The primary reason UK investors enter into a long-term investment strategy is to secure sufficient income for their retirement. But no matter what our investment goals are, the strategy we adopt to reach those goals will need to be continually refined and rebalanced as over the lifetime of an investment portfolio the level of investment risk we take will fluctuate depending on what stage of life we are at.

But what influences our changing risk tolerances and how can we ensure that our long-term investment strategy remains on track?

The importance of risk

Whether you are investing for a particular reason such as retirement, to generate an income or simply to make your savings work as hard as possible, the two questions you are most likely to ask before investing are: ‘What can I gain?’ (your potential reward) and ‘How much do I stand to lose?’ (your potential risk).

As investors, we are generally much more concerned with how much money we could lose, than the amount we could gain, which means that assessing and managing risk forms a large part of the investment process.

Some of the most common investment risks are:

• Capital risk – the risk of not getting your money back

• Currency risk – the risk associated with investing in more than one currency

• Geographical risk – the risk associated with investing in more volatile or risky countries

• Inflation risk – the risk that your investment does not keep pace with inflation, making it worth less over time

• Interest rate risk – the risk of interest rate changes

• Product risk – the risk that your investment changes and no longer meets your original requirements (this can happen if a fund objective changes to become less cautious, for example)

• Volatility risk – the extent and frequency that investments rise and fall (a highly volatile investment can vary significantly on a daily basis, for example)

Does your risk profile suit your long-term goals?

According to data from the 2017 Schroders Global Investor study, UK investors currently save an average of 11.3% of their income for retirement which they want to realise, on average, by 59.7 years old. But, the study also found that 27% of investors feel that their retirement income will fall short of their goals.

However, the reality is, the investment returns for many investors will likely fall short of their requirements or goals as a recent study by the Yodelar research team found that 9 in 10 portfolios that we reviewed contained funds that underperformed within their sectors.

But even though fund selection can have a sizeable impact on your portfolio returns, it is not the most important aspect of investing.

There are those who believe that good investment judgement and market timing is the key to the success of their investment portfolio, but a study by the CFA Institute on ‘determinants of portfolio performance’ found that as much as 90% of an investment’s return can be down to asset allocation. Although there are many different asset allocation models available they are each defined by risk. More specifically, what level of investment risk we are willing to tolerate in the pursuit of returns.

As risk defines the asset allocation of an investment portfolio it is critical that whenever our risk tolerances change (as they undoubtedly will do over various stages of our lives) that the level of risk assumed by our investment portfolios also change.

Your risk profile should take into account your overall appetite for risk, your financial position, your goals and your investment timeframe.

To keep your portfolio on track you need to receive regular reviews in order to ensure that you don’t expose yourself to too much risk while striving for growth - or that you don’t fall behind your investment timeframe by taking an approach that is overly conservative and delivers lower returns than you would like.

Why the level of investment risk we take changes over time

The CFA institute state “your appetite for risk decreases with age and commitment”. Therefore, as an investor, it is imperative that we understand what level of risk we are comfortable with taking, and should be taking, at each point throughout our investment journey to help ensure our portfolios are correctly structured to absorb a financial shock and withstand market fluctuation.

Although everyone's attitude toward investing and money is different, most investors share some common situations throughout their lives.

Major events such as getting married or becoming a parent don’t just define the course of our lives on a personal level. They also have profound effects on our financial goals and on our ability or desire to take risks in pursuit of those goals.

