Are you happy with your investment returns over the past ten years or do you think you could have achieved more?

In recent years Global markets have thrived resulting in record levels of investment growth and sizeable gains for many investors. Although such periods of prosperity can be hugely rewarding for investors, it can also mask the inefficiencies of poorly managed portfolios. As a result, some investors are unaware that their portfolios could have returned significantly higher returns if invested more efficiently.

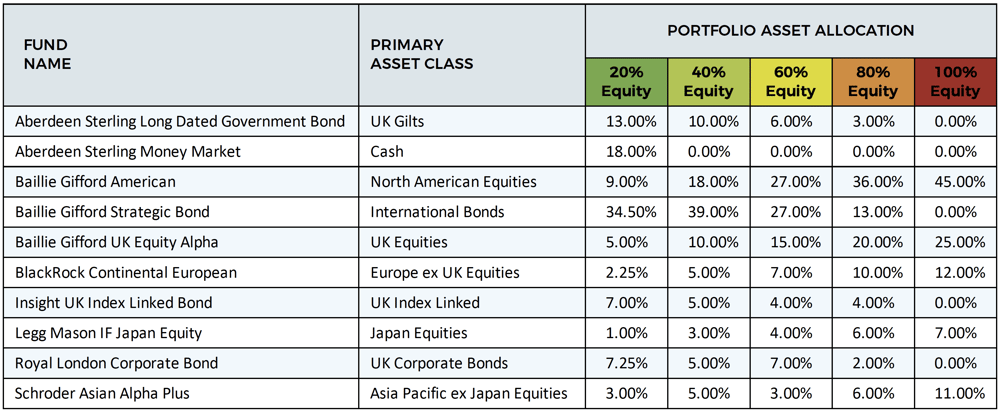

To identify the potential growth investors could have achieved from their portfolios over the recent 1, 3, 5 & 10-year periods we created five portfolios that have been built to reflect the asset allocation model as set by Vanguard for their popular range of LifeStrategy portfolios.

Each LifeStrategy portfolio assumes differing degrees of risk, with risk profiler Dynamic Planner rating each portfolio between 1 and 10 based on their risk exposure.

Their lowest risk LifeStrategy 20% Equity portfolio has a risk rating of 3 out of 10 and is suitable for cautious investors who are willing to sacrifice higher returns for greater protection against potential losses.

In contrast, the LifeStrategy 100% equity portfolio has a risk rating of 7 out of 10 and is only suitable to investors who are more comfortable with taking on greater investment risk in their pursuit of higher returns.

By following Vanguards asset allocation model, we then built five portfolios using only funds across the relevant asset classes that had consistently outperformed their peers during the periods analysed.

Consistent Top Performance

For each of the five portfolios, we used a maximum of 10 funds across ten different asset classes.

Although there is no fixed rule as to how many assets a diversified portfolio should hold: too few can add risk,

Although there is no fixed rule as to how many assets a diversified portfolio should hold: too few can add risk, but so can holding too many. Hundreds of holdings across many different assets can be hard to manage, and diversification for the sake of it runs the risk of poorer performance.

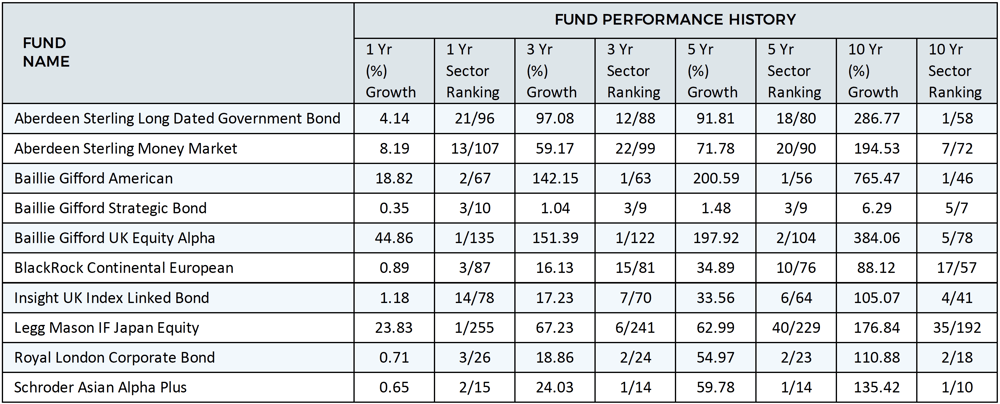

Each of the funds within each portfolio has a history of competitive performance, even during challenging periods.

