Every month Yodelar analyses hundreds of investment, pension, and ISA portfolios on behalf of client investors looking to assess the quality of their portfolio.

Through the use of our free portfolio analysis service we daily identify 2 main issues for investors – poor fund performance and poor risk management.

9 out of 10 portfolios we review contain funds that consistently perform in the bottom 25% of their sectors. Also for a large proportion of investors, the risk associated with their investment portfolios is dangerously out of kilter with what they intended.

In this report, we carried out a risk analysis of 500 investment portfolios and identified that a significant 44% of them do not fit their investors desired risk profile.

Risk Analysis of 500 UK Investment Portfolios

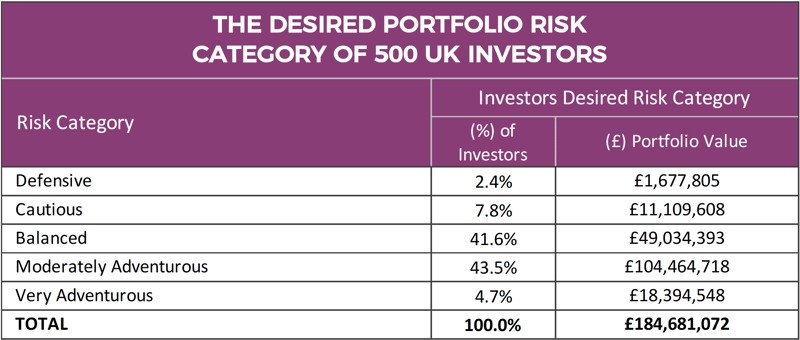

To gain a representative understanding as to how investment portfolios align with the desires of investors, we reviewed the actual portfolios of 500 UK investors. These 500 portfolios include a mix of adviser recommended portfolios and investor self-managed portfolios. Combined, they have a value of £184.6 million, and an approximate average value of £369k each.

From a category of 5 different options, each of the 500 investors have selected a risk profile that best fits their individual investment profile. The risk categories range from the low risk very defensive, up to the highest risk very aggressive category.

Our analysis identified the 2 most chosen risk categories were the mid ranged balanced and the higher risk moderately aggressive categories, which combined accounted for 85.1% of the portfolios reviewed. However, when it came to portfolio value, the largest portfolios were owned by investors who had a moderately aggressive investment approach, with approximately 56% of the combined value of all 500 portfolios held by investors who viewed themselves as moderately aggressive investors.

How We Determined The Risk Rating

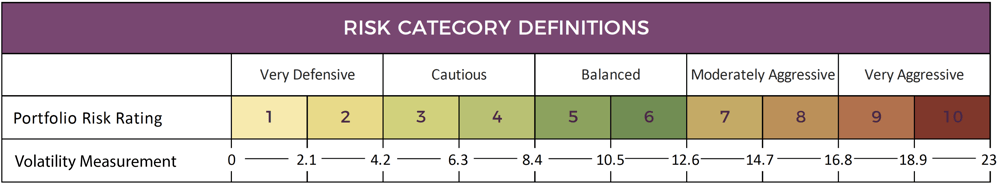

The classification of each risk category has been defined by measuring the overall level of volatility assumed by each portfolio against a recognised volatility to risk chart.

Each portfolio was assigned one of 5 risk categories based on where they positioned within a 1 to 10 risk level classification:

Very Defensive - A rating of 1-2.

Cautious – A rating of 3-4

Balanced – A rating of 5-6

Moderately Aggressive – A rating of 7-8

Very Aggressive – A rating of 9-10.

The least chosen option was the very defensive category with the majority of investors selecting a moderate to higher level of risk category, which would support the assumption that, in recent times at least, investors are more likely to take a higher risk approach with their investments as they seek prime returns.

44% of Investment Portfolios Do Not Fit The Correct Risk Category

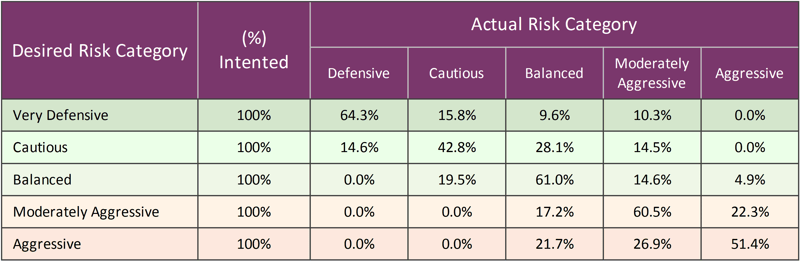

Our independent analysis of portfolios owned by 500 UK investors found that 44% of investment portfolios were classified within a risk category that did not fit the profile of the investors.

