- From the 101 JPM funds analysed 55 were unit trust and OEIC funds which combined manage more than £21 billion on behalf of UK investors.

- The JPM Asia Growth Fund has consistently ranked among the top of its sector for growth and over the past 1, 3 & 5 years it returned 24.63%, 40.72% and 174.95% respectively.

- The JPMorgan China Growth & Income trust has delivered some of the highest returns of any fund in recent years. Over the past 1, 3 & 5 years the fund returned very strong growth of 77.53%, 95.87% and 273.78% respectively.

- Over the past 5-years the JP Morgan’s Europe Strategic Value fund has returned growth of 14.27% which was well below the 55.59% sector average and worse than every other fund in the IA Europe Including UK sector.

J.P Morgan is one of the world’s oldest and largest financial institutions with total global assets in excess of $2.6 trillion. As a truly global firm, their investment teams are spread across more than 15 cities around the world and are connected by investment hubs in London, New York, Tokyo and Hong Kong. Through their Global investment teams, J.P Morgan believes they have the expertise across every key investment class and every economic region to deliver and manage efficiently top quality investment funds for their clients.

In this report, we analysed 101 funds managed by JP Morgan across their range of unit trust, Life and Pension funds and investment trusts. Each fund was analysed for comparative performance over the recent 1, 3 & 5 alongside all other funds within their respective sectors. Based on their performance each fund was then provided with a rating between 1 and 5-stars.

Performance Analysis of 101 JP Morgan Funds

Our analysis identified that from all 101 funds analysed 29.70% have received a 4 or 5-star rating by consistently ranking among the top performers in their sectors over the periods analysed. 13.86% rated as 3-star performing funds with 51.48% ranking among the bottom half of their sectors consistently and therefore received a poor performing 1 or 2-star performance rating.

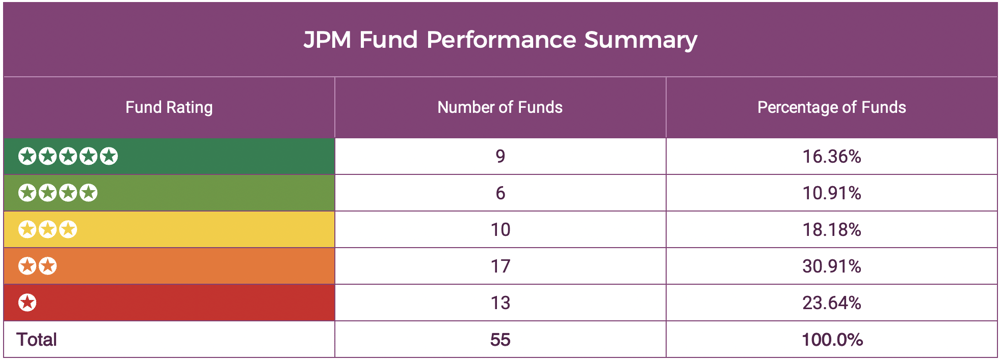

JP Morgan Unit Trust & OEIC Fund Performance

From the 101 JPM funds analysed 55 were unit trust and OEIC funds which combined manage more than £21 billion on behalf of UK investors. 9 of the 55 JP Morgan unit trust and OEIC funds received a top performing 5-star rating with a further 6 with an impressive 4-star performance rating. In contrast, 30 of the 55 funds rated a poor 1 or 2-stars for performance by consistently performing worse than the majority of their sector peers over the past 1, 3 & 5 years.

JPM Asia Growth C Acc

The JPM Asia Growth Fund leverages the broad resources and knowledge of JPM’s Emerging Markets and Asia Pacific platform to deliver exposure to the long-term structural changes driving Asia’s dynamic growth. The fund has consistently ranked among the top of its sector for growth and over the past 1, 3 & 5 years it returned 24.63%, 40.72% and 174.95% respectively.

JPM Emerging Markets B Acc

The fund is managed by Austin Foley who has managed this fund for several years. His long tenure and experience of past crises has moulded his strategy and have contributed to the good performance during this year's pandemic. The fund is primarily weighted in Chinese and Taiwanese equities with companies such chinese e-commerce giant Alibaba and TSMC, who manufacture processors for Apple and Android devices.

The fund is classified within the IA Emerging Markets sector alongside 110 competing funds where over the past 12 months it ranked 13th for performance with returns of 17.61% easily above the sector average of 6.73%. Over 5 years the fund has been even more competitive with its returns of 137.31% outperforming 96% of its competitors.

JPM US Select C Acc

The £700 million JPM US Select fund is one of a select few North American Equity funds that consistently ranks among the top 50% of its sector for performance.

Although the fund may not have returned the same level of growth as some of the North American sectors biggest performers it has still outperformed the sector average and returned growth of 18.51%, 51.99% and 143.51% over the past 1, 3 & 5 years.

