There are more than 11.1 million ISA users in the UK, who this year can shelter up to £20,000 from tax by investing in a cash or stocks and shares ISA - But as the clock ticks down on this year’s ISA season how can investors get the most from their ISA allowance and maximise any potential gains?

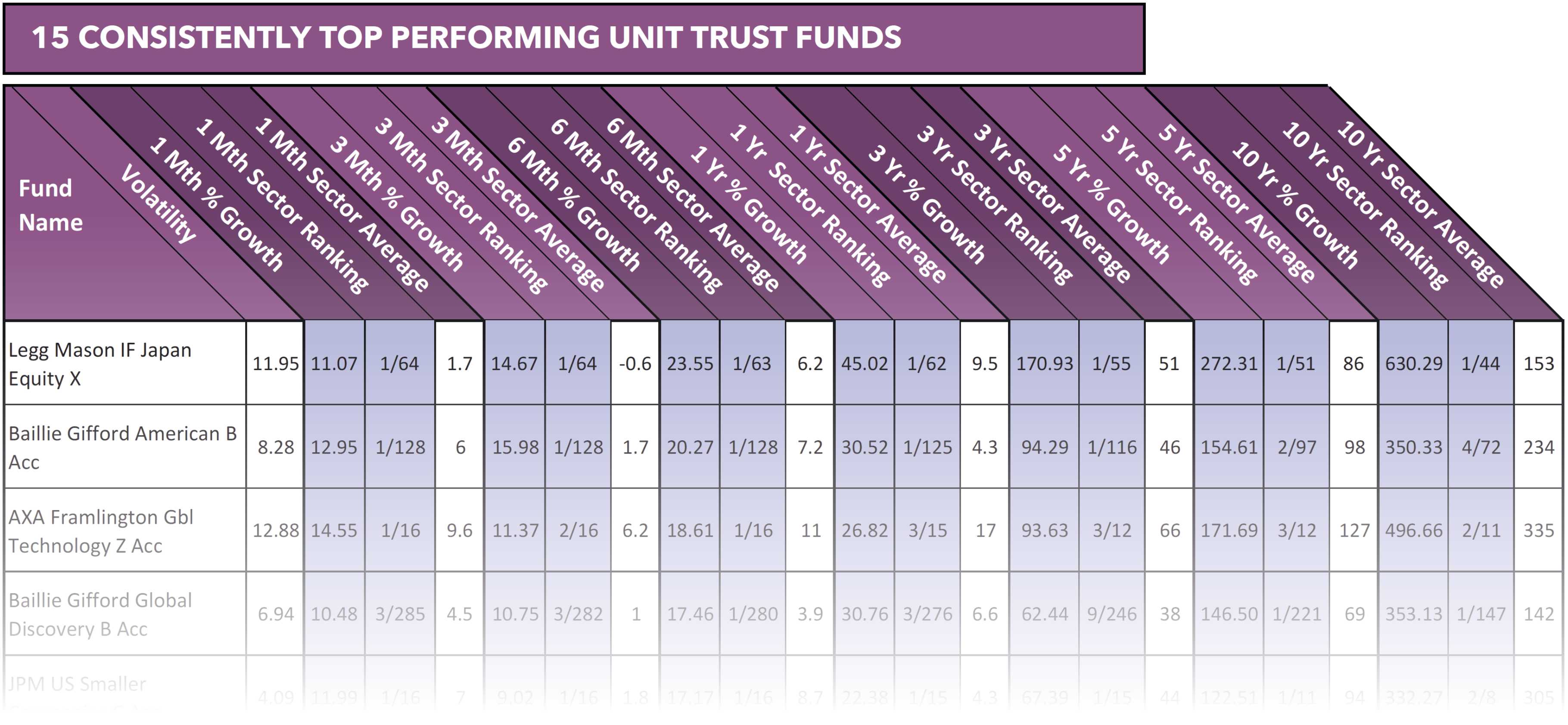

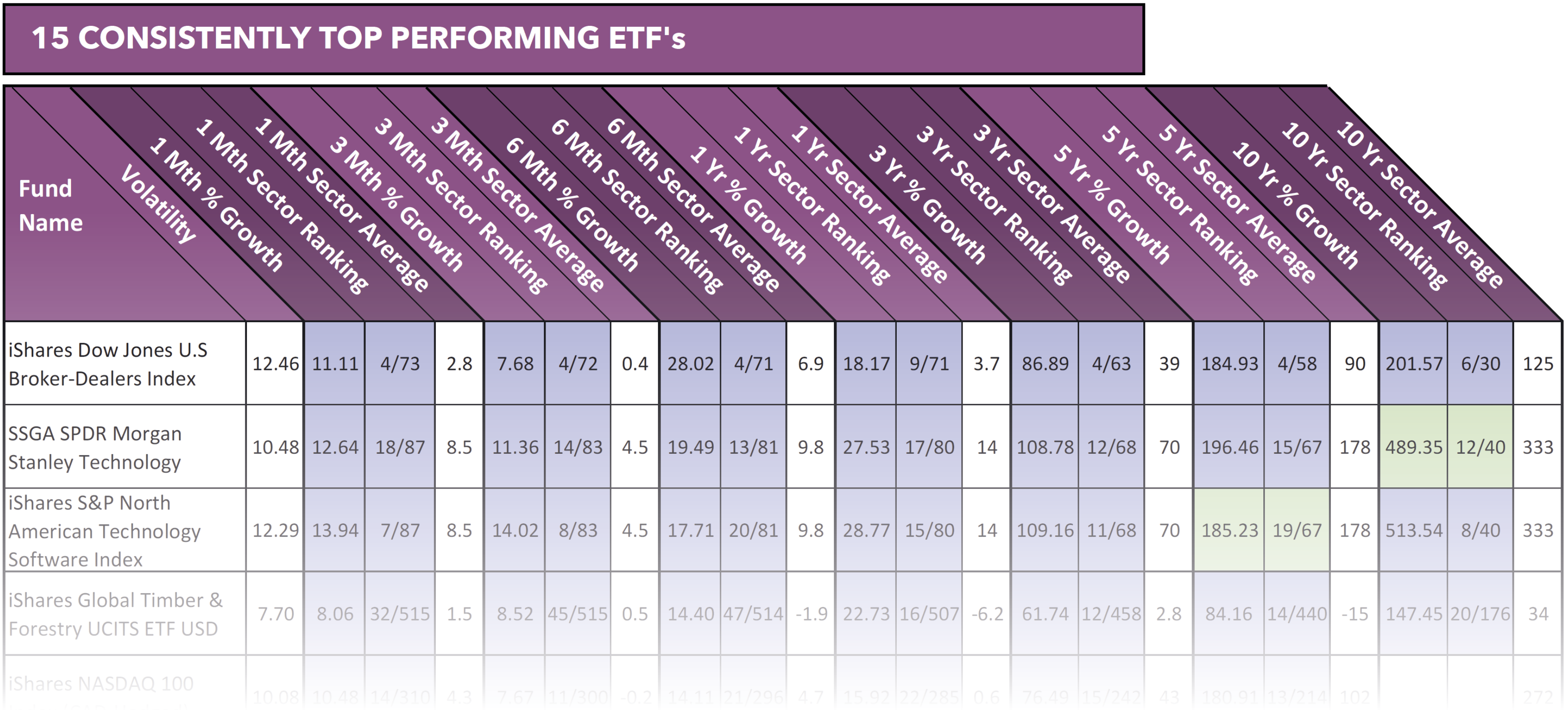

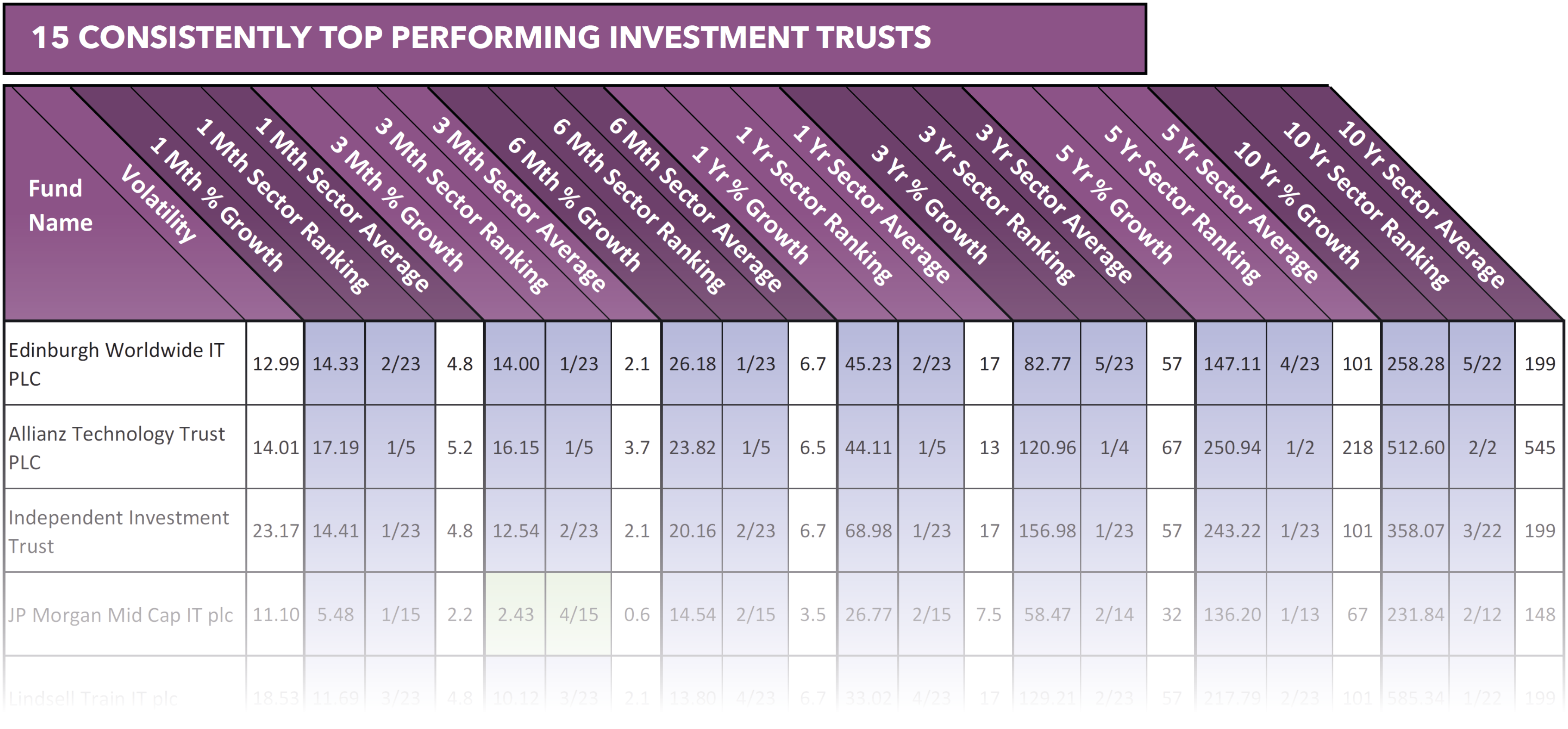

Discover the best ISA funds and find out how to build the most efficient ISA portfolio, using the best investment funds. This report details 15 investment funds, ETFs, and investment trusts that have consistently been among the best performers in their relevant investment sectors.

Getting The Most From Your ISA

