- High charges and poor performance from St. James's Place Wealth Management.

- Over 50% of SJP funds rank in the worst 25% of their sector over the last 5 years.

- Over 72% of SJP funds perform worse than the benchmark.

- The SJP UK High Income & other SJP funds rank as the worst in their sector.

- Highest initial and ongoing charges

- Restrictive exit penalties for clients wishing to leave

St James's Place Wealth Management

St. James’s Place wealth management holds a 12% share of the UK investment market according to a 2018 study by business research company Plimsoll. Today, this figure is likely much higher.

Click Here To Access Our Latest St James's Place Review

They are the largest wealth management firm in the UK and currently manage more than £108 billion on behalf of 730,000 clients. Yet despite their size and continued corporate growth, their investment products have been identified as serial under-performers with their opaque and high-cost model identified as one of the most expensive in the industry.

Yodelar has completed a number of reviews of St James’s Place and their investment funds over the last 5 years, and have continued to highlight to our readers that a large proportion of their funds perform poorly when compared to all other same sector funds.

The restricted nature of their business model (only able to offer investors their own branded funds), hinders them from offering clients access to the top performing funds available from the better fund managers listed in our Fund Manager League Table, such as Baillie Gifford, Schroders and Legg Mason.

Many SJP clients have questioned SJP management in relation to the factual performance of their funds, SJP have replied saying they feel market assessments are unfair. However the reality is that the performance of their funds and their investment portfolios lag well behind the majority of their competitors.

Click Here To Download The Full St James’s Place Fund Performance Analysis

SJP argue that their products are competitive and research highlighted by ourselves and other quality whole of market advice firms take a biased approach when rating their funds.

SJP has communicated to customers that they feel a fund that is ranked in the top 60% (but not in the worst 40%) of a sector is a top performing fund. This means a fund doing worse than the sector average and ranked 59 out of 100 in their opinion is still a top performing fund.

Through our fund research platform 'Investor Hub', we provide consumer investors with the ability to review all funds in all sectors and rank accordingly to identify the top performing funds, i.e. funds that rank in the top 25% of their sector.

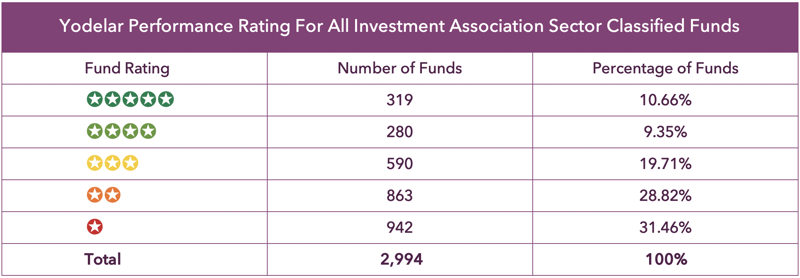

Of the 2,994 funds that have received a sector classification from industry trade body the Investment Association, 60% were rated by Yodelar as poor performing 1 or 2-star funds - which supports the general consensus that the majority of investment funds on the market are unable to beat the index benchmarks.

However, out of the 2,994 funds, there are approximately 600 funds that are able to maintain a top 25% performance ranking within their particular sector (4 & 5 star funds). Investors that are not restricted to firms such as St James's Place can therefore access these competent fund managers on behalf of their clients.

The below table shows the proportion of funds available to consumer investors and the proportion which have achieved certain star ratings, based on their sector performance.

