-

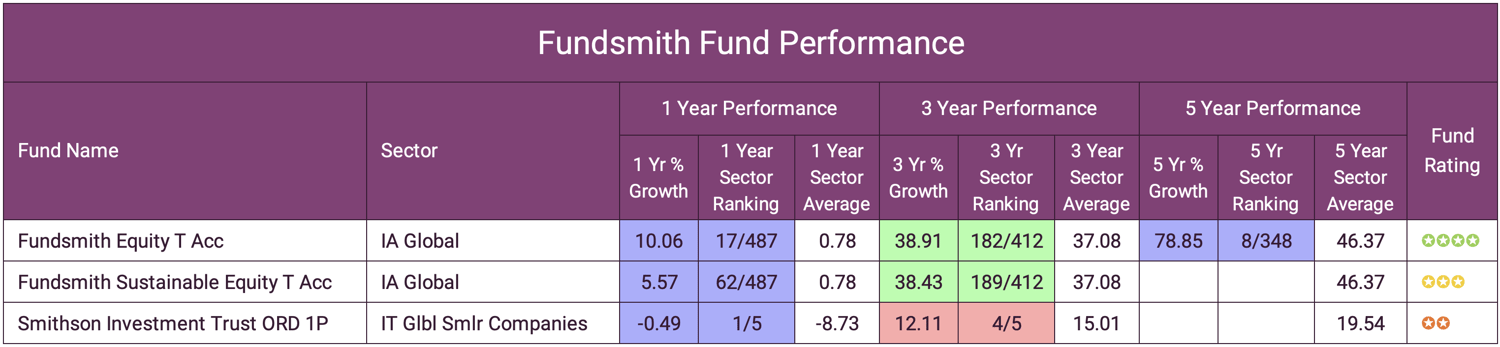

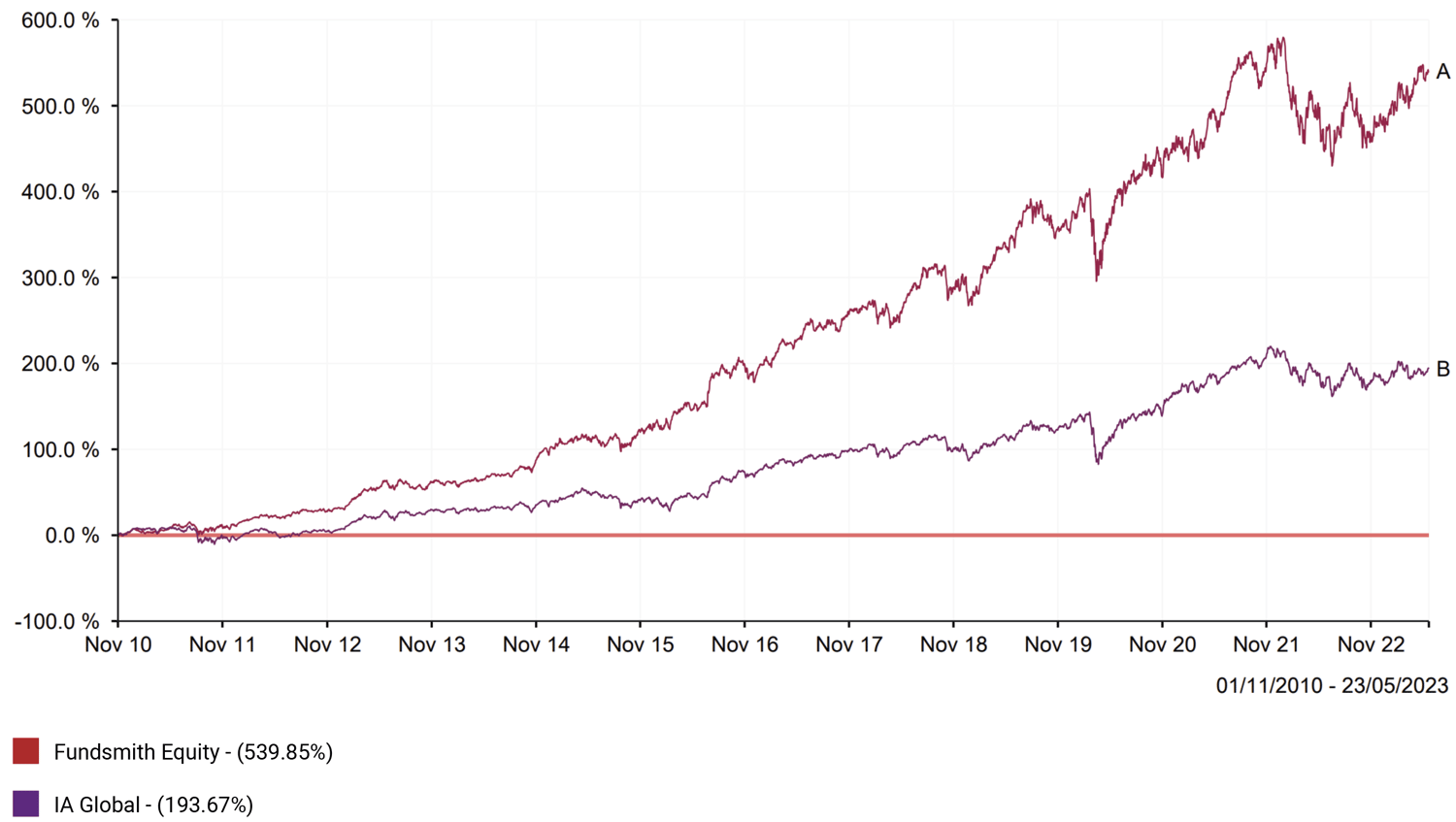

Since inception up until 1st May 2023 the Fundsmith Equity fund returned cumulative growth of 531.81% - the average for the period was 180.67%.

-

Over the past 5 years the Fundsmith Equity fund has delivered returns that were in the top 2% of the entire Global sector.

-

The Smithson Investment Trust has underperformed the sector average over the past 3 years but since its launch it has comfortably outperformed the average.

-

In November 2022, due to poor performance, Fundsmith closed their Emerging Equities Trust.

Poor performance in 2022 led some worried investors to dump the Fundsmith Equity fund in favour of competing funds that had fared better during the period. Was this a mistake or are Fundsmith funds not as competitive as many believed?

In this article, we will provide a detailed performance assessment for all Fundsmith funds and identify how each rank for performance compared to their peers and sector average not only over the past 1, 3 & 5 years but since their inception. The performance analysis will clearly identify whether Fundsmith has delivered value or not for their investors and whether they offer investors competitive investment opportunities.

Fundsmith Fund Performance Summary

Fundsmith currently manages 2 funds and 1 investment trust. In this analysis we analysed each for performance by comparing them to all other same sector funds over the recent 1, 3 & 5 years. Each fund has then been provided with a star rating based on their comparative performance.

Our analysis of each Fundsmith fund identifies their equity fund to have a 4 star rating with their Sustainable Equity fund rating as 3 stars - this was mainly due to not having any 5 year performance history at time or analysis. The Smithson Investment Trust was the only one to have underperformed the sector average over 3 years, resulting in a 2 star performance rating.

Fundsmith Equity Fund

The Fundsmith Equity fund, is Terry Smith's flagship fund which he launched in November 2010. The fund quickly grew in popularity and now holds the spot as the largest fund in the UK with some £23.5 billion of client money currently entrusted to this fund.

The fund’s focus on achieving growth by investing in quality companies has made it a favourite with investors and investment advisers and since its launch it has consistently delivered some of the strongest returns in its sector.