According to figures released by HMRC, 77% of all ISA accounts are still held in cash savings accounts - where interest rates averaged a measly 1% in 2017. This is expected to increase further this year as interest rates rise, particularly among new ISA subscribers. However, the returns they are expected to deliver will likely pale in comparison to an efficient, top performing stocks and shares ISA portfolio.

Undeniably, a stocks and shares ISA still offers the best opportunity for investors looking to maximise their ISA returns if they are willing to increase risk. Indeed, a strong 2017 saw many investment sectors deliver record levels of growth.

Through a stocks and shares ISA built to a suitable asset allocation model and containing a quality selection of funds investors can enjoy the tax efficient advantages of an ISA wrapper while also benefiting from extra growth gains from their investments.

Asset Allocation – The Right Mix For Your ISA Portfolio

The importance of asset allocation is widely acknowledged yet it remains the sole biggest risk to investors.

What exactly is asset allocation? In short, Asset allocation is the implementation of an investment strategy that seeks to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio based on the investor’s risk taking capacity, goals and the time frame needed to reach those goals.

The objective of asset allocation is to minimise volatility and maximise returns through a process that involves dividing your money among asset categories that do not all respond to the same market forces in the same way at the same time.

Balancing your portfolio to withstand the diverse levels of volatility from different investment markets is essential to the long-term stability of your investment portfolio.