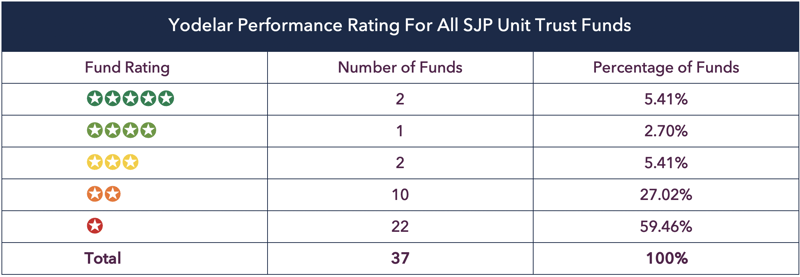

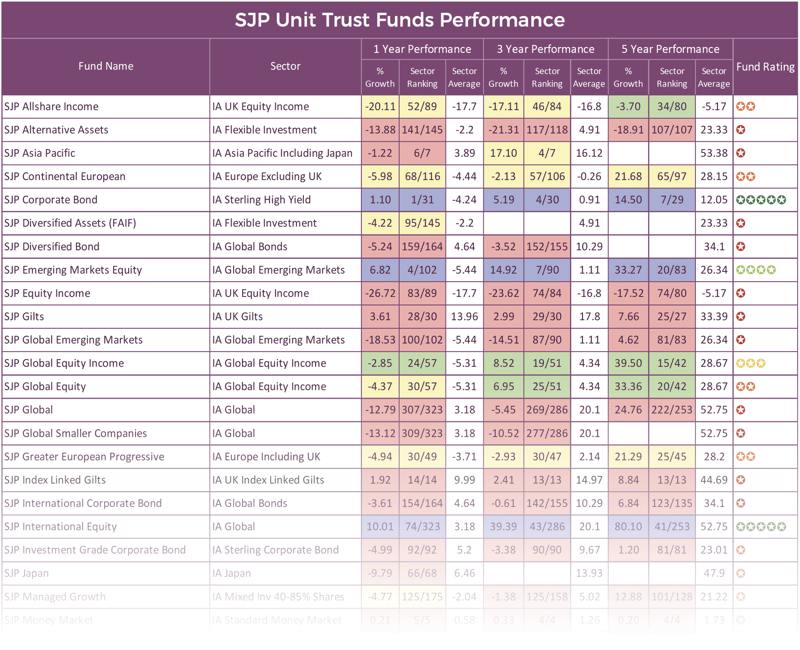

The above tables demonstrate that the majority of SJP unit trust funds have performed poorly with only 3 of SJP unit trust funds managing to outperform the majority of competing funds within their sectors over the past 1, 3 & 5 years.

Click Here to Find out How Yodelar Rate Funds

How we rate funds is completely transparent, unbiased and the same for all funds and fund managers (there are approximately 100 fund manager brands including St James's Place). The fact that a significant proportion of SJP funds fall within the 1 or 2-star rating is simply down to their lack of quality and consistent poor performance.

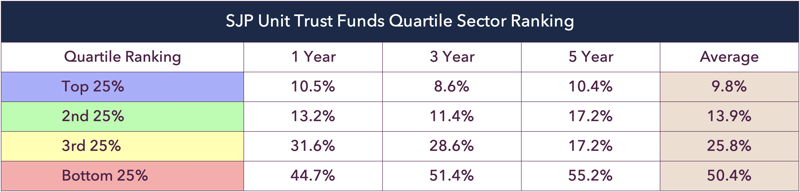

To eliminate any concern of rating bias, we removed our rating criteria and analysed how each SJP fund performed when compared alongside all other funds within their respective sectors over the past 1, 3 & 5 years, and focus on their quartile ranking.

