There are around 4,000 funds on sale in the UK that have a sector classification from industry trade body the Investment Association.

The Investment Association has 56 different sectors, the purpose of these sectors is to group funds that have a similar mix of assets and strategies so investors and advisers can compare fund performance and charges on a like for like basis.

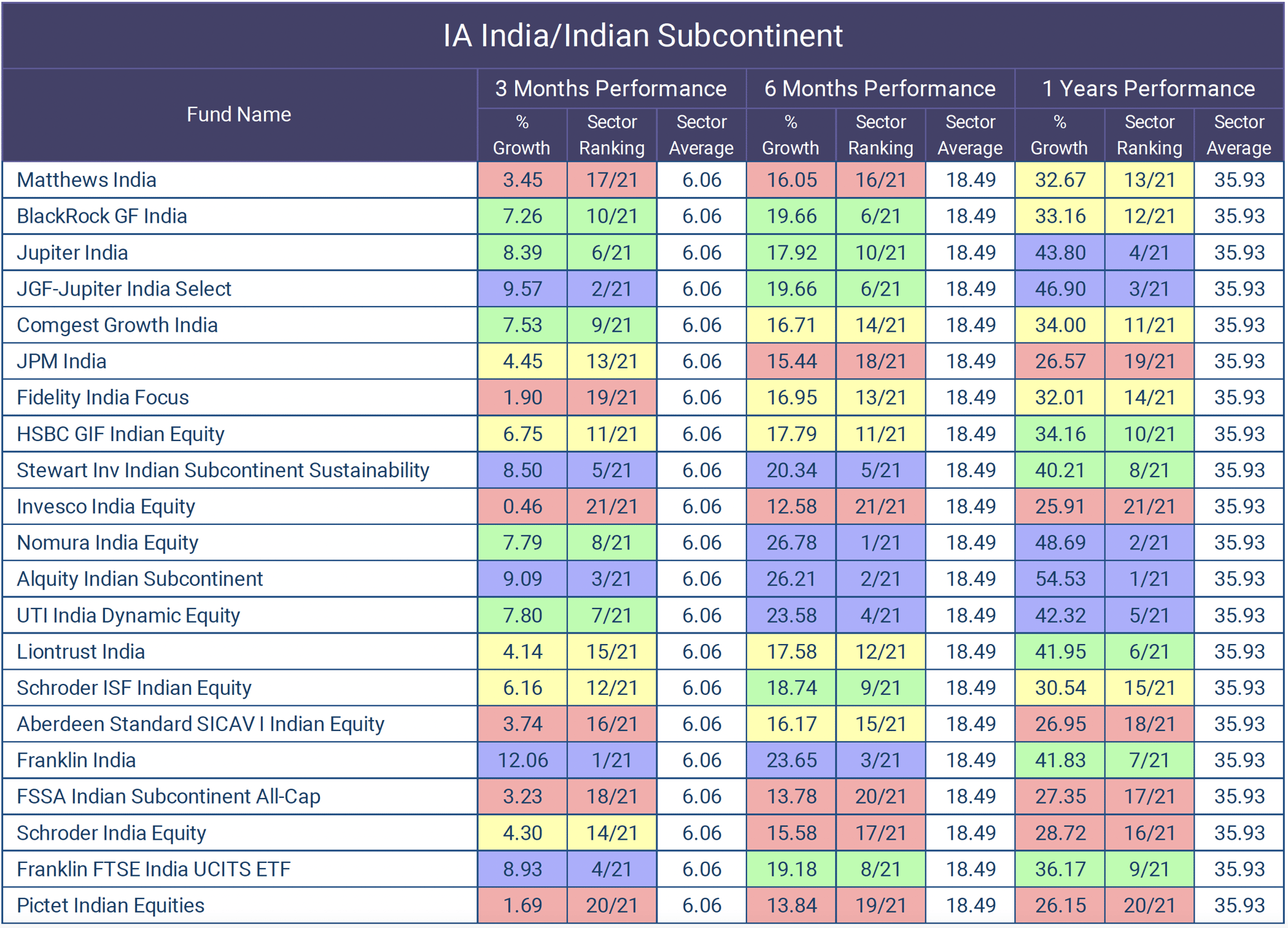

This past year, the Investment Association has expanded their range of sectors from 38 to 56 as a result of more specific criteria used to better define each fund's strategy. These new sectors have predominantly come from funds previously classified to the Global and Specialist sectors. Among these new sectors are the India/Indian Subcontinent and the Commodity/ Natural Resources sectors, both of which contain funds that have some of the highest average returns over the past 12 months.

