A recent study by Schroders found that 15% of those already in retirement do not have enough money to live comfortably, and there is a growing concern among those close to retirement that they will struggle to maintain their current lifestyle when they decide to retire.

Therefore, those investing towards retirement must ensure that their portfolio is efficiently managed as if overlooked it could have a sizeable bearing on whether their retirement is as comfortable as they planned.

How Much Do We Need For A Comfortable Retirement?

Standard Life recommends that to maintain a similar lifestyle in retirement, we need to save enough that provides an annual income which is at least 60% of our working income.

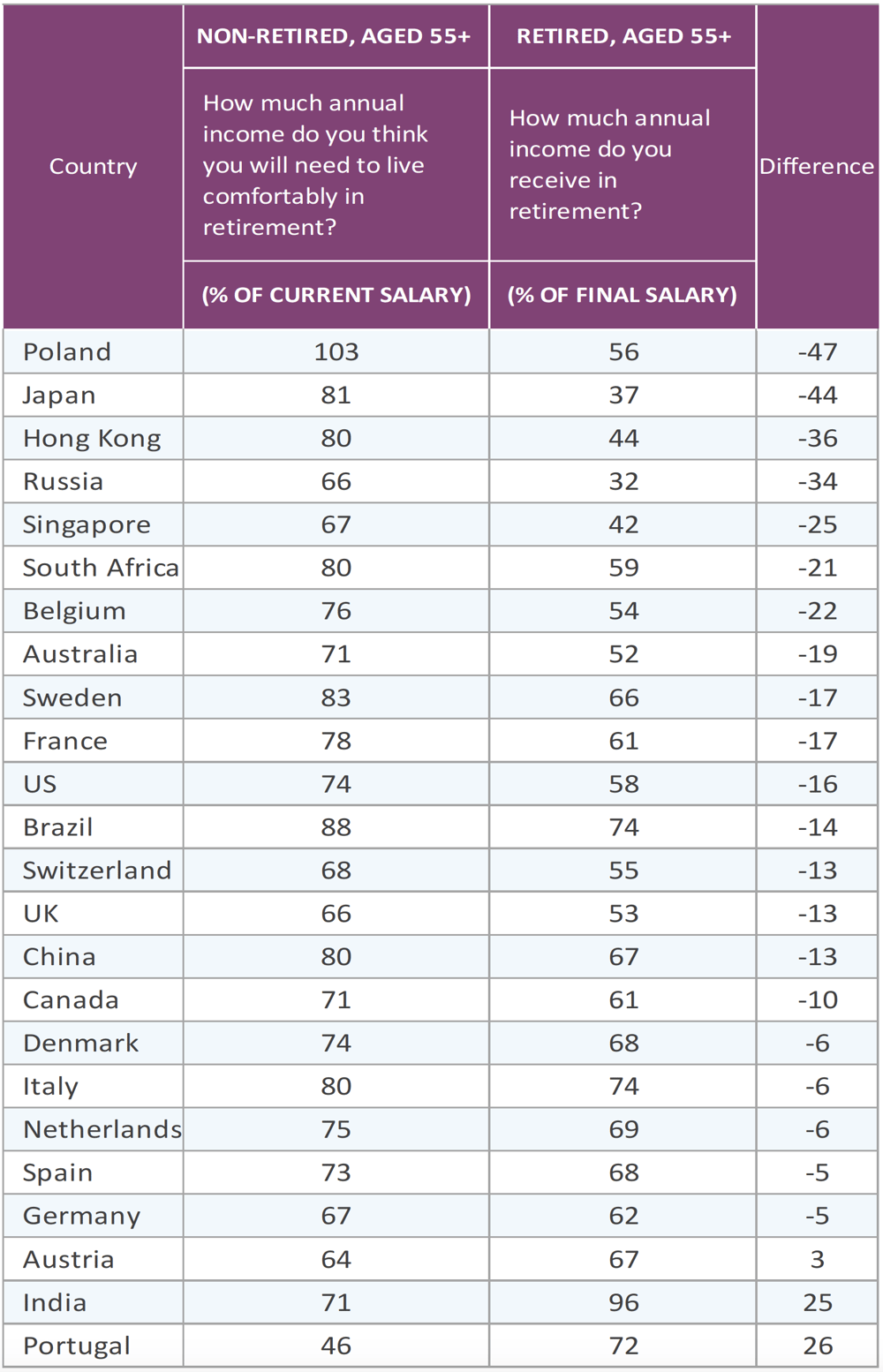

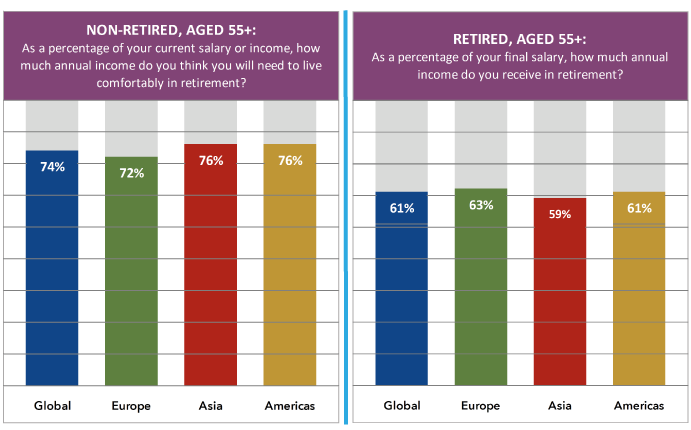

However, Schroders Global Investor study identified that the reality for UK retirees is that on average their annual retirement income equates to 53% of

their working income, a significant deficit to the 60% recommended by Standard Life and even further away from the two thirds that is widely recommended by pension managers.

