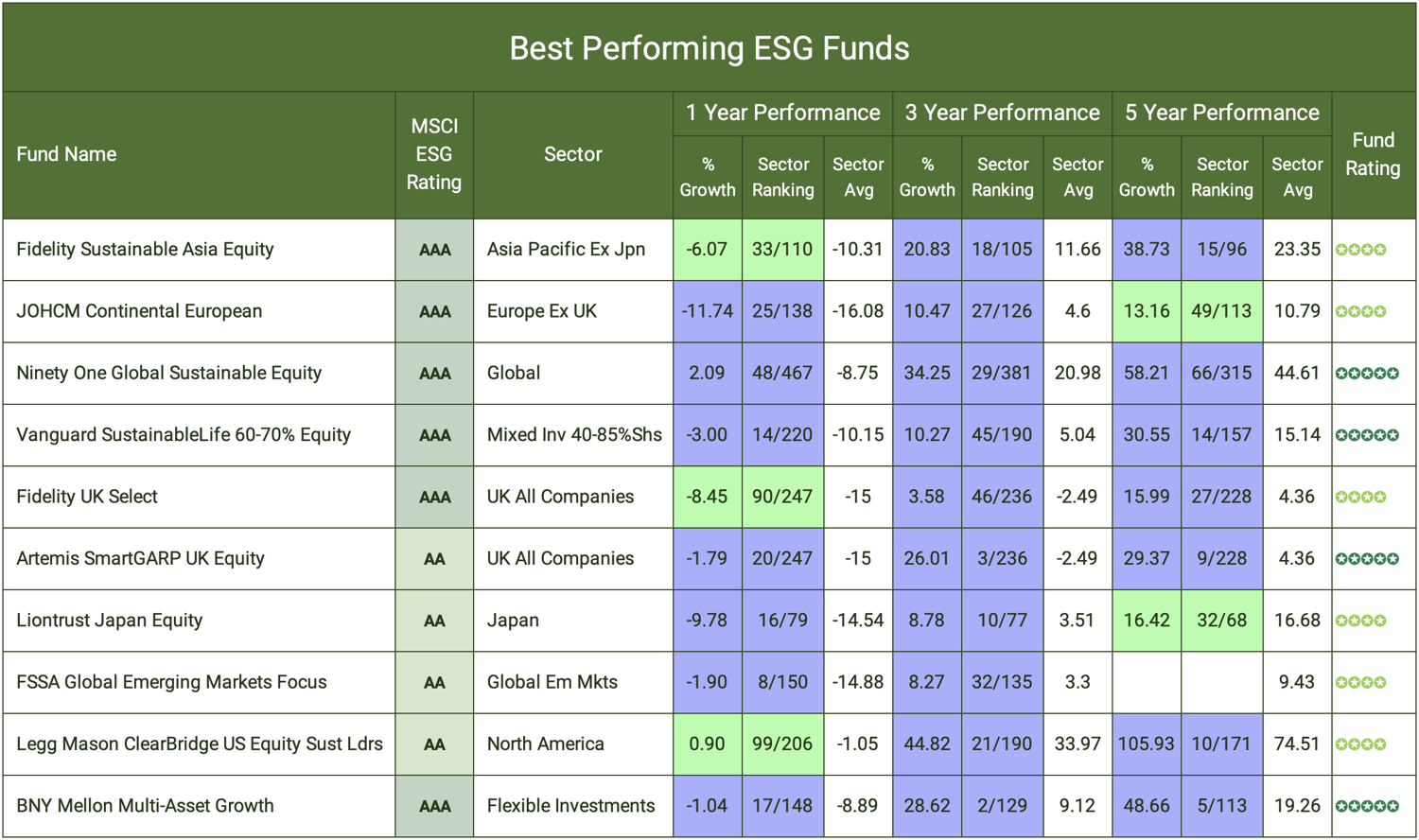

- Over the past 5 years the Vanguard SustainableLife 60-70% Equity fund outperformed 91% of the funds in its sector with growth of 30.55%.