In this report, we focus on 5 sectors that have averaged the highest growth over the past 12 months to gain a better understanding as to the regions and markets that have enjoyed the best performance during a challenging year.

Top Growth Sectors of 2021

The highest growth sector of the past year was the India/Indian Subcontinent sector with the funds classified within this sector averaging growth over the past year of 35.93%.

IA India/Indian Subcontinent Sector Classification

Funds which invest at least 80% of their assets in equities of the India/Indian sub-continent. Funds may invest solely in India or be diversified across the sub-continent. However, funds that invest solely in Sri Lanka, Pakistan or Bangladesh with the intention to gain specific exposure to these countries will be included within the Specialist sector and not the India/Indian sub-continent sector.

The sector only accounts for 21 of the 4,000 plus funds on the market that have a sector classification. It is a niche sector and although it contains funds from a specific region, as part of an asset allocation model the region would still be viewed as an emerging market, which is traditionally seen as a very high risk market.

Indeed, each of the 21 funds in the India/Indian sub-continent sector carries a maximum risk rating of 10 (based on the dynamic planner risk model), which makes their inclusion in a diversified investment portfolio limited to investors with a higher risk tolerance.

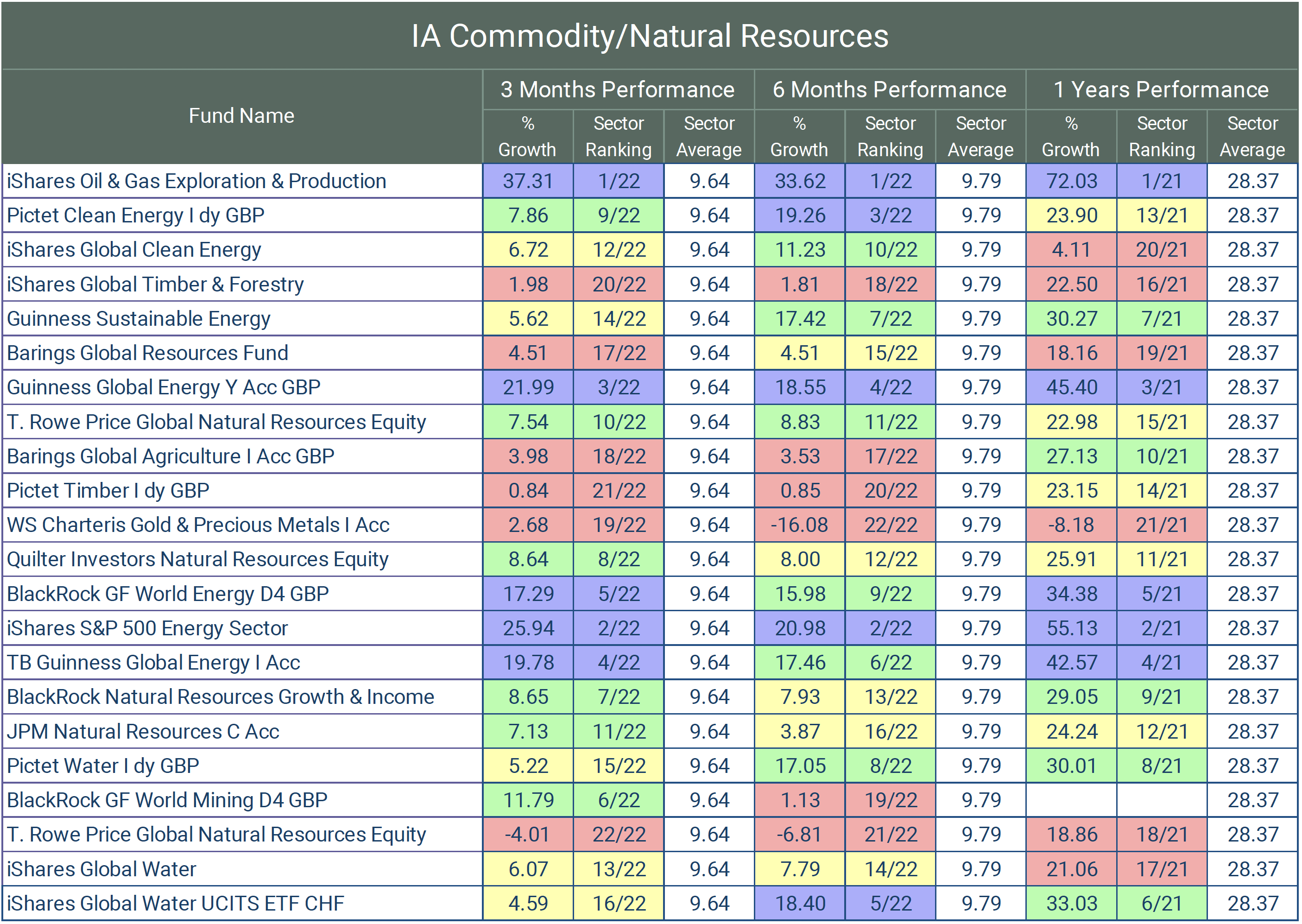

IA Commodity/Natural Resources

The sector with the 2nd highest annual growth average for 2021 was the Commodity/Natural Resources sector, which also had the highest average growth over the last quarter of 2021.

IA Commodity/Natural Resources Sector Classification

Funds that invest at least 80% of their assets in commodity or natural resources related equities. Funds may be diversified and offer broad exposure to commodities and natural resources, others may focus on specific industries/sectors.

Similar to the India/Indian Subcontinent Sector, this sector represents only a small percentage of the funds on the market. At the moment there are also 21 funds in the Commodity/Natural Resources sector with a combined £2.1 billion currently under their management. On average the funds in this sector have the highest growth over the past 3 months (9.64%) and the 2nd highest of all 56 sectors over the past 12 months (28.37%).

