Woodford's troubles came to a head in June of this year when, after two years of poor performance, he ran out of cash reserves to return to investors who were fleeing his Equity Income fund in their droves.

He was forced to freeze investors' money in the fund to give him time to sell some of the assets and raise cash. But after four months of suspension, Link Fund Solutions – which oversees the management of the fund – pulled the plug. It fired Woodford earlier this month, and appointed managers to sell all the assets and return the money to investors. Hours later, Woodford quit from the Income Focus fund and Patient Capital Trust and announced he would shut down his investment empire.

With Hargreaves Lansdown embedded at the centre of the controversy that has rocked the investment landscape we look at how we got here and why wasn’t it stopped much earlier.

The Hargreaves Lansdown Connection

In 2015, the first full calendar year for the Woodford Equity Income fund, Hargreaves Lansdown clients owned 38%, or £3.1 billion, of the fund. By 2016, that had risen to £3.4 billion, even though their relative stake in the fund had dipped to 36% after the fund had a strong early run of performance.

In 2017, Woodford endured a torrid year, falling to the bottom of the Investment Association’s UK Equity Income sector which prompted the first wave of withdrawals from his flagship fund.

Hargreaves Lansdown clients pulled £1 billion from the fund, at a faster rate than Woodford’s other investors. But such is the broker’s scale, and the inflows it had already driven, that at £2.2 billion their clients’ stakes still represented 28% of the fund’s assets.

During the initial 3 years, Woodford would have generated roughly £50 million in fee revenue from Hargreaves Lansdown clients alone.

For Woodford’s Income Focus fund, Hargreaves Lansdown’s influence is more alarming. Their clients owned roughly 75% of the then £703 million valued fund as of January past.

Hargreaves Lansdown’s backing of Woodford funds is so significant that, unlike any other broker, they were deemed a ‘related party’ in that it controls more than 20% of the shares and must disclose holdings in its annual reports.

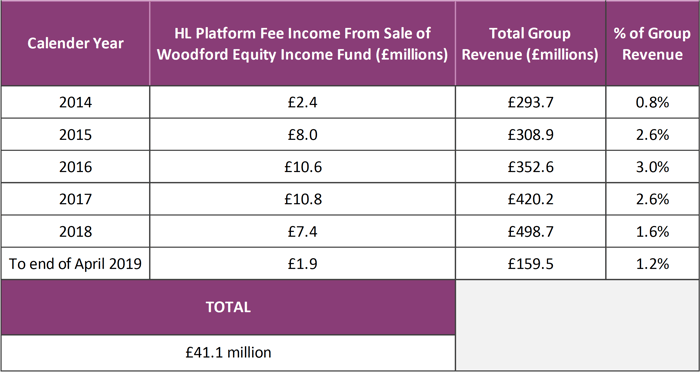

Hargreaves Lansdown Earn £41.1 million From LF Woodford Equity Income

Since the LF Woodford Equity Income fund launched in 2014 up to end of April 2019 Hargreaves Lansdown earned £41.1million in fee income generated from their clients who purchased the Equity Income fund through their platform.

Hargreaves Lansdown’s Role In The Woodford Investment Crisis

The support of Hargreaves Lansdown was a major factor behind the huge amounts Woodford was able to raise for his Woodford Equity Income fund, which at its peak stood at £10.2 billion. In the 2 years up to its suspension, the Woodford Equity Income fund had begun to show signs of difficulty as its performance started to drastically fall. Despite these concerns, Hargreaves Lansdown continued to publicly back Woodford by including his funds in their Wealth 150, which was recently changed to the Wealth 50 promoted funds lists.

At its peak, Hargreaves Lansdown investors held £3.4 billion in the Woodford Equity Income fund, with their Wealth 50 list contributing to the funds’ popularity with Hargreaves Lansdown clients.

The Wealth 50 list has often come under criticism over the clout it holds in directing the flow of investor money. Woodford’s funds had featured prominently on the list, with some raising concerns that the monetary relationship between Woodford and Hargreaves Lansdown played a role in its continued inclusion right up until the suspension of Woodford's Equity Income fund.

Regulator Concerns Over Recommended Fund Lists

When assessing the drivers for a recommendation of funds, the FCA found that funds affiliated with the platform are “significantly more likely to be added to the recommendation list than non-affiliated funds” while at the same time “are less likely to be deleted from recommendation lists”. The study also found that “recommended funds share a higher proportion of their revenues with the platforms than non-recommended funds”.