- The Ninety One Global Sustainable Equity fund has a triple A MSCI ESG Rating and has consistently been among the top performing ESG funds in the Global sector with 1, 3 & 5 year growth of 2.09%, 34.25% and 58.21% respectively.

- The Legg Mason ClearBridge US Equity Sustainable Leaders fund ranked 10th out of 171 funds in the IA North America sector over 5 years with growth of 105.93%.

Until recently, it was widely regarded that investors who wished to invest their money in funds that follow an ethical and sustainable framework would be expected to sacrifice an element of portfolio growth in return. But over the past several years this has changed and analysts now foresee environmental, social and governance (ESG) investing as a key driver of investment growth.

In such a short period of time the growing demand for ESG investing has been significant. The interest has now intensified to such an extent that it will now likely have a significant role in the future investment strategies for both fund manager and investor.

For investors, identifying the most suitable and efficient ESG funds can be a challenge but there is a growing number of proven top performing ESG funds available.

In this report, we feature 10 of the best ESG funds for performance and attach a full downloadable performance and ranking report for 50 of the top ESG funds available to investors.

The Rapid Growth of ESG Investing

Climate change has become a core topic of global politics with many governments putting in place adventurous targets on reducing their carbon footprint in the coming years. As a consequence, many industries have invested significantly in re-engineering their proposition; this challenge has created opportunities for new entrants into previously established markets, with Tesla being one of the most notable examples.

The global acceptance and the growing adoption of environmentally sustainable processes has fuelled innovation and made it much easier for fund managers to offer sustainability themed funds that challenge and exceed the performance of traditional funds that have followed an unrestricted investment framework - The 10 funds featured in this report are evidence of that.

Each of the 10 best performing ESG funds in this report represent some of the top performing funds on the market that also happen to maintain a high ESG rating. Please note, the funds are not listed in any particular order.

Download the full Best ESG Funds report

1. Fidelity Sustainable Asia Equity

The Fidelity Sustainable Asia Equity fund invests across Asia (excluding Japan). Manager Dhananjay Phadnis invests at least 70% of the fund in companies that are highly-rated on ESG measures. The rest is invested in companies that might not score highly today, but are on an improving trajectory.

The manager also avoids companies some might consider unethical, like tobacco companies, oil & gas extractors and makers of controversial weapons.

Engagement is a key part of Phadnis’ approach. He believes it’s the most effective way to influence a company’s behaviour and improve investor outcomes.

The manager recently engaged with a bank they hold that’s made progress on climate financing and improving the transparency of their emissions reporting. Although the bank’s targeting a complete phase out of coal lending by 2037, they’d like to see the company bring forward its commitment and will continue to press for more progress.

2. JOHCM Continental European

The Fund’s core style and risk profile has enabled it to outperform in both up and down markets and helped to build a market-leading performance track record since the Fund’s launch in 2001.

The fund consists of a diversified portfolio of Continental European equities primarily invested in blue chip and medium-sized companies. The manager's bottom-up stock selection involves the identification of factors leading to potentially strong company earnings growth and positive earnings momentum (e.g. pricing power, brand positioning, financial management) and comparative valuation analysis.

The management strategy of the fund is not specifically focused on ESG factors, but the funds holdings and the views of the fund’s manager, have identified the companies with ESG practices in place as the best holdings for this fund. As a consequence, the overall fund has obtained a AAA ESG rating from the MSCI.

3. Ninety One Global Sustainable Equity

The Ninety One Global Sustainable Equity fund utilises ESG characteristics by focusing on investing in companies considered as having operations and / or business models that aim to minimise their harmful effects on society and the environment, or whose products or services seek to benefit society and the environment.

The fund manager invests in companies they believe follow good governance practices (e.g. with respect to sound management and company board, corporate culture, capital allocation and remuneration policies).