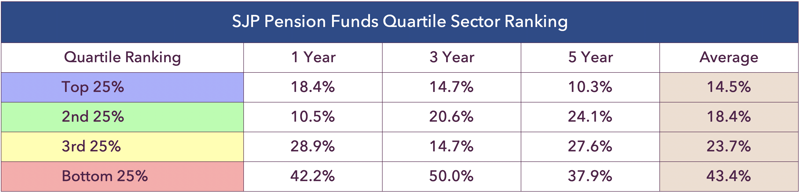

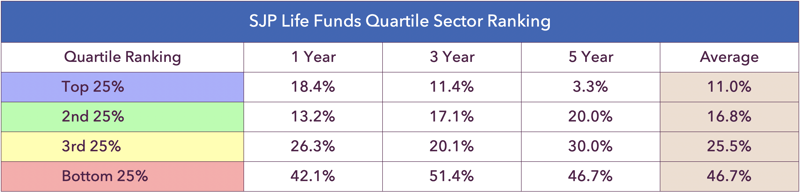

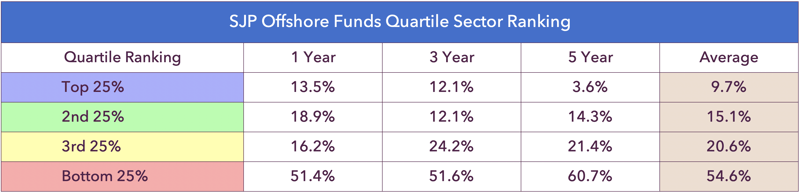

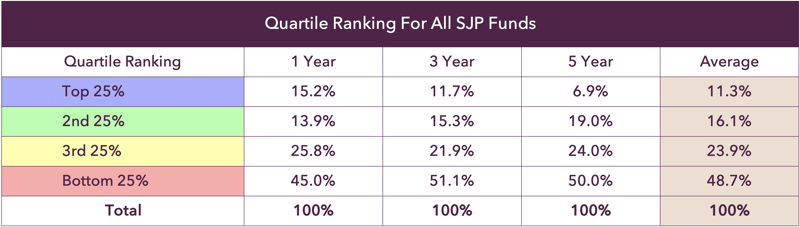

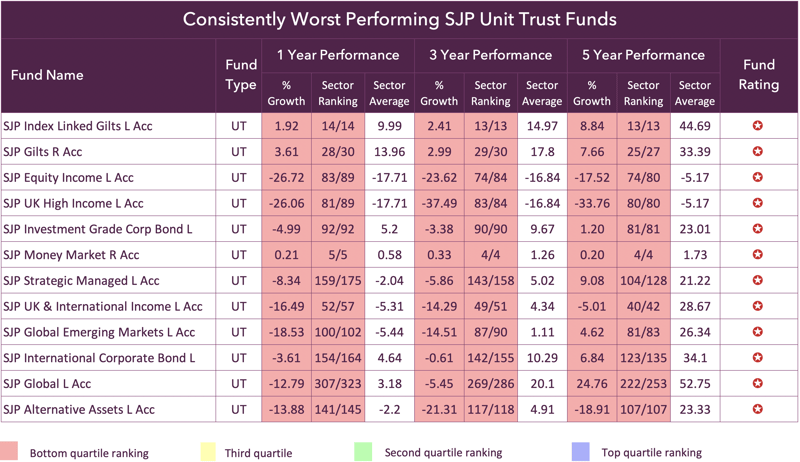

As identified in the tables below when compared alongside their sector peers a significant proportion of SJP funds fared poorly.

Over the past 1, 3 & 5 year periods 48.7% of SJP funds averaged in the bottom 25% of their sector with a further 23.9% ranking in the 3rd quartile, resulting in over 72% of their funds ranking in the worst 50% for performance.

Over the past 1, 3 & 5 years 72.6% of St. James’s Place funds performed worse than half of their peer funds within the same sectors. In contrast, just 11% of their funds returned a level of performance that ranked in the top quartile of their sectors.

St James's Place Portfolio Performance

SJP claims performance comparisons should not be made on their single funds but on their range of portfolios which its clients usually buy.

These portfolios are weighted based on their particular investment objectives and associated levels of risk.

As they are restricted SJP portfolios only consist of SJP funds, but as we identified in our fund performance analysis a large proportion of these funds have a history of poor performance, which will ultimately reflect in their portfolios end performance.