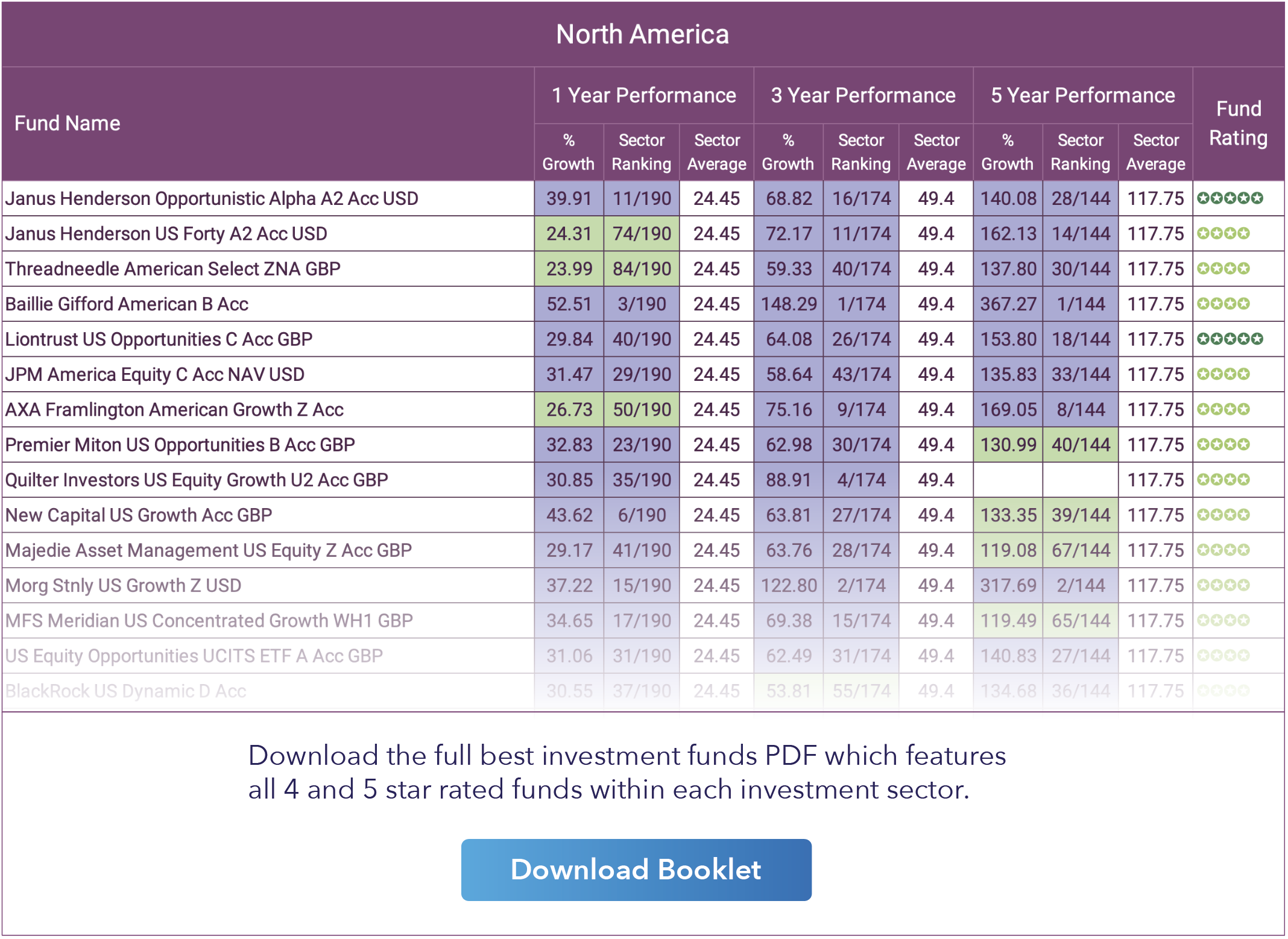

IA North America Sector

The North American equity sector is an important asset class that is likely to form an integral part of many mid to higher risk investment portfolios.

IA North American Sector Classification

Funds which invest at least 80% of their assets in North American equities. A fund that invests solely in Canada will be classified to the Specialist sector as it is not sufficiently diversified to qualify as a North American fund; conversely a US focused fund may be classified to the North America sector as it can be expected to be sufficiently diversified.

The IA North America sector is the 3rd largest sector behind the IA Global and IA UK All Companies sectors. Currently there is over £92 billion of UK investor money under the management of the 196 funds within the North America sector.

On average these funds have returned growth of 5.55% over the past 3 months, 15.58% over the 6 months and 26.82% over the past 1 year, which is the highest growth average of all the large sectors.