The fund follows a global asset allocation model and is classified within the IA Global sector alongside 466 competing funds. This fund has consistently excelled and over the past year it ranked 48th in its sector with returns of 2.09% and over 5 years it outperformed 80% of the sector with growth of 58.21%.

4. Vanguard SustainableLife 60-70% Equity

In response to the success of their highly popular LifeStrategy range, Vanguard launched four sustainable funds with an ongoing charge of 0.48% called the SustainableLife range. Each of the funds offer a different equity exposure but the Vanguard SustainableLife 60-70% Equity fund is one that has consistently performed well.

The fund has a mixed asset allocation model and it has a dynamic planner risk rating of 6 out of 10, making it suitable for a balanced investor. It has a triple A MSCI ESG rating and is classified within the IA Mixed Investment 40-85% sector where it has delivered returns of 30.55% over the past 5 years, which was more than double the sector average.

5. Fidelity UK Select

The Fidelity UK Select fund is a UK Equity fund that is classified within the IA UK All Companies sector. The fund has over 81% of its holdings in UK equities with the remainder spread across European Equities and North American equities. This fund also has an MSCI ESG triple A rating and over the 3 periods analysed it has consistently outperformed the sector average and ranked among the top funds in the sector.

Over the past 1, 3 & 5 years the Fidelity UK Select fund has returned -8.45%, 3.58% and 15.99% respectively. In contrast, the average returns for the period of all funds within the same sector was -15%, -2.49% and 4.36%.

6. Artemis SmartGARP UK Equity

The Artemis SmartGARP UK Equity fund does not have a targeted ESG strategy, but the fund currently has a double A MSCI ESG rating. Similar to the Fidelity UK Select, the fund is a UK equity fund that is classified within the UK All Companies sector where it has continually ranked among the top 8% for performance over the past year and the top 96% over 5 years.

Over the past 1, 3 & 5 years the Artemis SmartGARP UK Equity fund has returned -1.79%, 26.01% and 29.37% respectively. This was well above the sector average of -15%, -2.49% and 4.36%.

7. Liontrust Japan Equity

The investment objective of the Liontrust Japan Equity Fund is to generate long term (5 years or more) capital growth by investing at least 80% in shares of Japanese companies. These are companies which, at the time of purchase, are incorporated, domiciled, listed or conduct significant business in Japan. As such, the fund is classified within the IA Japan sector along with 78 competing funds.

Although the fund has performed slightly below the sector average over 5 years, it has ranked among the top of the sector for performance over the past 1 & 3 years with returns of -9.78% and 8.78%. In comparison, the sector average was -14.54% and 3.51% respectively.

8. FSSA Global Emerging Markets Focus

The FSSA Global Emerging Markets Focus fund is a Global Emerging Markets fund, which is a sector that is not known for its ESG opportunities, yet this fund has managed to maintain a double A MSCI ESG rating.

The manager of the FSSA’s Global Emerging Markets fund has built the fund company by company and from the bottom up, with little regard for index positioning. The fund has a focus on growth and aims to only invest in high quality companies with effective management teams, long-term, sustainable growth drivers and strong financials.

The fund is a relatively young one, with less than 5 years history but it has established itself as one of the sector's front runners. Over the past 1 & 3 years this fund has managed to return -190% and 8.27%, which is significantly better than the sector average returns of -14.88% and 3.3%.

9. Legg Mason ClearBridge US Equity Sustainable Leaders

Unlike some of the funds featured in this report, the Legg Mason ClearBridge US Equity Sustainable Leaders fund has a specific ESG strategy. The fund has a double A MSCI ESG rating and is classified within the highly competitive North America sector alongside 205 competing funds.

The fund invests at least 85% of its assets in shares of US companies that meet the investment manager's financial criteria and its criteria for environmental, social and governance (ESG) policies. The investment manager's portfolio construction accommodates only the companies that are Sustainability Leaders.

