When Britain voted to leave the European Union in June 2016, investors were faced with uncertainty as to what this meant for the future. In the time since, the pound has significantly weakened and inflation has hit 3%. Yet despite these economic changes many investors have enjoyed strong portfolio growth.

But as Brexit negotiations heat up and the possibility of a ‘Hard Brexit’ becomes ever more likely should investors be concerned and how should they prepare?

Should Investors worry about Brexit?

Although Brexit represents a significant shift in the political and financial landscape, investor sentiment has remained resilient even if there is uncertainty.

Recent research by Rathbones investment management, found that more UK investors fear inflation than they do Brexit. In fact, more than two-thirds (69%) of investors said they did not consider Brexit to be a substantial threat to their investment portfolio. Although inflation poses its own risks there is worry that UK investors may underestimate the impacts Brexit might have on their portfolios.

How Brexit has impacted investments

In the year since the EU referendum the pound has plunged and the stock market has soared, yet investor confidence remains high as many have enjoyed stellar gains in their portfolio as a result.

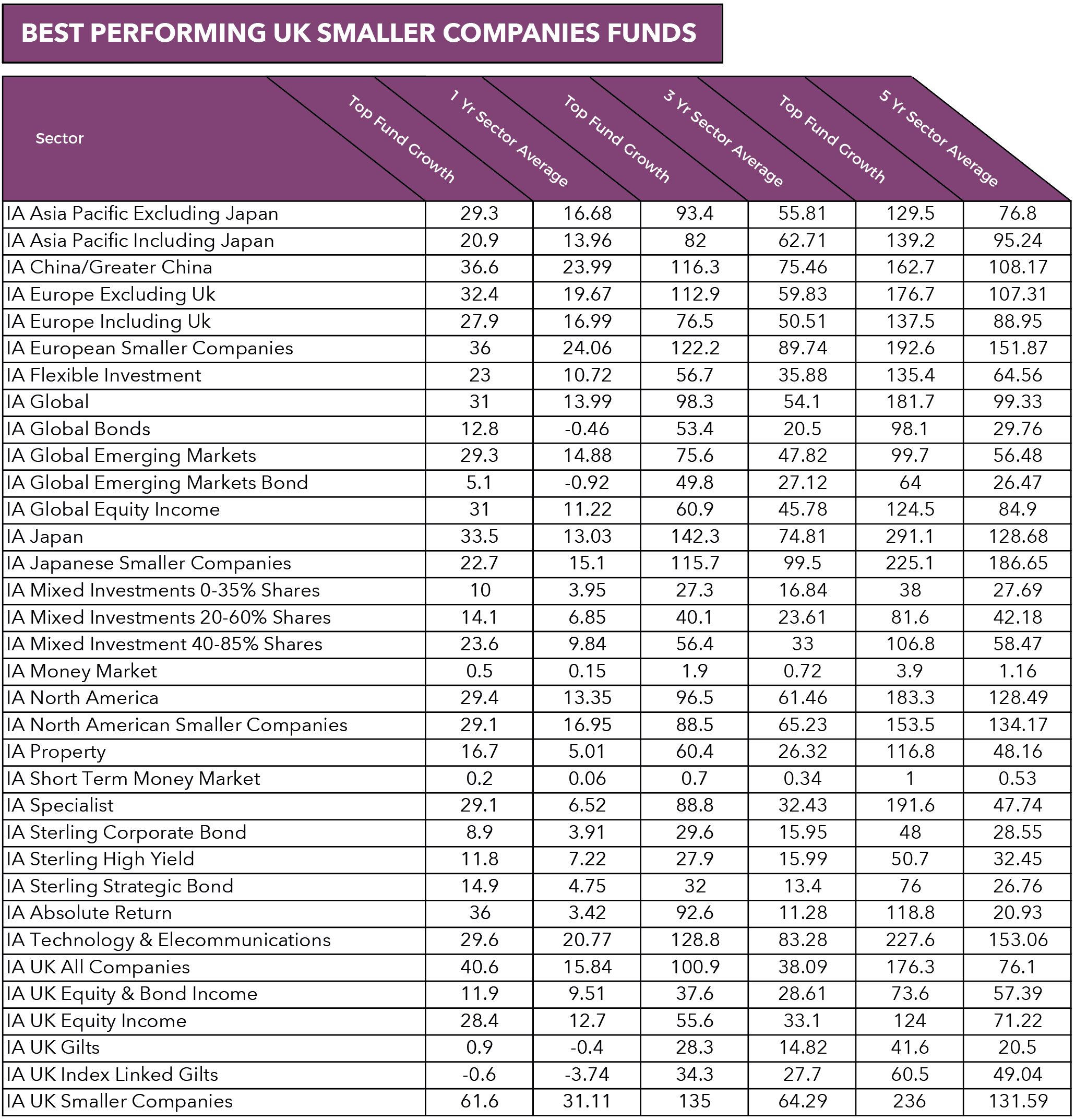

The FTSE 100 is up by more than 16% over the past year, as companies with overseas earnings have seen their profits boosted by weaker sterling. Meanwhile, the average UK All Companies fund returned average growth of 15.84% over the past year while the UK Smaller companies sector returned average growth of 31.11% over that period.

While many investors will rejoice at these gains, what they may not realise is their portfolio is likely to have been thrown out of kilter by the market moves.

Also, despite the recent strong performance, investors should not become over confident or dependent on the success of UK sectors. Over emphasis on one sector can expose investors to higher risk and larger losses should their performance turn the other way - and with the uncertainty of Brexit, there is a real risk of that happening.

*Performance figures up to November 2017

*Performance figures up to November 2017

Uncertain markets provide both opportunities & risks

Although investors should not overly focus on one region or sector it makes sense to prepare your portfolio for any potential volatility that may lie ahead as no-one knows exactly what the full impact of a hard Brexit will be on Investment markets or on sterling.

