UK online robo-advice manager Nutmeg recently hit the headlines for having to raise £4 million from its own customers in a crowdfunding campaign, just months after securing a £45 million investment from Goldman Sachs – bringing the total invested in the firm to over £116 million since their launch eight years ago.

Yet despite significant backing, the robo-advice firm has failed to return a profit. The recent closure of UBS and Investec’s robo-advice businesses have also helped fuel concerns over Nutmeg’s future.

Despite concerns over their long term viability, Nutmeg continue to actively grow their client numbers and funds under management by offering low-cost investments through their range of fixed allocation, fully managed and socially responsible portfolios.

Through these portfolios Nutmeg have attracted 65,000 clients and funds under management of £1.5 billion, and through their recent round of fundraising they aim to significantly scale up the business over the next 3 years. Nutmeg chief executive officer Martin Stead recently said: “Our journey over the past six years has been start-up through to scale-up and now we’re at scale-up-plus”.

Nutmeg remain optimistic for the growth of their company, but can investors share the same optimism for their range of portfolios?

In this report, we analysed the performance of each fund that Nutmeg use to construct their portfolios. We also compare the performance of all 35 of their portfolios alongside both our model portfolios and the 10 top performing portfolios managed by Yodelar investments.

Our analysis identifies that a number of funds used by Nutmeg have consistently struggled for competitive performance within their sectors, and their range of fully managed, fixed allocation, and socially responsible portfolios have all returned comparatively low growth.

Nutmeg Investments

Nutmeg launched in 2011 and are currently the most established robo advice firm in the UK. They currently offer a range of portfolios, each comprised of low-cost ETF’s, through their Fixed Allocation, Fully Managed and Socially Responsible investment portfolios.

Nutmeg Fully Managed Portfolios

Nutmeg provide investors with access to 10 Fully Managed portfolios which are managed by their investment team. Each portfolio contains a selection of ETFs that are weighted to reflect each portfolio’s particular risk level and objective. The portfolios range from the lowest risk 1 to the highest risk 10 and their investment team regularly make strategic adjustments to these portfolios as and when they see fit.

Nutmeg Fixed Allocation Portfolios

Nutmeg also offer 5 Fixed Allocation portfolios that range from the lowest risk Cautious portfolio to the highest risk Adventurous portfolio. Each fixed allocation portfolio contains a selection of ETFs that are weighted to meet their pre-set asset allocation, and they are only reviewed once per year to ensure these assets stay in line with your chosen risk level. Beyond that they do not make amendments to these portfolios.

Nutmeg Socially Responsible Portfolios

Ethical Investing is of growing importance to investors, but it is a complex topic that has lacked clarity. Even the Investment Association, the trade body for the UKs investment managers, no longer list ethical funds as they seek to gain further clarity on ethical guidelines.

However, in November 2018 Nutmeg launched their own range of ‘Ethical’ portfolios called Socially Responsible Investments (SRI). Nutmeg define these portfolios by following the Environmental, Social and Governance framework (ESG) which adhere to 3 key categories of criteria that are:

Environmental - Includes topics such as: pollution, deforestation, waste of resources, water stress and climate change.

Social - Includes topics such as: working conditions, health and safety, community engagement, diversity and child labour.

Governance - Includes topics such as: bribery, corruption, executive pay, leadership diversity, data security and tax strategy.

Nutmeg manage 10 risk rated socially responsible portfolios which range from the lowest risk 1, for very defensive investors, to the highest risk 10, which is more suitable for adventurous investors.

Nutmeg Investment Performance

Across their range of fully managed, fixed allocation and socially responsible portfolios, Nutmeg have 25 different Investment portfolios. At the time of review, these 25 portfolios are made up from 44 different ETFs that cover a diverse range of assets.

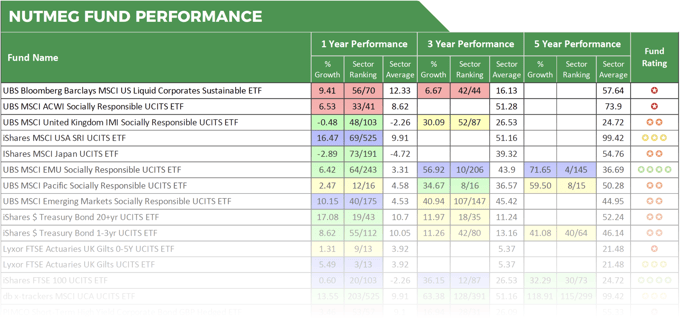

To identify how competitive each of these funds have performed we analysed their individual performance over the recent 1, 3 & 5 years and ranked each fund based on how they performed compared to each of their competitors within the same sectors.