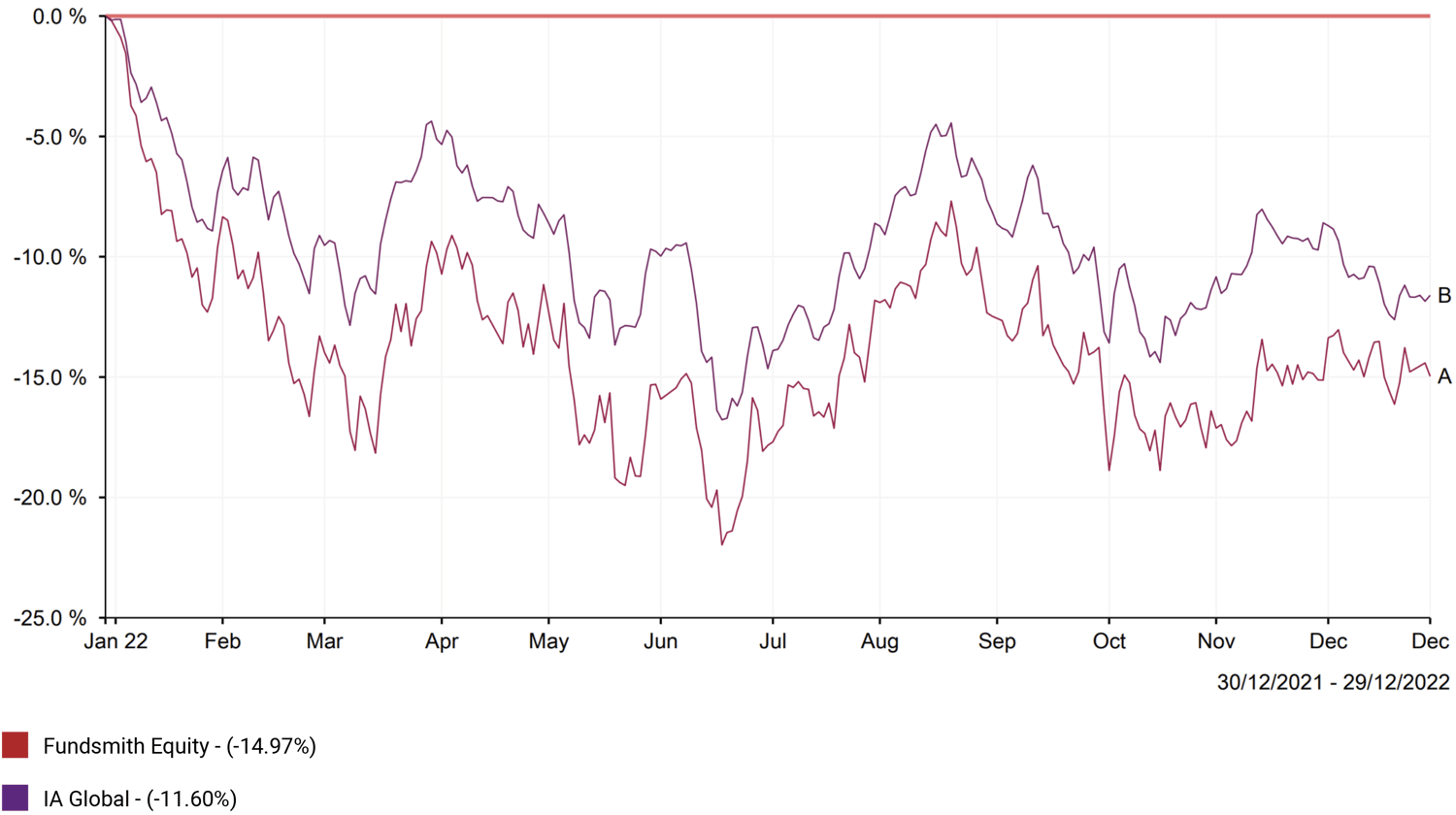

Like all growth focused funds, 2022 was a tough year for the Fundsmith Equity fund. Highly volatile global markets hit almost all sectors and industries which resulted in a period of underperformance for the fund. In 2022 the Fundsmith Equity fund returned negative growth of -14.97% with the sector averaging -11.60%. This period had raised concerns among some investors spooked by the tech sell-off along with general market uncertainty and high volatility, with some swapping the fund for lower risk and often lower quality alternatives.

A one year period is an incredibly short investment window and as such, investors should not place too much emphasis on short performance periods. Investment performance will always fluctuate and no one fund or fund manager will outperform during all market conditions.

2022, is a good example. It was a year that negatively impacted quality funds harder than those of lesser quality, so any investor making decisions based on last year's returns will be more likely to make poor choices.

Fund performance should be assessed over a longer period of 5 years or more as this will increase exposure to more political and economic challenges and different market cycles.