Over the past 1, 3 & 5 years the fund has delivered growth of 0.90%, 44.82% and 105.93%, each of which were comfortably greater than the sector average.

10. BNY Mellon Multi Asset Growth Fund

The BNY Mellon Multi Asset Growth Fund does not have a targeted ESG objective yet it currently has a triple A MSCI ESG rating, which makes it a suitable option for ESG portfolios. The fund is classified within the Flexible Investment sector and has a multi asset approach with 32% of the funds assets in North American Equities, 23% in UK Equities, 11% in Europe with a proportion spread across several other asset classes.

The fund has been a long term top performer not only over the 1, 3 & 5 years but over the past 10 years and more. Over the past 10 years the BNY Mellon Multi-Asset Growth fund has returned growth of 180%. In contrast the sector average for the same period was 86.25%.

Over the past 3 & 5 year periods the fund outperformed 96% of the funds in the Flexible Investment sector with returns of 28.62% and 48.66% respectively.

The Best ESG Funds

The 10 funds featured in this report are just a small selection of the quality ESG investment opportunities available to UK investors.

However, there are thousands of funds available to investors and a selection of these funds will have an ‘A’ plus ESG rating, but less than 10% will have consistently outperformed competing funds within their sectors and have a high performance rating.

The investment market is littered with poor quality funds, and the limited information available relating to performance has made it difficult to identify the good from the bad. This has resulted in billions being placed in funds that have persistently underperformed causing many investors to miss out on growth with their investment, ISA and pension portfolios.

In our full best ESG funds report we feature 50 of the best performing funds with a high ESG rating. This report identifies their performance and sector ranking over the recent 1, 3 & 5 years along with their overall performance rating.

ESG’s Growing Role In Fund Performance

The reality is that Ethical and sustainable investing is no longer niche and should now be a consideration for growth focused investors. The past year has been difficult for many investors with high volatility negatively impacting portfolio values. But as many analysts now predict markets have reached the bottom of the negative cycle, a return to growth is on the horizon with the outlook for funds with holdings in companies that have implemented ESG practices brighter than those who have yet to make the move, which for investors provides some exciting opportunities for future growth.

With greater accessibility to online fund performance and ESG rating tools as well as growth focused ESG portfolios, it has never been easier to invest in high quality, sustainable funds.

Strong ESG practices will always be core to any ESG investment strategy, but like any investment the overall objective is growth. When identifying the best ESG funds, how they have performed is a critical metric that efficient investors and high-quality advice firms analyse to help ensure their portfolios productively meet ESG objectives while utilising fund managers that have demonstrated consistency in delivering efficient returns.

Of course, past performance is not an indicator of future returns, but when asked, investors would prefer to invest with fund managers that consistently perform well over varying time frames. Each of the funds in our top ESG funds report have consistently been among the top performing funds in their sectors.

ESG Investing With Yodelar

For years, many investors felt that investing in sustainable funds meant sacrificing growth - which was often the case. But in a short period of time the growing demand for ESG investing has been significant. The interest has now intensified to such an extent that it will now likely have a significant role in the future investment strategies for both fund manager and investor.

The role of ESG is rapidly growing, but there remains a limited number of quality ESG portfolios on the market. As such, Yodelar Investments have created a range of risk rated ESG portfolios that provide investors with high quality, growth focused portfolios that adhere to the ESG framework as defined by industry leading investment research analysts, MSCI.

The development of our portfolios comes from years of research and analysis that included the consistent assessment of more than 100 fund managers, tens of thousands of funds and more than 30,000 investment portfolios.

Our investment approach ensures that the funds used to achieve the correct balance for each of our portfolios have consistently ranked among the best performers in their sectors. We believe this efficient and quality-based investment philosophy will help our ESG portfolios to excel and securely maximise the growth for our investors within a controlled ESG framework.