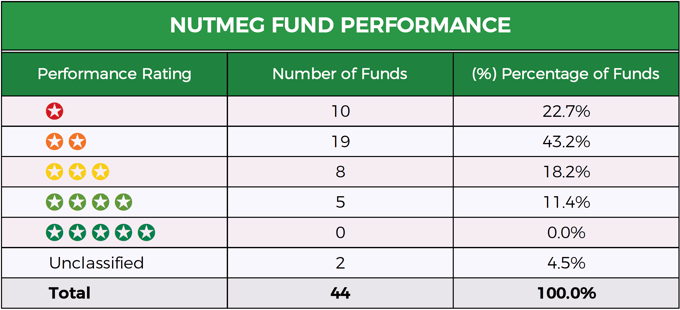

From our analysis none of the funds currently used by Nutmeg, with at least 5 years of history, had managed to consistently maintain a top quartile (top 25% position) sector ranking with a disappointing 65.9% receiving a poor 1 or 2 star performance rating.

The Best Nutmeg Funds

Although there were no 5 star rated funds, 5 of the funds analysed received a good 4 star performance rating. Among these funds was the UBS MSCI EMU Socially Responsible UCITS ETF. This fund is primarily weighted in French and German equities and over the recent 1, 3 & 5-years it has returned growth of 6.42%, 56.92%, and 71.65%, each of which were comfortably higher than the sector average.

Their highest growth fund over the past 5 years was the popular iShares Core S&P 500 UCITS ETF. This fund seeks to track the performance of an index composed of 500 large cap U.S. companies. It’s 5 largest holdings are in Microsoft, Apple, Amazon, Facebook and Berkshire Hathaway and over the past 5 years it has returned strong growth of 120.09%.

Of the relatively new funds used by Nutmeg the iShares MSCI USA SRI UCITS ETF was among the best performers. Since its launch, this fund has secured funds under management of £818 million and it is currently used within Nutmeg’s range of socially responsible investment portfolios. Over the past 12 months this fund outperformed 87% of funds in its sector with growth of 16.47%.

Download the full Nutmeg review here >>

Underperforming Nutmeg Funds

Of the 44 funds analysed 8 have consistently performed worse than at least 75% of competing funds within the same sectors since their inception. Among these poor performers was the UBS Bloomberg Barclays MSCI US Liquid Corporates Sustainable ETF, which over the past 3 years ranked 42nd out of 44 competing funds in its sector with growth of 6.67%, which was well below the 16.13% sector average.

The iShares Sterling Corporate Bond 1-5 Year UCITS ETF is another fund used by Nutmeg that has a history of poor performance. Over the recent 1, 3 & 5 years this fund returned 2.72%, 7.20% and 13.60% respectively, which were all well below the sector average and among the lowest in the sector.

Nutmeg Portfolios

For their first 5 years Nutmeg limited their investment proposition to 10 fully managed portfolios. They expanded this at the start of 2017 with the launch of 5 Fixed Allocation portfolios and again at the end of 2018 with the introduction of their 10 socially responsible portfolios.

Each of these portfolios follow a different criteria and are designed to appeal to a wider range of investors.

Nutmeg Fully Managed Portfolio Performance

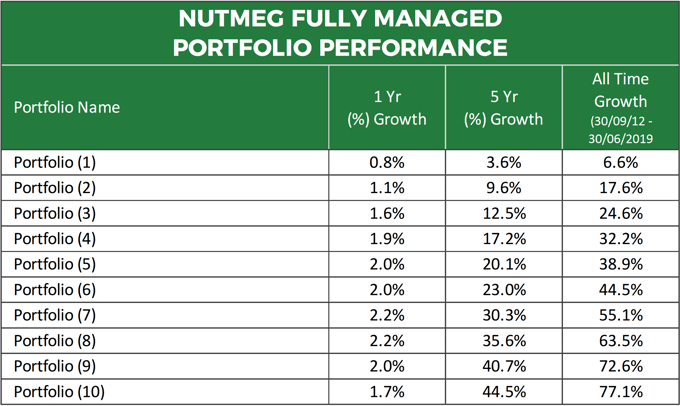

Nutmeg have 10 fully managed portfolios ranging from (1) very defensive to (10) adventurous. Nutmeg provide the cumulative growth figures for each of these portfolios over the recent 1 year and 5 year periods as well their overall growth since their inception on 30th September 2012. Over the recent 12 months each of these portfolios have had marginal growth, with a high of 2.2% returned by their portfolio 7 and portfolio 8.

