The first months of 2022, was among the worst in recent history for global investment markets with widespread negative returns and extreme volatility driven by the inflation concerns, rising fuel costs, the impact of the cost of living crisis and the economic fallout from the Russian invasion of Ukraine.

These sizeable market challenges saw high quality funds across several different asset classes underperform for periods, with consistently underperforming funds deceiving investors with their flattering strong comparative performance.

But there have been some quality funds that have endured the volatile first quarter to the year and its numerous challenges better than others and some of these funds also have a history of strong performance over a longer term.

In this report, we analysed the performance of 1,274 funds across 5 core investment sectors and featured 5 funds across each sector that have been among the top performers since the start of 2022.

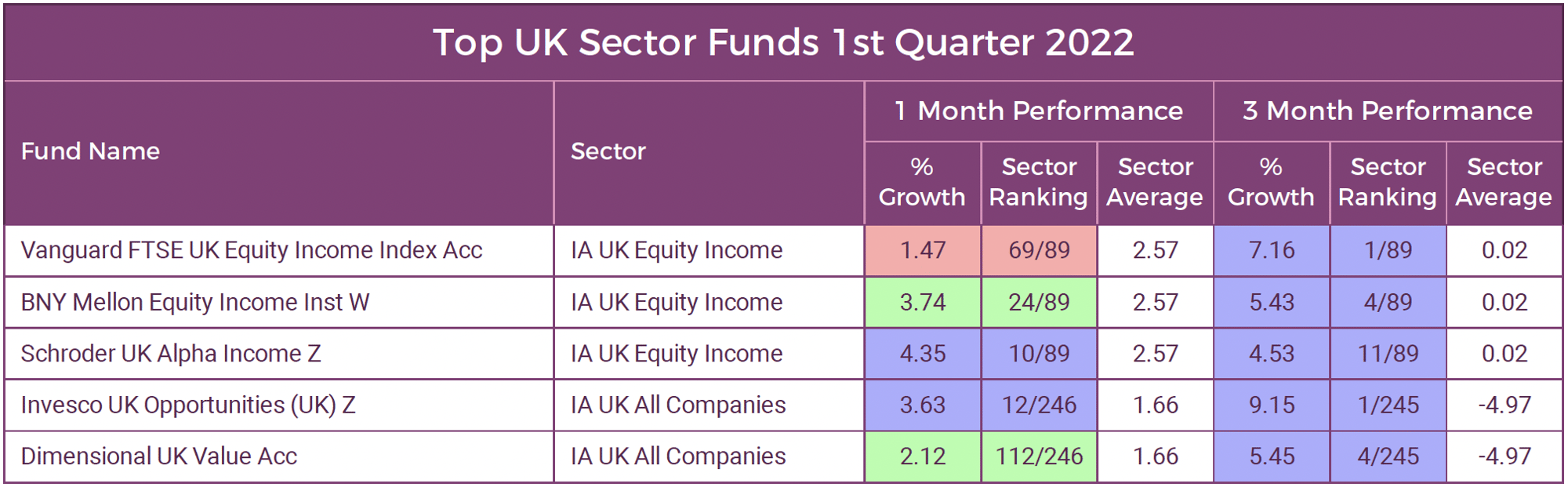

The Best UK Equity Funds 1st Quarter 2022

Many of the companies listed on the UK Stock Exchange will derive a large amount of their income from overseas, so although the sector dictates that at least 80% must be invested in UK companies, there is no easy way of telling where the listed companies activities are. This means that the fortunes of the holdings are often inextricably linked with global economic conditions. As such, many UK Equity funds are not as restrictive as some may believe.

The UK is home to some of the most successful companies in the world, and as many are globally diversified, they can absorb many of the UK’s political and economic changes. Many other UK companies with less global appeal have also been able to thrive despite being faced with political and economic uncertainty.

The 5 UK equity funds featured in the below table represent a small selection of the 335 UK equity funds on the market that have consistently performed well and particularly so in the first quarter of this year.

