St James’s Place Wealth Management is the largest restricted wealth management firm in the UK with over 650,000 clients entrusting almost £100 Billion into their range of investment products.

Their investment products continue to come under scrutiny in relation to poor fund performance and high charges. Despite these difficulties, as a public listed company, SJP has enjoyed exponential growth year on year, with financial reports highlighting a continued annual rise in funds under management and profits. SJP's operating profits for 2018 exceeded the £1 billion mark, representing a rise of 9% from the previous year.

Although many St James's Place investment products rank at the bottom end of performance tables, their business continues to go from strength to strength. In this report, we compare the ten year performance of SJP's share price against the ten year performance of their own funds.

SJP Fees Help Fund Growth & Acquisition

St James’s Place provides a face to face wealth management service fronted by their team of partner advisers. As a restricted wealth management firm, SJP will only recommend and sell their own brand of products and investment funds. Many of these products have high upfront fees that generate large sums of initial revenue for the company. A proportion of their products also charge exit penalties which ensure high client retention and further ongoing fee revenue.

St James's Place charges and ongoing fee structure has enabled SJP to generate significant levels of initial and ongoing sales revenue. In turn, this has allowed them to acquire more advisory firms and associated client banks, increasing both partner numbers and client numbers year on year.

This strategy has been extremely effective for SJP PLC as a company, but questionable for the client, who is indirectly funding SJP growth and acquisitions.

High fees and revenue have allowed SJP to double their number of partner advisers in just 5-years to 3,954 and grow their client numbers to more than 650,000.

The exponential rise of St James’s Place Wealth Management has seen their funds under management reach £95.6 billion at the end of 2018, which represents a rise of 115% in just five years.

Share Price Performance Versus SJP Portfolios

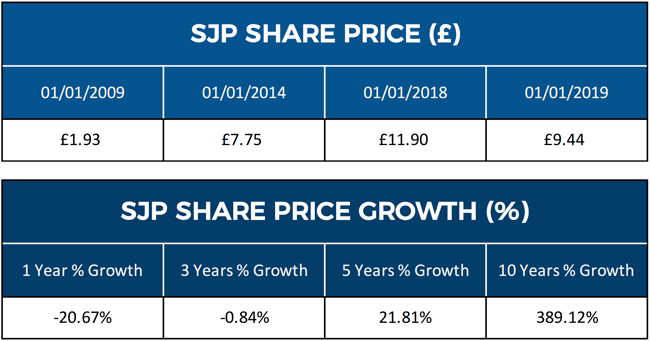

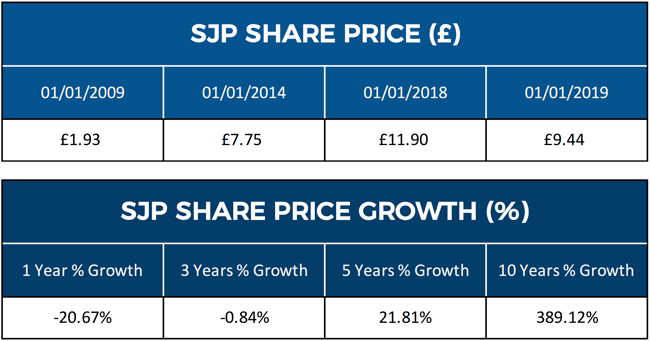

2018 was a disappointing year for a lot of investors. High volatility and political uncertainty saw markets plummet, resulting in many investors ending the year at a loss. SJPs share price was also hit as they finished the year down 20.67% from the previous year at £9.44 per share. Despite the drop in share value, SJP shareholders still saw their annual dividends increase by 12.5% from the previous year to 48.22 pence per share.

Looking at SJP's share prices over a wider time frame (as per the table below) you will see that their share price grew 21.28% over five years, and 389.12% over ten years.