Although this may cause concern, the reality is that most retirement calculators base their projections on pension growth that is 5%, which, in recent years at least, is a conservative estimate.

Having a conservative estimate helps to lower the expectations of investors, and it also promotes the belief that any growth above those projected is a sign that their portfolio has outperformed due to sound retirement planning or high-quality fund choices. However, in reality, many investors could be missing out on valuable extra growth each year.

An analysis of 3,503 funds across all sectors in the IA universe found that over the recent 5-year period the average annual growth was 10.28%.

Therefore, investors would likely have seen their portfolios deliver growth comfortably above the 5% annual estimate - even if they contained funds that performed below the sector average.

Is Your Pension Portfolio Falling Short?

For those looking to enjoy a more comfortable retirement, it is estimated that they would need between £35,000 and £45,000 per year to do so.

However, based on average pension projections (where pension growth is estimated at 5% per year) it would require saving £1,667 per month for 25 years to build a pension pot of £1,000,000, which would then provide an allowance of £40,000 per year for 25 years.

But as the average yearly growth of all unit trust and OEIC funds in the Investment Association universe currently exceed 10%, what returns could be expected from a portfolio which was invested efficiently in consistently top quartile performing?

By investing efficiently in funds that have consistently outperformed their peer's investors can generate returns from that could have a significant impact on the size of their pension pot.

To provide an example, our model portfolio, which follows the asset allocation model set by Which? and is suitable to a mid or balanced investor, returned cumulative growth of 94.01% over the recent 5-year period - which averages at 18.8% per year.

If we use this growth figure as a projection for pension growth and assume that it maintained this level of growth for the term of our pension, we would have secured a pension pot of £3.7 million over 25 years. It would also take just 13 years of saving £1,667 per month to build a £1,000,000 pension pot.

This portfolio consists only of unit trust and OEIC funds that have continually outperformed at least 75% of their peers within the same sector over the past 1, 3 & 5-year period.

Maintaining such levels of growth over the lifetime of a pension would be unexpected, but over the past 5-years, this level of growth was not unrealistic.

Will More Miss Out On The Retirement They Want?

Currently, there is a 13% gap between the amount retirees receive each year compared to what those nearing retirement project they will need. If retirement income doesn’t stretch as far as desired, it is often too late to do anything about it.

In the decade from 2002 to 2012, data from the Office for National Statistics showed that the population aged 65 and over increased by 15%, with official projections suggesting that growth in the population aged 65 and over will rise to 20% by 2022. Which could see a further rise in the number of retirees forced to cut back on their spending.

On average in the UK, people who are not yet retired but over the age of 55 think they will need at least 66% of their current annual income to ensure a comfortable retirement.

Why The Amount We Need In Retirement Is Often Lower Than Expected

There are several reasons why you don’t need to replace 100% of your pre-retirement wage:

- Once you are over pension age you no longer pay National Insurance Contributions on your income, whereas workers are generally paying NICs at a rate of 12% on a band of earnings;

- Once you are retired you are generally drawing out of a pension, whereas when you are in work, you need to set aside some of your income to put into a pension;

- Once you are retired you are more likely to have paid off a mortgage and therefore you no longer need to be able to fund mortgage repayments out of your take-home pay;

- Once you are retired you no longer have work-related costs such as commuting, buying work clothes etc.

The income tax system is progressive and so a higher proportion of post-retirement income is likely to be covered by the tax-free personal allowance and the basic rate band than the income of those of working age.

The Importance of Efficiency For A Comfortable Retirement

Whether you are 35 years away from retirement or six years into it, the level of comfort afforded in retirement can be influenced by how you save and retirement or six years into it, the level of comfort afforded in retirement can be influenced by how you save and invest the money available to you today.

Identifying if your portfolio contains underperforming funds is essential to improving your portfolios performance. But equally important is the choice of funds which are selected to replace them.

As an investor, there are many strategies to choose from, but ultimately, no matter what model or investment strategy you choose to follow, the priority should be to invest efficiently by building a portfolio of quality funds that fits within a suitably balanced risk model.

To maintain efficiency your investment portfolio should be rebalanced at least twice per year to ensure it continues to fit the desired risk profile and that your portfolio only contains funds that having consistently outperformed their peers. By following this process, you may find that your pension pot grows well above the target you initially set.