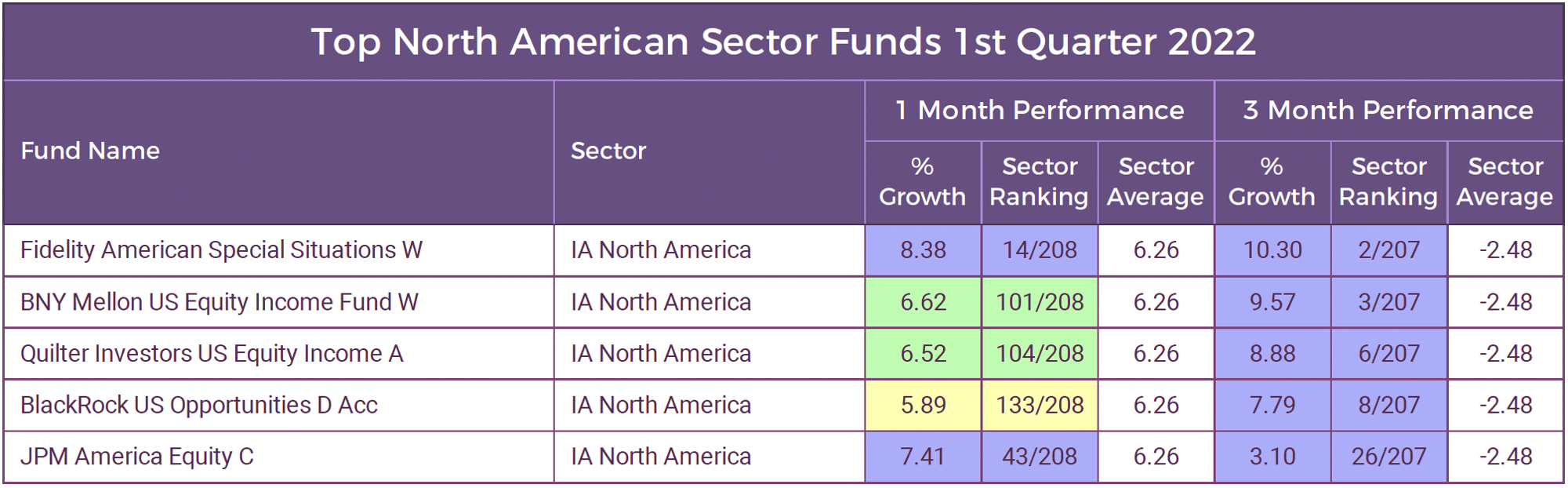

The Best North American Equity Funds 1st Quarter 2022

The North American equity sector is an important asset class that is likely to form an integral part of many mid to higher risk investment portfolios.

The North America sector is one of the most competitive on the market, with 208 funds currently classified within the IA North America sector. With such a large selection of funds that offer similar equity exposure, selecting the most suitable in this asset class can be difficult for both investors and advisers.

North American equities have consistently been among the most competitive and volatile asset classes, but in recent years, it has also been one of the most rewarding for investors.

Over the past 3 & 5 years, the IA North America sector has had the 2nd highest average growth returns of the 36 Investment Association sectors, behind only the IA Technology & Telecommunications sector, which reflects the sizeable influence the sector has on how well the portfolios of many UK investors perform. But like any sector, there are funds that perform poorly, those that perform moderately and those that excel.

Consistency is a crucial component that successful fund managers must achieve and the 5 funds featured in this report have been among the top performers in the sector since the start of the year but with extreme volatility this can quickly shift and it remains to be seen if they can maintain this performance going forward.

