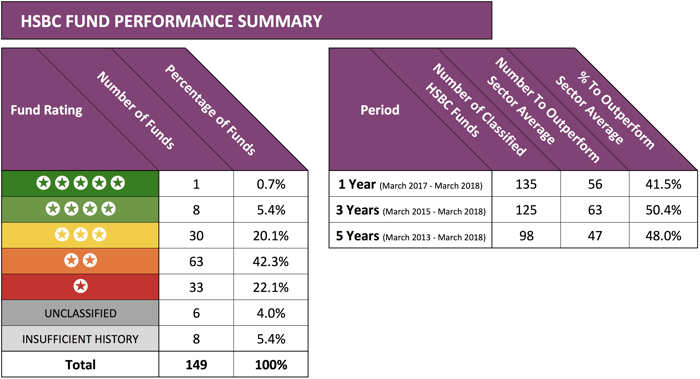

In this report we have analysed the performance and sector ranking of 149 HSBC investment funds:

- Only 1 of the 149 HSBC funds consistently outperformed its competitors and received a 5-star performance rating.

- Over the recent 5-year period 52% of HSBC funds underperformed the sector average.

- 64.4% of HSBC funds received a poor 1 or 2 star performance rating.

HSBC is one of the world's largest banking and financial services organisations with around 3,900 offices in both established and emerging markets that serve over 38 million clients.

The global asset management arm of their business was established in 1973, and their worldwide reach and popularity have helped them amass more than £334 billion of client funds under management. This was bolstered by a huge 2017 for the firm as they generated an extra £43 billion of funds under management in just 12 months with a growing number of investors attracted by the comfort and security of a worldwide brand.

With a worldwide reach and significant funds under management HSBC holds a major share of the investment market, but how competitive has their funds performed alongside all other competing same sector funds?