The JPM Europe Strategic Value Fund Ranked 44th Out of 44 Funds

One of JP Morgan’s most disappointing funds was their Europe Strategic Value fund. This fund has endured a torrid few years and has been plagued by heavy losses significantly worse than the sector average. Over the past 5-years, this fund has returned growth of 14.27% which was well below the 55.59% sector average and worse than every other fund in the IA Europe Including UK sector.

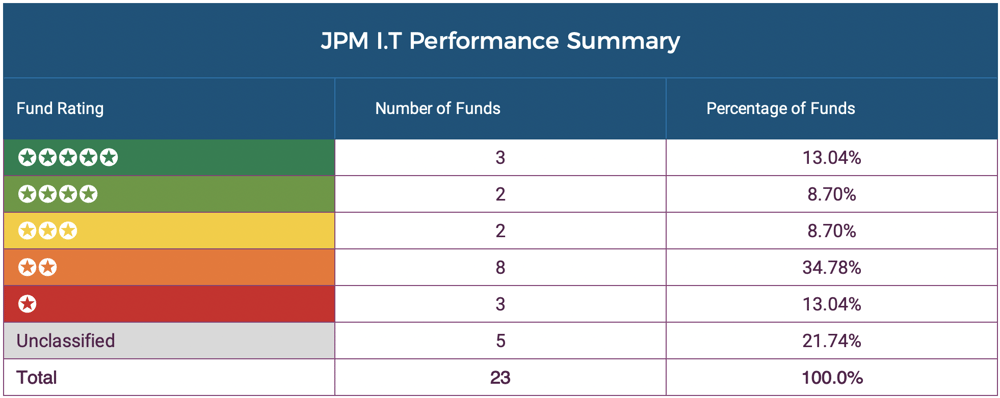

JP Morgan Investment Trust Performance

It is through their range of investment trusts that JP Morgan are recognised for delivering strong performance. In total, we analysed the performance of 23 JPM Investment Trusts and identified their best investment trusts for performance.

JPMorgan China Growth & Income

The JPMorgan China Growth & Income trust has delivered some of the highest returns of any fund in recent years. As the fund's name suggests it is primarily focused on investing in companies in China which accounts for some 97% of the portfolio's composition. Over the past 1, 3 & 5 years the fund returned very strong growth of 77.53%, 95.87% and 273.78% respectively.

JP Morgan Emerging Markets IT

JPMorgan Emerging Markets Investment Trust plc seeks to uncover quality stocks from across emerging markets that are also attractively valued. The aim of the fund is to maximise total returns from Emerging Markets and provide investors with a diversified portfolio of shares in companies which the manager believes offer the most attractive opportunities for growth.

The Company can hold up to 10% cash or utilise gearing of up to 20% of net assets where appropriate. The emerging markets remain an important region for growth opportunities and the JP Morgan Emerging Markets IT PLC has consistently delivered strong returns. The performance of this trust has been remarkably consistent over the past decade and we believe it is well positioned to continue to deliver strong growth returns. As identified in our performance analysis, this fund has returned growth of 10.58%, 32.51% and 125.89% over the past 1, 3 & 5 years.

The JPMorgan Indian Investment Trust Returned Losses of 20% This Year

The JPMorgan Indian IT aims to provide capital growth from Indian investments by outperforming the MSCI India Index. It invests in a diversified portfolio of quoted Indian companies and companies that earn a material part of their revenues from India.

The fund is primarily invested in Financial companies which account for 27% of the funds composition and as this sector was one of India's hardest hit during the Covid19 pandemic it has been a torrid period for the fund.

Over the past 12 months this fund has returned losses of -19.94% and over 3 years the losses are at over -25% making it one of the worst performers in recent years.

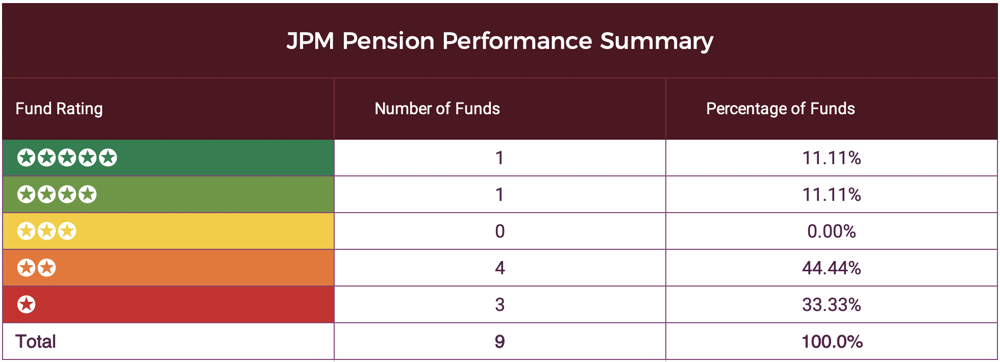

JP Morgan Pension Funds

Our analysis of the 9 pension funds currently managed by JP Morgan identified that 7 have consistently ranked among the worst in their sectors for performance with just 2 funds consistently maintaining a top quartile sector ranking over the past 1, 3 & 5 years.