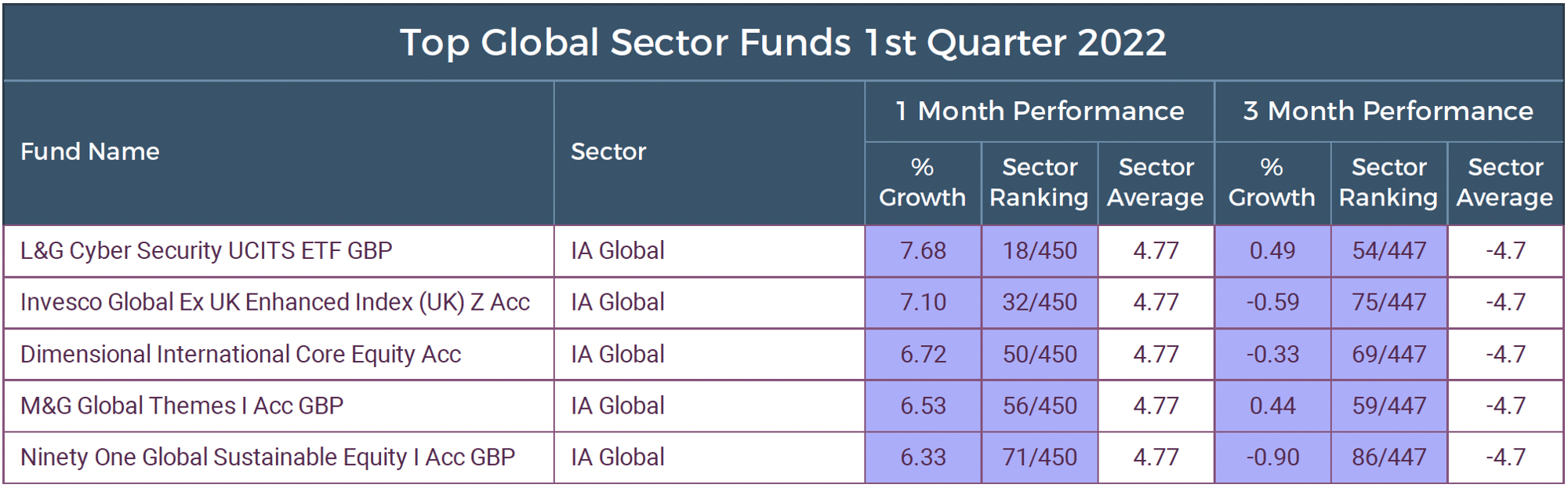

The Best Performing Global Funds 1st Quarter 2022

Global funds invest in a wide range of stocks across world markets, with this broad focus potentially helping to minimise the impact of stock market shocks on a portfolio. For example, if one region or sector suffers a knock, hopefully gains elsewhere will help offset these losses.

However, in recent times, a large proportion of growth enjoyed by Global funds can be attributed to their heavy weighting in US stocks, with North American equities continuing to average some of the highest returns across all asset classes. But with a young, educated workforce across developed Asia. Rising household income in China, India and Brazil. Natural resources in Canada, Australia and Russia, there are many Global markets that have a positive long term outlook which Global funds can capitalise on.

The 5 Global funds in this report utilise a diverse range of markets to deliver for their investors. They have been some of the most consistent and best performing funds in the IA Global sector this year with some consistently ranking towards the top of the sector over the past 3 & 5 years.

