The progression of the digital age has not only given investors access to extensive fund information but it has enabled the development of technology where investors can now conveniently invest and manage their own portfolios, without the need of a financial adviser.

These online investor platforms or fund supermarkets have helped boost the number of self-investors, who were previously put off by the complexity of investing. They offer investors access to a wide range of investment products, the ability to monitor their own portfolio, invest tax efficiently while also reducing administration fees and charges.

But with such a wide array of fund supermarkets available, each with different charging structures, how can ‘DIY investors’ be sure the fund supermarket they use is the most cost efficient for their portfolio?

How fund supermarkets charge & why it’s important for investors

Up until recently, fund supermarkets primarily made their money from commission paid by fund managers, were out of a typical ongoing annual fund charge of 1.5%, they would keep roughly a third. But in 2014, the FCA put a ban on commission payments. This change forced fund managers to create ‘clean’ units or variants of an existing fund with the commission removed, which typically halved the ongoing management charges investors paid to 0.75%. But as fund supermarkets now charge investors separately - and as each have different fee structures - their charges can vary significantly from one investor to the next.

Finding the lowest priced fund supermarket

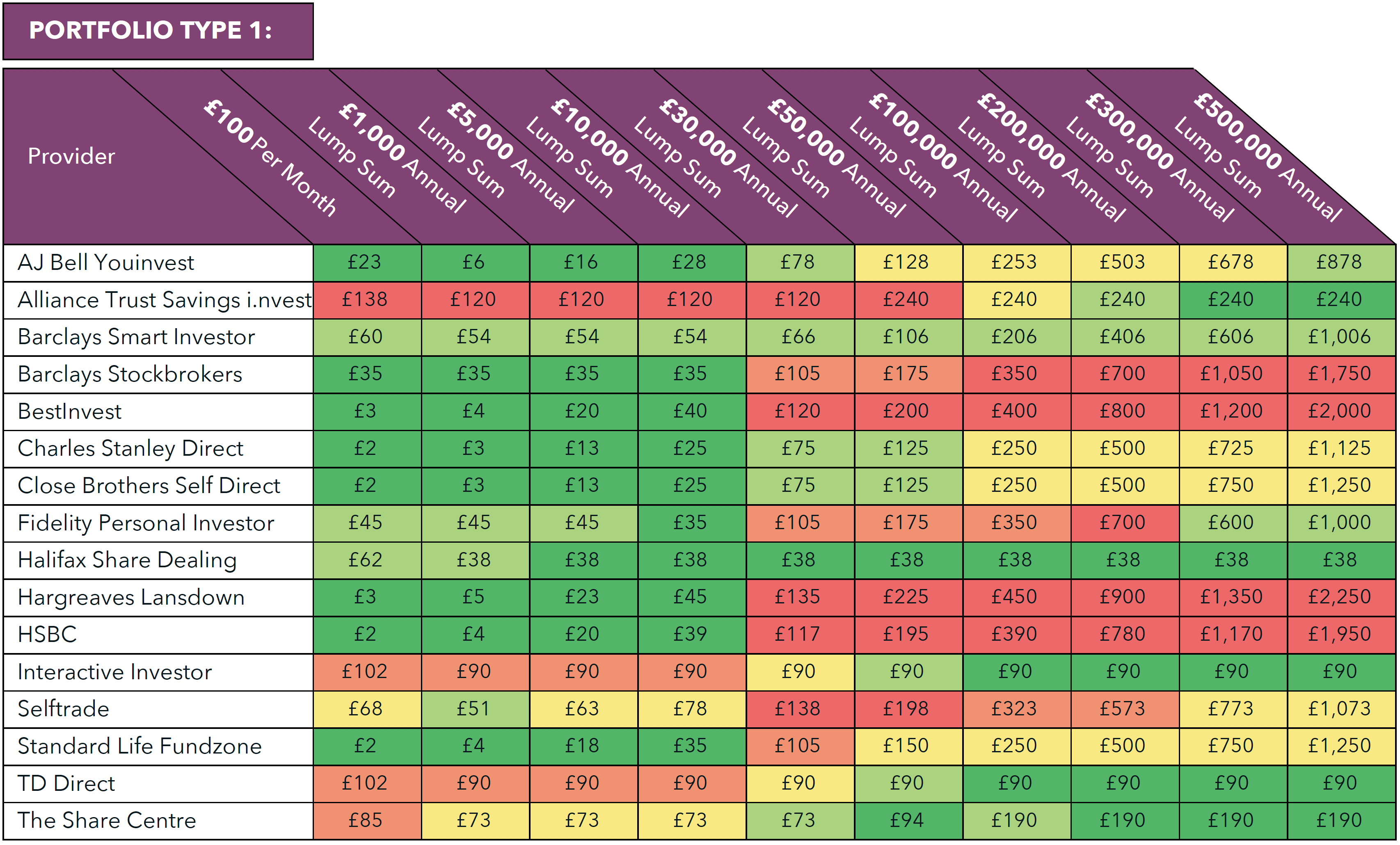

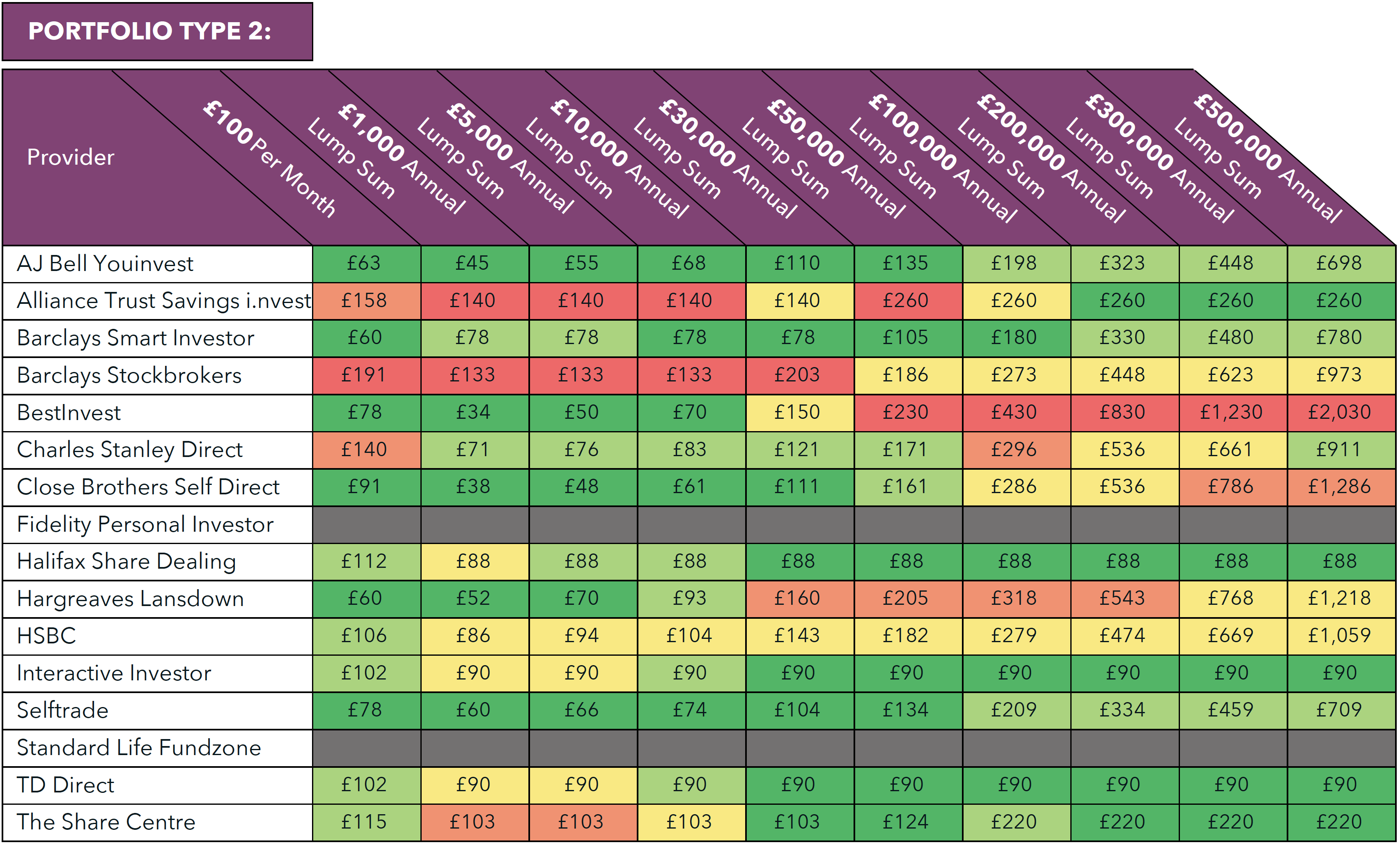

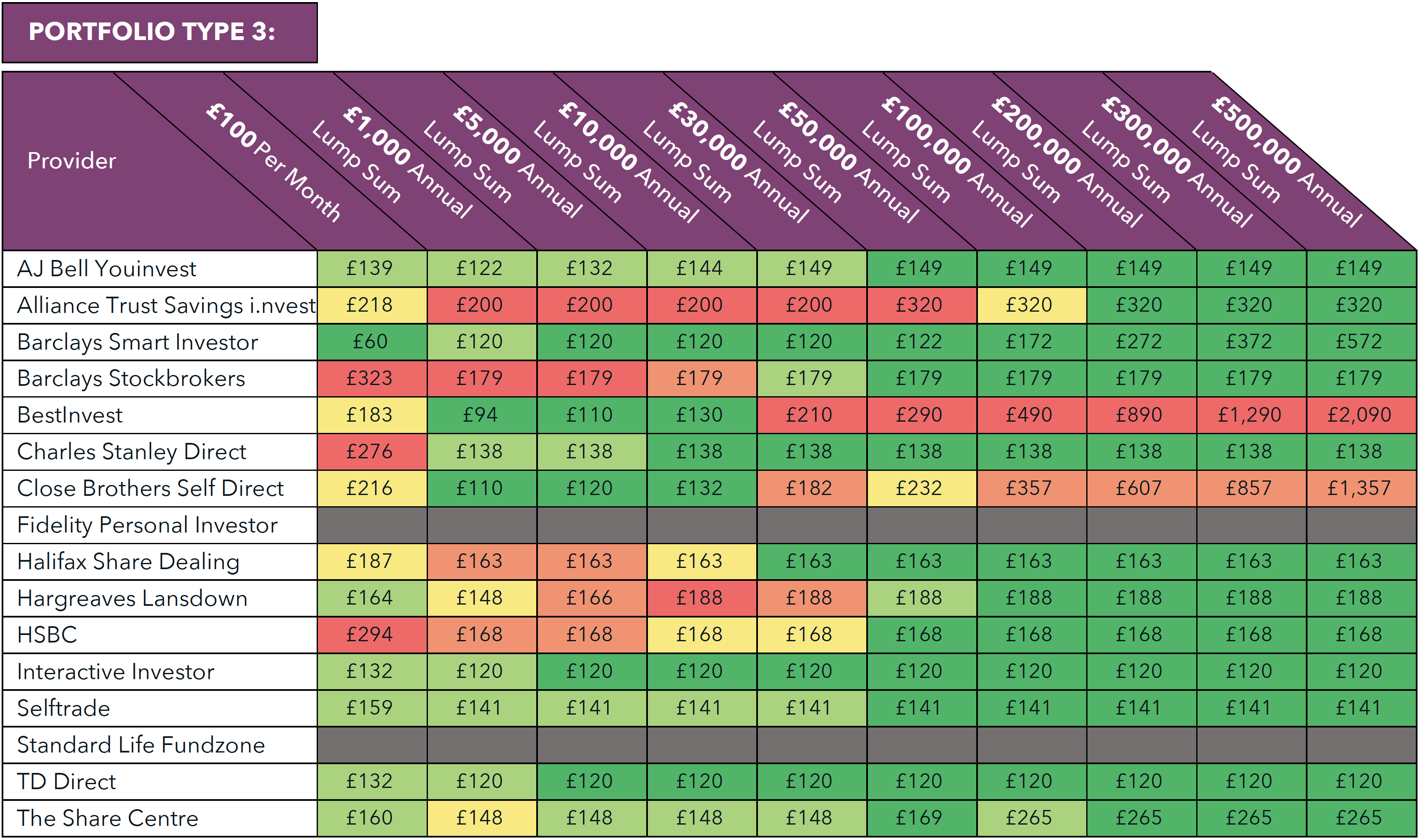

To help provide an example of fund supermarket charges we have tabled the fees 16 different fund supermarkets charge based on 10 different investment amounts across 3 different types of investment portfolio.

