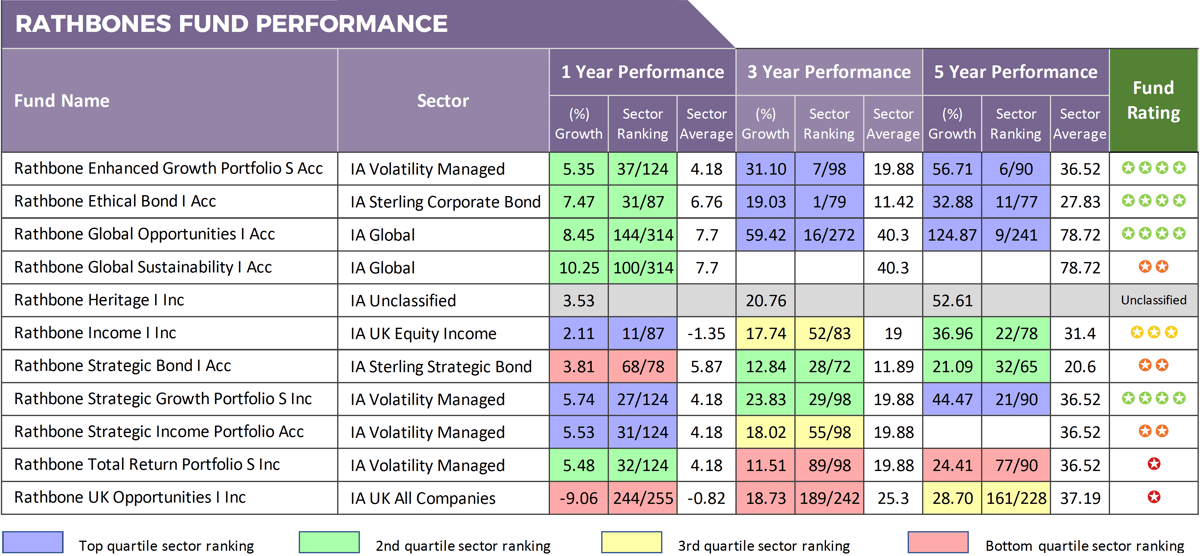

- Over the past 3 years the Rathbone Ethical bond fund ranked 1st out of 79 funds in its sector with growth of 19.03%.

- The Rathbone Global Opportunities fund returned growth of 124.87% over the past 5 years which was higher than 96% of competitors.

- 75% of Rathbones sector classified funds with at least 5 years history have delivered 5 year returns that were better than at least half of their peers.

Rathbones has evolved from family business into an independent FTSE 250 public company that is responsible for managing £5.5 billion of client assets in their modest range of unit trust and OEIC funds.

Although small in stature compared to many of their rivals, Rathbones have established a reputation as a provider and manager of some of the top funds on the market.

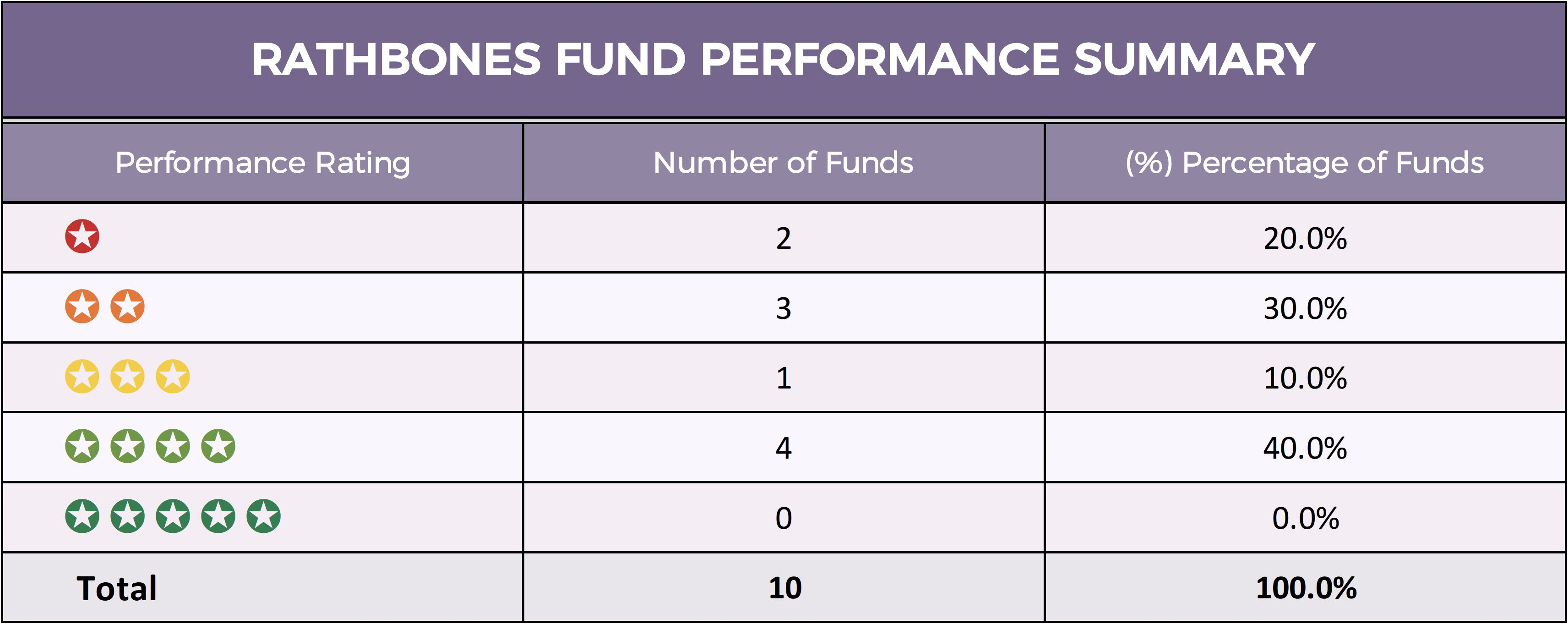

For this review we analysed the performance and sector ranking for each of their range of funds and identify that some 40% of their funds have indeed consistently ranked among the best in their sector for performance.

