Mixed asset investments have witnessed record inflows that have exceeded £6 billion in the six months up to the end of May 2018, which was comfortably higher than any other asset class. The significant demand for Multi-Asset funds has resulted in both massive inflows from investors and the launch of new funds, which has led to Multi-Asset funds now accounting for 13% of the 3,000 plus unit trust funds on the market.

With such a vast selection it is difficult for investors and advisers to identify which Multi-Asset funds have consistently maintained a high level of performance within their designated risk parameters.

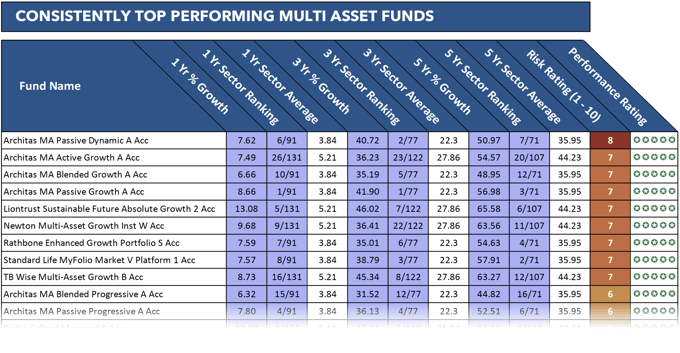

The following table identifies all of the risk profiled Multi-Asset funds that have received a 5-star performance rating by consistently outperforming at least 75% of same sector funds over the 1, 3 & 5 year period up to 1st June 2018.

Risk profile – 8 (High Risk)

From the 388 Multi-Asset funds analysed only 9 have a high-risk profile of 8, and only one has maintained consistent top quartile sector performance over the recent 1, 3 & 5 year periods. This fund was the ‘Architas MA Passive Dynamic’ fund which is a relatively small fund with just over £24 million of client funds under management. Launched in March 2011, this fund aims to deliver a combination of capital growth and income by taking on high levels of volatility through exposure to a diversified range of asset classes.

Risk Profile – 7 (Highest Medium Risk)

52, or 13% of the funds analysed have a risk profile of 7. From these 52 funds, eight had received a 5-star performance rating as they had managed to maintain a level of performance that was greater than at least 75% of same sector funds over the recent 1, 3 & 5 years periods. Architas manage three of these funds. They were the Architas MA Active Growth fund, the Architas MA Blended Growth fund and the Architas MA Passive Growth fund. Each of these funds consistently outperformed the sector average.

However, from the Multi-Asset funds with a risk profile of 7, the highest returns over the past five years were from the Liontrust Sustainable Future Absolute Growth 2 fund.

This fund currently holds £177 million of funds under management and its fund managers Peter Michaelis and Simon Clements have followed a strategy of investing in a broad range of companies across the world, which to date has delivered great success.

This fund’s impressive performance has seen it return one-year growth of 13.08%, three-year growth of 46.02% and five-year growth of 65.58%, which consistently better than at least 95% of same sector funds during the same periods.

Risk Profile – 6 (High Medium Risk)

A total of 73 of the 388 funds analysed hold a ‘high medium’ risk profile of 6. Nine of these funds received a 5-star performance rating with Architas once again showcasing their ability to manage high-quality Multi-Asset funds with 2 of the nine funds managed by them.

However, with growth of 12.20%, 47.14% and 63.11% over the recent 1, 3 & 5 years respectively it was the Baillie Gifford Managed fund that had the highest growth. This popular fund holds over £3.5 billion of client money, and it has a diverse investment focus investing primarily in a combination of equities, fixed interest securities, collective investment schemes and cash.

Risk Profile – 5 (Low Medium Risk)

Risk profile 4 and 5 are the most popular risk profiles for Multi-Asset fund managers, and from our analysis of 388 Multi-Asset funds, 101 have a risk profile of 5.

Our analysis of these funds identified that only six consistently maintained top quartile sector performance. Once again an Architas managed fund was among the top performers in this risk category with their MA Passive Intermediate fund returning five-year growth of 45.27%. Another consistently top performing Multi-Asset fund with a risk profile of 5 was the £ JPM Global Macro Opportunities fund. Managed by James Elliot and Shrenick Shah this fund launched in 2013 and quickly established as a popular investment with funds under management currently exceeding £1.2 billion. This Globally diversified fund has enjoyed growth of 40.63% over the recent five year period, which was better than 97% of same sector funds.

Risk Profile – 4 (Lowest Medium Risk)

From the 101 Multi-Asset funds with a risk profile of 4, only 3 received a five-star performance rating. These three funds were the M&G Episode Income fund, the Schroder Mixed Distribution funds and the Vanguard LifeStrategy 40% Equity fund. All three funds have enjoyed strong performance which was relatively similar and consistently better than the sector average.

Risk Profile – 3 (Low Risk)

Three was the lowest risk profile where a fund received a 5-star performance rating. There were 53 funds analysed that had a risk rating of 3, but only one was able to maintain a sector ranking that was consistently better than at least 75% of its peers over the recent 1, 3 & 5 year period - that fund was the popular Vanguard LifeStrategy 20% Equity fund.

Since its launch in June 2011, the Vanguard LifeStrategy 20% Equity fund has continually and outperformed the IA Mixed Investment 0-35% shares sector with 1, 3 & 5-year returns of 3.02%, 16.16%, and 28.36% well above the sector average. This fund is one of three Vanguard LifeStrategy funds to receive a 5-star performance rating, the others being their LifeStrategy 80% Equity and their LifeStrategy 40% Equity.

Log in now to view the complete list of top performing Multi-Asset funds in the July 2018 edition of the Yodelar magazine

Log in now to view the complete list of top performing Multi-Asset funds in the July 2018 edition of the Yodelar magazine

Not subscribed? Register now for instant access to all premium reports.

Summary

Our independent analysis of 388 Multi-Asset funds identified that only 7% maintained a level of performance that consistently ranked in the top quartile of their sectors over 1, 3 & 5 years, which shines a light on just how many Multi-Asset fund managers struggle with both performance and consistency.

However, the small proportion of fund managers identified in this report have navigated multiple markets and maintained top quality performance within a specified risk mandate, which shows that despite widespread poor performance that there are Multi-Asset fund managers who have a proven ability to provide investors with excellent investment opportunities on a consistent basis.