Despite short-term underperformance in 2022, our analysis identifies the Fundsmith Equity fund to have outperformed the sector average since its inception, net of all market cycles.

Since its launch on 1st November 2010, the Fundsmith Equity fund has delivered huge growth of 539.85%. In comparison, the average growth returned in the IA Global sector during the same period was 193.67%. As can be seen in the above chart, the fund has a much higher growth curve than the sector average but during periods or market declines the fund has fallen more sharply than many of its peers.

How The Fundsmith Equity Fund Compares To Its Rivals

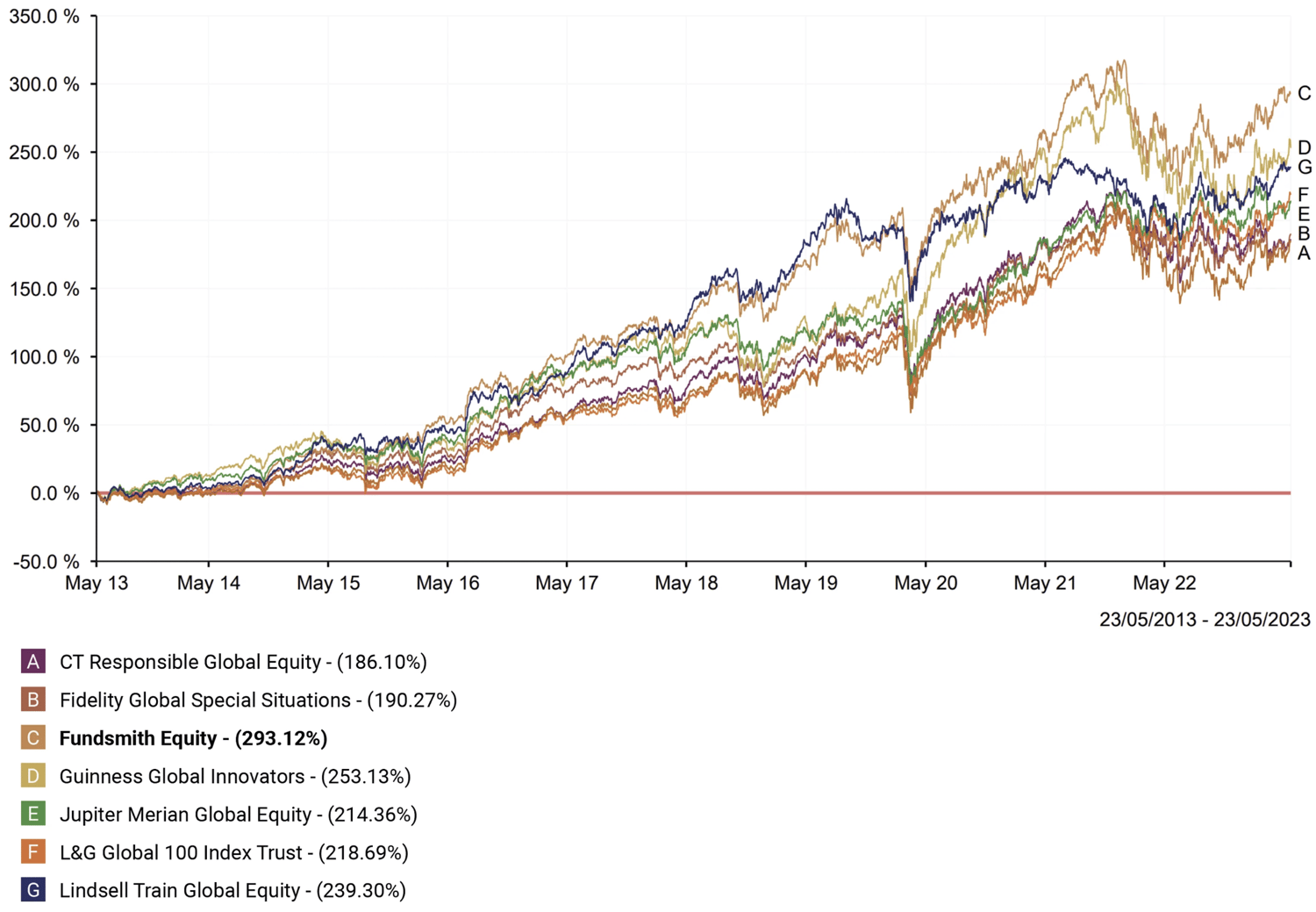

Other than using the sector average as a comparison we have also compared the Fundsmith Equity funds performance alongside some of the most popular funds on the market that are also classified within the same IA Global sector.

