Along with fund selection, one of the most critical decisions for your investment portfolio is your choice of asset allocation.

Efficient portfolios are built to include high-quality funds that incorporate a wide range of asset classes, however, how they perform can vary significantly based on which asset allocation model they follow – and in some cases, the difference in growth between 2 similar risk portfolios with different asset allocation models can exceed 70%.

Investment portfolios are built to fit one of several different risk profiles. At one end you have conservative investors who are willing to accept lower returns for greater protection against losses, at the other end investors are willing to take on higher levels of risk in the pursuit of higher returns. However, the majority of investors fit somewhere in between.

In order to maintain the correct level of risk, it’s essential that every portfolio is weighted based on whatever asset allocation model they choose to follow. However, as demonstrated in this report the role of asset allocation goes beyond balancing risk.

Comparing Asset Allocation Models

To provide an example of how similar risk portfolios with different asset allocation models can return different levels of growth we constructed a range of portfolios using top performing funds across a broad spectrum of asset classes.

The weighting we then placed on each fund was based on the asset allocation model used by Hargreaves Lansdown, BestInvest, and Vanguards range of ready-made portfolios.

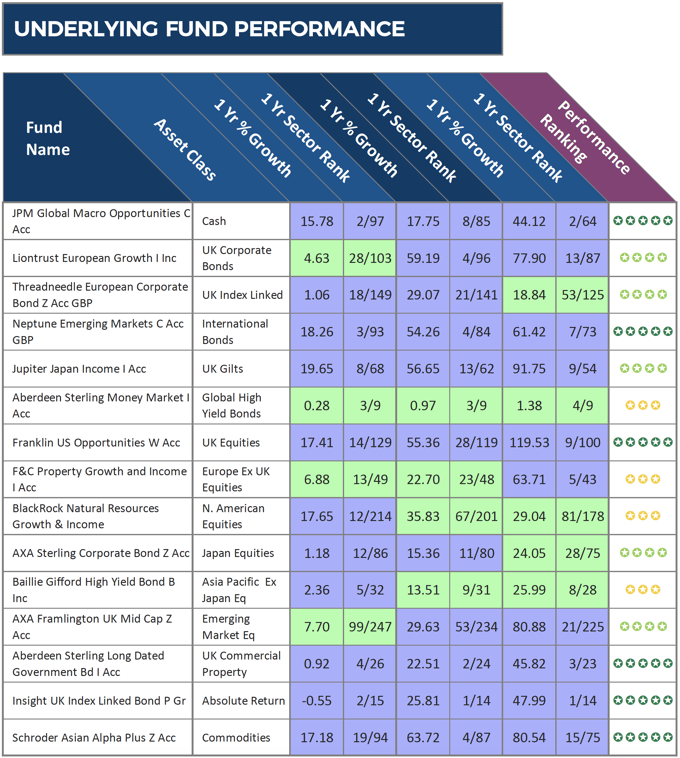

Underlying Funds & Their Performance

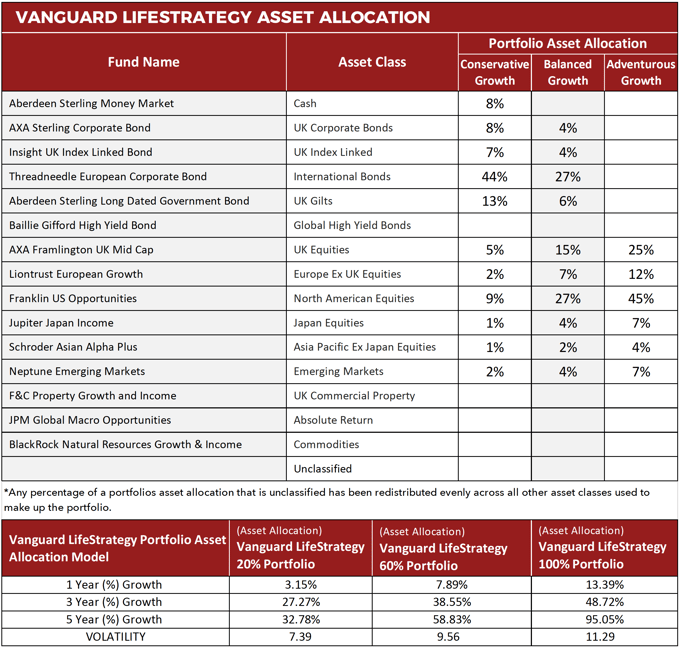

The below table details the funds used to replicate the desired asset allocation models.