In our pricing heat maps we use a colour-coded scale, with the cheapest showing as green and the most expensive as red, shifting towards yellow at the mid-point.

We've looked at three types of portfolio, with each then costed for 10 pot sizes - from the small but growing (£100 invested each month) to the large (lump sum of half a million).

The first portfolio type assumes you've invested entirely in open-ended funds, such as unit trusts, and rarely trade - making one buy and one sell each year. The second portfolio assumes a split between funds and shares in individual companies, with six trades completed a year. The third assumes a portfolio made entirely of shares, and traded 12 times a year - six buys and six sells.

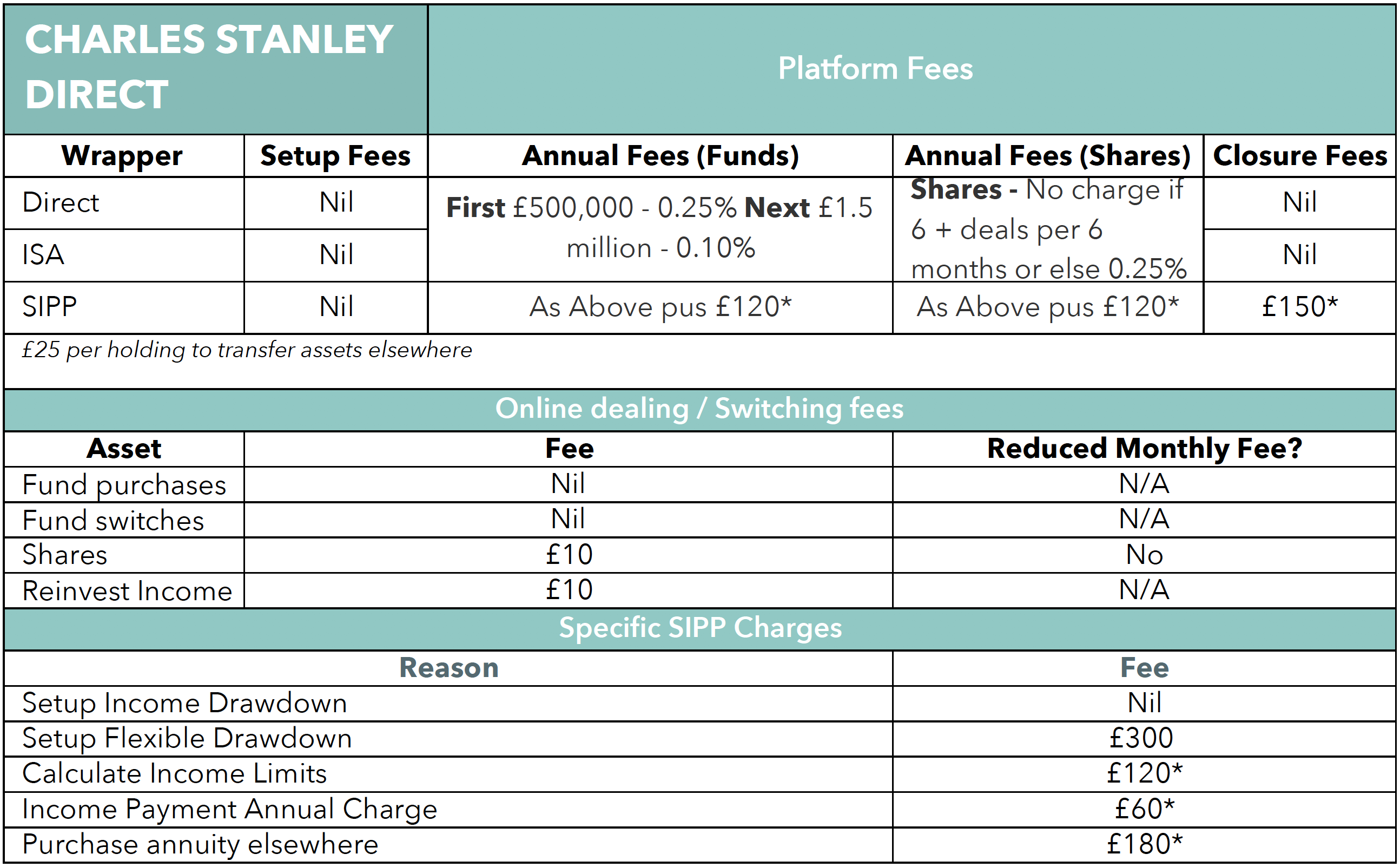

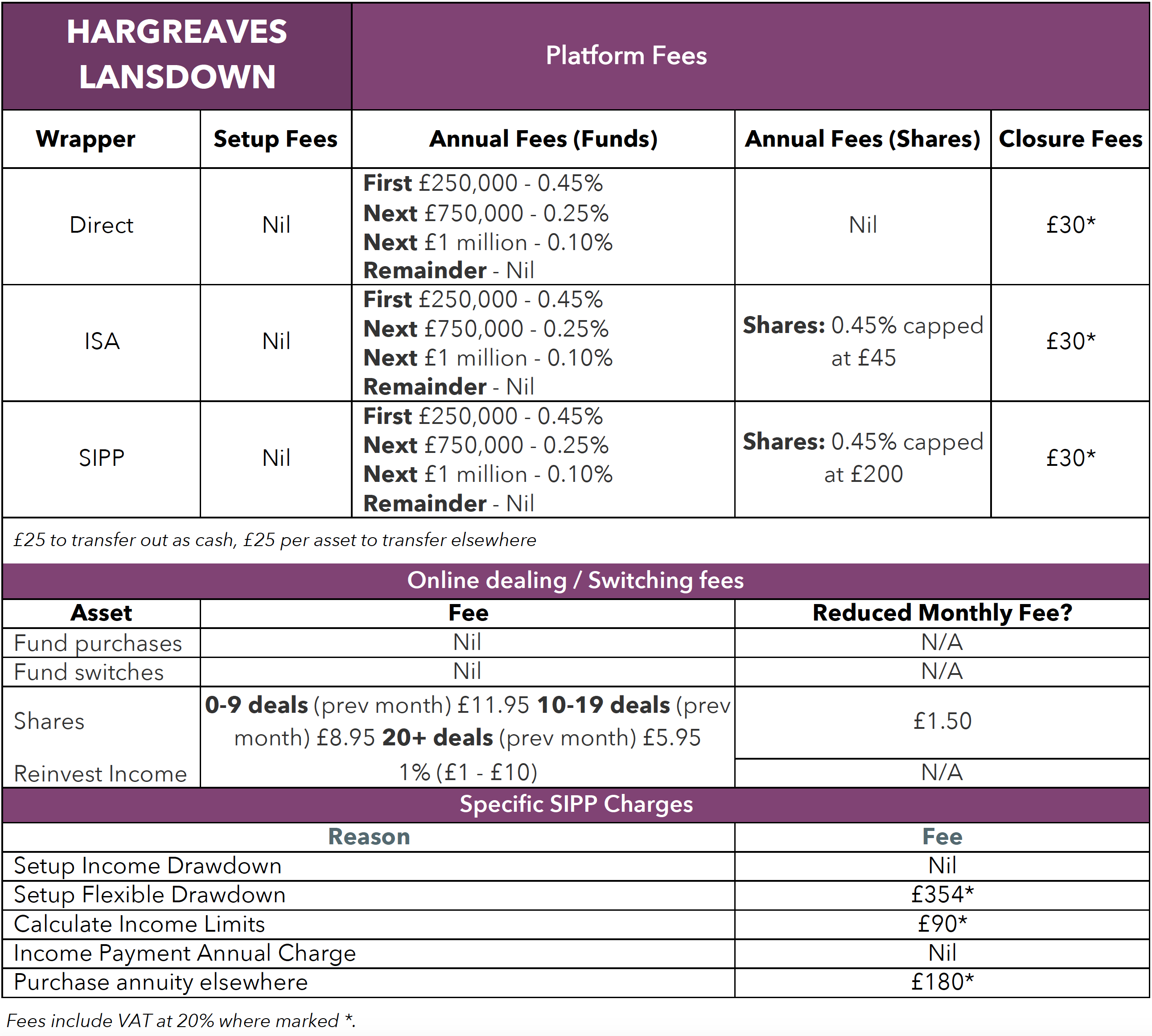

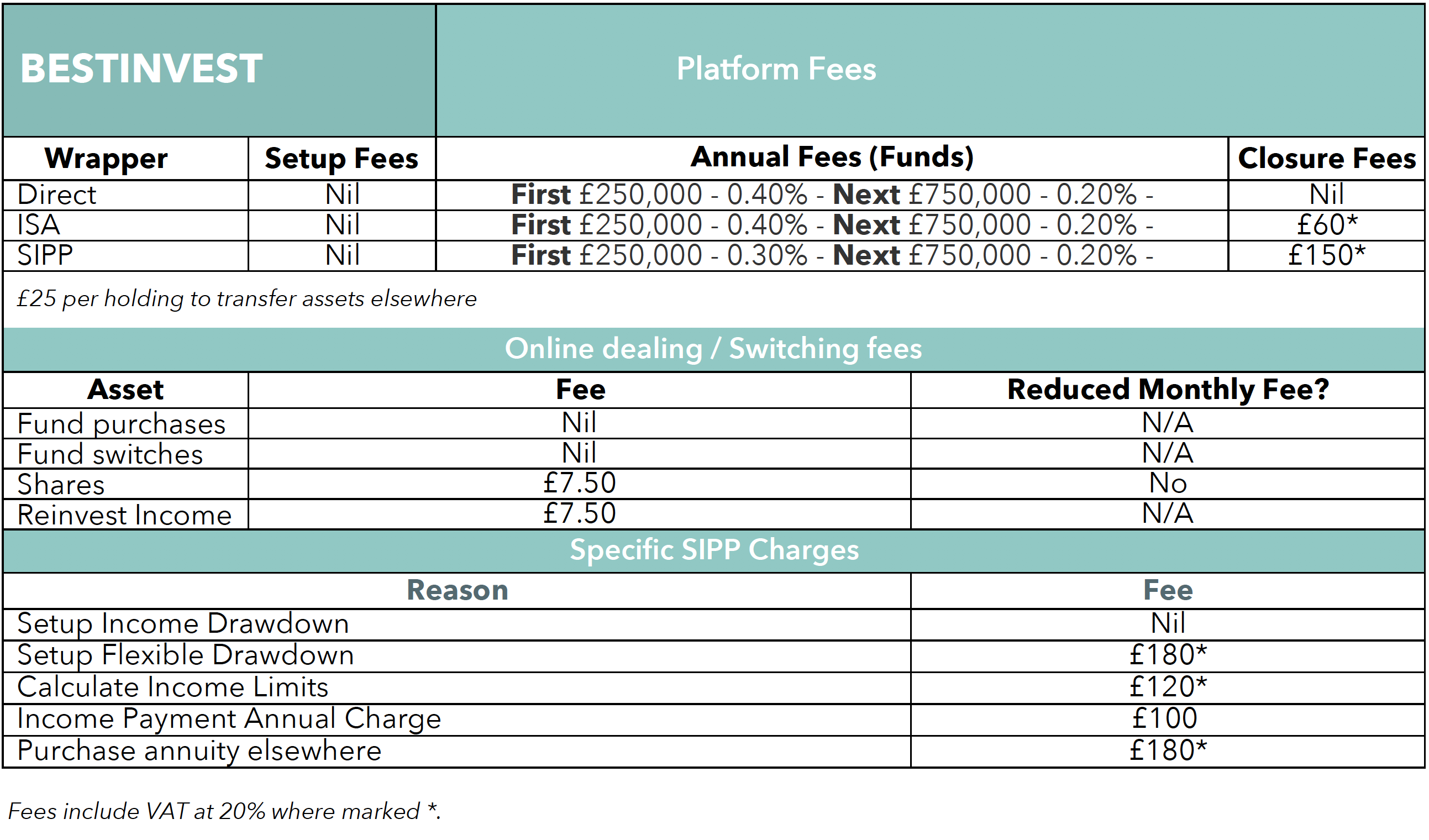

A closer look at the fees for the 4 largest fund supermarkets

Working out cheapest fund supermarket can be complicated, as they don't all charge in the same way and how they charge can differ based on the wrapper used or how you allocate your portfolio, yet despite the complexity of charges and the numerous different fund supermarkets on the market, there are only a few that are popular among DIY investors.