The chart above shows the most recent 10 year performance of some of the most popular, similarly risk rated funds that are also classified within the IA Global sector - such as the Lindsell Train Global Total Return fund.

With 10 year returns of 293.12%, the Fundsmith Equity fund was again the top performing Global fund for the period, inclusive of all negative cycles.

Fundsmith Sustainable Equity Fund

It wasn’t until November 2017 that Terry Smith launched his second global equity fund, the Fundsmith Sustainable Equity fund. As the funds name suggests, the funds strategy is to focus on sustainable categories, which was a departure from Smith’s earlier stance on ethical funds. The fund closely follows the same global strategy as the Fundsmith Equity fund, but its primary difference is that it is an ethically themed fund and therefore excludes investing in sectors that do not align with sustainability categories.

Sectors excluded from the Sustainable Equity fund are:

- No Aerospace and Defence

- No Brewers, Distillers and Vintners

- No Casinos and Gaming

- No Gas and Electric Utilities

- No Metals and Mining

- No Oil, Gas and Consumable Fuels

- No Pornography

- No Tobacco

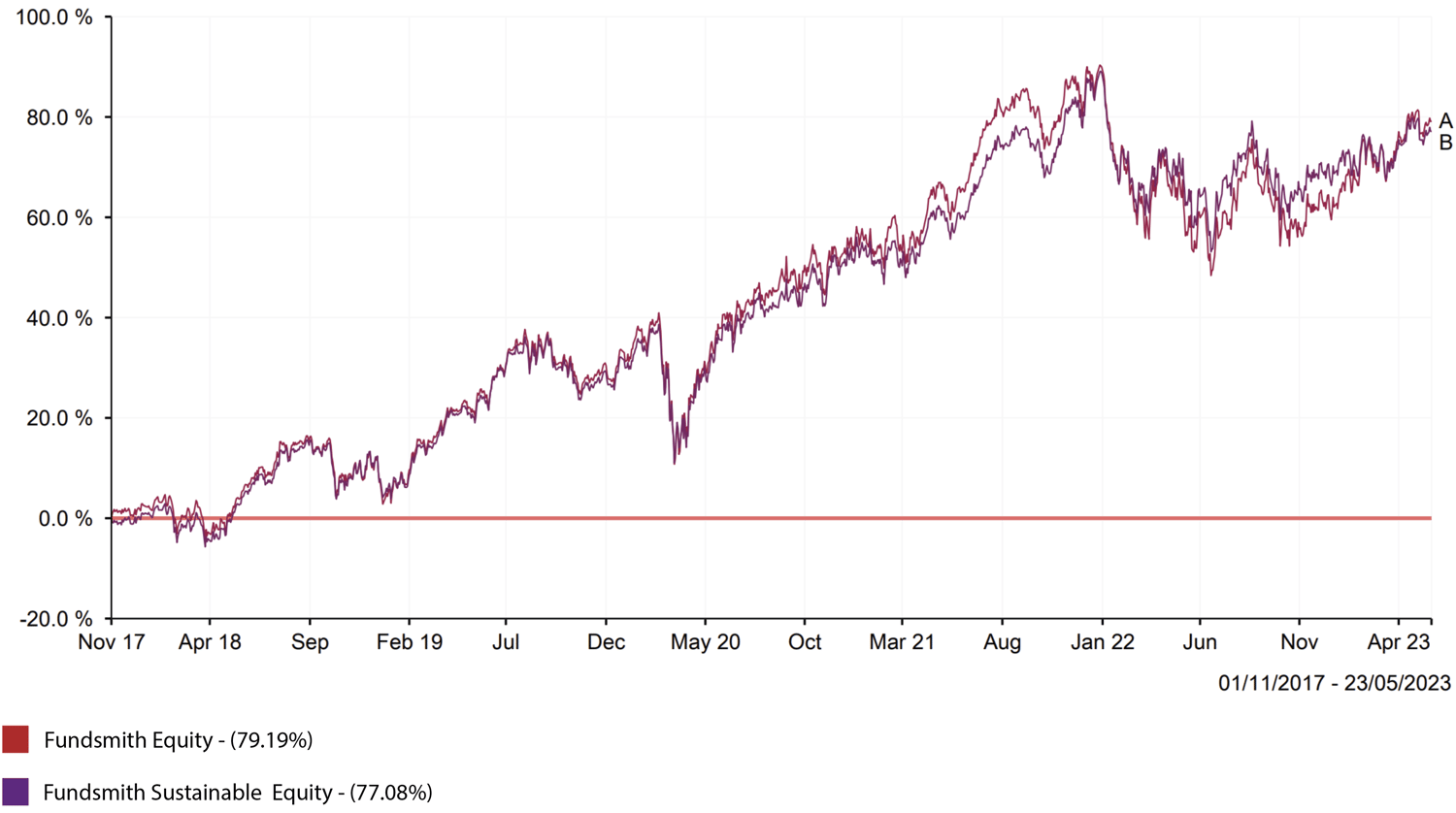

Despite initial scepticism about ethical funds, the Fundsmith Sustainable Equity fund has closely matched the performance of the Fundsmith Equity fund since its launch, but it is a more expensive option with ongoing charges of 1.05% in comparison to the 0.94% for the Fundsmith Equity fund.

Since its launch on 1st November 2017, the Fundsmith Sustainable Equity fund has returned growth of 77.08% closely matching the 79.19% returned by the Fundsmith Equity fund.

Terry Smith Pulls The Plug On The Fundsmith Emerging Equities Trust

Fundsmith launched the Fundsmith Emerging Equities Trust (FEET) in June 2014 as a variation on their existing investment strategy with the Fundsmith Equity fund but with one added dimension: the companies invested in by FEET will have the majority of their operations in, or revenue derived from, Developing Economies and will provide direct exposure to the rise of the consumer classes in those countries.

