The return of volatility in 2018 following mostly calm conditions dampened returns available to investors as a difficult year culminated in just 11 of the 36 Investment Association sectors achieving gains.

North American funds thrived the most as a stronger US dollar helped boost returns for UK investors throughout the year, and the funds that invest in more growth-orientated areas, notably technology, also fared particularly well.

In contrast, Chinas slowing growth and trade tensions with the US has contributed towards a difficult year for Chinese equities. As one of the world’s biggest buyers of goods, Chinas woes have also impacted European Equities, which have also been unsettled by US threats to impose stringent trade tariffs.

Emerging markets have seen their currencies plunge against a strengthening dollar, while investors have become concerned that these developing nations may be unable to repay loans taken out in the US national currency. Many, including Argentina, are now likely to fall into recession.

UK markets have continued to suffer from the uncertainty of Brexit with massive outflows of money from UK equities.

As a result, only a small proportion of investment sectors have averaged gains this year, with a small percentage of funds within these sectors posting exceptional returns in challenging conditions.

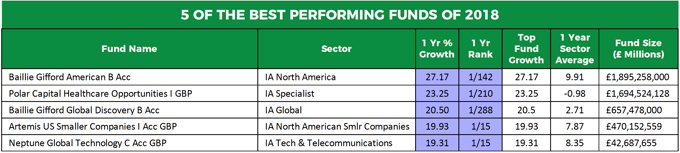

The Best Performing Funds of 2018

Baillie Gifford American

The best performing fund of 2018 was the consistently stellar Baillie Gifford American fund. This fund sits within the North American sector, and it has a concentrated portfolio of high-quality stocks such as Facebook, Amazon, Apple, Netflix and Alphabet.

Over the recent 12 months, the North America sector averaged growth of 9.91%. However, the Baillie Gifford American fund maintained its ranking as the top performing fund within the highly competitive North America sector as it delivered returns of 27.17%.

Polar Capital Healthcare Opportunities

Another fund to excel in 2018 was the £1.7 billion Polar Capital Healthcare Opportunities fund. This fund aims to preserve capital and achieve long-term growth by investing in a globally-diversified portfolio of companies within the healthcare industry. This specialist fund returned growth of 23.25% over the past 12 months to rank 1st out of 210 funds in the specialist sector, which was unable to average any gains over the same period.

Baillie Gifford Global Discovery

It is unsurprising that the highly regarded Bailie Gifford investment team manage more than one of this year’s best performing funds. Their second top performer was their Global Discovery fund, which sits within the highly competitive IA Global sector alongside 287 competing funds. Over the past 12 months, this fund returned growth of 20.50%, which was the highest in the entire sector and significantly greater than the 2.71% sector average.

Artemis US Smaller Companies

America is home to a vast number of the world’s most innovative, entrepreneurial and fastest-growing small companies. Because smaller companies tend to be less well covered by financial analysts than their larger peers, experienced investment managers, such as Cormac Weldon who manages this fund, can use detailed research to find the leaders of tomorrow before their potential receives wider recognition.

This fund has a relatively small yet diversified portfolio of between 40 to 60 stocks whose market value is mostly below US $10 billion. This young fund only launched towards the end of 2014, but it has managed to rank as the highest growth fund in its sector consistently. Over the recent 12-months, this fund returned growth of 19.93%, which was comfortably above the sector average of 7.87%.

Neptune Global Technology

The Neptune Global Technology Fund is a focused portfolio of 40-60 global technology stocks. Although it has a universal mandate, 86% of its current holdings are US Equities, which have proven to be the strongest performers of 2018.

With just over £42 million of client funds under management, this fund is one of the smallest in its sector, but with growth of 19.31% in 2018, it has been the best performer, easily beating the sector average of 8.35%.

View more best fund reports and performance insights >>

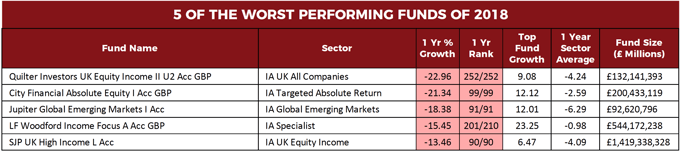

The Worst Performing Funds of 2018

On the opposite end of the performance spectrum lies a larger proportion of funds that have performed miserably in 2018.

Quilter Investors UK Equity Income

The worst performing UK equity fund of 2018 was the Quilter Investors UK Equity Income fund, which is managed by Neil Woodford.

This £132m fund, lost a huge 22.96% in the recent 1 year period to rank last of all 252 funds in its sector. It hasn’t just been the past 12-months that have been difficult for this fund. Over the recent 3 year period, this fund had negative growth of -24.33%, which again was the worst in its entire sector. In comparison, the top performing fund in its sector returned 58.98%, and the sector averaged growth of 17.49%.

City Financial Absolute Equity

The City Financial Absolute Equity Fund aims to achieve a positive absolute return for investors over rolling 36 month periods, primarily through investment in UK and global equities. However, this 1-star rated fund has had a torrid three years, and over the past 12-months, it has been the worst performing fund in its sector ranking 99th out of 99 funds with negative growth of -21.34%.

Jupiter Global Emerging Markets

The Jupiter Global Emerging Markets Fund aims to achieve long-term capital growth by investing primarily in companies listed or exposed to emerging markets worldwide.

Currently, this funds’ primarily holdings are in financial, technology and consumer services companies in Asia and Latin America. Although volatility and falling markets of the past year have played a sizeable role in the recent woes of emerging market funds, the £93 million Jupiter Global Emerging Markets fund has consistently underperformed. Over the last 5 year period, this fund has returned cumulative growth of 30.78%, which was well below the 40.41% sector average. The past 12-months have been a particularly difficult time for this fund as it returned negative growth of -18.38%, to rank 91st out of 91 funds in the IA Global Emerging Markets Sector.

LF Woodford Income Focus

Following the worst year for his strategy since the tech bubble, Neil Woodford had said he expected his stock selection to be vindicated in 2018. Unfortunately for his investors, that hasn’t happened as his funds again languish at the bottom end of their sectors having lost big this year.

The second of his funds to be launched under the Woodford investment brand was the Income Focus fund. This fund has a simple objective of providing a high level of income together with capital growth. However, just like Woodford's flagship UK Equity fund, the Income Focus fund has performed poorly. Over the recent 12-months, this £544 million fund returned negative growth of -15.45%, which was worse than 96% of competing same sector funds.

SJP UK High Income

Despite being named the UK High-Income fund this fund has been anything but, as this £1.4 billion SJP fund has been a serial underperformer.

Although this fund has entry fees of 5%, it only managed to return 5.78% over the past five years, which was the worst in the IA UK Equity Income sector. Over the past three years, it returned negative growth of -11.79 to again rank last in its sector. Over the recent 12-months, this fund posted further losses of -13.46%, which was also the worst in its sector.