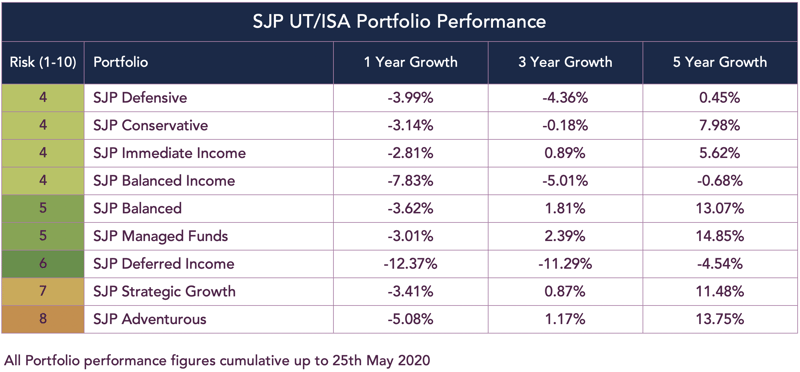

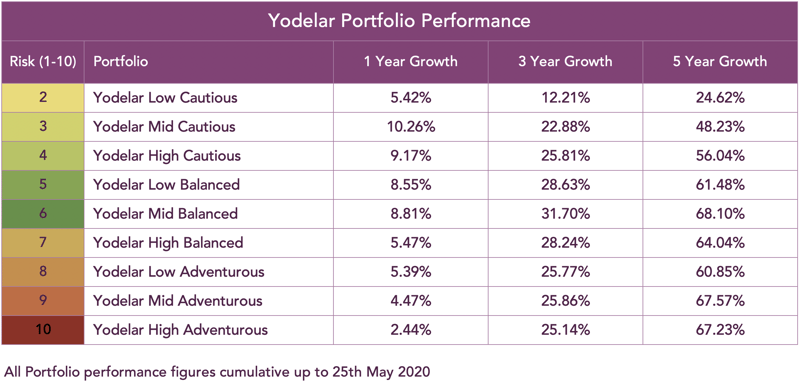

The following tables demonstrate the recent 1, 3 & 5-year returns of all nine SJP unit trust portfolios. To provide a comparison, we also include the returns of Yodelar Investment portfolios during the same period. Yodelar portfolios are composed of a mixture of active and passive funds that have been selected from an unbiased analysis of more than 70,000 funds and 100 different fund manager brands. Each fund within Yodelar portfolios have consistently ranked among the top performers in their respective sectors.

As identified in the analysis below each of the 9 SJP unit trust/ISA portfolios have returned cumulative losses for the past 12 months and over all 3 periods analysed they have achieved significantly lower returns than similar and lower risk Yodelar portfolios.

St James Place Fund Performance

In total, we analysed 151 St. James’s Place unit trust, pension, life and offshore funds for performance and sector ranking over the recent 1, 3 & 5 years and found that 104 performed below the sector average over the recent 12 months. Over 5 years it was worse as 76% of SJP funds with 5 years history returned 5 year growth that fell below the average for their sectors.

In contrast, just 31 of the 151 funds analysed managed to maintain a level of performance that ranked above at least 50% of same sector funds during the periods analysed.

Download the full report >>

The SJP Approach To Fund Management

SJP provides investors with an in-house range of products and portfolios that hold only SJP funds.

It is a complete business structure that keeps all fee revenue from advice fees to fund management fees in-house, boosting SJP’s revenue streams.

The main limitation of the SJP model is that their advisers must only recommend SJP products and funds meaning their investors are only exposed to SJP funds irrespective of how good, bad or indifferent they are. As a restricted advice firm they have no onus to provide clients with comparative performance from all other fund managers, unlike 'whole of market' or Independent advice firms.

To provide a diverse range of funds and portfolios that cater to all risk categories St. James’s Place offers access to 151 funds. These are made up of 37 unit trust funds, 35 pension funds, 42 life funds, and 37 offshore funds through SJP International (SJPI).