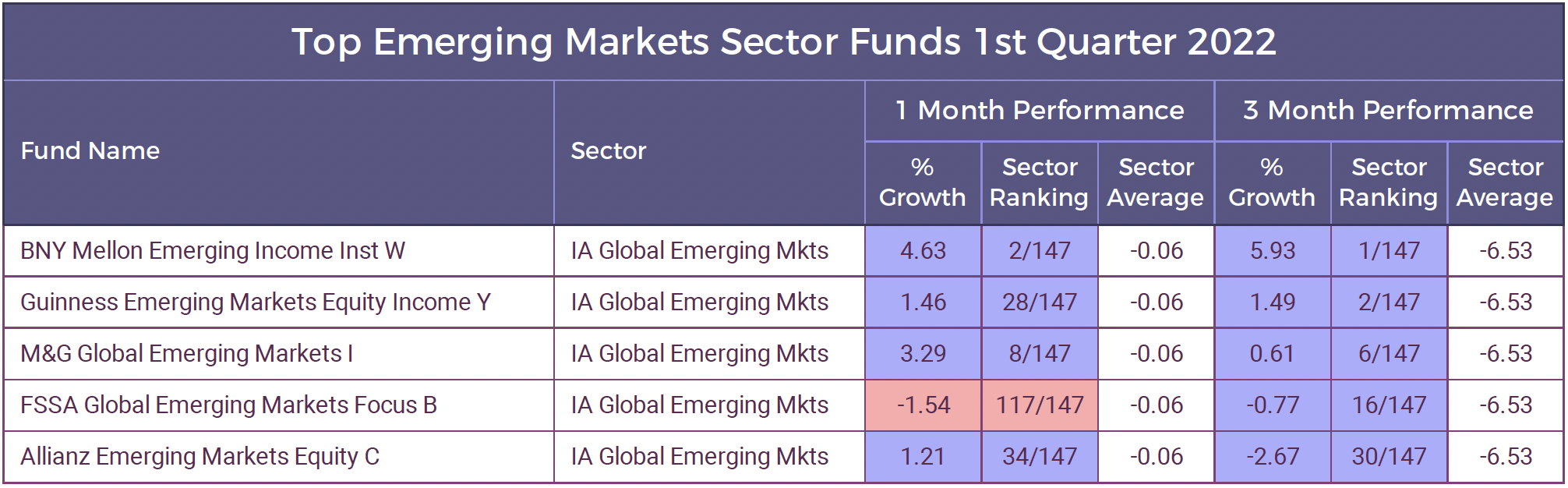

The Best Emerging Markets Funds 1st Quarter 2022

Emerging markets endured a challenging 2021, dragged down mostly by China and South Korea, which represent close to half the index. But the developing world is diverse, and many individual countries did well.

In the 2nd half of 2022, we believe companies with robust fundamentals will be well positioned to benefit from improving dynamics in emerging markets.

In the technology sector, semiconductor manufacturers deserve attention, particularly in Taiwan. Financials across a wide array of countries are benefiting from a lending resurgence and improving credit quality, and consumer-discretionary companies, like internet and 5G providers, should continue to prosper as more emerging market consumers hop online to shop and game. We also expect a manufacturing pickup to ripple across emerging markets, but especially in Vietnam and Indonesia, which filled the void created by the US-China trade standoff in recent years.

Emerging market companies are as diverse as the countries, economies and markets where they operate. By developing differentiated insights, active investors can identify the most promising opportunities in changing market conditions to capture the recovery potential in emerging market funds.

