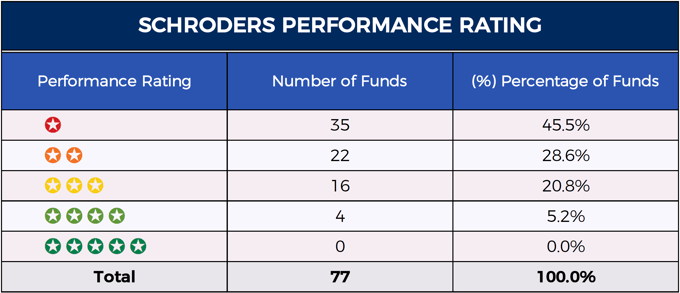

- 74% of Schroders funds received a poor 1 or 2 star performance rating for consistently performing worse than at least half of their peers.

- The Schroder UK Opportunities fund ranked 215th out of 229 funds in the UK All Companies sector with 5-year growth of 15.56% compared to the 36.05% sector average.

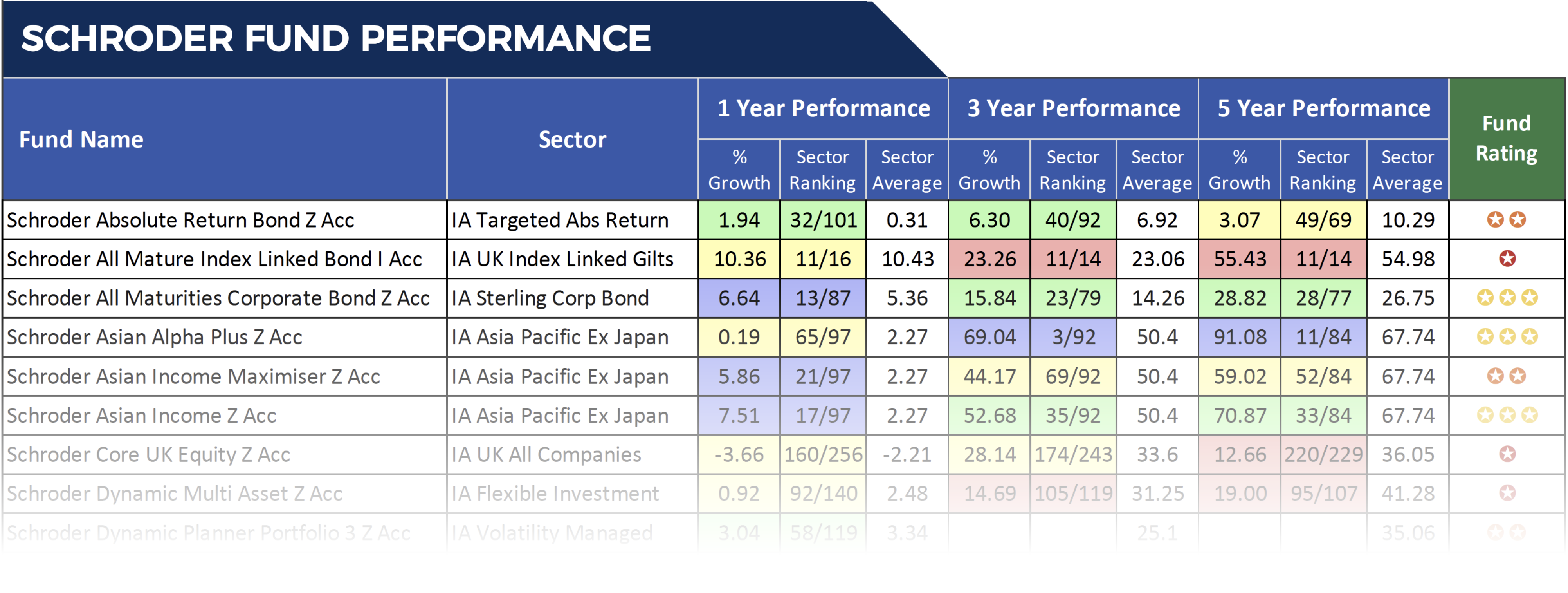

- Over the past 1, 3 & 5 years the Schroder Long Dated Corporate Bond has consistently been the top performing fund in the IA Sterling Corporate Bond sector.

Schroders is a global asset manager with more than 5,000 employees across six continents. They are currently responsible for more than £421 billion of client money. They have extensive investment resources and currently manage a range of 71 unit trust & OEIC funds and 6 Investment Trusts which have become some of the most popular choices for UK investors.

To identify how competitive their range of funds and investment trusts are, we analysed the performance of each fund over the recent 1, 3 & 5 years alongside all other competing same sector funds.

Schroders Performance

We compared the performance of Schroder’s 71 unit trust & OEIC funds and 6 investment trusts alongside the performance of their peers over the 1, 3 & 5 year period up to 1st July 2019.

