industries throughout the world that many investors are unaware that their portfolios now contain a growing number of funds that adhere to Environmental, Social and Governance (ESG) practices.

There are a number of online tools that make it possible for investors and advisers to analyse the ESG capacity of a fund as well as how competitive that fund has performed.

Through a combination of the Yodelar Investor Hub platform our regularly updated best funds report and the MSCI ESG rating tool investors have the ability to identify the best performing funds and determine their ESG rating, making it possible to efficiently identify suitable, high quality funds for a sustainable investment portfolio.

Top Performing ESG Portfolios

There are over 53,000 funds and ETFs that have been provided with an MSCI ESG rating. A selection of these funds will have an ‘A’ plus ESG rating, but less than 10% will have consistently outperformed competing funds within their sectors and have a high performance rating.

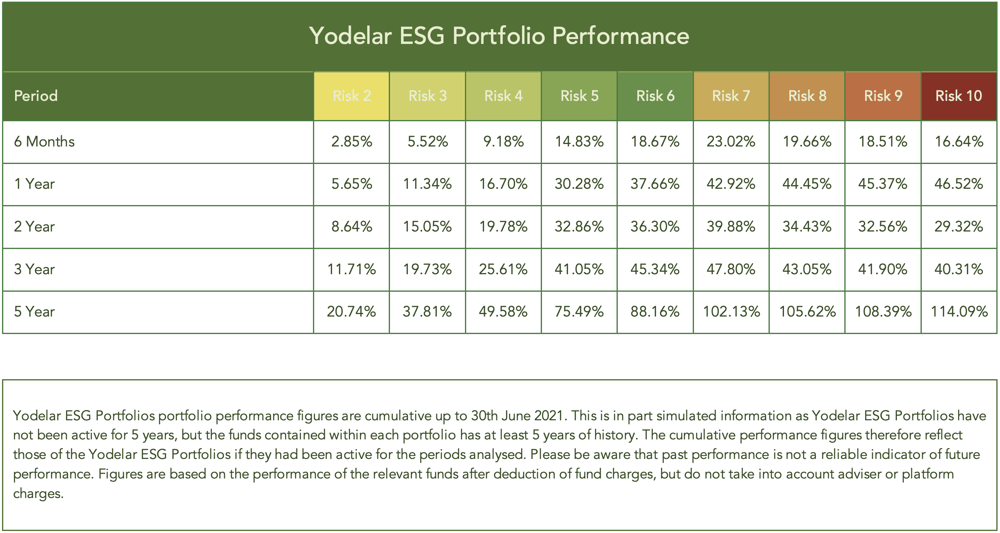

In constructing our ESG portfolios we analysed the performance and rating of all available funds and selected those that have consistently outperformed their peers, fit within a defined asset model, have an MSCI ESG rating of A, AA or AAA, and represent what we believe to be excellent future growth potential.

Most ESG portfolio options on the market are limited to a small selection of funds that are often restricted to those managed by the wealth management firm themselves. Finding the most suitable ESG rated funds, then building and maintaining a diversified portfolio of high quality funds to fit defined risk criteria requires significant analysis and continuous monitoring, which is simply not a viable option for many investors or advisers.

Using a whole of market, research driven approach Yodelar have launched a range of risk rated ESG portfolios that provide investors with high quality, growth focused portfolios that adhere to the ESG framework as defined by industry leading investment research analysts, MSCI.

ESG Funds - Due Diligence

Greater adaptation to ESG practices among a growing section of industries has resulted in some traditional funds to stumble into a high rating for their ESG criteria, which adds to the high quality fund options available to investors who wish to maintain an ESG efficient portfolio.

There are numerous sustainable investing options available to UK investors, and the growing attraction of these funds has prompted providers and fund management brands to promote their funds as ESG funds, with some even renaming their funds to incorporate sustainable investing terms.

However, as many use their own ESG rating criteria there is concern that some funds are overstating their ESG exposure.

Over promotion of ESG is often dubbed ‘greenwashing’ (i.e. when a company gives a misleading impression that its activities are environmentally sound). Recently, Fidelity International completed their first survey focused on sustainability. In the survey they asked analysts: “What do you think about your companies’ efforts to promote their ESG credentials relative to their actions?” and gave them a scale of possible answers to capture whether companies tend to over or under promote their efforts.

While the analysts reported some instances of over promotion, their responses show they had a much broader set of behaviours in mind, including general differences in reporting approaches across regions, sectors and individual companies.

From a sector perspective, energy and industrials have the largest proportion of analysts who say companies talk up their ESG credentials. That is unsurprising given the pressure on these areas to show they are reducing emissions.

Less expected, perhaps, is that 50 per cent of healthcare analysts say their companies promote better ESG credentials than merited. “Most companies in the pharma space talk about improving access to healthcare but actions on drug pricing don’t match those commitments,” explains one healthcare analyst covering North America.

The survey identifies that the true ESG scope within a company can differ as their is no single defined rating criteria and as a result, some funds promoted by fund managers as ESG efficient funds might not be as strong as they think, with in some cases ‘standard’ funds will have a stronger true ESG status.

This survey highlights the importance of a defined ESG rating process, which is why the Yodelar ESG Portfolios utilise the MSCI ESG Rating criteria to ensure the funds within our portfolios meet consistent ESG guidelines.

Yodelar ESG Portfolios Ratings

To help ensure the funds we use for our ESG portfolios meet consistent ESG metrics we follow the MSCI ESG rating criteria and employ this criteria to each fund we analyse and select.

The MSCI are a Global leader in providing expert research, data and technology that helps to add transparency and drive more informed investment decisions. Their ESG measurement criteria is extensive and their unbiased, straight forward, transparent rating formula fits perfectly with our whole of market outlook on investing, which we believe is the most beneficial to investors.

The MSCI ESG Rating is designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. They use a rules-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. The MSCI ESG Ratings range from leader (AAA, AA), average (A, BBB, BB) to laggard (B, CCC).

MSCI ESG Ratings uses a rules-based methodology designed to measure a company’s resilience to long-term, industry material environmental, social and governance (ESG) risks. They leverage Artificial Intelligence (AI), machine learning and natural language processing augmented with over 200 analysts, to research and rate companies on a ‘AAA‘ to ‘CCC’ scale according to their exposure to industry-material ESG risks and their ability to manage those risks relative to peers.

ESG Investing Without Compromise

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios. Our research identified that only a small proportion of funds and fund managers have consistently delivered top performance, with more than 90% of the portfolios we reviewed containing funds that continually underdeliver.

Our investment approach ensures that the funds used to achieve the correct balance for each of our portfolios are consistently among the best performers in their sectors.

We believe this efficient and quality-based investment philosophy will help our ESG portfolios to excel and securely maximise the growth for our investors within a controlled ESG framework.

Contact us or chat online to find out more about our new range of ESG portfolios.