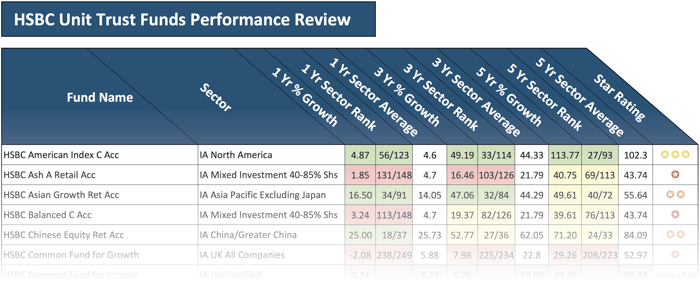

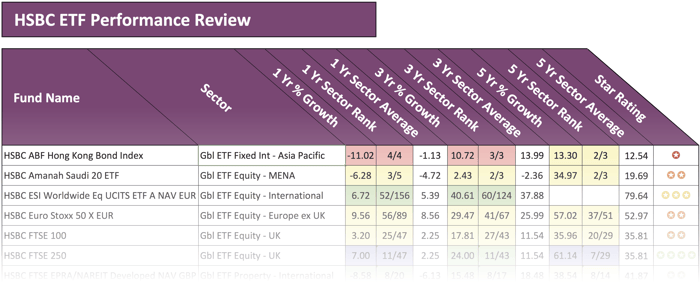

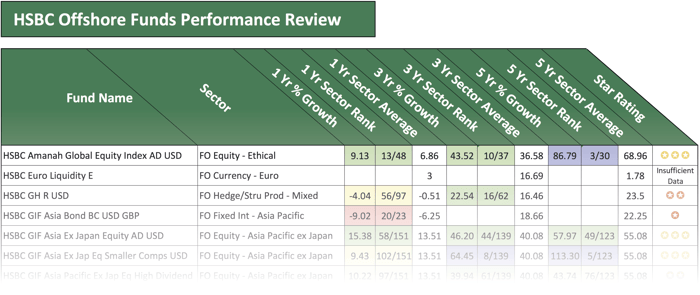

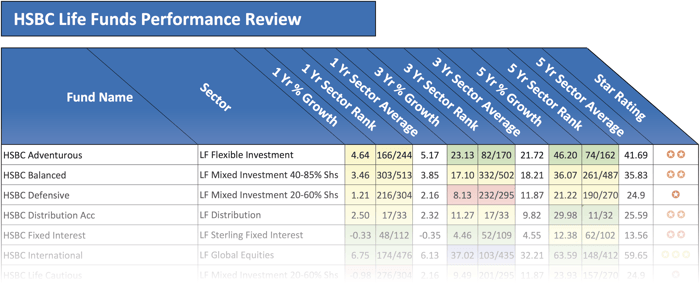

In this HSBC fund review, we analysed 29 of their ETFs, 43 unit trust funds, 12 Life funds, and 65 offshore funds and identified that only 1 of their funds was able to consistently maintained top quartile performance within its sector and received a 5 star performance rating. In contrast, 96 HSBC funds received a poor 1 or 2 star performance rating.

The Best HSBC Funds

In our recent fund manager league table (which ranks fund managers based on the performance of their funds), HSBC came in a lowly 52nd out of 65 fund managers. In this analysis, we provide an insight into the individual performance of each HSBC fund and apply a fund rating between 1 and 5 stars based on how each fund performed over the recent 5-year period.

Our analysis identified that only 1 of the 149 funds analysed received a ‘top performing’ 5-star rating. This fund was the HSBC China USD ETF which holds a relatively small £260.8 million of client funds - representing only 0.06% of the total funds under the management of HSBC. Launched in January 2011, the objective of this passive fund is to track the performance of the MSCI China Index, and over the recent 5-year period it has consistently been among the top performers in its sector. This fund returned growth of 77.39% over the recent 5-year period, which was considerably greater than the sector average of 55.31%. With growth of 29.17% over the recent 1 year it also outperformed the sector average of 15.84%.

Although only 1 HSBC fund received a ‘Top performing’ 5-star rating, 8 of their funds acquired a ‘good’ 4-star performance rating. One of these funds was the HSBC FTSE 250 ETF, which aims to replicate the performance of the FTSE 250 Index. This fund sits alongside 46 competing ETFs within the same sector and over the recent 5 year period it has performed comparatively well returning growth of 61.14% over 5-years, which outperformed 76% of the ETFs in its sector.

View the complete HSBC review 2018 in the March edition of the Yodelar magazine. Register now for just £1 for instant access to all premium reports.

View the complete HSBC review 2018 in the March edition of the Yodelar magazine. Register now for just £1 for instant access to all premium reports.

View the complete HSBC review 2018 in the March edition of the Yodelar magazine. Register now for just £1 for instant access to all premium reports.

View the complete HSBC review 2018 in the March edition of the Yodelar magazine. Register now for just £1 for instant access to all premium reports.

Disappointing Performance From 64% of HSBC Funds

96 of the 149 HSBC funds analysed have factually performed worse than at least 50% of same sector funds during the recent 5-year period with a proportion consistently underperforming their peers. One of the most disappointing HSBC funds was their UK Focus fund, which is one of 249 funds competing within the IA UK All Companies sector. Over the recent 12 months, this fund returned negative growth of -1.73% and ranked 235th out of the 249 funds in its sector for growth. Over 5-years it hasn’t fared much better as it was outperformed by 94% of same sector funds with growth of 28.19%, in comparison the sector average was 52.97%.

The HSBC Income fund was yet another one of their funds to under-perform. The objective of this fund is to provide an above average yield together with capital growth by investing predominantly in the UK. However, over the recent 5-year period this fund was outperformed by 94% of funds in its sector with growth of 31.43%, which was notably lower than the sector average of 49.91%.

There are investors and indeed advisers who seek comfort in the arms of a recognised and long-standing brand, but as established in this report, this does not always equate to competitive returns for the investor. Indeed, a large proportion of the HSBC funds we analysed have consistently underperformed within their sectors and delivered lower returns for their investors than the funds they compete alongside.

Therefore, for the investors in pursuit of maximising their portfolio growth in a manner suitable to their risk profile may be better served looking beyond HSBC for top performing investment opportunities.