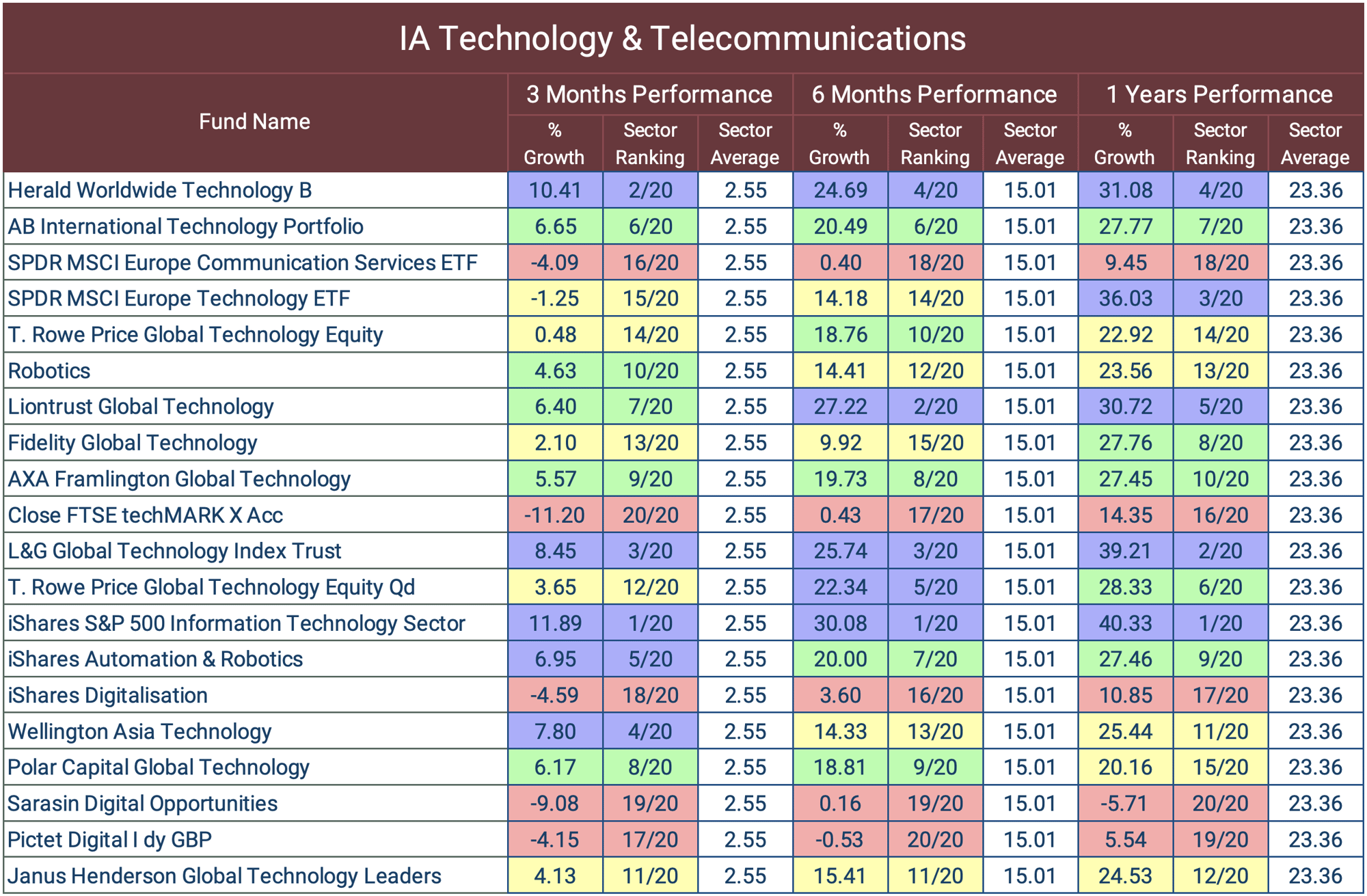

IA Technology & Telecommunications Sector

Since the early 2000s, there has been a huge surge in technological innovation that has brought digital technology and communication to the forefront of the lives of billions of people across the globe. Technology has created the age of convenience, where at the click of a button we can access a plethora of services and products. This opportunity has seen the unprecedented rise of new companies, many of which are now among the largest and most influential in the world.

Half the world now has a smartphone and so is connected anytime anywhere. The cloud now enables any new company or service to scale to billions of users faster and cheaper than ever before and digital payments are now mainstream, allowing these new services to monetise instantly. The coming together of this technology infrastructure has already proved incredibly disruptive in retailing, music, TV, travel, ride-hailing and even dating. Artificial intelligence is now leveraging that existing technology infrastructure to disrupt established industries like Financial services (notably in China and India), industrials and health care, driving lower-cost services, more efficiency and more productivity.

Established firms at the forefront of innovation are well placed to lead the market and continue to thrive, but in an ever-expanding industry, there is also enormous opportunity for new companies to rapidly grow, which makes it an exciting market for many investors.

IA Technology & Telecommunications Sector Classification

Funds that invest at least 80% of their assets in equities of technology and related sectors, including industries such as telecommunications, robotics and online retailers.

Some funds in the sector may have a specific focus such as an industry focus (e.g. automation and robotics) or country/regional focus (e.g. Asian Technology) or thematic focus (e.g. digitalisation). These funds may exhibit different characteristics to diversified technology funds and investors should take extra care when making comparisons.

Unsurprisingly, the IA Technology & Telecommunications sector has consistently averaged among the top returns, and over the past year this high average continued even after the huge self off in technology funds in the first quarter of the year as concerns that they were overvalued consumed the market. However, over the past 3 months, 6 months and 1 year period the funds within this sector have averaged growth of 2.55%, 15.01% and 23.36% respectively.