This analysis identified that during the periods analysed, only 2 of Schroders funds consistently outperformed at least 75% of same sector funds, and 45.5% of their investment funds consistently ranking in the bottom quartile (worst 25% of funds within their sector).

Amongst the funds that have struggled to compete in recent years was their celebrated range of Maximiser funds.

Schroder’s Maximiser Funds

In 2005, Schroders launched the first of a new range of funds called Maximiser funds. Schroders’ Maximiser strategy aims to deliver a sustainable high level of income from a stock-market based investment, and the range has proven popular with UK investors.

Schroder Income Maximiser

There are 3 Maximiser funds, the largest of which is the Schroder Income Maximiser fund, which was also the first to launch in November 2005. This fund currently manages £1.2 billion of client assets and its objective is to deliver a target income of 7% per year for investors by investing at least 80% in shares of UK companies.

The fund is heavily weighted in financial services companies with holdings in HSBC, Aviva and Standard Chartered, but it also has holdings in consumer services brands such as Morrisons and Tesco’s.

Over the recent 5-years, the Schroder Income Maximiser fund returned growth of 29.00%, which ranked the fund 44th out of 78 funds and was lower than the 29.87% sector average for the period.

In the most recent 12 months the fund return losses of -3.85%, which was worse than 61% of same sector funds.

In comparison, the Neptune Income fund, which is also classified within the IA UK Equity Income sector, returned growth for the same 1, 3 & 5 year periods of 5.71%, 46.74% and 51.75%.

Over the recent 1, 3 & 5-year periods the performance of the Schroder Income Maximiser fund has been disappointing. But since its launch in November 2005 up to 1st July 2019, it has returned cumulative growth of 150.79% compared to the 122.22% sector average for the period, supporting Schroders recommendation that this fund is only suitable for investors who are prepared to whether market movements and hold their money in the fund for the long haul.

Schroder Asian Income Maximiser

The second Maximiser fund launched by Schroders was their Asian Income Maximiser fund, which has amassed funds under management of over £407 million since it launched in June 2010.

The fund aims to provide income and capital growth by investing at least 80% of its assets in Asian equities (excluding Japan) which Schroders believe have good long-term income and capital growth potential. Since its launch, this fund has returned growth of 124.80%, which was better than the sector average of 113.98%.

Over the past 5 years this fund has struggled. Its growth of 59.02% fell below the 67.74% sector average, and it was lower than 62% of same sector funds. In recent months the fund has performed much better with growth of 5.86% over the past 12 months ranking better than 79% of its rivals.

Schroder US Equity Income Maximiser

The most recent of the Maximiser range of funds is the Schroder US Equity Income Maximiser fund which launched in April 2017. The fund currently manages a comparatively modest £110.93 million of client assets and it is classified within the highly competitive IA North America sector. The strategy of this fund is to invest at least 80% of its assets in a passively managed portfolio from the top 500 listed US companies by market capitalisation.

Since its launch over 3 years ago up to 1st July 2019 it has returned growth of 23.84%, which was below the 28.26% sector average. Over the past 12 months it has ranked within the bottom 50% of funds in the IA North America sector with growth of 11.35%.

Download and access the full Schroders review now >>

The Best Schroder Funds

Over the recent 1, 3 & 5 years the Schroder Long Dated Corporate Bond fund has been an exceptional fund, and one of Schroders strongest performers. During these periods the fund returned growth of 11.44%, 25.39%, and 54.25%, which was higher than every other fund in the IA Sterling Corporate Bond sector. In contrast, the average returns within this sector over the same periods was 5.36%, 14.26% and 26.75% respectively.

Another fund to perform well was the Schroder Global Emerging Markets fund. This fund currently manages £943 million of client assets, and as the name suggests, it is an emerging markets fund classified within the IA Emerging Markets sector.

The fund invests at least 80% of its assets in equities of emerging market companies worldwide but currently it is primarily weighted in Asia Pacific and South Korean Equities. Over the past 5 years this fund has returned growth of 62.75%, which was above the sector average of 51.35% and better than three quarters of competing emerging market funds.

The £350 million Schroder Sterling Corporate Bond fund has also performed consistently better than at least 75% of competing same sector funds over each of the three periods analysed.

The fund invests at least 80% of its assets in bonds denominated in sterling (or in other currencies and hedged back into sterling) issued by UK companies and companies worldwide.

Over the recent 12 months the fund outperformed 93% of same sector funds with growth of 8.06% compared to a sector average of 5.36%. The fund also outperformed the majority of competing funds over the last 3 & 5 years with growth returns of 21.76% & 34.47% respectively.

Underperforming Schroder Funds

From the 77 funds and Investment Trusts analysed, 74% consistently performed worse than at least half of their competitors. Among the worst underperformers was the £150 million Schroder UK Opportunities fund which consistently ranked among the worst in its sector.

Over the recent 5 year period this fund returned growth of 15.56%, which was less than half the sector average and worse than 94% of competing funds within the IA UK All Companies sector. In the recent 12 months the fund returned losses of -6.87% which ranked the fund 210th out of 256 funds.