Financial analysts have suggested that one way to do this is to consider focusing on investing in sectors and markets that are less likely to fall victim to country-specific political risk.

However, some investors believe that Brexit will favour certain industries so they have decided to place heavier focus on shares in companies within these industries in an attempt to add growth to their portfolio. But such an approach is risky, as the performance of a share relies solely on the company concerned. Such an approach can increase portfolio volatility and expose investors to greater loses should their shares perform poorly.

It is widely believed that a less risky approach is to invest within funds that hold weightings in multiple companies across many industries. Such an approach can also achieve impressive gains when particular sectors or industries perform well while also mitigating the risk of losses.

Diversification is Key

There are many investment strategies regarding Brexit that divide opinion, but diversification remains key to portfolio success.

Diversification is a straightforward investing concept. It is about recognising two things: risk is everywhere, and spreading your money around helps limit exposure to any single thing – be it a country, region, industry,

company, trend and so on. By mixing and matching a variety of assets, you construct a portfolio that is likely to be less volatile than a more concentrated one.

The UK accounts for just 3.5% of the world economy and 6.6% of developed-world equity markets, based on market value. Therefore, despite their strong performance, investing solely in UK sectors not only exposes you to the risks inherent in any tightly concentrated portfolio, but it also limits your ability to invest where the opportunities may liAlthough the UK sector continues to deliver competitive returns other regions that have been strong are America, continental Europe and developed Asia. By diversifying across such wide-ranging markets will help investors strengthen their portfolio against loss should one region or sector experience a downturn.

Rebalance Your Portfolio

As an investor, you will always be exposed to political uncertainty as well as fluctuating markets and trends which is why we should not be overly concerned or influenced by Brexit.

Whether you believe UK sectors will remain strong or whether you fear for their future, the single most important aspect of investing is to ensure your portfolio remains diversified and correctly balanced. This will help you reach your investment objectives no matter what the markets through at you.