Investing by definition is about putting money to use by purchase or expenditure, in something offering potential profitable returns - Yet for some investors, growing their money is not the primary driver in their investment decisions.

In recent years in particular, the cost of investing has become more influential, with some investors focusing more at how much they can save in fees rather than focusing on quality investment products that offer the best potential for higher returns.

Such an approach can prove to be costly resulting in investors missing out on returns that significantly outweigh the savings from investing in low-cost portfolios.

Each sector will have consistently top performing funds when compared to all same sector funds. Those that prioritise experience and consistent performance first, and cost to invest second make use the better performing competitive funds, and generate better returns.

To achieve maximum efficiency from your portfolio it is important to distinguish the value between a high quality, possibly more expensive product, to that of a lower priced poor performing alternative. Cost and growth must be a balanced assessment based on factual information.

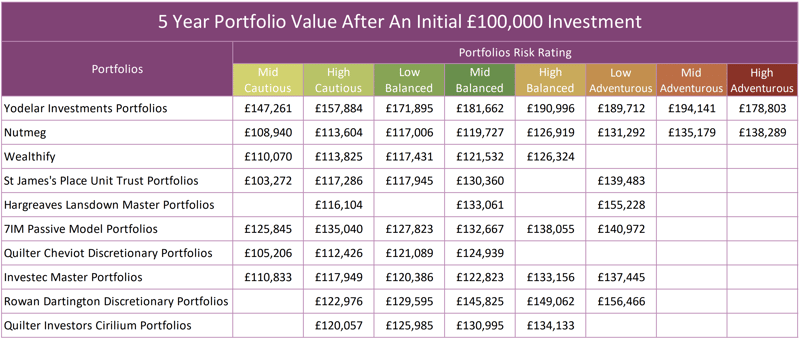

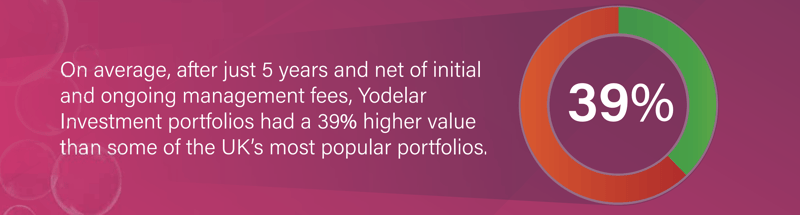

Our research team carried out a comprehensive analysis of some of the UK’s most popular investment portfolios to determine how much of an influence cost has on their overall performance. We included the low-cost portfolios of online Robo advice firms Nutmeg and Wealthify, as well as the portfolios of discretionary providers along with more established brands such as Investec and St. James’s Place. Our analysis found that despite providing an initial saving on fees, low cost options provided the lowest returns.

31% of Advisers Recommend Discretionary Portfolios

Although relatively unknown to investors, discretionary portfolio management firms have fast become one of the largest suppliers of investment portfolios on the market. They are often seen as low-cost investment options but their fees can vary greatly based on the fees applied by the adviser who recommends the portfolio.

These firms provide a complete portfolio management service that financial advisers pay to use as it removes the complexities and time required to manage their own investment portfolios for clients. To employ these services, the adviser will pay the discretionary management firm a fee which they then pass onto their clients along with a further management charge as a means for their remuneration

A recent survey by Defaqto, an independent researcher of financial products, highlighted that 43% of UK financial advisers are currently outsourcing their investment proposition, and of those 72% are using discretionary management services.

In our report, we analysed the portfolios of two prominent discretionary portfolio providers and established what an initial £100,000 investment would be valued at after 5 years. To determine these values, we took into account the management fees of the discretionary providers, but as adviser fees can vary, we could not include any additional management fees that would typically apply.