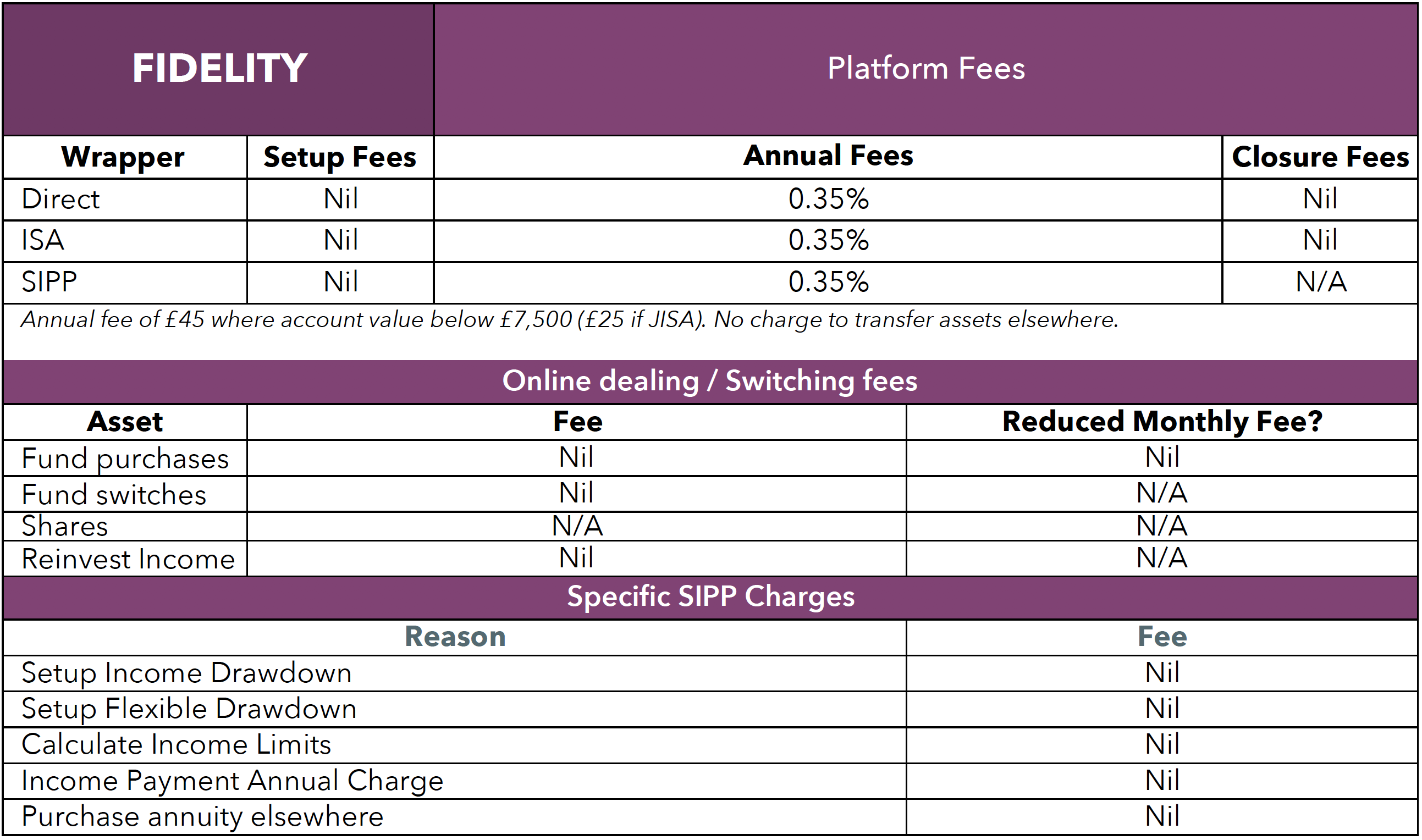

The following tables provide a comprehensive overview of the fees and charges associated with 4 of the biggest fund supermarkets in the UK, Hargreaves Lansdown, Bestinvest, Fidelity and Charles Stanley.

Should cost be the deciding factor when choosing a fund supermarket?

Cost is undoubtedly one of the most important factors for DIY investors when choosing a platform, and it can be easy to get confused by the vast options and platforms available. While cost is important there are other factors to consider when choosing a fund supermarket.

There are platforms out there for everyone. Some platforms – such as Hargreaves Lansdown offer rafts of information on the basics of investment and have lists of recommended funds.

Others, such as AJ Bell Youinvest and Interactive Investor, have much more detailed notes on each recommended fund and are most suited to experienced investors and others offer bonuses and freebies to entice you to sign up.

But ultimately, the platform you pick should come down to how much money you want to invest, how experienced you are at investing and how much it’s going to cost.