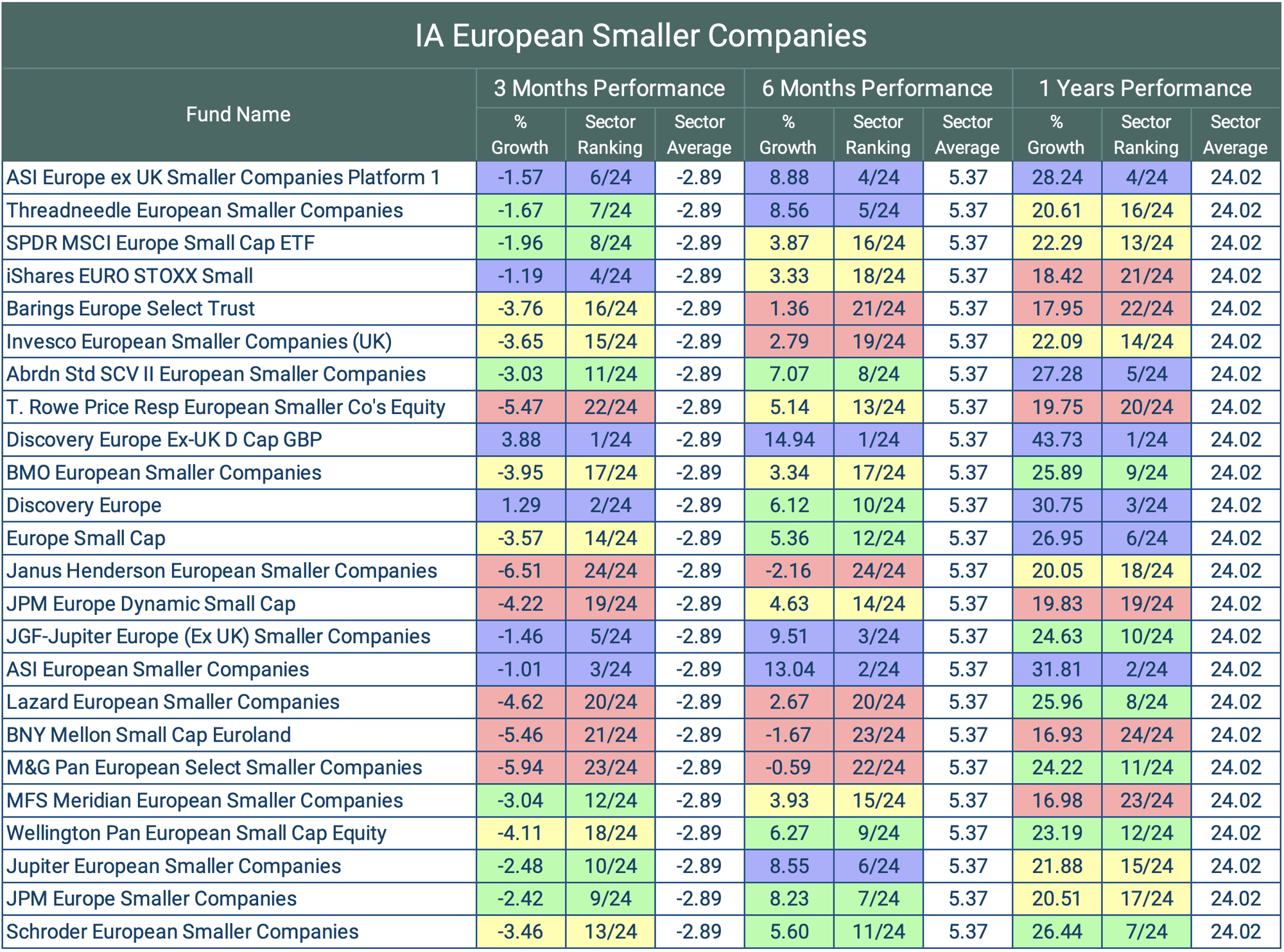

IA European Smaller Companies Sector

Funds which invest at least 80% of their assets in European equities of companies which form the bottom 20% by market capitalisation in the European market. They may include UK equities, but these must not exceed 80% of the fund's assets.

Volatile markets are not easy to navigate, but they offer opportunities for the patient investor. Small cap is a universe especially ripe with these opportunities, because the companies are less well researched and understood. The European Smaller Companies sector is one such sector that could offer investors significant growth potential.

Over the past 12 months, the IA European Smaller Companies Sector has returned average growth of 24.02%. However, the last quarter of a year saw it stutter slightly with negative growth of -2.89% for the period.

Balance Is Key

In the pursuit of growth, it can be easy for investors to become over-reliant on the success of one asset class and thus load the weighting of their portfolio in funds in sectors that have performed well. But the risk of doing so can be painfully evident should that sector take a slump.

The sectors featured in this report have averaged the highest returns in what has been a turbulent year but this does not mean that they are any more likely to avoid a slump in the future. Indeed, since the breakout of the Omicron variant, all Global markets have taken a hit with highest risk sectors feeling this more than most. For example, the India/Indian Subcontinent sector experienced negative growth of -6.36% in the 4 weeks since the variant was announced.

No single equity style, sector, country or region outperforms all others all of the time. Global diversification spreads risk amongst countries and currencies to offset the risk of investing in just one region or country. As such, globally-diversified portfolios are vital to long-term investment success.

Being able to spread your risk across various countries shields investors from country-specific conflicts and regulations. In this way, if one country struggles economically due to regional issues, your portfolio will feel that it affects less.