JPM Emerging Markets Pn

With a similar management team and philosophy as the unit trust and Investment trust of the same name, it is not surprising that the JP Morgan Emerging Markets Pension fund has also consistently excelled in the pension universe. Over the past 1, 3 & 5 years this fund has returned growth of 18.99%, 27.73% and 121.74%, each of which were consistently better than the sector average.

JPM Emerging Europe Equity Pn

The JPM Emerging Europe Equity fund invests primarily in companies in European emerging-markets countries, including Russia.

This fund has consistently been one of the best performing funds in the Specialist pension sector where it has returned growth of 19.16%, 20.68% and 96.24% over the past 1, 3 & 5 years.

The JP Morgan US Pension Fund Performed Worse Than 92% of Its Peers

After returning losses of -5.86% this past year the JPM US pension fund ranked 281st out of 304 funds in its sector.

This disappointing performance fell well below the 9.75% sector average. Over the past 3 & 5 years the fund's performance was equally poor as its growth returns of 23.14% and 86.72% was also among the lowest in its sector.

JPMorgan Europe Dynamic ex UK Pn

The fund currently invests in smaller UK companies that make up the lowest 10% by size of the main UK share markets.

Over the past 5-years, this fund has returned growth of 10.98% which was lower than 95% of funds within the same sector and well below the sector's average growth of 40.84% for the period.

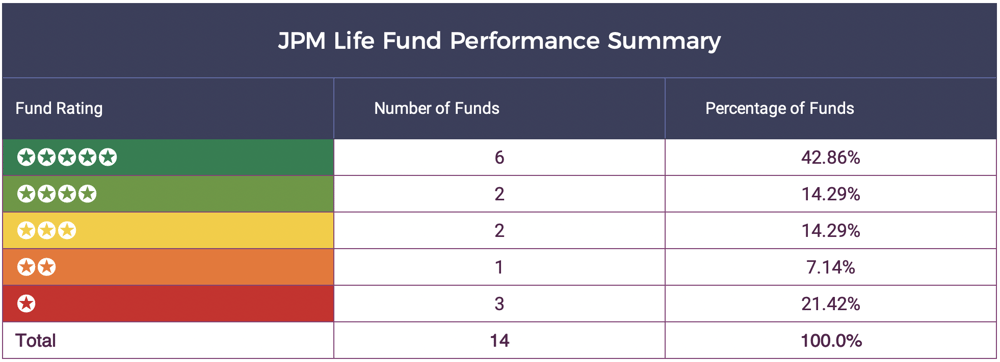

57% of JP Morgan’s Life funds Received A 4 or 5 Star Performance Rating

Of the 101 JP Morgan funds analysed for this report, 14 are from their range of life funds, and it is their life funds that have the highest percentage of top performing funds with half consistently outperforming at least 75% of competing funds within their sectors over each of the 3 periods analysed.

JPM Life All Emerging Markets Equity LF

One of the top performing Life funds managed by JP Morgan is the JPM Life All Emerging Markets Equity fund. This fund ranked 1st in its sector for performance over the past 5 years as it returned growth of 144.38%, which was more than double the sector average.

JPM Life Balanced 1

The JPMorgan Life Balanced Fund is a pooled life fund for pension schemes investing primarily in global equities and bonds. The fund currently manages £291 million of client money and it’s underlying holdings are made up of a blend of JPM funds, with the consistently top performing JPM Life US Equity fund making up the largest holding within the fund with a weighting of almost 30%.

The fund is in essence a multi asset fund and acts as a ready made portfolio. It is classified within the LF Mixed Investment 40-85% Shares sector where it has consistently ranked among the top performers. Over the past 1, 3 & 5 years this fund has outperformed at least 97% of the 483 funds in this sector with growth returns of 10.48%, 22.78% and 62.23%.

JP Morgan’s UK Focused Life Funds Have Underperformed

JP Morgan’s UK focused Life funds have struggled for competitive performance, which is a theme throughout their range of UK pension funds, unit trust funds and investment trusts.

For their Life fund range, the JPM Life UK Dynamic fund has been particularly poor. This fund is classified within the LF UK All Companies sector where it has consistently ranked among the worst performers. Over the past 12 months this fund returned losses of -16.36% which ranked 480th out of 559 funds.

The JP Life UK Specialist Equity fund is another JPM Life fund that is classified within the LF UK All Companies sector to also underperform. Over the past 12 months this fund has returned losses of -13.39% as it ranked 431st out of 559 funds.

JPM Review Summary

Of the 101 JPM funds analysed an 30 received a rating of 4 or 5 stars for their consistently impressive performance with their range of Life funds and Unit trust/ OEIC funds in particular performing well. As with all fund managers, JPM have a proportion of funds under their management that have underperformed, but for investors, having the ability to identify the good performers from the bad can help improve fund selection and as identified in this report, JP Morgan have some very strong investment opportunities on offer.