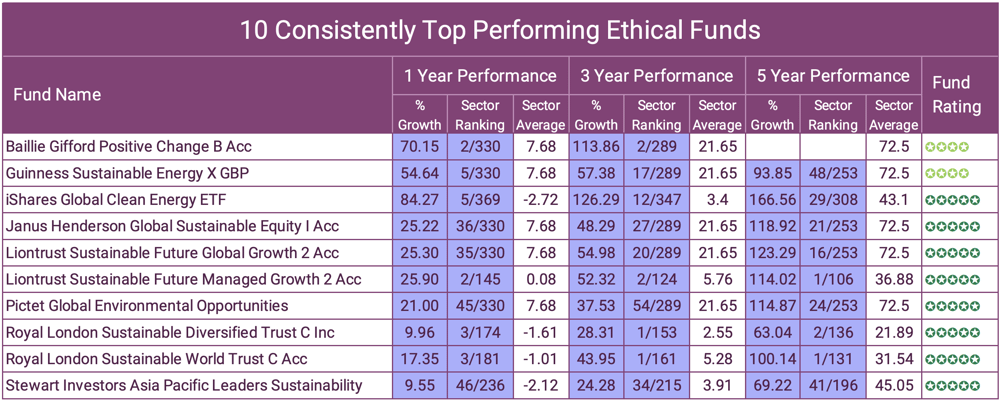

- The Liontrust Sustainable Future Managed Growth fund has returned the highest growth in its sector over the past 5-years (114.02%).

- Since its launch in 2017 the Baillie Gifford Positive Change fund has outperformed 99.5% of the funds in its sector.

- Despite the volatility of 2020 the iShares Global Clean Energy ETF has returned growth of 84.27% for the past 12 months.

Up until recently, investors who wished to invest their money in funds that follow an ethical and sustainable framework would be expected to sacrifice an element of portfolio growth in return. But over the past several years this has changed.

Climate change has become a core topic of global politics with many governments putting in place adventurous targets on reducing carbon footprint in the coming years. As a consequence, many industries have invested significantly in re-engineering their proposition; this challenge has created opportunities for new entrants into previously established markets, with Tesla being one of the most notable.

Tesla developed revolutionary battery technology that made long distance travel via electric vehicles a viable mode of transport and in just several years they now control a huge share of the global car market and have become the largest supplier of electric vehicles in the world.

The global acceptance and the growing adoption of ethical and environmentally sustainable processes has made it much easier for fund managers to offer sustainability themed funds that challenge and exceed the performance of funds that follow an unrestricted investment framework - The 10 funds featured in this report are evidence of that.

10 Best Ethical Funds The 10 funds featured in this report have been assessed based on how they performed alongside all other funds within their allocated sectors, irrespective if those other funds have an ethical framework or not. They have been selected as they have each consistently ranked at the top of their sectors over the periods analysed.

Baillie Gifford Positive Change Fund

Baillie Gifford believes that capital thoughtfully and responsibly deployed is a powerful mechanism for change. With their Positive Change fund Baillie Gifford actively seeks out companies whose products and services are providing solutions to global challenges. They use the United Nations Sustainable Development Goals to help identify and measure the contribution that individual companies are making to solving global challenges.

There are many ways in which businesses can support the transition to a more sustainable world for current and future generations. For their Positive Change fund, Baillie Gifford uses four impact themes to measure how companies address global challenges and how they each contribute towards a sustainable future.

Social Inclusion

260 million children worldwide have no access to education and through their Positive Change fund, Baillie Gifford aims to invest in companies that help address this issue and promote a more inclusive society by improving the quality and accessibility of information. One such company being Alphabet which is the parent company of Google and Loon, which provides internet access via high altitude balloons.

Environment & Resource

Needs Baillie Gifford sees human activities as the biggest detrimental impact on the environment, such as climate change, which can limit global development, They believe the solution to such problems is to invest in and promote the growth of companies that can reduce the environmental impact of economic activities and increase resource efficiency. One such company that Baillie Gifford believes meets this criteria is renewable energy firm Orsted.

Healthcare & Quality of Life

Baillie Gifford sees the biggest challenge to the modern healthcare system is that it remains reactive rather than proactive. They believe that medical research companies such as Illumina, who specialise in providing human genome sequencing tools, can aid in the understanding and prevention of diseases as well as advance medical treatments.

Base of The Pyramid

Baillie Gifford refers to the challenges faced by the world's least affluent people; in particular the 4 billion people globally who live on annual incomes of less than $3,000 as 'base of the pyramid'. To help this demographic, Baillie Gifford aims to invest in companies that provide low cost healthcare and basic goods or finance companies who help finance low income individuals potentially kickstart ventures that can increase their income.