It is not just the regulator that has been critical of how these funds are selected. Terry Smith, a respected fund manager and founder of investment firm Fundsmith, recently voiced concerns over how Hargreaves Lansdown selects its recommended funds.

Smith was quoted in the Times as saying, “recommended funds continue to be chosen mainly for fund managers’ willingness to comply with a charging structure which enables Hargreaves Lansdown to maximise its own profitability, and not because they perform well for investors”.

Indeed, our analyses of Hargreaves Lansdown’s Wealth 150, and more recently the Hargreaves Lansdown Wealth 50 lists, identified a large proportion of the funds they feature have a history of poor performance.

Hargreaves Lansdown’s Recommended Funds List Contains Poor Performing Funds

The funds within their Wealth 150+ list have been described by Hargreaves Lansdown as funds that “offer the ultimate combination of first-class long-term performance potential and low management charges” and represent their views on the “Best funds available to UK investors”. This list included the Woodford Equity Income and Income Focus funds, with the latter included as soon as it launched in April 2017.

At this time we completed a comprehensive performance analysis of all the funds within the Wealth 150 lists. This analysis identified that 45% of the funds they featured had a history of poor performance, with only 11% consistently maintaining a top quartile sector ranking.

At the start of 2019, Hargreaves Lansdown rebranded the Wealth 150 to the Wealth 50 to reflect its change to a more condensed list of funds. This list was immediately met with scorn for controversially excluding Terry Smith’s top performing Fundsmith Equity fund while keeping faith with rival Neil Woodford, whose funds had been on a downward trajectory for some time.

Our review of the 64 funds on the Wealth 50 list identified that 39% had ranked in the bottom half of their sectors for performance with just 12.5% of the funds it featured returning a level of growth that ranked within the top quartile of their sectors over the 1, 3 & 5 year periods that were analysed.

Hargreaves Lansdown Face Legal Action Over Their Role In The Woodford Saga

Law firms Slater & Gordon and Leigh Day are investigating whether consumers who invested in Neil Woodford’s funds through Hargreaves Lansdown's platform, multi-manager funds or advisers have legal recourse via the courts or ombudsman for any losses they might incur.

Kamran Vojdani, solicitor at Leigh Day, said the firm had received more than 500 enquiries about Hargreaves' role in the Woodford debacle, from those who invested in the multi-manager funds, invested directly via the Wealth 50 recommended funds list or used the firm’s in-house advisers.

Slater & Gordon's head of group litigation Gareth Pope added: 'We're concerned to establish if there was any actionable wrongdoing or conflict of interest by Hargreaves Lansdown in continuing to include Woodford funds on their Best Buy Lists if it had concerns as to their underlying investments.

'We'll also be looking at the price achieved when buying and selling instruments, such as ordinary shares, on the Hargreaves Lansdown platform and whether or not this represents Best Execution.'

Peter Hargreaves Criticises Neil Woodford's Relationship With Hargreaves Lansdown

Hargreaves Lansdown founder Peter Hargreaves recently launched a scathing attack on Neil Woodford’s relationship with the company he founded. In an interview with The Times Peter Hargreaves, who founded the broker alongside Stephen Lansdown in 1981, criticised the firm for keeping faith in Woodford for too long.

Mr Hargreaves said. ‘It’s annoyed the hell out of me that it would appear he [Woodford] has not been truthful with Hargreaves Lansdown. But it’s also annoyed me that they let it go on so long’.

‘The clients have been stuffed in this horrible Woodford fund.’ He added: ‘Woodford has been in this situation before and had always come good and the last thing you want to do is tell your investors to sell and next week it all goes right. The problem was Hargreaves Lansdown had too much with him.’

In relation to this article one times reader commented “I cannot understand why anyone would have stayed invested in this fund, when it had performed abysmally pretty much from launch. A bit of simple research would have pointed to a number of equity income funds which have performed well over the same timeframe.“

This is a very valid point! But the trouble was, many of those in positions of influence, who now slam Woodford, had lauded him as the messiah of investing just a few years ago. Investors were continually confronted with fawning reports on the ‘Star’ fund manager on a seemingly daily basis. This high publicity undoubtedly helped to promote Woodford's position as a ‘star’ fund manager and contributed to the rise of his flagship fund, which hit an unprecedented £10 billion of funds under management in its first 2 years.

Yodelar Were The First Research Company To Call Woodford Out!

At Yodelar, we have always informed investors factually that Woodford was far from a Star Fund Manager, and was poor performing for many years.