Since its launch the fund had continually struggled with uncompetitive performance prompting Terry Smith to apologise to his investors and in 2019 saw him hand over the day to day control of the trust. At the time Smith said, ‘Every human being, including me, has a limit to the amount of things they can focus on,’ he said. ‘Having people who are actually full time working on the trust as portfolio managers is more of a necessity than I thought it was.’

Since launch, investors holding onto the trust and reinvesting any dividends would have made 24.8% compared with 57.2% for the MSCI Emerging Markets index or 40.7% for the typical emerging markets investment trust.

However, in September 2022 Terry Smith pulled the plug on the fund due to its poor performance. Announcing the intention to close the trust, Smith said: “We have always maintained that we would only run funds where we felt we had a particular edge that would allow us to deliver superior risk-adjusted returns.

‘Fallen below our expectations’: Fundsmith emerging markets trust to close Terry Smith: Fundsmith valuation at cheapest level in five years “ Whilst FEET has made a positive return since launch in 2014 it has fallen below our expectations and, unlike other fund managers who might seek to hold onto the fund for the sake of the fee income, we feel it would be in the best interests of shareholders to receive their investment back in cash through a liquidation of the portfolio and wind-up of the company."

The trust subsequently received its stock exchange notice of cancellation on 14th November 2022.

Smithson Investment Trust

When Smithson launched in October 2018, it received unprecedented demand that saw it break the record for raising the greatest amount ever by a UK domiciled trust in its initial public offering (IPO).

Terry Smith launched Smithson as he believes small and medium sized companies have been shown to outperform large companies. Smith points out that small and mid cap companies have fewer research analysts studying them than larger ones and as such, it stands to reason that there may be less known about the mid cap stocks and consequently more discrepancies between price and value that Smithson can take advantage of.

