In the pursuit of high returns, most investors have overlooked the social and environmental behaviour of the companies within the funds they invest in.

Socially responsible investing is increasing in popularity and in recent years it has grown significantly with the investment association, the trade body for UK fund managers, stating that £20 billion is now invested in ethical unit trust and OEIC funds, which is up from £5.8 billion just 10 years ago.

Ethical funds were introduced in the 1980s to allow those with certain beliefs to invest their money with a clean conscience. However, with a reputation of poor performance, they appealed little to traditional investors, but with greater emphasis on environmental and social issues, there has been a sharp increase in the demand for investment products that encompass a wide range of ethical and socially responsible values.

Ethical themed investing may be on the rise, but can investors do good and achieve good returns at the same time? Our performance analysis of 140 ethical funds featured in interactive investors ethical fund list shows that they can with approximately 1 in 10 sustainable funds consistently outperforming their peers.

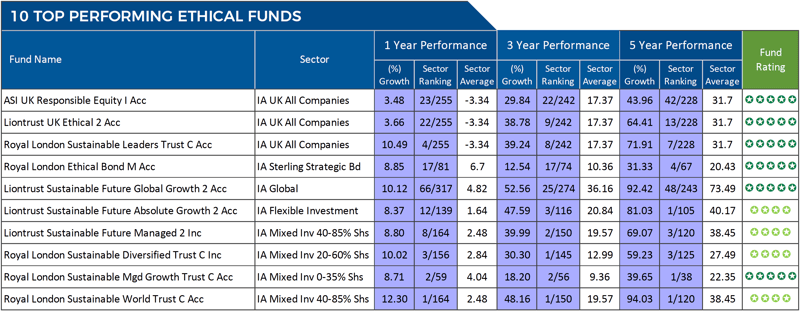

In this report, we feature 10 ethical funds, each with different ethical and Socially responsible themes, that have consistently outperformed at least three-quarters of their peers over the recent 1, 3 & 5 year periods.

10 Top Performing Ethical Funds

Our performance analysis of the 140 ethical and socially responsible funds featured in interactive investors ‘long list’ identified that proportion has continually excelled within their sectors. The 10 top-performing ethical funds featured in this report represent 10 of the most consistent, and top-performing funds from the ‘long list’.

Although the funds are not listed in any particular order they are managed by 4 fund management firms which suggests a level of expertise by these fund managers to produce and manage funds that adhere to an ethical approach and deliver highly competitive returns.

-

1. ASI UK Responsible Equity Fund

Formerly known as the Aberdeen UK Responsible Equity fund, the fund recently changed its name to the ASI UK Responsible Equity fund, to reflect the 2017 merger between Standard Life and Aberdeen.

The fund has been around since 2006 and its aim is to generate growth over 5 years or more by investing in UK equities, which meet the fund’s environmental, social and governance screening criteria. Currently, the fund manages £34.8 million of client assets, which makes it one of the smallest funds in its sector. Despite its small size, over the past 1, 3 & 5 years this fund has consistently ranked among the top performers in the UK All Companies sector where it sits alongside 254 competing funds. Over the 1, 3 & 5 year periods analysed it returned cumulative growth of 3.48%, 29.84%, and 43.96%, which not only comfortably outperformed the sector average but it also performed consistently better than at least 82% of all other funds in the same sector.

This impressive fund has been able to deliver highly competitive performance while embracing an ethical and socially responsible investment approach.

-

2. Liontrust UK Ethical

The Liontrust UK Ethical fund is one of four ethical funds managed by Liontrust that have made it into our top 10 list, which affirms their expertise in creating, managing and delivering high quality ethically themed funds.

The Fund aims to generate capital growth by investing in the shares of a broad range of UK Companies, based on the fund manager's view of their long-term return prospects. It will invest only in companies that meet their ethical requirements and meet their rules for environmental and social responsibility.

This fund also sits within the UK All Companies sector. Over the past 10 years, this sector has averaged growth of 127.01%, whereas the Liontrust UK Ethical fund has delivered 10-year growth of 203.93%. In more recent years this fund has continued to excel with recent 1, 3 & 5-year growth of 3.66%, 38.78%, and 64.41% outperforming at least 75% of all funds within the sector.

-

3. Royal London Sustainable Leaders Trust

The investment objective of the Royal London Sustainable Leaders Trust is to achieve capital growth over the medium term (3-5 years) by investing at least 80% in the shares of UK companies listed on the London Stock Exchange that are deemed to make a positive contribution to society.

The fund primarily invests in financial, Industrial, or healthcare companies, and similar to the previous 2 funds, it is classified within the UK All Companies sector where it has consistently ranked among the best performers. This past 12 months the fund has returned 10.49% growth, which not only exceeded the growth of the previous 2 funds but it was also better than 98.5% of all 254 competing same sector funds.