The Schroder MM Diversity Income fund was another fund managed by Schroders that has struggled for performance in comparison to other same sector funds. Since its launch in 2010 the Schroder MM Diversity Income fund has performed below the sector average. Over the past 5-years this fund returned growth of 15.27%, which fell well short of the 27.38% sector average and was worse than 97% of same sector funds. Over the recent 12 months this fund has not performed much better as its growth of 0.61% was not even a quarter of the sector average for this period.

Schroders Investment Trusts

Schroders are also a strong proponent of Investment Trusts, which they promote as “one of the investment world’s best kept secrets”. Schroders currently have a range of 6 investment trusts which vary in strategy and invest in a range of UK, Asia and real estate sectors.

Schroder Asian Total Return Investment Company

The Schroder Asian Total Return Investment Company is an investment trust that launched in 1987 and currently has a market value of £363 million. The objective of this investment trust it to achieve a high rate of total return primarily through investment in equity and equity-related securities in Asia Pacific companies (excluding Japan).

Over the past 5-years this fund returned growth of 126.93%, which was the highest performing funds in its sector.

Schroder Asia Pacific

Sitting alongside the Schroder Asian Total Return Investment Company in the IT Asia Pacific sector is the Schroder Asia Pacific investment trust. With a market value of £785 million this fund has been a more popular choice for investors but it has consistently performed worse than the Schroder Asian Total Return I.T.

Over the past 1, 3 & 5 years this fund returned growth of 0.85%, 74.44% and 96.05%, which although better than the sector average they were below that of its sister fund.

Schroder Income Growth

The principal investment objectives of this investment trust is to provide real growth of income, or growth of income in excess of the rate of inflation, and capital growth as a consequence of the rising income. It is a UK focused fund with 1005 of its holdings in UK based companies which include Royal Dutch Shell, Glaxo Smith Kline, BP and Lloyds.

The IT UK Equity Income sector is a competitive sector which includes some of the most popular investment trusts in the UK. Over the recent 1, 3 & 5years the Schroder Income Growth IT managed to deliver moderately competitive returns of -0.61%, 31.74% and 30.45%. However, compared to the popular Finsbury Growth & Income IT, which has consistently been the top performer in that sector, its returns are small. Over the same 1, 3 & 5-year period the Finsbury Growth & Income IT returned growth of 13.93%, 63.91% and 94.80% respectively.

Schroder Japan Growth

The Schroder Japan Growth Investment Trusts principal investment objective is to achieve capital growth from an actively managed portfolio principally comprising securities listed on the Japanese stock markets.

This I.T is classified within the small and volatile IT Japan sector where it has consistently been one of the worst performers. Over the past 12 months this fund returned significant losses of -12.55%, and although all other competing funds returned losses for the period the Schroder Japan Growth trust sustained the largest.

Over the recent 5-year period this investment trust returned growth of 62.47%, which was the 2nd lowest in the sector and almost half that of the 120.44% returned by Baillie Gifford Japan IT.

Schroder Oriental Income

Launched in July 2005, the Schroder Oriental Income IT is classified within the IT Asia Pacific Income sector where its objective is to provide a total return for investors primarily through investments in companies which are based in, or which derive a significant proportion of their revenues from the Asia Pacific region.

Over the 1, 3 & 5 year periods analysed the Schroder Oriental Income Investment Trust has returned growth of 10.43%, 53.04% and 71.91% which were comparatively modest returns for a higher risk sector which saw the JP Morgan Asian IT, which is within the same sector, return growth of 10.36%, 87.95% and 109.62% over the same period.

Schroder UK Mid Cap

The Schroder UK Mid Cap Investment Trust aims to invest in financially strong medium-sized companies across the UK that they feel can offer higher long term returns than their larger counterparts.

Since its launch in July 1995 the Schroder UK Mid Cap IT has returned cumulative growth of 533.45% compared to the 496.27% sector average. However, over the recent 5 years its growth of 30.68% fell below the sector average of 37.31%.

Schroders Fund Review

Schroders manage some of the most popular funds in the UK. Their range of unit trust and OEIC funds hold £35 billion of client assets, yet despite their popularity, our analysis identified that a large proportion of Schroder funds have consistently performed below the sector average and worse than the majority of their competitors.

We also identified the proportion of Schroders funds that have continued to deliver excellent performance on a consistent basis. This selection of consistently top performing funds may make up a small percentage of their overall fund range, but they represent some of the top performers in their sectors and have demonstrated their quality on a consistent basis.

Over the recent 5 year period, the majority of Schroder funds analysed have struggled to compete with same sector funds. Although most of their funds ranked below their peers over the 1, 3 & 5 year periods analysed, many have outperformed the sector average since their inception.

Schroders recommend that only investors who are willing to invest for the long haul and ride out potentially long periods of underperformance should consider investing in their funds. For investors who fit this profile, investing with Schroders could still be the most suitable option.