Alongside each funds name is the asset class and sectors they belong to as well as their cumulative performance over the recent 1, 3 & 5 year period up to 1st June 2018.

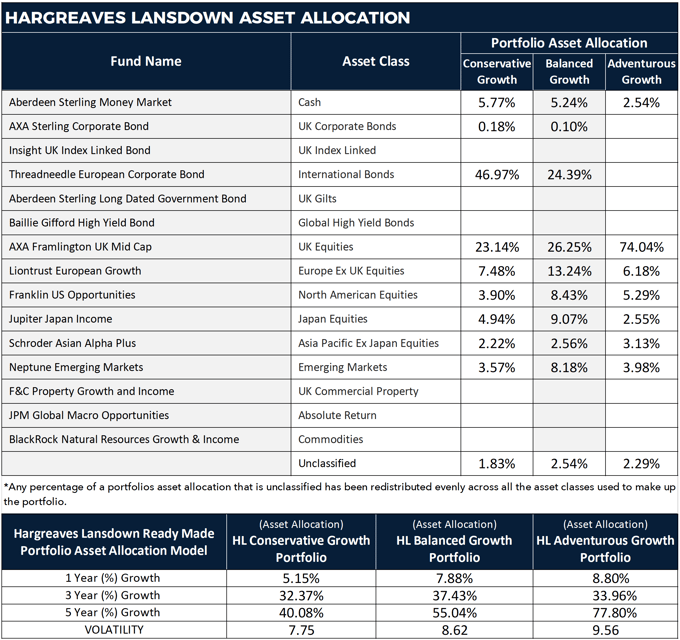

Hargreaves Lansdown Portfolio +

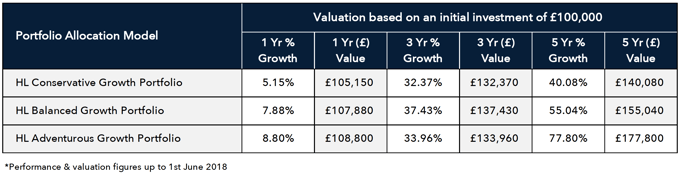

Hargreaves Lansdown has three ready-made portfolios; they are their Conservative Growth (suitable for lower risk investors), their Balanced Growth portfolio (Suitable to balanced investors), and their Adventurous Growth portfolio (suitable to higher risk investors).

These portfolios have been built using a selection of their own in-house funds and contain a range of asset classes, which have been strategically balanced to make up the desired portfolio concentration.

Each of our sample portfolios was then built to follow (as closely as possible) the same asset allocation models that have been used by Hargreaves Lansdown.

As demonstrated below the three portfolios we constructed to follow 3 Hargreaves Lansdown models have each delivered differing levels of growth over the recent 1, 3 & 5 year periods with, unsurprisingly, the more adventurous portfolio returning the highest growth.

