Scottish Widows was established more than 200 years ago with the purpose of setting up ‘a general fund for securing the provisions to widows, sisters and other females’. Now more than 6 million customers use their vast range of products that include life cover, critical illness, income protection, pensions, annuities and savings and investment products.

Their distinctive marketing and advertising campaigns have helped them to become one of the most recognisable and trusted financial institutions in the UK. And according to a research report from Hall & Partners, they were the pension provider UK consumers would be most happy to deal with.

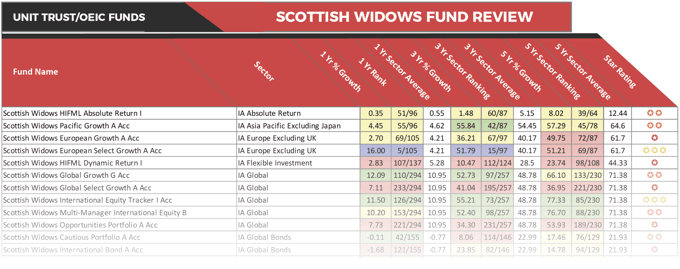

Currently, UK consumers entrust Billions of pounds of their savings in Scottish Widow’s extensive range of investment and insurance products. But how competitive are these investments? To find out, we analysed the 1, 3 & 5-year performance and sector ranking for all 554 Scottish Widow funds and as identified in this report, more than 61% received a poor 1 or 2-star performance rating with the performance of some of their funds among the very worst in their sectors.

Deal Sees Aberdeen Receive £130 Million per Year To Manage Scottish Widow Funds

In 2000 Scottish Widows demutualised and in 2009 they became part of the Lloyds Banking Group where they were merged with Clerical Medical.

In 2015 Lloyds banking group sold Scottish Widows Investment Partnership to Aberdeen Asset Management in a deal reported to be worth £660 million. However, this deal did not include Scottish Widows, the groups' life, pensions and investment business.

However, as part of the deal, Lloyds gave Aberdeen a highly lucrative mandate, reportedly worth £130 million a year, to manage their extensive range of Scottish Widow funds, which held some £109 billion of client money.

About This Review

For our Scottish Widows fund review we analysed each of their funds for cumulative growth over the recent 1, 3 & 5year period up to 1st August 2018, and compared this growth to all other similar funds that compete within the same sectors. This analysis identified that 66 of the 554 funds reviewed received a high 4 or 5-star performance rating by consistently outperforming 75% of competing funds. However, 338 or 61% of Scottish Widows funds consistently performed worse than their peers and received a poor performing 1 – 2-star performance rating.

The Best Scottish Widows Funds

From their range of 62 unit trust funds, only 38 have sector classification. Our performance analysis for these 38 funds identified that none had been able to achieve top quartile growth within their sectors consistently over the recent 1, 3 & 5-year period. The only 4- star rated Scottish Widows unit trust fund was the Scottish Widows HIFML UK Property fund. This property fund currently has £437 million of client funds under management, and over the recent one year period, it ranked 2nd in its sector for performance by returning growth of 12.55%. To provide a comparison, the average growth of all other competing property funds within the same sector was less than half at 5.6%. Over the longer term, this fund has maintained its competitive performance with 5-year cumulative growth of 68.88%, which was considerably higher than the 44.56% sector average, and better than 91% of competing funds.

The Best Scottish Widows Pension Funds

For this analysis, we reviewed the performance of 293 Scottish Widows pension funds (there are 297 Scottish Widows pension funds, but four funds had insufficient performance history). This analysis identified that just over 11% maintained a high level of performance in comparison to their peers and received a very good 4 or 5-star performance rating. Among the best performing Scottish Widows pension funds was the Scottish Widows Pension Portfolio One Pension Series 2 fund. This fund currently has more than £1.6 billion of client funds under management, and with a risk profile of 7, it is a fund that is more suitable for adventurous investors with a relatively high-risk tolerance. Over the recent 12 months, this fund returned growth of 6.92%, which was notably higher than the sector average of 3.69% and better than 83% of all other same sector funds. Over the recent 1, 3 & 5-year periods this fund has consistently outperformed the sector average and ranked among the best 25% of funds in its sector.

The Best Scottish Widows Life Funds

Scottish Widows are one of the largest suppliers of Life funds in the UK with just under 200 available to UK consumers. Our analysis of these funds identified that some of the strongest performers were from funds that were managed by third-party fund managers such as Schroders and Baillie Gifford. For example, the Clerical Medical Schroder Monthly Income fund is currently managed by Michael Scott of Schroders. Over the recent five year period this life fund returned growth of 32.51%, which was the 2nd highest in its entire sector.

Another Life fund managed by an external fund manager is the Scottish Widows BlackRock UK fund. This life fund is managed by Nick Little, who is a member of BlackRock’s UK Specialist Equity fund, and over the recent 12-months, it returned growth of 14.75%, which ranked 6th out of 600 funds in its sector. Over 5-years its performance has also been very impressive with its 5-year growth of 54.02% outperforming 94% of its peers.

One of the best performing Life funds under the management of Scottish Widows is their Defensive Managed fund. This fund primarily invests in bonds and sits within the LF Mixed Investment 0-35% Shares sector along with 103 competing funds that have at least 5-years performance history, With cumulative growth of 28.31% over the recent 5-year period this fund outperformed some 95% of all other funds in the same sector. Over the short term, this funds’ performance has also been strong with recent 1-year growth of 2.35% ranking higher than 89% of its peers.

Access the full report in the August 2018 edition of the Yodelar Magazine

61% of Scottish Widows Funds Have Consistently Underperformed

Despite their size and market share, Scottish Widows and a significant proportion of their funds have simply underperformed.

In our fund manager league table, we analysed 98 fund managers and provided a ranking to each based on the performance of their unit trust funds. In our most recent league table, Scottish Widows ranked a lowly 97th, with only St. James’s Place ranking lower.

One of their most disappointing funds was the Scottish Widows Corporate Bond fund, which has a sizeable £3.6 billion of client funds under management. This popular fund has continually underperformed, and over the recent 12 months, it returned negative growth of -1.52%, which was the worst of all 87 funds in its sector.

Another poor performer was the Scottish Widows Gilt fund which holds some £3 billion of client funds. This fund returned 5-year growth of 18.32% over the recent 5-year period, which was worse than 91% of its peers, and over the last 12-months, it ranked 23rd out of 26 same sector funds with negative growth of -0.35%.

From their pension fund range, 63% ranked among the worst performing funds in their sectors. One such fund was the Scottish Widows High Income Bond Pension. This serial under-performer has continually ranked among the worst funds in its sector for growth, and over the recent 5-year period its cumulative growth was the worst in its sector.

What does the future hold for Scottish Widows?

The widespread underperformance of a significant proportion of Scottish Widows funds has not gone unnoticed with questions raised as to the quality of the fund managers.

However, the recent merger between Aberdeen Asset Management and Standard Life has not gone down well at Lloyds. They believe this 2017 merger has made them a material competitor and therefore they have announced their intent to end their relationship and withdraw Aberdeen’s mandate to manage their funds.

A number of investment houses including BlackRock and Schroders are understood to be in the running to take over management of those assets, although Standard Life Aberdeen made it clear in May that it would not give up the mandate without a fight.

What this means for investors in Scottish Widows funds is still unclear, but based on the performance of their funds, a change in management may not be a bad thing for investors.

Access more reports featuring Scottish Widows >>