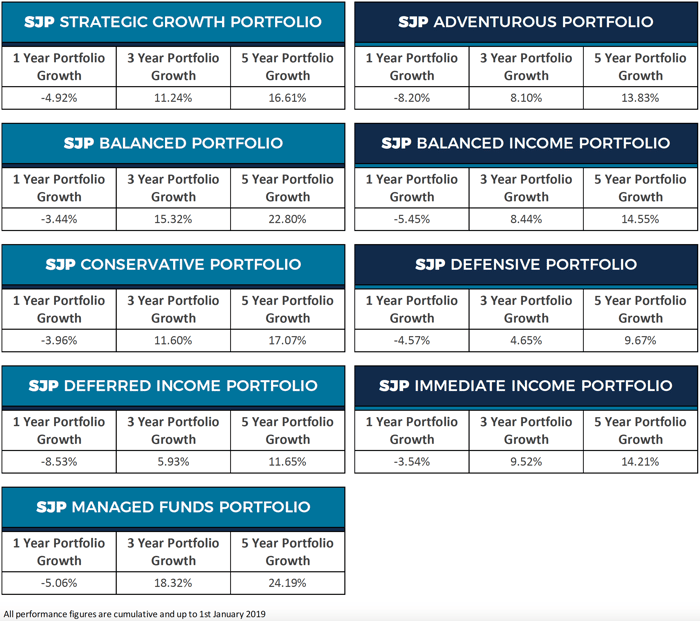

The tables below detail the performance of SJP's 9 investment portfolios, each containing a mix of SJP funds to suit the different risk and income needs of SJP clients. These 9 St James’s Place Investment Portfolios returned 5 year growth figures ranging from 9.67% (SJP Defensive Portfolio) up to 24.19% (Managed Portfolio). During the same period, SJP Shares grew by 21.81%, which was higher than 7 of SJPs 9 readymade unit trust portfolios.

Share Price Performance Versus Individual Funds

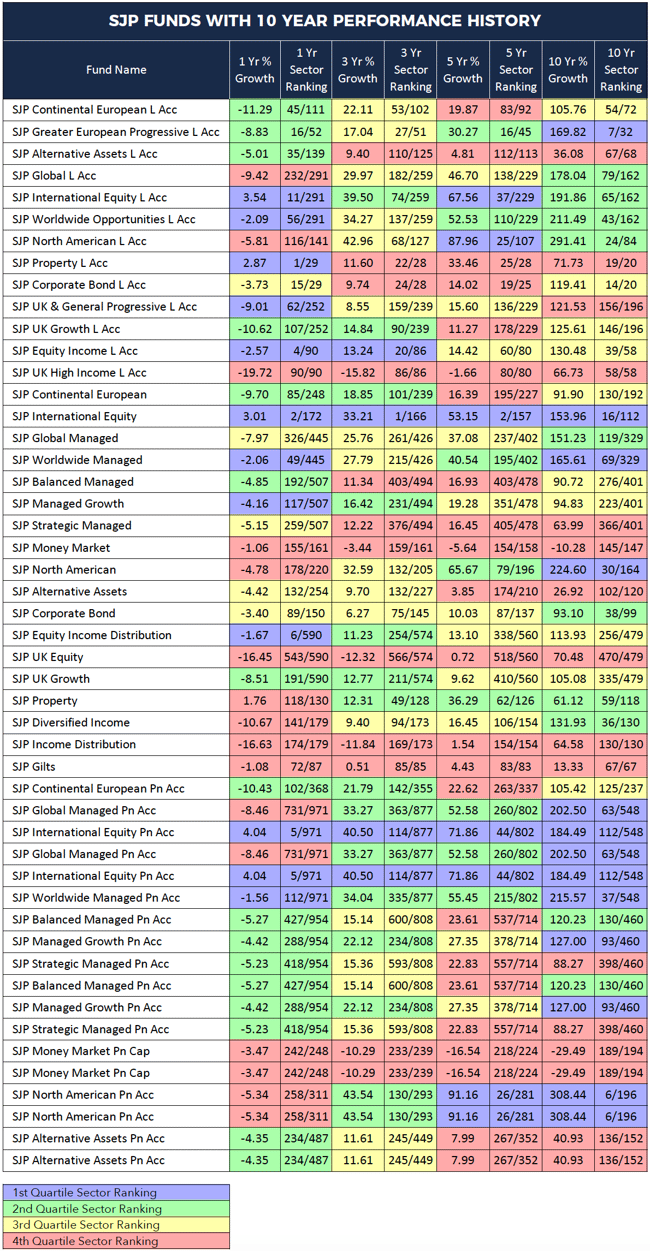

From the table below, you will see that the 10-year growth of all St James’s Place funds fell short of that enjoyed by their shareholders. Among their worst performing funds was the SJP UK High Income fund managed by external fund manager Neil Woodford. This fund manages more than £1.4 billion of client money. Over the past 10 years, it delivered growth of 66.73%, which was almost 6 times lower than the growth of SJPs shares. This fund has continually ranked last in its sector over the 1, 3, 5 & 10 year periods analysed.

The Future For St. James's Place

St James’s Place reputation and value proposition is regularly called into question with many investors criticising the performance of their funds and the cost of their service.

In our recent St James's Place review we identified that many SJP funds have struggled to compete with same sector funds, with only 1.8% managing to consistently rank in the top quartile of their sector for performance over the recent 1, 3 & 5-years.

As a public listed company SJP have continued to grow and gain greater market share, but with their share price performing better than 100% of their available investment funds over the last 10 year period, where does the value rest for the consumer investor?

Can SJP change to offer more value for their clients? Can they afford to change their existing distribution model and associated fees? With the increase in consumer information and the rise of financial technology can traditional distribution models like SJP continue to grow? Only time will tell!