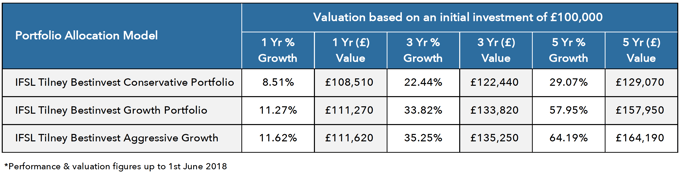

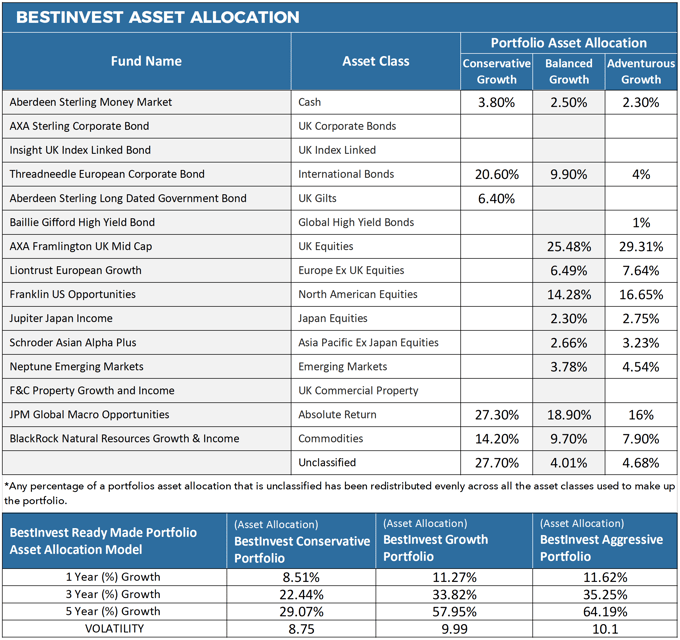

BestInvest Ready-made Portfolios

Similar to the previous process, we also constructed 3 portfolios, each representing different risk profiles, to reflect (as close as possible) the asset allocation model used by BestInvest to create their lower risk IFSL Tilney BestInvest Conservative Portfolio, medium risk IFSL Tilney BestInvest Growth Portfolio and higher risk IFSL Tilney BestInvest Aggressive Growth portfolio. However, with BestInvests portfolios a proportion of their underlying holdings were unclassified.

Therefore, for the purpose of this analysis, we redistributed any unclassified assets across all other known asset classes that they invest in.

Vanguard LifeStrategy

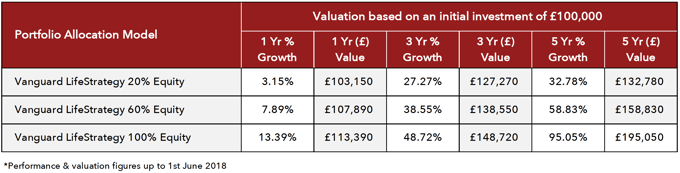

The final three portfolios were constructed using the asset allocation model used by Vanguard for 3 of their very popular LifeStrategy range of readymade portfolios. The Vanguard LifeStrategy 20% Equity currently holds £809.5 million of client money and adopts a cautious level of risk. The LifeStrategy 60% Equity, assumes a mid-balanced level of risk and the LifeStrategy 100% Equity has the highest level of risk and is targeted to fit an adventurous investment profile.

Our analysis found that the asset allocation used by Vanguard for their adventurous LifeStrategy 100% Equity portfolio has delivered the highest returns of all the portfolios analysed.

Using the asset allocation model of Hargreaves Lansdown's Conservative Growth portfolio our model portfolio returned growth of 40.08% in the 5-year period up to 1st June 2018, which was more than 72% greater than the portfolio built to replicate the asset allocation model of BestInvest’s Conservative portfolio.

The Value of Asset Allocation

Based on the model portfolios we created the following table shows the value an initial investment of £100,000 on 1st June 2013 to 1st June 2018 would now be worth.

The example portfolios and the underlying funds used for this report are included for illustrative purposes only and should not be viewed as a recommendation to invest.

Asset Allocation & Portfolio Performance

Asset allocation and risk are intrinsically intertwined, but regardless if you are a cautious or aggressive investor or somewhere in between, there are countless asset allocation models available to suit your risk profile. Careful selection of the asset classes that comprise a portfolio, as well as the individual investments within each asset class, is important to the ultimate performance of the portfolio.

While there is some debate over the exact percentage of portfolio performance that should be attributed to asset allocation, our analysis identifies that the difference in growth, in some cases, can be significant.

*The example portfolios created for this report have been built to follow, as closely as possible, the asset allocation of the model portfolios used by Hargreaves Lansdown, BestInvest and Vanguard. However, the funds within our example portfolios may have different objectives and underlying holdings to those of the model portfolios that were analysed and their performance and asset allocation could change in the future.

**This report is for information purposes only and should not be viewed as a recommendation to invest.