The risk category with the best correlation of intended risk and actual risk was the very defensive category. In this risk category, 64.3% of investors who had said they were defensive investors, had a portfolio that matched their risk profile. In contrast, just 42.8% of investors who had said they had cautious investment profile actually had a portfolio that matched their chosen risk category. For the cautiously minded investors whose portfolios did not fall within the cautious category 14.6% had assumed lower risk than intended and fell within the very defensive category. Whereas 14.5% of portfolios that belonged to investors with a cautious risk preference had in reality assumed a moderately aggressive level of risk.

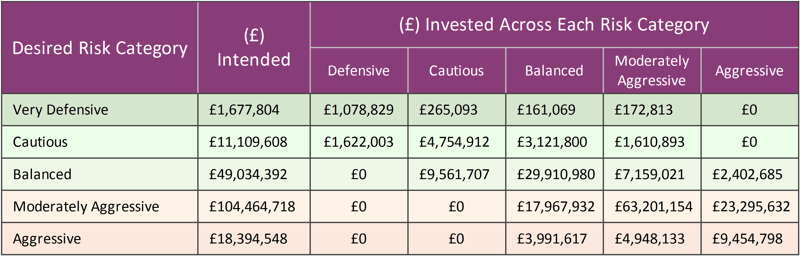

The risk category with the largest variation in monetary value was the moderately aggressive category. Of the £104 million total value of the portfolios owned by moderately aggressive investors, £23 million was invested in very aggressive portfolios with just under £18 million taking on lower risk within the balanced risk category.

Although there are a number of factors that determine risk, volatility is a primary indicator of investment risk. There are also numerous risk models available to investors.

Why Are So Many Investment Portfolios Out of Sync?

In the pursuit of growth, we find that many self investors fail to implement an adequate asset allocation model, with some investing all or the majority of their money in one single asset class. The problem with this approach is that if the asset class were to experience a sharp decline then so would the value of the clients overall investment portfolio with potentially catastrophic results.

Blinded by high growth these investors are unaware of the risks they are taking with such an approach. Should these investors experience a downturn, such as the sharp fall experienced by many asset classes at the end of 2018, their overall wealth and potential retirement plans would be seriously affected.

There are a number of reasons why a portfolio could end up in an unintended risk bracket. In the majority of cases this can be attributed to a poor spread of asset classes, which is a problem typically associated with inexperienced self-investors not rebalancing, or worse investors who pay for advice, and are not receiving the regular rebalancing from their advice firm.

Portfolio Drift & How It Can Influence Risk

Portfolio drift occurs when asset classes have varying intermittent rates of return. Over time, weightings tend to drift from their target allocations, which is why it’s crucial to keep this drift in check. For example, an asset class that started with a 15% holding can eventually make up considerably more than 15% of a portfolio after months or years in which it outperforms other asset classes.

Although having a particular asset class outperform seems great at first, it can prove dangerous in the long run when the asset class inevitably corrects itself. Many investors experienced this during the 2008 financial crisis. Through the years before the markets crashed, equities were considerably outperforming other asset classes, especially bonds, by a significant margin. Although this drift in asset allocation had the short-term effect of increasing investors’ net worth, it also quietly increased the risk their portfolios were exposed to.

Unfortunately, when the crash came, investors who failed to rebalance their portfolios experienced much larger losses than they thought possible. This devastated many people’s net worth and forced many to postpone their retirement.

What Determines Investment Risk?

Every investment can be described in terms of the amount of risk associated with it. Higher-risk investments tend to experience greater volatility, which means they are likely to go up and down in value more often and by larger amounts than lower-risk investments. In return, higher-risk investments have the potential to produce higher returns over the long term.

For example, investments such as cash deposits and bonds issued by the UK Government (known as gilts) are considered low risk. Property, corporate bonds are considered medium risk. In the case of global bonds, generally those which pay a higher income are riskier than those which pay a lower income level. Shares in companies in the UK and other developed markets are considered high risk, while shares from companies in emerging markets are considered very high risk. You can reduce the overall risk in a portfolio by using 'diversification' – in other words, spreading your money across different investments.

By doing this, you can match your overall portfolio to the level of risk that is right for you.

Does Your Risk Profile Suit Your Long-Term Goals?

The level of investment risk we are comfortable taking will define the balance of assets within our portfolio. Over time our risk profile and our acceptance for loss will vary. Therefore it is important to regularly review our risk profile and the underlying assets in our portfolio.

The importance of having a portfolio that is continuously aligned to our risk profile is more than protecting against decline, it will also have a sizeable influence on our portfolio growth.

A study by the CFA Institute on ‘determinants of portfolio performance’ found that as much as 90% of an investment’s return can be down to asset allocation. Although there are many different asset allocation models available, they are each defined by risk. More specifically, what level of investment risk we are willing to tolerate in the pursuit of returns.

An efficient portfolio will provide the appropriate blend of risk and reward. But maintaining an efficient portfolio requires continuous monitoring and rebalancing.