Years before the demise of Woodford Investment Management and at the height of Woodford’s popularity, we initially reported on Woodford’s performance as a fund manager and how the data did not support the widely held view that he and his funds had a record of superior performance.

During Woodford’s last years at Invesco, before Woodford Investment Management, his funds struggled when compared to all other same sector funds. Why wasn’t this more widely reported? With the exception of the first few months of the Woodford Equity Income fund, performance data consistently demonstrates that the funds managed by Woodford lacked performance when compared to the majority of competing funds within the same sectors.

How Woodford's Previous Funds Performed

In his previous role as a fund manager with Invesco Perpetual, Neil Woodford managed 6 funds. Several years ago, we analysed the discrete monthly performance as well as 5 year cumulative performance for each of these funds in the 5 year period up to his departure from Invesco in 2014.

Invesco Perpetual High Income Fund

Woodford took over the management of the High-Income fund in February 1988 and it was his time in charge of this fund that helped to build his reputation as a fund manager. During the 26 years he managed this fund he had helped to deliver levels of growth that were among the top in its sector, but towards the end of his reign this fund had begun to lack consistency. In the last 5 years Woodford managed this fund it achieved growth of 119.59%. While this may seem very impressive, the sector average for this period was 147.43%.

Invesco Perpetual Income Fund

Like the High-Income fund, the Invesco Perpetual Income fund is classed within the UK All Companies sector and it achieved somewhat similar levels of performance. The fund returned growth of 119.09% in the 5-year period up to Woodford's departure in March 2014, which was also lower considerably lower than the 147.43% sector average.

Invesco Perpetual Monthly Income Plus Fund

Managed by Neil Woodford between 6th February 1999 and 14th October 2013, the Monthly Income Plus fund took some time before it started to deliver competitive returns for investors. In Woodford's first 4 years in charge this fund only managed to return growth of 1%, but in the period between 6th February 2003 to his departure on 14th October 2014 this fund returned growth of 181.46%, which was the highest in its sector.

Invesco Perpetual Distribution Fund

Neil Woodford managed the Invesco Perpetual Distribution fund between 26th January 2004 and 14th October 2013. During this period the Distribution fund returned growth of 115.06%, which ranked the fund 4th when compared to the other 34 same sector funds that were active during the same period.

St James’s Place Strategic Managed

Outside of Invesco Perpetual, Neil Woodford was also contracted by St James’s Place to manage the St James’s Place Strategic Managed Fund, which he managed between 6th April 2010 to 27th April 2014. During his time, he delivered growth of 27.89%, which ranked the fund 79th out of 172 main unit funds in the same sector.

Edinburgh Investment Trust PLC

Between 15th September 2006 and 27th January 2014, Neil Woodford managed Invesco’s popular Edinburgh Investment Trust. His time as manager of this trust got off to a rocky start as between September 2006 and March 2009 it returned negative growth of -25.45%, however, during his overall time as manager of this trust Woodford delivered returns of 88.58% which was comparatively low when compared to the Finsbury Growth & Income Trust, which sits within the same sector and returned growth of 119.76% over the same period.

The Neil Woodford PR roadshow

A contributing factor in the rise of Woodford’s brand as a ‘star’ fund manager can be connected to the relationships he forged on the ground with those who had influence over investors.

Woodford had recognised from an early stage that gaining trust with financial advisers would help him reach investors. One of the ways he managed to do this was through his many UK wide relationship building events where he invited advisers from that region to a pre-paid dinner function where they got the opportunity to mingle, ask questions and listen to Woodford discuss his philosophy and investment outlook. Although advisers were not encouraged to favour Woodford funds, this PR roadshow helped to build Woodford's connection with advisers, who in their dealings with clients, are then more likely to look favourably on Woodford funds as opposed to those of his competitors with whom they had no personal affiliation too.

What Next For Woodford Investors?

If you invested £10,000 in the Woodford Equity Income fund when it launched in June 2014, your investment would be worth £8223. The same amount invested in the Woodford Income Focus fund when it launched in April 2017 would now be valued at just £7090. but the biggest drop is reserved for the Woodford Patient Capital Trust were an investment of £10,000 in April 2015, would now be valued at £4157.

For Woodford, it is difficult to see how his career as a fund manager can recover, but the £120 million in dividends he received along with his firms co-founder Craig Newman in the 6 years his firm was active, will surely go some way to ease the pain. However, for the investors who entrusted Woodford to manage their money there is no such comfort as they face up to the prospect of losing billions of pounds.

With potential legal action against Woodford and Hargreaves Lansdown incoming, it is likely this story will rumble on for some time yet.