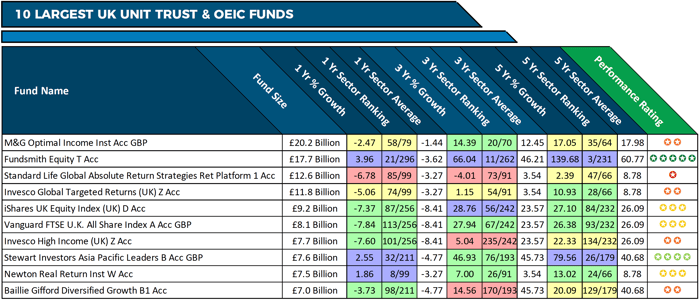

With billions of pounds under management, a handful of investment funds have grown to dominate the market. There are 3523 funds across 36 Investment Association sectors with funds under management that total £1,069.6 billion, yet just 10 funds account for 10.2% of this amount.

These funds combined hold more than £109.4 billion of assets under management. With such a dominant market share they are among the most favoured choices with UK advisers and consumer investors alike. But does their performance reflect their high standing or are there less favoured but better performing alternatives elsewhere?

In this report, we feature the performance and sector ranking for each of these popular funds over the recent 1, 3 & 5-year periods. Each fund has been provided with a performance rating between 1 and 5-stars based on how they consistently performed in comparison to their peers.

As detailed within, our analysis identifies that some of the most heavily invested funds in the UK are among the worst performers.

“Some of the most heavily invested funds in the UK are among the worst performers.”

All figures up to 1st February 2019

-

1. M&G Optimal Income

The M&G Optimal Income fund is a flexible fund, where at least 50% will be invested in bonds ranging from government bonds, investment grade corporate bonds, and high yield bonds. In terms of money managed, it's been a rollercoaster few years for M&G Optimal Income. Assets under management peaked in 2014 at £24.5 billion, falling to £15 billion over the next 2 years. Over the last few years it has once again become the largest retail Unit Trust & OEIC fund in the UK with recent assets under management totalling £20.2 Billion.

Despite its status as the UK's largest retail Unit Trust & OEIC fund, the M&G Optimal Income fund has regularly returned growth that was worse than at least half of competing funds within the same sector. Over the past 12 months this fund returned losses of -2.47%, and over last 5-years it returned growth of 17.05% both time periods the M&G Optimal Income fund was ranked in the worst 50% when compared to same sector competing funds.

-

2. Fundsmith Equity

Since launch the Fundsmith Equity fund has been one of the most popular and top-selling funds in the UK. Over the past three years its total funds under management grew by almost £7 billion to £17.7 billion taking it above the Standard Life Investments Global Absolute Return Strategies fund, which up until recently was the largest Unit Trust & OEIC fund in the UK.

Managed by Terry Smith, the Fundsmith Equity fund targets long-term growth by investing in a concentrated portfolio of 20-30 large, liquid stocks with a market cap greater than $2 billion and include PayPal, Microsoft & Facebook. This funds strategy has served it well. It has consistently been one of the top performing funds not only in its sector but in the entire IA universe.

The past 12 months have been a difficult time for Global markets with the sector averaging losses of -3.62%. During this challenging period, the Fundsmith Equity fund not only managed to return growth of 3.96% but it also outperformed 93% of its competitors in doing so. Over 5-years it maintained its consistency as it was one of the best performers in its sector returning growth of 139.68%, which was more than double the 60.77% sector average and better than 99% of its peers.

.png?width=500&name=oie_transparent%20(9).png)

3. Standard Life Investments Global Absolute Return Strategies (GARS)

Standard Life Investments Global Absolute Return Strategies (GARS) launched in 2008. It was marketed as a portfolio that “aims to provide positive investment returns in all market conditions” which helped it gain popularity with advisers. Its inclusion in the influential Hargreaves Lansdown Wealth 150 recommended funds list also enabled it to gain traction with investors. By March 2016 it had grown into a behemoth as it became the largest Unit Trust & OEIC fund comfortably in the UK with total assets under management of £53 billion.

However, over recent years the fund has been plagued by poor performance and the funds’ size has dropped at an alarming rate as investors leave in their droves. Currently, the fund sits at £12.6 billion, which, although the 3rd largest fund on the market, its enormous outflows of £40 billion in just 3-years has been of great concern for investors and advisers.

With continued below par performance it is not difficult to see why this fund has fallen out of favour. Over the recent 1-year period it returned losses of -6.78%, which was worse than 85.9% of competing funds within the same sector. Over the past 3-years, this fund also lost money for its investors as it returned negative growth of -4.01%, even though the sector averaged growth of 3.54%. Over the past 5-years, it has only managed to return growth of 2.39%, which was well below the 8.78% sector average and worse than 71% of its peers.

4. Invesco Global Targeted Returns (UK)

Similar to the Standard Life GARS fund, the Invesco Global Targeted Returns sits within the Targeted Absolute Return sector. It aims to deliver a positive total return in all conditions, and with fewer rollercoaster ups and downs than the market as a whole. Since its launch in September 2013, it has grown to become the 4th largest Unit Trust & OEIC fund in the UK with current funds under management at £11.8 billion. Despite its size this fund has a disappointing performance history.