The Baillie Gifford Positive Change fund is still in its infancy, but since it launched in January 2017, it has been exceptional ranking 2nd out of 330 funds over the last 1 & 3 years with returns of 70.15% and 113.86%. To put this performance into context, the most popular fund in the Global sector is the Fundsmith Equity fund. Over the same time period the Fundsmith Equity fund returned growth of 13.77% and 43.76%.

Guinness Sustainable Energy

The Guinness Sustainable Energy Fund gives investors exposure to global sustainable energy markets.

The Fund is managed for capital growth and invests in companies involved in the generation, storage, efficiency and consumption of sustainable energy sources (such as solar, wind, hydro, geothermal, bio-fuels and biomass).

We believe that over the next twenty years the sustainable energy sector will benefit from the combined effects of:

Demand growth - The electrification of transportation and improved energy storage economics brings attractive long term sustainable energy demand growth.

Improving Economics - Sustainable energy sources have become cost competitive with power from fossil fuels; we expect the cost of supply to continue to fall.

Public & Private Support - Both governments and companies are pursuing sustainable energy in order to achieve mandated carbon targets or to improve public perception.

Low current exposure - Poor profitability and need for subsidies has kept the weight of sustainable energy in global indices and broad global equity funds at a low level.

Sustainability Theme - The sustainable energy sector offers ‘green’ credentials that some investors are targeting to help facilitate global de-carbonisation and to reduce carbon intensity of their portfolios.

The fund is also classified within the IA Global sector where it has consistently been one of the most competitive funds in the sector. Over the past year it outperformed 98.5% of the funds in this sector with growth returns of 54.64%, which was significantly greater than the 7.68% sector average for the period.

The past 3 & 5 years it also maintained a top quartile sector ranking with returns of 57.38% and 93.85% respectively.

Janus Henderson Global Sustainable Equity

Companies are analysed and selected after taking into account how companies generate profits and their impact on people and the planet.

The Fund invests at least 80% of its assets in companies, of any size, in any industry, in any country. The Fund invests in companies whose products and services they consider to be contributing to positive environmental or social change and thereby have an impact on the development of a sustainable global economy. Each company is analysed and selected after taking into account how they generate their profits and how this impacts on people and the planet.

For this fund, Janus Henderson avoids investing in companies that they consider to potentially have a negative impact on the development of a sustainable global economy. The Janus Henderson Global Sustainable Equity fund is one of 5 funds in this report that is classified within the competitive IA Global sector. Although its performance is not quite that of the Baillie Gifford Positive Change fund or indeed the Guinness Sustainable Energy fund, it has still consistently ranked among the top performers in the sector.

iShares Global Clean Energy ETF

The iShares Global Clean Energy ETF (ICLN) provides exposure to global companies involved in clean energy related businesses, using S&P analyst expertise to identify and select the companies involved in clean energy opportunities, including:

Clean energy producers - Biomass & biofuel energy, Geothermal energy, Solar energy, Ethanol & fuel alcohol, Hydro-electricity, Wind energy.

Clean energy tech & equipment - Biomass & biofuel Hydro-electric turbines Photovoltaic cells Fuel cells Wind energy. iShares believe that 50% of the world's energy is predicted to come from solar and wind by 2050, which is 7 times greater than that of 2015 and currently, 28.1% of the funds holdings is allocated to companies in the renewable electricity sector.

The fund is currently responsible for managing £2.1 billion of client assets and in recent years in particular it has enjoyed exceptional growth rates. Over the past 12 months the fund has experienced huge growth of 84.27% and cumulatively over 3 & 5 years it has returned growth of 126.29% and 166.56%.

Liontrust Sustainable Future Global Growth 2 Acc

Liontrust advise the fund’s investment process is based on the belief that in a fast-changing world, the companies that will survive and thrive are those which improve people’s quality of life, be it through medical, technological or educational advances; drive improvements in the efficiency with which we use increasingly scarce resources; and help to build a more stable, resilient and prosperous economy.

The process seeks to generate strong returns while benefiting society through identifying long-term transformative developments and investing in companies exposed to these powerful trends that have a positive impact and make for attractive sustainable investments.

In the first several years since its launch in 2001, the Liontrust Sustainable Future Growth Fund endured a difficult period where it struggled to deliver positive growth, but in the recent decade it has consistently delivered competitive returns. Over the past 5 years the fund returned growth of 123.29%, which was better than 94% of all other IA Global funds, and this past year, it returned growth of 25.30%, which is more than treble the sector average.

Liontrust Sustainable Future Managed Growth 2 Acc

In 2001, Liontrust launched their Sustainable Futures range of funds in the belief that the companies that will survive and thrive are those that help to build a more stable, resilient and prosperous economy by improving people’s quality of life through ethical and sustainable means. ]

The investment process for their Sustainable Future funds is to invest in companies positively exposed to long-term transformative themes and to limit or completely avoid investment in companies exposed to activities that cause damage to society and the environment.