All of these funds are SJP owned and branded but none are actually managed by SJP themselves. Instead, SJP outsources the management of their funds to other fund management firms. These fund managers are selected by SJP’s investment committee and they are each mandated to build and run the fund in accordance with SJP’s objectives - such as the desired risk exposure and asset allocation.

In recent years SJP has publicly withdrawn fund manager mandates from Neil Woodford, AXA Framlington, Janus Henderson, Schroders and BlackRock as concerns grew over their performance and direction.

SJP’s switching of fund managers is not unique and although they believe their exclusive relationships with these fund management brands increases the quality and level of expertise the end result has persistently underwhelmed, with some of their funds continually languishing at the bottom of their sectors.

Under pressure from the regulator to evaluate funds SJP recently admitted that 50% of their UK funds do not offer good value as reported on CityWire.

Indeed, 32.7% of SJP funds with at least a 5-year history have returned cumulative losses over the past 5 years. See table below summarising SJP's worst performing funds, and detailing their sector ranking when compared to all other fund management brands.

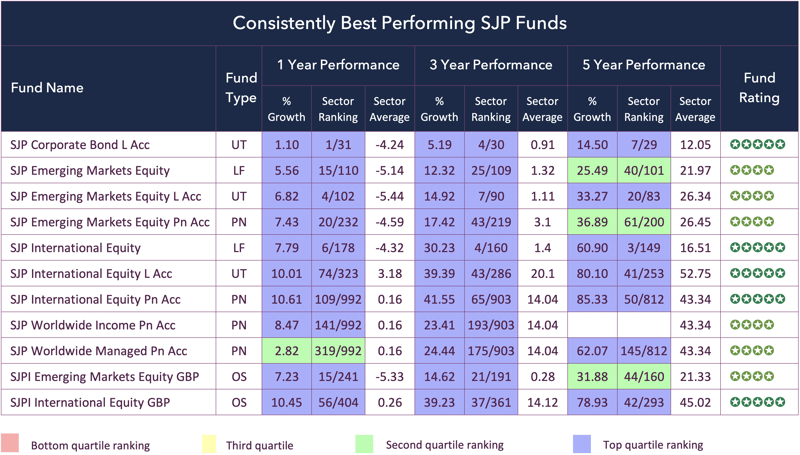

The Best Performing St James's Place Funds

Although their fund range is blighted by underperformance it is important to recognise the small proportion of their funds that have been competitive and consistently performed well. The table below shows the SJP funds that have performed the best within their respective sectors with the majority consistently outperforming two-thirds of their competitors over the periods analysed.

The SJP International Equity fund has been their strongest fund for comparative performance. This fund has a mid risk range and is managed by Hamish Douglass of Magellan. As identified in the table below it has consistently ranked among the elite performers in its sector over the 1, 3 & 5 year periods analysed.

St James's Place Charges and Fees

St James's Place charging model is unique and often criticised for its complexity. In January this year their recently appointed non-executive director, Helen Morrissey said

"I would like to satisfy myself that fund charges are transparent and fair, but I do not believe they are transparent because otherwise, I would be able to explain them to you very quickly."

Among the most contentious aspects of their fee model are the St James's Place exit penalties which they apply to their range of pension and bond products. Investors in these products who wish to exit and move their money to another provider are required to pay SJP up to 6% of their investment value to do so. SJP has been accused of using this penalty to secure control of clients' investments for several years as a means to increase their ongoing revenue.

This penalty reduces by 1% for each year the investor remains with SJP until after 6 years, at which point, exit penalties would no longer apply. However, there is a caveat, if you make changes to your SJP pension or bond portfolio by adding more funds for example, then this will automatically reset the exit penalty.

SJP's charges have been a regular source of contention and a report by The Sunday Times found their fees are even a concern to their advisers with a leaked call from St James’s Place managing director Ian Gascoigne identifying that some advisers want them to scrap their expensive fees, which have helped to pay for extravagant rewards from cufflinks to cruises which SJP had regularly awarded to their top selling advisers.