How Quality Beats Cost

The portfolios analysed have a wide variation in management costs which range from as low as 0.30% all the way up to a hefty 5%. One of the portfolios with a 5% initial charge was the Quilter Investors Cirilium Portfolio which after 5 years, would have grown an initial £100,000 investment to £125,985. In comparison, the lower-priced Nutmeg and Wealthify portfolios, which have a charge of 0.75% and 0.40% respectively, had lower overall growth.

The cost savings from a lower-priced investment portfolio will only make a difference if the portfolio is able to closely match the performance of its competitors. But if a portfolio is generally uncompetitive any savings from lower fees will be of little reward as the missed opportunity growth from a better quality but more expensive portfolio will typically grow the value of a portfolio higher.

*Figures based on portfolio performance up to 1st November 2019

True value for investors comes from quality rather than cost and as evidenced by the performance of the Yodelar Investment portfolios the difference in monetary value after 5 years is significant. Yodelar’s processes differ from most as we have no arrangement either directly or indirectly with fund managers which allows us to make independent investment decisions that are based on the performance, consistency & management quality of the underlying funds. Whereas, providers such as St. James’s Place can only provide a restrictive service to investors as their portfolios only contain their own brand of funds.

When Expensive Products And Poor Performance Combine

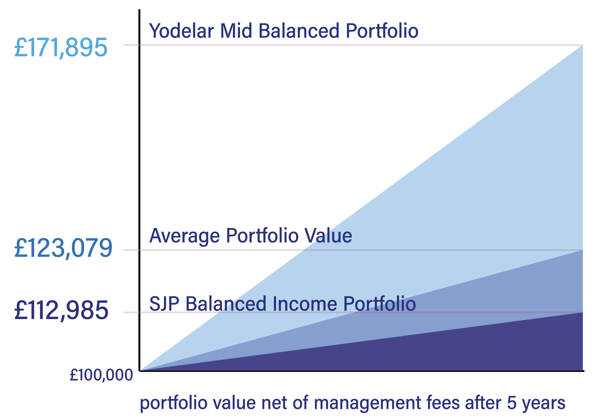

The cost of investing has its biggest impact when a portfolio is both expensive and comparatively poor performing, as was the case with the SJP Balanced Income portfolio. This portfolio has an initial fee of 5% and an ongoing management fee of 1.69%, which is well above the 3% industry average, according to a recent FCA study. Over the past 5 years, an initial investment of £100,000 in this portfolio would be valued at £112,985, which is some way off any of the other providers that we analysed.

The Impact of Fees Can Be Lower Than You Think

The impact of fees is less than many are led to believe. For example, an initial investment of £100,000 into an investment portfolio with an initial management fee of 2% and an ongoing management fee of 1% will have a higher value after 5 years than a portfolio where the initial and ongoing fees are just 0.3% simply by maintaining an annual level of growth that is 0.9% higher.

To put this into perspective, over the past 5 years the Yodelar Mid Balanced portfolio had an average annual growth, after management fees, of 16.32% whereas the 9 similar risk portfolios analysed averaged annual growth of 4.6%, which is a difference of 11.72%.

Find A Portfolio That Ticks All The Boxes

Low-cost portfolios must contain low-cost funds, and as many low-cost funds underperform, so too does many low-cost portfolios. But equally, there are many high priced investment portfolios that fall well below average when it comes to performance.

When it comes to making the best investment decisions investors should look at value rather than cost. But how can investors determine, with a strong degree of certainty, whether or not an investment portfolio is both high quality and fits your objectives?

Deep Rooted Flaw of Low-Cost Models

It is also important to recognise that low-cost portfolio providers are forced to maintain their low fee structure in order to maintain the viability of their business. As a consequence, they are forced to overlook many high-quality funds that do not fit their cost structure in favour of lower-priced, and often lower growth alternatives.

When it comes to investing, cost will and should always be an important consideration, but it should never be the dominant factor. Investing is about growth and although many low-cost portfolios do just that, they have a deep-rooted flaw that will always limit their potential. As a consequence, the real value from investing is not in the short term gain from saving on fees but from the long-term value of investing in portfolios that focus on quality.