As identified in the fund performance figures, equities in traditionally more volatile markets such as North America and Japan returned some of the highest levels of growth, as too did UK equities with the Baillie Gifford UK Alpha fund continually outperforming the majority of similar funds in the same sector as it grew by an exceptional 44.86% over the past year and by a total of 384% over the past 10 years.

How Each Portfolio Performed

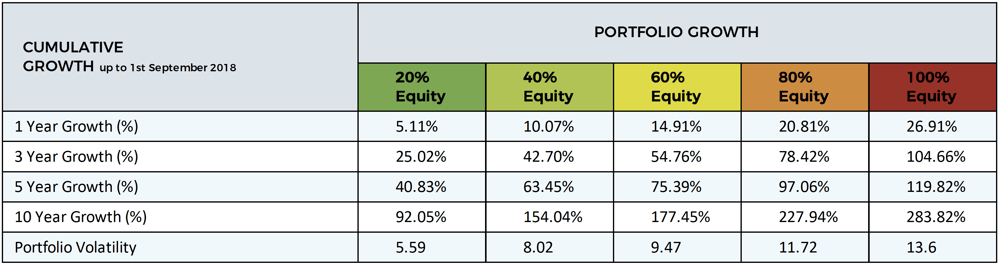

Our analysis found that a portfolio of consistently top performing funds built to fit a popular and successful asset allocation model returned some highly impressive growth figures over each of the periods analysed. Unsurprisingly, the higher risk portfolios returned the biggest growth figures with the 100% equity portfolio achieving growth of 283.82% over the past ten years – which averages at 28% per year.

However, perhaps the most impressive was the relatively low risk 40% equity portfolio. Although this portfolio follows a low-risk rating of 4 out of 10, it managed to average growth of 15.4% annually over the past 10-years.

An Efficient Plan To Maximise Future Returns

As investors, we all should have an investment plan that includes suitable asset allocation, tax management, rebalancing and cost management strategy. However, an investment plan will only really work if you know how efficient each aspect of your portfolio is performing.

Whether you manage your own investments or have an adviser do it on your behalf, it is always beneficial to understand, monitor and assess the quality of your investments.

1. Asset Allocation

Suitable asset allocation is one that provides measured exposure to asset classes and therefore ensures the balance between risk and reward is fitting for you.

2. Cost

Cost is one of the most important factors for investors. But how much is too much? The proliferation of low-cost investment portfolios, such as those offered by Robo-Advice platforms, has helped to bring cost to the forefront of investment decisions.

However, as we previously reported these low-cost alternatives often deliver considerably lower returns than more expensive but better-performing options.

3. Fund Selection

The quality of the underlying funds that make up your portfolio will have significant influence over the performance of your portfolio. Fund performance is not a regulated aspect of financial planning, and financial advisers are not required to research funds.

As a result, a large proportion demonstrates a poor level of knowledge on fund performance or the actual quality of funds they recommend.

However, our fund search tool, and portfolio grading function makes it easy for investors and advisers to identify precisely how competitive their funds and overall portfolio is performing.

4. Rebalancing

Asset allocation and rebalancing go hand in hand. Over time the funds within your portfolio will grow higher or lower than each other and shift the balance of your portfolio. Therefore, regular rebalancing is critical to efficient investing.

What Can We Expect In The Future?

According to research by Schroders, UK investors expect an average annual return of 8.7% on their investments over the next five years. However, the Schroders Economics Group say it’s too high, as they forecast a 4.2% annual return for world equities over the next seven years. Other financial analysts have predicted growth of 6.8% for UK equities and 7.2% for international equities, while some have even predicted up to 18%.

However, the continuously shifting sands of regional and international politics, uncertainty over future trade deals, the innovation of new technologies, climate and economic concerns are just some of many factors that will influence how future investment markets perform. The fact is, future forecasts and projections, no one knows how much growth if any, our investments will achieve in the next ten years. But with sufficient understanding and efficient planning investors can help ensure their portfolios continually maximum growth.