SJP’s Advice Fees Are Being Challenged

Similar to other advice networks SJP charge their clients an advice fee on top of fees associated with the funds and products they recommend.

However, the type of advice SJP provide and the type provided by an independent advisory firm is not the same. SJP is a restricted advice network and as such their advisers can only advise their clients on SJP branded products such as their own range of funds and investment portfolios. Therefore, SJP is unable to advise on 99.3% of the pension, life and unit trust market currently available to UK investors. This has led to concerns that SJP Partner Advisers are merely sales agents selling St. James’s Place funds and portfolios, with the majority of these demonstrating a poor performance history.

Some investors also believe that SJP’s restricted advice model means that their comparatively high advice fees are an unnecessary expense, and their relationship with SJP is transactional as opposed to an advisory one. Yet SJP’s 4.5% upfront advice charge remains one of the highest in the industry, and well above the 2.06% industry average that was established from a survey carried out by VouchedFor of 423 advisers from 263 firms.

St James's Place Fund Charges

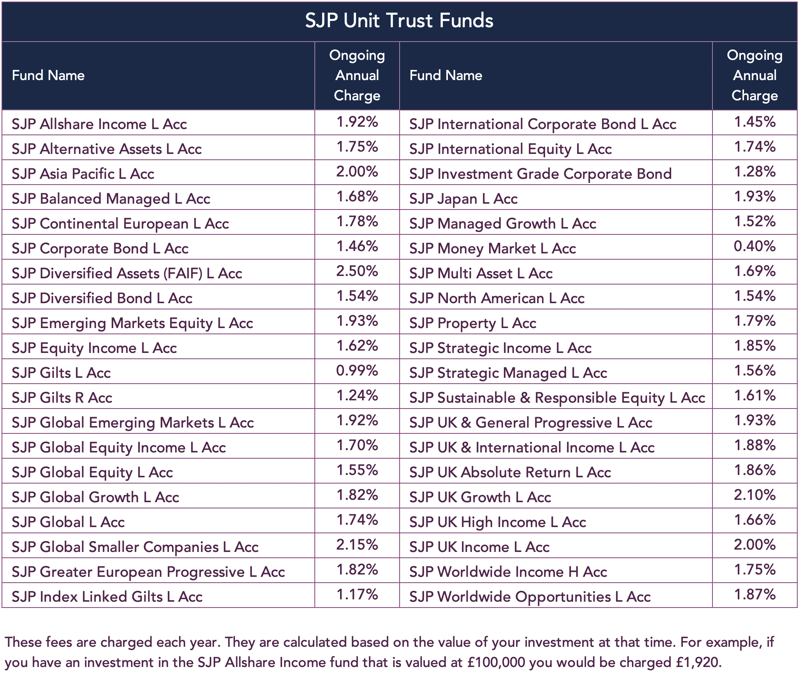

There are almost 3,000 unit trust funds available to UK investors and on average their annual ongoing charge comes to 1.01% of the value of your investment in that fund.

The table below shows the current annual ongoing charges associated with each St. James's Place unit trust fund. As detailed below these fees can reach as high as 2.5% per annum, with the average sitting at 1.69%, which is almost 70% higher than the industry average.

SJP advise that these ongoing charges cover all aspects of operating each individual fund during the year, including fees paid for investment management, administration and ongoing advice.

SJP Performance Fees

SJP also apply a performance fee to their UK Absolute Return Unit Trust fund. On this fund, a performance fee of 20% of any outperformance becomes payable if the fund outperforms the 3 month Sterling LIBOR benchmark, even though the annual fund charge is 1.86%.