Rathbones Fund Performance

Rathbones manage a relatively small selection of funds some of which have struggled to maintain competitive performance within their sectors whereas others have a history of consistent strong performance.

8 of Rathbones 10 sector classified funds have at least 5 years performance history, 4 of which have consistently outperformed at least half of their peers during the recent 1, & 3 years, while over 5 years, each of these 4 funds returned top quartile growth.

The Best Rathbone Funds

Our analysis identified 4 Rathbone funds to have maintained competitive performance during the 1, 3 & 5 year periods analysed. Combined, these 4 funds manage £3.7 billion of client assets, which is almost 67% of the total assets under their management.

Rathbone Enhanced Growth Portfolio

The Rathbone Enhanced Growth Portfolio has a risk rating of 7, which is categorised a high medium risk fund. The fund’s objective is to seek to achieve a long term total return in excess of the Consumer Price Index (CPI) +5% over a minimum five to ten year period.

In the 8 years since its launch on 1st August 2011, the Rathbone Enhanced Growth Portfolio has returned cumulative growth of 87.47%. Over the recent 3 & 5 years it achieved growth of 31.10%, and 56.71%, which were some of the highest in its sector.

Rathbone Ethical Bond

Launched in 2002, the Rathbone Ethical Bond currently manages £1.275 billion of client assets and is one of the most popular funds on the market with an ethical criteria. The objective of the fund is to provide a regular, above average income through investing in a range of bonds and bond market instruments that meet strict criteria ethically and financially, with insurance, Banking and Social Housing making up the top 3 sectors where this fund invests.

Over the past 12 months the fund returned growth of 7.47%, which although this ranked in the 2nd quartile for the sector it was still above the 6.76% sector average. However, the funds 3 year growth of 19.03% was the highest of all 79 funds in the sector.

Rathbone Global Opportunities

This is a global fund that invests in under-the-radar and out of-favour companies. The funds management approach is flexible around company size, sector and geography, although they prefer mid sized companies in developed markets. The fund is a concentrated portfolio of 40 to 60 holdings which the fund manager believes are unblemished, innovative, differentiated, scalable and sustainable growth companies that are shaking up their industries. This fund currently manages £1.8 billion of client money and since its launch in May 2001, it has delivered excellent growth of 465.36%.

Rathbone Strategic Growth Portfolio

With a risk rating of 5, the Rathbone Strategic Growth Portfolio is a low medium risk fund that is classified within the IA Volatility managed sector. Since its launch on the 8th June 2009, Rathbone Strategic Growth Portfolio has amassed funds under management of £500 million and delivered growth of 123.33%. Over the past 5 years it has been one of the best funds in its sector with returns of 44.47% ranking better than 75% of same sector funds.

Underperforming Rathbone Funds

In contrast to the 4 funds featured above, a proportion of Rathbone funds have struggled within their sectors and delivered uncompetitive performance. The 3 funds featured below are responsible for managing £480 million of client assets.

Rathbone Total Return Portfolio

Similar to the Rathbone Strategic Growth Portfolio the Rathbone Total Return Portfolio was launched on 8th June 2009 and also sits within the IA Volatility Managed sector. However, performance wise, these funds have notable differences. Whereas the Rathbone Strategic Growth Portfolio was among the top ranking funds in the sector over 5 years, the Total Return Portfolio ranked among the bottom with returns of 24.41%, which were well below the 36.52% sector average. However, it is worth noting that this fund adopts a lower risk approach and carries a Dynamic Planner risk rating of 3.

Rathbone UK Opportunities

The objective of the fund is to achieve capital growth by buying shares in companies whose potential the fund manager feels is under-appreciated by the market and to sell them when this potential is recognised.

The fund has the flexibility to invest in companies of all sizes, primarily companies domiciled, incorporated or having a significant part of their business in the UK, although it may hold up to 20% in shares of European companies. The fund is classified within the very competitive IA UK All Companies sector where it has struggled to deliver competitive returns. Over the 1, 3 & 5 year periods up to 1st August 2019, this fund returned -9.06%, 18.73%, and 28.70%, each of which were well below the sector average and among the lowest in the entire sector.

Rathbone Strategic Bond

The Rathbone Strategic Bond fund aims to focus on achieving longer term capital growth from a diversified portfolio of predominantly Sterling denominated (or hedged back to Sterling) fixed interest and other bond instruments, including gilt edged and other sovereign stocks, corporate bonds, convertibles, preference shares and permanent interest bearing shares.

Since its launch on 3rd October 2011, the fund has returned cumulative growth of 48.55%, which was only slightly lower than the 46.34% sector average for the same period. Over the recent 5 years the fund returned modest growth of 21.09%, but over the past 12 months its growth of 3.81% ranked among the lowest in the sector.

Rathbone Performance

Rathbones investment process is designed to allow their investment managers flexibility and discretion to deliver for their clients, and although small in size, our analysis identifies their funds have continually managed to deliver strong performance from the majority of their fund range.

Although the majority of Rathbones funds have maintained competitive performance, there are consistently better performing investment alternatives available. Nevertheless, investors should not overlook Rathbones when it comes to making funds choices, as they have continually provided investors with some high quality investment opportunities.