-

4. Royal London Ethical Bond

The Ethical Bond fund is classified within the Sterling Strategic Bond sector. This sector has traditionally been a lower risk sector than the UK All Companies sector, which the 3 previous funds are classified within, and therefore the growth of the funds within this sector are typically lower. Yet despite following a lower risk asset allocation model, the Royal London Ethical Bond returned growth of 8.85% this past 12 months, and over the recent 3 & 5 years, it managed to deliver growth of 12.54% and 31.33% respectively. This fund has consistently excelled within its sector and over the most recent 10 years, it has returned growth of 104.54% compared to the 72.89% averaged by competing funds within the same sector.

-

5. Liontrust Sustainable Future Global Growth Fund

The Liontrust Sustainable Future Global Growth fund invests typically, at least 90% of its Net Asset Value in global companies that meet their particular rules for environmental and social responsibility.

The fund is a Globally focused fund that adopts a relatively adventurous strategy in order to deliver competitive returns. With such a strategy comes a higher degree of risk but over the past 1, 3, & 5 years it achieved growth of 10.12%, 52.56%, and 92.42% respectively. In contrast, the Global sector averaged growth of 4.82%, 36.16%, and 73.49% for the same periods.

6. Liontrust Sustainable Future Absolute Growth

The Liontrust Sustainable Future Absolute Growth fund launched in 2001 and currently manages £260 million of client assets. The fund is a Flexible investment fund that invests in companies from around the world that meet the manager’s rules for environmental and social responsibility, which they deem to have the best prospects for long term growth.

This fund has consistently been a top performer and over the recent 5 years, it has returned growth of 81.03%, which was the highest of all funds in the flexible investment sector.

-

7. Liontrust Sustainable Future Managed

The fourth and final Liontrust fund in this report is their Sustainable Future Managed fund. This fund is the second-largest in their range of funds and currently manages £1.1 billion of client assets. The fund typically invests at least 70% of the fund in shares of global companies, with up to 30% in bonds and cash.

The overall ethical strategy of this fund is based on the fund managers belief that in a fast-changing world, the companies that will survive and thrive are those which improve people’s quality of life, be it through medical, technological or educational advances; drive improvements in the efficiency with which we use increasingly scarce resources; and help to build a more stable, resilient and prosperous economy.

The overall objective of the fund is to seek and generate strong returns while benefiting society through trends that have a positive impact and can make for attractive and sustainable investments. Since the fund launched in 2001, it has consistently outperformed the sector average and over the recent 1, 3 & 5 years it returned growth of 8.80%, 39.99%, and 69.07%, each which were better than at least 95% of funds within the same sector.

8. Royal London Sustainable Diversified Trust

The Royal London Sustainable Diversified trust fund is an actively managed fund that aims to balance growth and risk to deliver competitive returns. It invests in shares in high-quality companies such as Vodafone Group and Compass Group, along with corporate bonds, property and cash.

The fund has a sustainable approach to investing, which focuses on key themes such as Emerging Markets and Global Power Shortage. The manager of the fund takes into account social, ethical, environmental and company management issues, such as executive salaries and bonuses, to help identify the most suitable companies to invest in.

This fund has a relatively low-risk approach, yet it still managed to return growth of 10.02%, this past year, which was the 3rd highest out of all 156 funds in its sector. Over 3 years it was the top performer in its sector with growth of 30.30% and over 5 years it outperformed 97.5% of competing funds with growth returns of 59.23%.

-

9. Royal London Sustainable Managed Growth Trust

Like many of Royal London’s funds, their Sustainable Managed Growth Trust has over 300 holdings. Royal London’s sustainable team favours a distinctive approach, integrating the consideration of environmental, social and governance (ESG) issues, alongside financial analysis, throughout the investment process. They state that every holding has to meet key criteria and the team actively engage with the companies in which they invest to champion best practice on behalf of our clients, challenging companies on issues such as environmental policy and corporate governance standards.

The policy for maintaining an ethical focus is based on avoiding companies they believe exposes investors to unacceptable financial risk resulting from poor management of ESG issues.

The fund has a low-risk approach and sits within the Mixed Investment 0-35% Shares sector where it has consistently excelled. Over the past 5 years, it has managed to return growth of 39.65%, which was the highest in the entire sector.

-

10. Royal London Sustainable World Trust

The Royal London Sustainable World Trust invests in a mix of large companies such as Johnson & Johnson and eBay. The fund also invests in some high-quality corporate bonds, and government bonds, but with a primary focus on equities, the fund has a mid to high-risk rating. Similar to the Liontrust Sustainable Future Managed, the RL Sustainable World Trust sits within the Mixed Investment 40-85% Shares sector where it has consistently been a top performer. Over the past 1, 3 & 5 years this fund returned growth of 12.30%, 48.16%, and 94.03%, which was not only considerably higher than the sector average of 2.48%, 19.57%, and 38.45%, but it was the highest growth of all funds within the sector.

With consumer demand for ethical investing on the rise, the number and quality of ethical and socially responsible funds on the market have surged. The traditional view that ethical investing means a sacrifice in growth is no longer true. In this report, we identify a selection of ethically themed funds that have consistently ranked among the top performers in their sectors and each represents some of the best opportunities for all investors seeking growth.