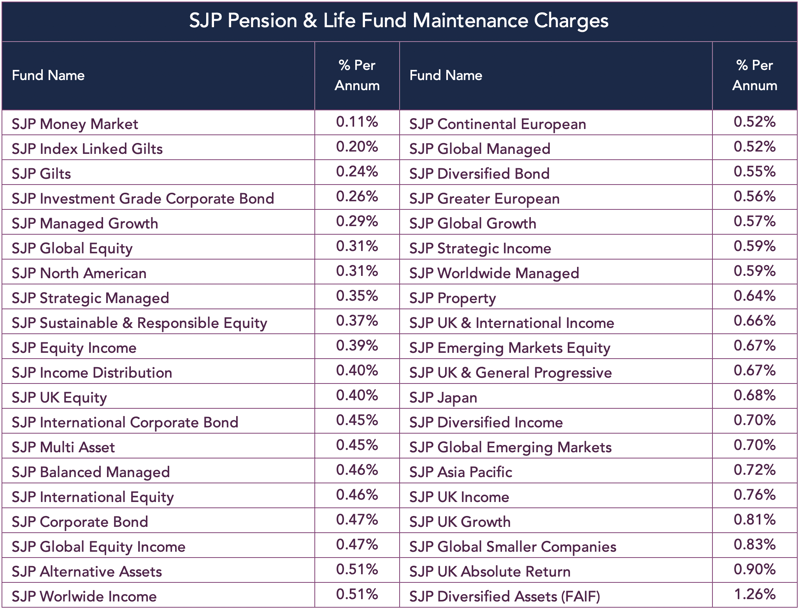

SJP Maintenance Charges

Included in St. James's Place pension and bond products there is an ongoing charge of 0.5% which is to fund the ongoing advice and relationship with their partner advisers.

In addition to this, they also apply an annual maintenance charge, which they say is to fund the management and maintenance of your underlying investments.

Coronavirus Hit SJP Clients Harder

2020 has been a challenging year for investors. The outbreak of the coronavirus pandemic and the subsequent lockdown has impacted almost all industries with many completely grinding to a halt. In March, investment markets tumbled at a rate not seen since the 2008 crash and although they steadied almost all investment funds and portfolios were negatively impacted. But some were hit harder than others, with performance data showing that the investment funds with historically poor performance fared worse than those with a statistically better performance record.

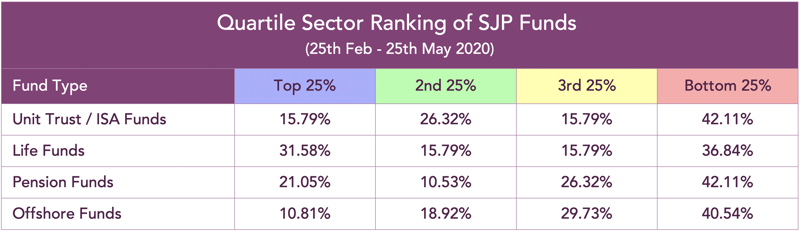

To assess how St. James’s Place funds performed during the turbulence of recent months we analysed each of their performance over the 3 month period (up to 25th May 2020). This analysis identified that the majority of SJP funds continued to maintain a level of performance that was below the sector average with many experiencing greater losses than the majority of their competitors.

Based on the above analysis, in the 3 month period up to 25th May 2020, 62.3% of SJP funds performed worse than at least half of all other funds in the same sectors.

Business Growth Over Client Growth

SJP’s strategy has been to grow and grow fast. They see the future of the wealth management industry as one that is dominated by a few large firms with smaller, independent practices becoming obsolete. More advisers mean more clients and more clients mean more funds under management and a higher market share.

When an advice practice is bought over by SJP the assets of their clients are also typically moved to SJP thus boosting their funds under management and increasing their fee income. Although the decision to move to SJP is not one the clients of an acquired firm have proactively sought, the scale of SJP, the size of their client bank, adviser numbers and market share make the move one that inherited clients are typically comfortable with.