The importance of asset allocation was never more evident than during the financial crisis of 2008 when some investors close to retirement lost almost all of their savings. Market movements dictate growth and the more rewarding but higher risk holdings within their once balanced portfolios grew at a faster rate. Therefore, overtime their failure to review and rebalance their portfolios caused them to become overexposed to aggressive markets that plummeted in value almost overnight, wiping out the value of their investments.

Asset allocation is crucial to the success of any portfolio. There are many different asset allocation models available but finding the most suitable one for you will help maximise your investment returns while minimising your exposure to risk.

Identifying The Best Funds To Build A Robust and Top Performing ISA Portfolio

Although market movements dictate investment growth not all funds are able to consistently maximise growth during fluctuating periods. Indeed, a large proportion of funds simply achieve growth through the performance of the market - when a market is thriving they benefit from easy gains but when the market is struggling they are unable to maintain those gains.

However, like any industry there are those who simply do a better job than others and with investing there are a proportion of funds available that regularly demonstrate exceptional performance.

These funds are typically comprised of strong underlying holdings, managed by quality fund managers and consistently deliver returns that outperform the market and their peers.

Access the complete list of 15 consistently Top performing unit trust funds in the March edition of the Yodelar Magazine. Register now for just £1 and get instant access.

The unit trust fund with the top performance in the 12-month period up to 1st March 2018, was the Legg Mason IF Japan Equity fund with 1 year growth of 23.55%. This popular Japanese equity holds £1 billion of funds under management and has consistently delivered on its aim to achieve capital growth through investment in securities of Japanese companies. In fact, over all 7 periods analysed this fund ranked 1st in its sector for growth and over the recent 10 years

it returned exceptional growth of 630.19%. However, as a Japanese equity this fund has a relatively high level of volatility and is viewed as a higher risk investment that may be best suited to an aggressive investment portfolio.

Access the complete list of 15 consistently Top performing ETFs in the March edition of the Yodelar Magazine. Register now for just £1 and get instant access.

From the 15 listed ISA eligible ETF’s the Vanguard Mega Cap Growth was one of the most popular. Holding over $3.4 billion this passively managed ETF employs a full-replication approach and seeks to track the performance of the CRSP US Mega Cap Growth Index. Launched on 17th December 2007, this fund has returned 10-year growth of 344.94% and most recently it returned 1 year growth of 11.92%.

Access the complete list of 15 consistently Top performing Investment Trusts in the March edition of the Yodelar Magazine. Register now for just £1 and get instant access.

Among the ISA eligible investment trusts to continually deliver top performance was the Baillie Gifford managed Scottish Mortgage Investment Trust PLC.

This popular investment holds over £6.3 billion of funds under management and returned growth of 34.84% over the past 1 year and 373.10% over the past 10 years. It is an actively managed, low cost investment trust which has consistently delivered on its aim to achieve greater returns than the FTSE All World Index over a 5-year rolling period.

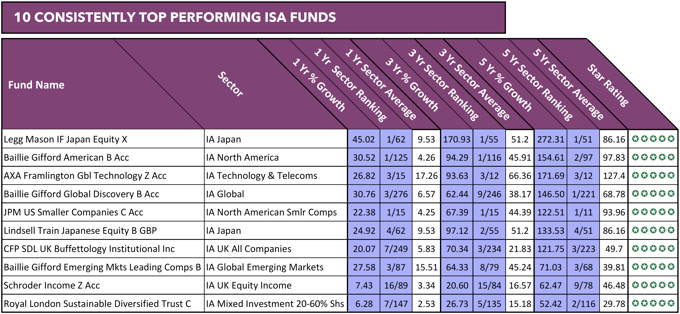

Identifying the top performers

Although there are various forecasts and opinions relating to future market and investment performance, no one knows for certain what the future holds. Nonetheless, we believe that the funds and the fund managers that have navigated through fluctuating markets and periods of instability while consistently outperforming their peers offer the best potential for future top performance.

In an industry that has often been criticised for being over complicated and lacking transparency, identifying top performance has never been straight forward. However, below we list 10 of the best performing funds over the 1, 3 & 5-year period up to 1st March 2018.

In the pursuit of gains, it isn’t uncommon for investors to lose sight of their portfolios asset allocation as the thrill of a strong performing investment can often overpower an investors obligation to stick to their investment objectives.

However, through the right mix of asset allocation and fund selection investors give themselves the best opportunity to make the most of this year’s ISA allowance and maximise their overall portfolio performance.