Nutmeg Fixed Allocation Portfolio Performance

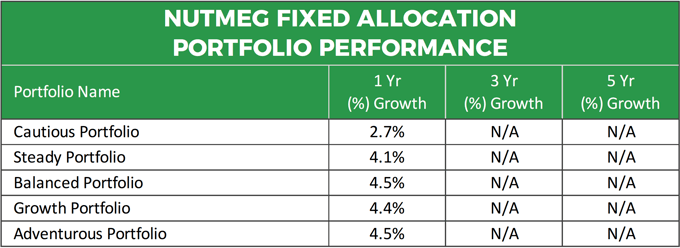

Nutmeg’s 5 Fixed Allocation portfolios were introduced at the start of 2017 and they represent their lowest priced products. Each of these 5 portfolios have been created to automatically follow a pre-set asset allocation model and therefore require minimal monitoring from Nutmeg. As relatively new products, performance information for Nutmeg’s Fixed Allocation portfolios is limited, but over the recent 12 months they have managed to average better returns than their Fully Managed portfolios.

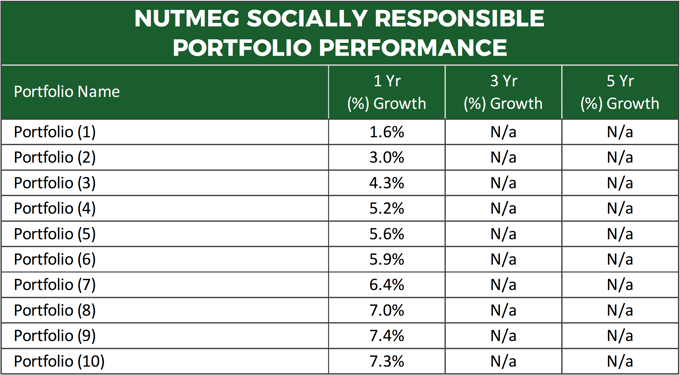

Nutmeg Socially Responsible Portfolio Performance

Similar to their Fully Managed range, Nutmeg’s 10 socially responsible portfolios are managed by their investment team and have a similar pricing structure.

As a proportion of the funds used by Nutmeg to construct their socially responsible portfolios are quite new, performance data for these portfolios is limited. However, our analysis of the available performance data identified growth over the past 12 months between 1.6% for their lowest risk 1 portfolio and 7.4% for their higher risk 9 portfolio.

Download the full Nutmeg review here >>

Nutmeg Portfolio Comparison

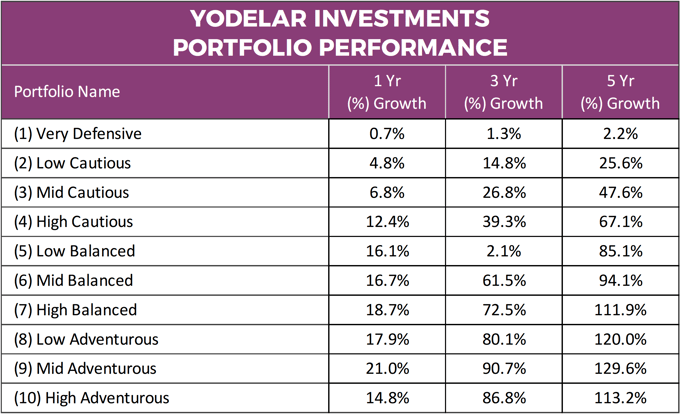

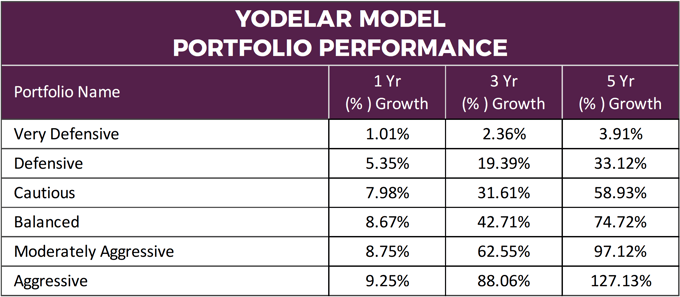

In order to identify how competitive Nutmeg’s portfolio returns have been we compared their performance to our range of 6 model portfolios, which contain consistently top quartile performing funds and follow an asset allocation model as previously set by the consumer watchdog Which?. We also analysed their performance alongside the 10 risk rated portfolios managed by Yodelar Investments which also contain a selection of proven, top quality funds.

Our analysis identified significant performance variations with both our top-performing model portfolios and Yodelar Investment portfolios returning vastly superior growth for the periods analysed.

The 10 portfolios used by Yodelar Investments are composed of a mixture of active and passive funds that have consistently ranked among the top performers in their respective sectors and have been strategically balanced to fit the asset allocation models as defined by Dynamic Planner, the UK’s leading risk profiler. The average annual charge of these portfolios (1.66%, which includes a 1% annual management charge), is higher than those provided by Nutmeg but the vast difference in performance has thus far significantly outweighed the cost savings offered by Nutmeg.