Fundsmiths philosophy for Smithson is to look at companies within industries which have a history of delivering long-term value and avoid the temptation of looking at companies in industries that do not. One of the reasons for this is because Fundsmith believe there are many fads in investing which come and go: “the Dotcom boom; the mining “supercycle” (which turned out to be just a plain old cycle); the credit bubble; and most recently the cryptocurrency craze, one more example in a continuous stream of ‘new’ ways to make money. There are no new ways to make money. It is now a subject over which people have obsessed for centuries and so radical discoveries are unlikely.”

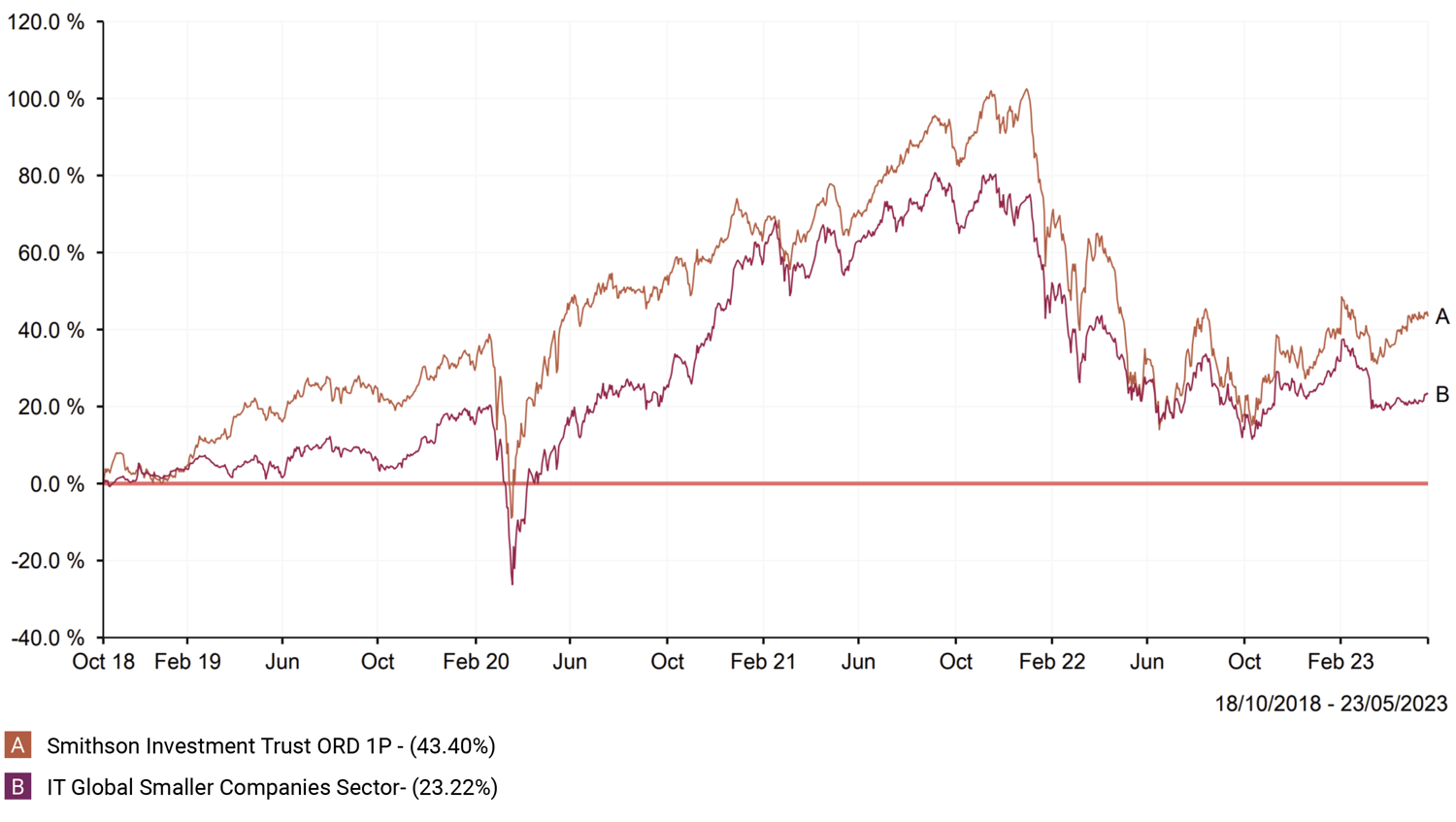

The Smithson trust experienced a difficult 2022 where it performed below the sector average but as the chart above shows, since its launch it has returned growth of 43.40% compared to the sector average of 23.22%.