Risk - FSCS Protection Problem With One Provider

One of the main risks of investing with SJP is the fact you have all your eggs in one basket. St James's Place is one provider. The Governments Financial Services Compensation Scheme protects investors up to the value of £85,000 per provider.

Many investors are unaware that they are only protected up to £85,000 as an SJP client, where as a good whole of market independent adviser will ensure you diversify across multiple providers to maximise your government protection. £850k invested across 10 fund manager brands allows an investor to have maximum protection under the FSCS.

Suggest Article - Why Your Investments May Not be Fully Protected

Better To Buy SJP Shares Than SJP Investments?

Many investors have stated that they wish they had invested in St James’s Place Shares instead of their funds. Their high charges, cash flow and high profitability have allowed SJP to acquire more financial advice firms than any other firm in the UK, with SJP clients indirectly footing the bill.

As a distribution model, SJP has been able to acquire IFA practices faster and more aggressively than any other firm in the UK. Their ability to extract large chunks of cash from client investments as initial fees and ongoing charges has allowed them to acquire a large number of advisory firms and associated client banks.

SJP offers large upfront payments to advisory firms as an incentive to join and become a St James's Place partner. Once onboard newly recruited advisers will transfer their client's investments across to SJP portfolios and funds. The associated upfront fees are again generated, creating more SJP sales revenue to acquire more firms. This strategy has been extremely effective for SJP Wealth Management, but questionable for the client, who is indirectly funding further SJP acquisitions and growth.

Their model has been shunned by other IFA's as the "Road to Nowhere".

Is SJP Out of Touch With Investors?

In an age where investment information is more accessible, investors are beginning to look beyond the perceived security from investing with large corporate firms and factor in performance, quality and value when making decisions. They are also more savvy in regards to risk and the issues around relying on one provider only.

Among the factors to drive investment decisions is protection, which is even more prevalent on the back of the high profile collapse of Neil Woodford. As a result, the government's Financial Services Compensation Scheme (FSCS) and the protection it provides to investors has become a more important factor in the decision-making process of investors. As mentioned, this scheme protects investors up to a maximum of £85k per provider, which makes it riskier for investors who rely on one provider such as St James’s Place.

A diverse portfolio using the best brands in the various sectors allows investors to have a diverse portfolio with more protection from the Government's Financial Services Compensation scheme. Many SJP investors are unaware of this, and should the worst ever happen to SJP, many investors will have serious issues.

Today, it is much easier to access real information such as performance and ranking data which in the past was the biggest challenge to the traditional decision-making process of investors. This is diluting the authority of referrals, recommendations and adviser relationships, and it poses one of the biggest threats to wealth management firms such as St James's Place, whose restrictive model is becoming increasingly less appealing.

With relevant information available Investors are now better equipped to make informed decisions that are driven by a desire to invest efficiently using the better performing fund managers for improved outcomes. We welcome the fact that investors are spending more time assessing the performance and quality of funds & investment products.

SJP’s business model is focused on complete ownership of their client journey and generating multiple revenue streams from each client.

Although highly profitable, SJP’s business model has been accused of being outdated in the new information age. The performance of their funds has consistently been poor and a principal reason why a growing number of informed investors are moving providers. But it is their high, opaque charging structure that for years has been the most publicised topic of contention.

An increase in investor knowledge has encouraged many investors to move away from SJP, towards lower cost better performing alternatives, who place clients at the centre of their value proposition.

For many investors, their model is overly expensive and according to Milena Mileva, a fund manager with Baillie Gifford, widely viewed as one of the best fund management firms in the UK, the fees charged by SJP were “very very high” across the entire chain, adding they “had to change”.

Despite accusations of being out of touch with investors SJP have recently said they have no plans to review its charging structure, nor do they believe that their fund performance is cause for any concern. But the fact is investor decisions are now being driven by these very factors, and as identified in this report, all but a select few of SJP funds have consistently underdelivered, which makes their long term investment proposition one that is distinctly less appealing.