- Due to their rise in popularity Multi-Asset funds now account for 13% of all unit trust funds.

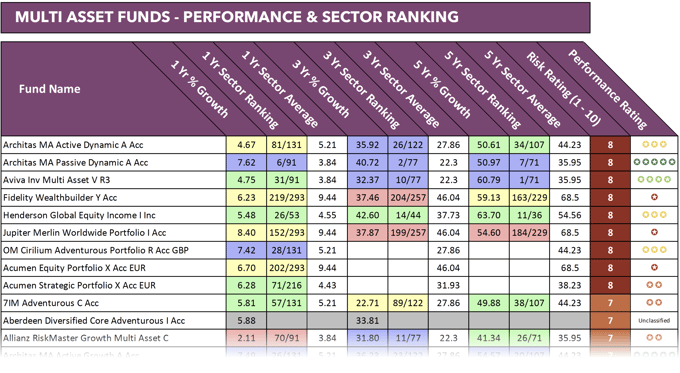

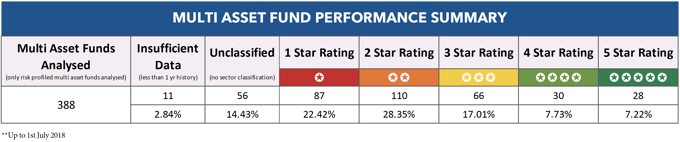

- Less than 15% of risk profiled Multi-Asset funds available have received a 4 or 5-star performance rating.

- More than 22% have consistently underperformed a received a poor 1-star performance rating.

Asset allocation is becoming critically important in a world of shorter and more extreme investment cycles with some investment experts believing that a dynamic approach to asset allocation within investment funds is required to best deal with such cycles.

This increased focus on asset allocation combined with the continued pursuit for greater convenience has led to the rise of Multi-Asset funds, which can remove the complexities of asset allocation and provide investors with simple one-stop investment solutions.

Indeed, the past several years has seen an exponential rise of Multi-Asset funds, with 13% of the 3,000 plus unit trust and OEIC funds on the market now made up of an ever-growing number of risk-profiled Multi-Asset investment funds.

But are these diverse, readymade investment funds competitive and should you invest in them?

Record Inflows into Multi-Asset funds

According to data from the Investment Association (IA), In May 2018, mixed asset was the best-selling asset class by some margin with £572 million in net retail purchases. And between May 2017 and May 2018 more than £13.7 billion was invested into Multi-Asset funds, which was higher than all other asset classes and accounted for over 30% of the unit trust and OEIC fund retail sales during that period.

Why Multi-Asset Funds Stand Out

At a time when geopolitical concerns are on the rise and volatility has returned to markets, protecting portfolios from large market spikes is possibly more critical than ever.

Multi-asset funds often prove popular with investors seeking to ride out volatility and may provide some peace of mind in an uncertain economic climate as Brexit negotiations continue, with a fund manager using their expertise to find the right overall balance of assets within one fund.

Catriona McInally, an investment specialist at Prudential UK and Europe, observes: “The growth in the multi-asset sector has been driven by investors’ looking to vehicles that provide diversification to dampen the effects of market uncertainty.”

According to Serge Pizem, Head of Multi-Asset Investments at AXA IM, investors using multi-asset strategies could be well-prepared for developments on capital markets. Pizem said, "By tapping into various asset classes and market segments, investors have a globally structured portfolio that can help respond quickly to market changes and realise potential returns or mitigate risks."

View the performance, sector ranking and rating for ALL Multi-Asset funds in the July edition of the Yodelar Magazine.

Subscribe today for just £1 for full access to all premium features >>

Are Multi-Asset Funds Safer Investments?

Multi-asset funds offer investors exposure to a range of assets within one fund, essentially acting as ready-made portfolios for investors.

They typically focus on shares and bonds for a spread of investments, although they may also invest in property, cash, and alternative assets such as commodities. The idea is that any losses from assets that don’t perform well are offset by those from assets that do, potentially improving returns for investors over the long-term.

For example, bonds may do well in difficult economic conditions when investors may be seeking assets that are considered safer. Whereas, equities typically perform well during periods when there is strong economic growth and companies are profitable.

Are Multi-Asset Funds For You?

Among the most significant challenges for investors is building a portfolio with the right mix of assets to protect them against sudden losses when markets fall.

A typically diversified portfolio is made up of a range of different assets such as equities, bonds, property and cash. As each type of asset performs differently at various points in time, making sure your asset allocation is diversified can help reduce overall volatility.

Diversification doesn’t mean all risk attached to investments is wiped out, but it can potentially mitigate the risk of losing significant amounts of your savings if the market suddenly falls, compared to investing in a single asset.

Purchasing a risk-rated Multi-Asset fund - a fund that invests in a range of asset classes rather than just one and is continually balanced by the fund manager to maintain a pre-set risk level while targeting particular growth goals, – may prove to be a more comfortable and more beneficial solution for investors. Mainly as its the fund manager rather than the investor who is responsible for finding the right balance between different assets. This could prove particularly beneficial to those who don’t have the time or experience to manage their investments.

However, despite all of their benefits Multi-Asset funds could inhibit the portfolio growth for experienced investors. This is because high-quality specialist funds that focus on one particular market and excel in that area will ultimately generate higher returns should that market perform well - whereas a Multi-Asset fund by definition must limit its exposure to any one market while trying to simultaneously maintain a balance and be competitive in several other completely different markets at once.

Therefore, experienced investors who invest in quality funds within a suitably balanced portfolio could achieve higher returns by staying away from Multi-Asset funds.

How Have Multi-Asset Funds Performed?

To determine the performance of the current batch of Multi-Asset funds we analysed 388 risks profiled Multi-Asset funds with a combined total of £170 billion of client funds under their management.

Each Multi-Asset fund was reviewed for performance and sector ranking alongside all other unit trust funds within the same sectors. This analysis established that almost 15% received a good to excellent 4 or 5-star performance rating when compared alongside all other same sector funds.

What Makes A Good Multi-Asset Fund?

The right multi-asset fund is one that is well diversified and remains within a particular volatility boundary with an expected level of return. A good multi-asset manager will then look to diversify from other risks within a portfolio such as credit risk, market risk, currency risk and interest rate risk - this is what investors should be getting for the fee they pay for a multi-asset fund. However, our performance analysis of almost 400 Multi-Asset funds highlighted the variance in performance between fund managers, with all 5-star rated Multi-Asset funds managed by a small proportion of fund managers (20%).

Therefore, if you are invested in or considering investing in Multi-Asset funds ensure you invest in a fund that is managed by a fund manager who has proven their ability to deliver competitive returns through different market conditions.

Summary

Risk-profiled multi-asset funds have seen significant inflows and a plethora of launches in recent years as their flexibility and convenience have helped to grow their appeal.

Although they certainly have definite benefits, they are not for everyone: such as those at either end of the risk scale, with lower end defensive investors better suited to cash and higher risk growth seekers better suited to investing in a portfolio comprised of specialist funds.