Over the past 12 months, the Invesco Global Targeted Returns fund returned losses of -5.06% and over 3-years it only managed to return growth of 1.15%, which was below the sector average and worse than many low-interest savings accounts. However, its 5-year returns of 10.93% were above the sector average of 8.78% and considerably higher than the 2.39% returned by the competing Standard Life GARS fund.

-

5. iShares UK Equity Index (UK)

The iShares UK Equity Index (UK) is a passive fund that aims to achieve capital growth by tracking the performance of the FTSE All-Share Index closely. Among the key factors that have contributed to this fund’s popularity is the low-cost structure that has helped it grow to become one of the largest funds in the UK with funds under management reaching £10.7 billion.

It’s been a difficult year for UK markets which has resulted in the UK All Companies sector averaging losses of -8.41% for the past 12 months. Investor confidence has plummeted with £billions withdrawn in recent months, with £1.5 billion removed from the iShares UK Equity Index (UK) fund.

As a tracker fund, it falls in value if the market it tracks falls, so its losses of -7.37% this past year has not come as a surprise. Over the recent 3 & 5-years, which saw steady growth in the UK sector, the iShares UK Equity Index (UK) fund returned above 28.76% and 27.10% respectively, which was above the sector average but below its top performing active counterparts.

-

6. Vanguard FTSE U.K All-Share Index

The Vanguard FTSE U.K All Share Index is the 6th largest in the UK and another passive fund that sits within the UK All Companies sector. Similar to the iShare UK Equity Index (UK) fund, the Vanguard FTSE U.K All-Share Index fund seeks to track the performance of the FTSE All-Share Index. As such, it also suffered losses this past year as it returned negative growth of -7.84%, and over 3 & 5-years it had similar returns of 27.94% and 26.38% respectively.

With funds under management of £8.1 Billion, this low-cost tracker holds a sizeable share of the UK market. But with investor confidence in the sector low and continued political and economic uncertainty it is expected that further withdrawals will happen in the coming months. However, in recent weeks the sector has rallied with an average growth of 4.18% over the past month, which was the 6th highest of all 36 Investment Association sector.

-

7. Invesco High Income (UK)

The 7th largest Unit Trust & OEIC fund in the UK is the Invesco High Income fund. This popular fund is where fund manager Neil Woodford earned his reputation as a star fund manager, although he has taken a battering in recent years with the poor performance of his current funds. Now managed by Mark Burnett the Invesco High Income fund has had a difficult few years performance wise. Over the recent 3 year period this fund ranked 235th out of 242 funds in its sector with low returns of 5.04%. This was more than 4 times lower than the sector average for the period of 23.57%. Over the recent 5-year period this fund also performed below the sector average as it returned cumulative growth for the period of 22.33%, which was worse than 56% of its rivals.

The poor performance of this fund combined with investors moving huge sums out of UK equities has seen the Invesco High Income fund reduce its funds under management to £7.7 billion - a drop of £2 billion in just six months.

-

8. Stewart Investors Asia Pacific Leaders

The popular Stewart Investors Asia Pacific Leaders Fund invests in shares of mid to large sized companies that typically have a market value of at least $1 billion and operate in the Asia Pacific region including Australia and New Zealand but excluding Japan. In recent years this fund has earned a reputation as a stellar performer. But after a change of manager in 2015, when Angus Tulloch retired, 2017 had proved a disappointing year in terms of performance for incumbent manager David Gait. As a result, funds under management dropped from £10.1 billion in 2016 to £7.6 billion, which currently puts this fund 8th in the list of largest UK Unit Trust & OEIC funds.

Despite a dip in performance around the time of changing fund managers the Stewart Investors Asia Pacific Leaders Fund has been able to maintain a top quartile sector ranking over the recent 1 and 5-year periods with a growth of 2.55% and 79.56% respectively.

-

9. Newton Real Return

Last year’s high volatility and poor performing markets saw a decline in fund size across many sectors. Among the funds hit the hardest was the Newton Real Return fund, which saw its FUM reduce to £7.5 billion after £2.7 billion was withdrawn from it last year. Despite this sharp fall, this fund still ranks as the 9th largest UK Unit Trust & OEIC fund.

Managed by Aron Pataki and Suzanne Hutchins the fund aims to achieve significant real rates of return in Sterling terms predominantly from a portfolio of UK and international securities.

Although this fund experienced large outflows this past year it was still one of the few funds in its sector to return growth for the period as it ranked 8th out of 99 funds in its sector with 1-year returns of 1.86%.

-

10. Baillie Gifford Diversified Growth

The Baillie Gifford Diversified Growth ranks number 10 for size with current funds under management sitting at £7 billion.

Launched in 2008, the objective of this fund is to achieve long term capital growth at lower risk than equity markets by investing in a diversified portfolio of assets that include other Baillie Gifford funds, as well as directly in bonds, commodities and closed-end funds. Performance wise, this lower risk specialist fund has returned 1, 3 & 5-year growth of -3.73%, 14.56%, and 20.09%.

The ten funds in this report account for more than 10% of the total FUM across all 3523 Unit Trust & OEIC funds that are recognised by the Investment Association. These funds are some of the most popular on the market, yet despite their fund size, their performance figures show mediocre to poor performance from 8 of the 10 funds as many of their lower value peers have delivered consistently better returns.