How age can affect our attitude to risk

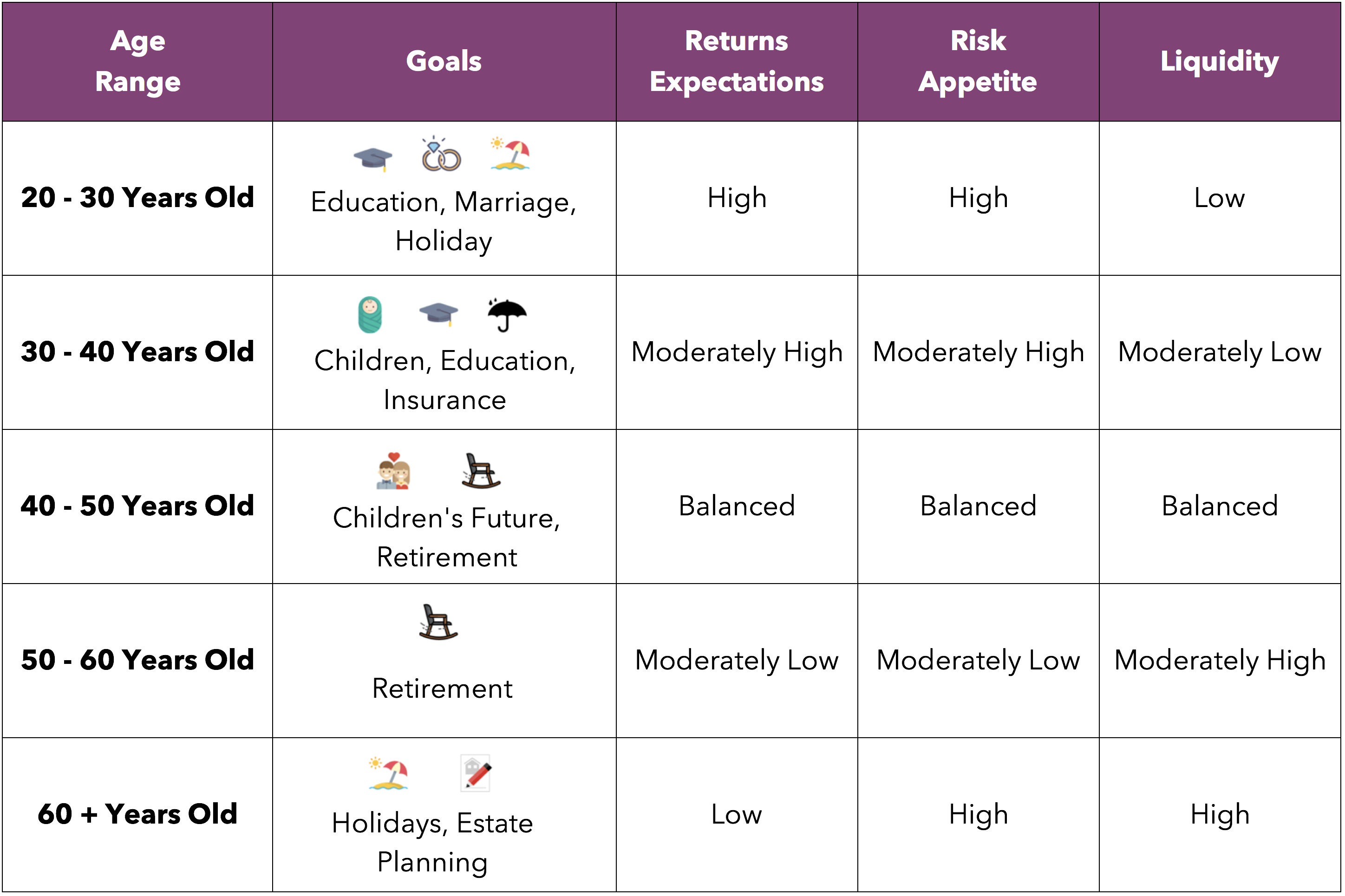

Based on the above chart, we list examples of how the desire for returns and the risk we are willing to take can change with age.

20-30 years old

(High returns expectations, High-risk appetite, Low liquidity)

Pros:

• Less commitment

• More years to recover any possible losses due to inevitable events

Cons:

• Low Salary

• Little experience when it comes to investing

30 -40 years old

(Moderately High Returns Expectations, Moderately High risk appetite, Moderately Low liquidity)

Pros:

• Getting a better salary

• Enough number of years to recover any possible losses due to inevitable events

• Enough experience in investing

Cons:

• Higher responsibilities: Starting a family, factoring mortgage and children’s expenses

40 -50 years old

(Moderately High Returns Expectations, Moderately High risk appetite, Moderately Low liquidity)

Pros:

• Hitting the peak for your salary

Cons:

• Financial commitment might be high due to children

• Financial commitment might be high due to children going to college and universities

• Lesser time to plan for retirement

Middle age is the time to work backwards to find out how much more you need before you can retire. Depending on how much you have saved up over the years, the percentage will be a balanced between high risks assets such as stocks and low risks one such as bonds.

The risk appetite should depend on how close you are to your retirement plan.

50 years old onwards

(Moderately Low Returns Expectations, Moderately Low risk appetite, Moderately High liquidity)

Pros:

• Children might be old enough to provide you with allowance

• Accumulated a good amount of savings

Cons:

• Possible health problems, increasing medical cost

• Lesser time to plan for retirement

This is the transition phase for many investors where it is now much more likely that a low risk approach, where cash is more accessible, is the most suitable strategy.

Balancing risk for investment success

In the investment world, risk can assume many guises; be it the risk posed by inflation silently eroding the spending power of savings, to market movements, changes in interest or exchange rates, or various personal and professional life events.

However, by understanding investment risk and determining what level of risk you feel comfortable with during various stages of your life you are putting in place one of the most important elements required to attain a successful investment portfolio.