Almost two thirds of the portfolio is invested in the US, with information technology, healthcare and financials the most favoured sectors. Among the biggest holdings are Visa, a card payment specialist, Thermo Fisher Scientific, which makes instruments and healthcare equipment, and Ecolab, which specialises in water, hygiene and energy efficiency products.

Over the past 1, 3 & 5 years the Liontrust Sustainable Futures Managed Growth fund has achieved growth returns of 25.90%, 52.32% and 114.02%, each of which were significantly higher than the sector average and better than at least 75% of all other funds within its sector.

The Liontrust Sustainable Investment team are confident that their fund’s very competitive performance will continue as they believe there is a clear opportunity for growth in the companies helping with the transition to a more sustainable, zero-carbon world in the coming years, with massive change required from many of these sectors as they work to overcome the hurdles from the fossil fuel industry.

Pictet Global Environmental Opportunities

Over the past quarter of a century, Swiss-based Pictet Asset Management has built a reputation for 'thematic' investing – identifying key long-term investment trends and then setting up funds that hold shares in companies likely to benefit from them.

One of its most popular and successful thematic funds is Global Environmental Opportunities, a £5 billion fund that invests in companies looking to tackle some of the world's biggest environmental challenges. The fund invests primarily in companies operating in services, infrastructures, technologies and resources related to environmental sustainability.

In the past year this fund has experienced a surge in popularity with its funds under management leaping from £2 billion to £5 billion as investors attracted by its ethical ethos and consistently strong performance choose to invest in the fund. Over the past 5 years this fund has returned growth of 114.87% which was better than 91% of same sector funds.

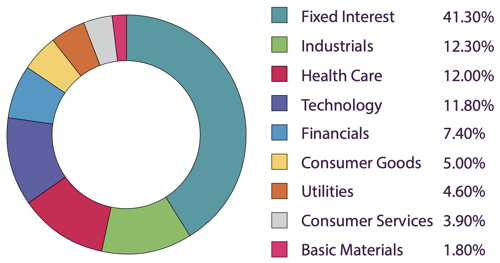

Royal London Sustainable Diversified Trust

Royal London Asset Management (RLAM) has been providing sustainable investment options since 2003, with their Sustainable Diversified fund one of their most popular and consistently strong performers. The fund is essentially a multi asset fund with a diverse spread of assets across multiple global regions.

The fund adopts a middle of the road 5 out of 10 (where 1 is the lowest risk and 10 the highest) approach to investment risk. The fund has had a comparatively difficult 6 months but over the past 1, 3 & 5 years it has consistently ranked among the top 25% of performers in its sector with returns of 9.96%, 28.31% and 63.04%.

Royal London Sustainable World Trust

This fund invests primarily in equities (up to a maximum of 85% of the fund), and some fixed interest securities. Similar to Royal London's other Sustainable funds, this fund is a mixed investment fund which invests in companies across numerous global regions and asset classes.

Since launch in September 2009 the fund has steadily grown in popularity with current assets under management now touching £2 billion. The funds strategy is primarily geared towards investing in technology and healthcare companies, which are two sectors that have performed strongly during the current covid climate. Indeed, this fund's primary holding is in Astrazeneca who are the company behind the recent Oxford led Covid19 vaccine.

Performance wise this fund has consistently fared well. Over the past 3 & 5 years it has been the number one ranked fund in its sector for growth with returns of 43.95% and 100.14% respectively.

Stewart Investors Asia Pacific Leaders Sustainability

The Stewart Investors Asia Pacific Leaders Sustainability fund invests in the shares of large and medium-sized companies that are either based in, or have significant operations in the Asia Pacific region including Australia and New Zealand, but excluding Japan.

Almost 35% of the funds holdings are in companies whose primary operations are in India. Specific consideration is given to companies that are positioned to benefit from, and contribute to, the sustainable development of the countries in which they operate.

The fund has consistently maintained a competitive performance history and over the past 1, 3 & 5 years it returned growth of 9.55%, 24.28% and 69.22% respectively.

Summary

The 10 funds featured in this report represent a selection of the consistently top quartile performing funds on the market that follow an ethical and sustainable investment approach. They represent, what we believe to be, some of the most notable ethical funds currently available but it is important to note that there are numerous other high quality ethical themed funds that offer exceptional value on the market.

In fact, 26% of the funds listed in Interactive Investors long list of ethical funds have consistently maintained top quartile performance within their investment sectors over the past 1, 3 & 5 years compared to less than 10% when all funds are taken into account. Ethical investing has come such a long way that not only does following an ethical investment approach no longer mean sacrificing returns but it is now statistically more likely to yield greater returns.