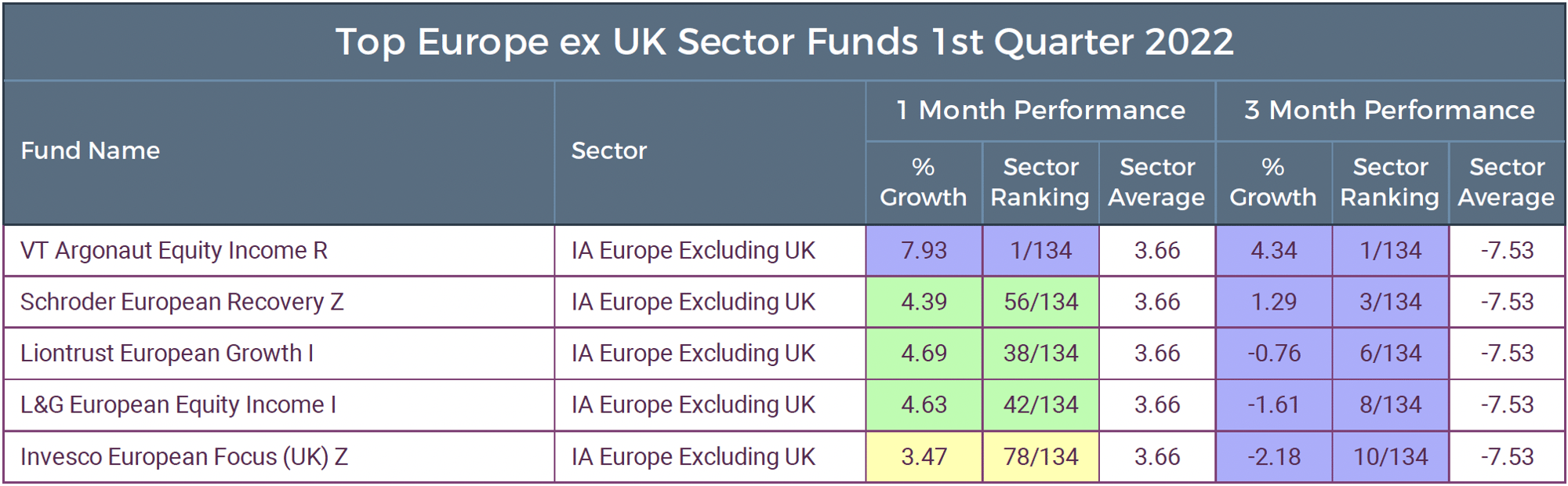

The Best European Equity Funds 1st Quarter 2022

Europe is one of the most diverse, rich and complex equity markets in the world. With different cultures, political systems and economic profiles it can offer attractive investment opportunities for investors.

Europe is home to many of the market leaders in utilities and offshore infrastructure, automobiles, construction and industrials. These priority areas offer huge potential for the region to produce best-in-class technology and services to accommodate for the changes that are underway. Goldman Sachs research indicates that eight out of ten of the top global renewable energy companies (ex-China) are European. And the shift to renewables is closer than many expect and this has been pushed closer by the desire to move away from gas and oil as a result of the Russian invasion of Ukraine.

Maximising Growth & Recovery By Investing In Proven Quality

The funds featured in this report represent some of the top performing funds in their sectors over a short time frame. As such, their performance may not sustain a high level of competitiveness in the mid to long term when market stability returns.

Although these funds have been among the top performers so far this year, how they perform going forward is not guaranteed. However, our research shows that the funds with a consistent history of outperformance are more likely to continue to outperform compared to the funds and fund managers who have a more chequered performance history.

Balance Is Key

In the pursuit of growth, it can be easy for investors to become over-reliant on the success of one asset class and thus load the weighting of their portfolio in funds in sectors that have performed well. But the risk of doing so can be painfully evident should that sector take a slump.

The sectors featured in this report are among the most heavily utilised in the industry and they each host a range of region specific investment options that can add both value and balance to a portfolio through a strategic asset allocation model.

As no single equity style, sector, country or region outperforms all others all of the time. Global diversification spreads risk amongst countries and currencies to offset the risk of investing in just one region or country. As such, globally-diversified portfolios are vital to long-term investment success.

Being able to spread your risk across various countries shields investors from country-specific conflicts and regulations. In this way, if one country struggles economically due to regional issues, your portfolio will feel that it affects less.

Does Your Portfolio Contain Top Performing Funds?

Inefficient investing will undoubtedly have adverse long-term consequences. It is so important to distinguish the funds and fund managers who outperform their peers in order to ensure your portfolio is made up of high-quality funds.

Our free portfolio review service has helped thousands of investors identify areas for improvement and provide complete clarity as to the quality of advice they have received.

Our portfolio review service will provide an independent analysis of your portfolio and identify:

- If your portfolio contains top, mediocre or poor performing funds

- How your portfolio growth compares to a similar risk portfolio of top-performing funds

- Potential areas for improvement

- The overall quality rating of your portfolio

Our portfolio analysis feature provides a clear insight into how each of your individual funds is performing while grading your portfolio based on its overall performance - making it easy to identify weak points or areas for potential improvement.

Upload your portfolio for a comprehensive portfolio review and find out how competitive the performance of your portfolio has been and if the advice you have received to date has been up to par.