Terry Smiths Investment Strategy

Fundsmith’s success is built on a simple investment strategy, which involves taking bold bets on a small number of companies and holding them for the long term, without paying attention to the quirks of a macroeconomy. This is rooted in Mr Smith’s belief that “nobody is capable of consistently predicting macro events” and that it is more worthwhile to identify good companies, a skill he honed over decades working as an analyst. “You might think every fund manager tries to invest in good companies, but I can assure you they don’t,” he says. “At Fundsmith we have spent a lot of time coming up with a definition of what is a good company.”

The Type of Companies Fundsmith Invests In:

- high quality businesses that can sustain a high return on operating capital employed;

- businesses whose advantages are difficult to replicate;

- businesses which do not require significant leverage to generate returns;

- businesses with a high degree of certainty of growth from reinvestment of their cash flows at high rates of return;

- businesses that are resilient to change, particularly technological innovation;

- businesses whose valuation is considered by the Company to be attractive.

- The Company will not invest in derivatives and will not hedge any currency exposure arising from within the operations of an investee business nor from the holding of an investment denominated in a currency other than sterling.

Fundsmith invests in mature companies with strong balance sheets and established brands, which are capable of reinvesting their profits and compounding value for investors over time, while excluding cyclical sectors, such as mining and financials.

He avoids companies that require leverage to generate profits, which is why he won’t invest in companies which require borrowed money to function or survive – such as banks.

Terry Smith says that his philosophy of investing in good companies is easier said than done, but he believes most other fund managers don’t do this. “Very few investment managers boast about the fact that they invest in low-quality businesses, but most of them do, often because they consider such businesses as ‘cheap’.

They buy these companies because they believe the price to be too low relative to their assets or earnings and then wait for the market to revalue them upwards. This is logical; however, the revaluation will depend on the whim of the market or events which are difficult to predict, such as the business cycle, takeovers, restructuring or management change.

So the revaluation might happen quickly, it might take a long time, or it may never happen at all. None of these are particularly good for an investor.”

Focus on Long Term Quality Not Short Term Trends

Terry Smith has dismissed last year's trend that saw many investors move into so-called value stocks, insisting his focus on quality growth companies will win out in the long term and that ‘no amount of recovery or low valuation will turn a poor business into a good one’.

The veteran stock picker was irritated by commentary around the stock market shift at the start of 2021, which caused companies that would benefit from lockdown ending to surge, while growth stocks fell out of favour.

The Fundsmith Equity fund went on to lag the MSCI World index in five of the seven months from November through to May.

But the value trade has petered out over the last number of months as concerns about the strength of the economic recovery have mounted, leading investors to switch back into quality growth stocks.

Smith said: 'There are several lessons to be learnt from this, not the least of which is that no amount of recovery or low valuation will turn a poor business into a good one and quality is the main determinant of long-term performance.’

Summary

The poor performance and the subsequent closure of the Fundsmith Emerging Equities Trust was undeniably a blow to Terry Smith. But this has done little to distract from the long term success of his Fundsmith Equity fund, which as identified in this article continues to represent an extremely competitive investment option.

What is important to note, is that over-reliance on any one fund manager or fund can prove harmful to investors. Despite the clear quality of the Fundsmith Equity fund in particular, investors can improve investment outcomes and increase protection by investing in a diverse portfolio that has an unrestricted approach to fund selection and fund management. Under the financial services compensation scheme (FSCS) the UK Government guarantees to protect investors assets up to £85,000 per provider. Investors can maximise this protection by investing in a portfolio that utilises several fund management brands.

Also, research has shown that having a diverse portfolio of high quality funds that specialise in one particular asset class can improve portfolio returns as it utilises regional specialists. No one fund manager is an expert in all asset classes so it makes sense to have a mix of funds from different providers who specialise in a particular asset class.