-

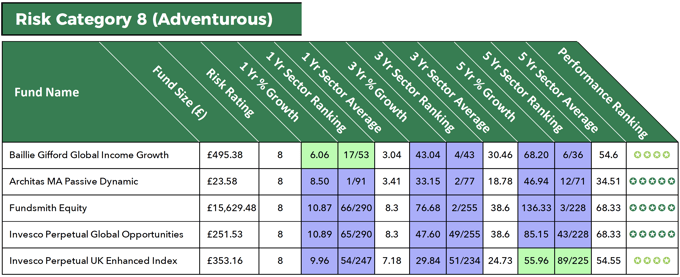

The Fundsmith Equity fund has a high risk profile of (8) but over the recent 5-year period it returned growth of 136.33%, which was among the best in its sector

-

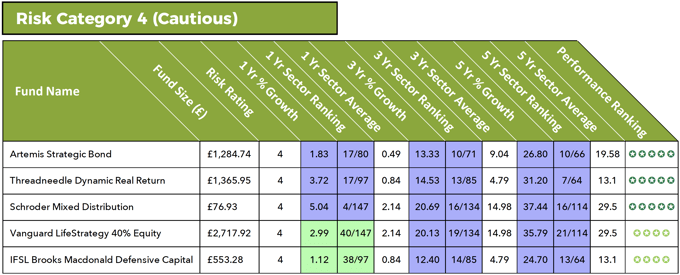

With 5-year growth of 37.44% and with a low risk profile of (4) the Schroder Mixed Distribution fund has been among the best performing funds for low risk investors

-

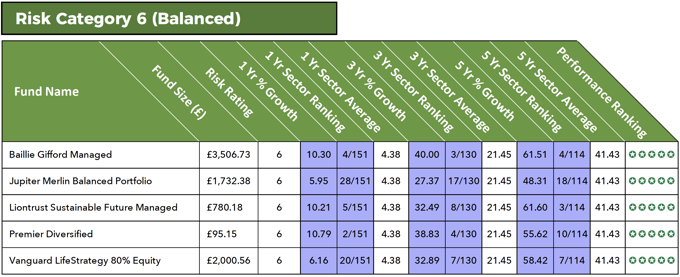

With a mid level risk profile of (6) the consistently top performing Baillie Gifford Managed fund has better growth than at least 97% of competing same sector funds.

The big issue every potential investor must face is risk – specifically, how much risk do they want to take on to get a decent return?

In recent years, many fund providers have looked at ways to make this task easier, and one of those ways was to introduce risk profiled and risk-targeted funds. These funds provide investors with access to ready-made investments that have, or target, a risk rating between a low risk 1 to a high risk10. As the providers of these funds manage the risk process, investors and advisers don't have too, which has made these funds a common investment option with more than 400 risk profiled funds now on the market.

However, although with risk profiled funds the risk element may be taken care of performance is not, and indeed the difference in performance between funds with a similar risk profile can be significant.

In this report, we identify 15 of the Best performing funds that have been risk profiled and rated to fit a cautious (4), balanced (6) and adventurous (8) risk profile.

The Purpose of Risk Profiled Funds

In theory, this means that investors and their advisers can carefully determine what their investment goals and attitude to risk are, find out what rating matches and then select an investment fund, or indeed fund number, that corresponds to their needs.

However, there have been concerns that risk profiled funds would be difficult to continually grade and ultimately result in investors investing in funds based on a risk profile that might no longer be applicable. Legal & General Investment Management’s Justin Onuekwusi, who co-manages the group’s risk-targeting multi-asset funds has said: “Financial markets change all the time as political and economic events impact the world; so a fund which is rated five today, for example, could easily be rated four or six in a year or two’s time.”

Mr Onuekwusi argues that, under such circumstances, an investor will, therefore, be no longer holding an investment that matches their desired outcome and attitude to risk.

How Risk Profiled Funds Work

A risk profiled fund is a fund that has been assessed by an independent risk-profiling firm, in a bid to determine how risky it is. A profiler assigns the fund with a rating, generally between one and 10, with a rating of one carrying the least amount of risk and ten being carrying the most. A fund that has the majority of its assets in shares, for example, will have a higher rating than say, a fund that has more supposedly ‘safer’ assets such as bonds

As an investor, it’s then up to you to pick a fund with a rating that matches your appetite for risk. For example, if you have a medium or balanced attitude to risk you might select a fund with a ‘five’ or ‘six’ rating, whereas, if you’re more cautious, you may prefer to go for a fund with a rating of ‘three’ or ‘four’.

A risk profiled fund can have a number of goals, for example, its primary aim could be to beat a particular benchmark or deliver a certain level of income. But importantly, the rating of any given fund is based on its makeup at the time of the assessment. Managers of risk profiled funds are typically not required to ensure that risk is held within a specific range, and as markets change, a fund’s risk profile could alter and become more or less risky as time goes on. In other words, investors need to ensure their chosen fund continues to match their needs and investment objectives.

Not to Be Confused – The Difference Between Risk-Targeted Funds & Risk Profiled Funds

The mandate of a risk-targeted fund is very different from that of a risk profiled fund – as the name suggests, risk-targeted funds target a specific level of risk. Their main aim is to control the level of risk investors are exposed to over the long term. As such, a fund will be constructed with the goal of delivering risk-adjusted returns – it will take on a more specific amount of risk to achieve a particular level of return, to investors.

The manager will adjust the fund’s profile in a bid to ensure that the level of risk, or volatility, it’s exposed to remains within its set target range. While investors can of course still lose money, they’ll at least know that the fund manager must always remain within a guideline risk range – they can’t take on more or less risk to the portfolio.

5 Best Performing Funds For Cautious Investors

With combined funds under management totalling almost £6 billion, the five funds have consistently outperformed their peers and delivered returns that in some cases exceeds even good performing higher risk funds.

5 Top Performing Funds For Balanced Investors

With a risk rating of (6) all 5 of these top-performing funds fit the risk profile of a balanced investor. Each of these funds have excelled in their respective sectors and consistently outperformed at least 75% of same sector to earn a 5-star performance rating.

5 Top Rated Funds For Adventurous Investors

Each of these funds have a risk rating of 8, and includes the perennial top performer and investor favourite the Fundsmith Equity fund, which has also highest growth out of all listed funds with 5-year growth (up to 1st June 2018) of 136.33%.

Diversification - The Best Way To Manage Risk

Ultimately, whether or not you choose to use risk profiled funds the best way to manage all types of investment risk funds the best way to manage all types of investment risk effectively is by building a diversified portfolio, which includes different investment types across a range of companies, industries, geographical areas and markets. A well-diversified portfolio will help to spread the risk so that even if one market performs badly, your portfolio’s overall performance should hopefully remain relatively stable.

However, if your investments are all concentrated on a particular industry or area, one change to its landscape can have a significant impact on your overall portfolio.