Our growth comparison demonstrates that even with higher fees, a suitably balanced portfolio of consistently top performing funds can deliver returns that are significantly greater than those of low-cost, robo-advice firms such as Nutmeg. Although important, the cost of investing should not take precedence over the pursuit of growth - which in essence, is your reason for investing.

Performance figures at 1st July 2019

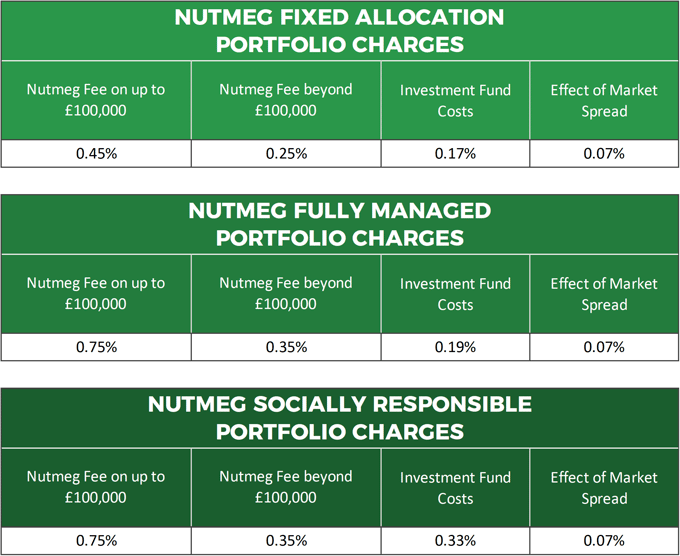

Nutmeg Portfolio Charges

To attract clients, Nutmeg’s robo-advice model focuses primarily on keeping costs to a minimum - which they do by constructing their portfolios using a selection of low-cost ETFs.

From their 3 different types of portfolios both the Socially Responsible portfolios and Fully Managed portfolios are actively managed by their investment team. For each of these portfolios Nutmeg charge a fee of 0.75% on investments up to £100,000 and 0.35% on anything beyond that. As their Fixed Allocation portfolios only require review once per year their fees for these portfolios are quite a bit lower with charges of 0.45% on investments up to £100,000 and 0.25% beyond that.

Investors Seek Better Returns

Online robo-advisory investment services bet heavily that investors would be attracted by their low-cost, passive investment models. Cost is of course important, but growth to achieve our financial objectives is the primary reason we invest, and as the portfolios of robo-advisory services continue to prove uncompetitive, their proposition simply does not appeal to growth seeking investors, and seems a more suitable option for lower value investors. The majority of clients who use robo-advice services are new investors with small portfolios.

As a consequence, the sustainability of low-cost robo-advisory investment services has been called into question with two heavily invested robo-advice services closing down in recent months.

Robo Advice Investment Services Doomed To Fail?

UBS shut its online investment advice service SmartWealth to new clients less than 2 years after launch, marking one of the first significant casualties in the UK robo-advice market. In May this year, just 9 months after SmartWealth failed, Investec became the second to close its online robo-advisory investment service after admitting appetite was too “low”, writing off more than £20 million in operating losses and software costs.

The failure of these Global investment giants to make a viable robo-advice business has increased concerns for the rest of the industry in the UK.

Is Nutmeg Sustainable?

Nutmeg has proven to be a costly venture that has required several rounds of heavy funding which has totalled £116 million since their launch in 2011. Yet despite huge investment they have returned heavy losses for each financial year. The fundamental financial problem at the heart of Nutmeg’s proposition is that they are not managing nearly enough assets in order to break even.

Nutmeg’s average customer still holds only £23,000 on its platform, meaning the company earns just over £100 a year in fees for the average customer with a fixed allocation portfolio.

However, Nutmeg remain positive for the future. They plan to generate half of their future revenue from licensing its service to banks and large institutions, which have large customer bases but have been slow to launch their own robo-advice offerings. Whether or not this strategy helps them secure the viability of their business remains to be seen, but for investors, their investment proposition continues to be weak.

Nutmeg Review – Are They The Right Option?

As the first robo-advice firm to market, Nutmeg always faced an uphill battle, but even so, after several years they remain unprofitable despite significant financial backing. As identified in our analysis, their portfolios have returned minimal growth that falls well below that of our model portfolios and their lack of competitive investment options is undoubtedly a negative for serious investors.

The fact is, their model does not appeal to enough consumers and their proposition will unlikely attract many with a sizeable portfolio who see little value in saving on costs only to miss out on sizeable growth.

But for those with limited sums to invest, and therefore more exposed to the impact of investment costs, Nutmeg’s low-cost model could still be a suitable option and certainly a viable alternative to the low interest rate savings accounts currently available.