In a bid to make ethical investing more transparent online fund platform Interactive Investor, in collaboration with independent experts SRI Services, and data provider Morningstar, have developed a list of 140 ethical investment funds that have been categorised based on their ethical style and the strategy of each fund.

Identifying suitable ethical funds to invest in has traditionally been a difficult task, but this

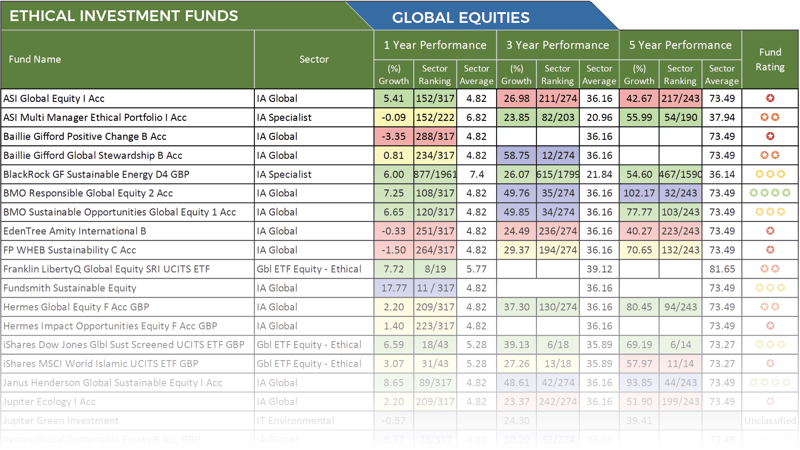

list sheds light on a large selection of ethical focused funds. To add further clarity, we have analysed each of the ethical funds listed for both performance and sector ranking over the recent 1, 3 & 5 years and identified which funds have performed the best and which ethical funds lag behind when compared to same sector competing funds.

The Growth of Ethical Investing

In recent months, millions worldwide have gathered across the world’s major cities to protest for greater climate change awareness and push for widespread reforms in order to help reduce our carbon footprint.

Sustainability is a hot topic with more and more businesses seeing the need to drastically reform their processes and business models in order to better follow ethical practices and become more environmentally sustainable.

There is also a common view that the companies making such changes are also showing their commitment to their long-term survival and essentially implementing measures that will give them a future advantage over competitors who have yet to put an ethically focused strategy in place.

With more companies adopting an ethical approach, fund managers will have more quality companies to invest in and investors will have a wider selection of ethical funds to choose from, making ethical investing more mainstream.

When the UK's first ethical unit trust fund was launched in 1984 it was faced with considerable scepticism from mainstream investors. Today, ethical funds receive much more acceptance and are no longer viewed as a low growth investment that lag behind their non-ethical counterparts. Indeed, in just 10 years assets held in ethical funds have trebled.

Although Ethical investing has become more mainstream there is still uncertainty as to which funds are actually Ethical and to what degree, which has made the challenge of finding the most appropriate ethical fund all the more difficult.

Interactive Investors list of funds goes some way to bring clarity by identifying ethical options and categorising them based on their styles and ethical approach.

3 Styles of Ethical Investing

Each ethical fund in the list is indexed by asset class and placed into one of three key investment styles. The 3 styles are Avoids, Considers and Embraces.

Avoids

Summary Description: Funds that focus on simply excluding companies, sectors or specific business practices.

Pros: Fund managers that screen out unethical companies may give peace of mind to investors who are actively looking to avoid certain sectors.

Cons: There is huge disparity in relation to the range of sectors and companies that are excluded from funds that apply negative screening. Some very ethical funds can exclude over 60% of available investments, while others only avoid 3%. Customers should do further due diligence to ensure any investment option fits with their personal ethical criteria.

Considers

Summary Description: Funds that carefully consider an often wide range of ethical and/or environmental, social and governance (ESG) issues or themes when balancing positive and negative factors.

Pros: Managers who consider ethical issues will often invest in ‘best in sector’ companies that they consider to be operating more sustainably than their peers.

Cons: This is a wide-ranging group covering many different approaches. Each fund manager will consider some ethical criteria as part of their analysis of individual companies, so investors will need to do further research to determine whether a particular fund meets their ethical requirements.

Embraces

Summary Description: Funds that focus on companies delivering positive social and/or environmental outcomes.

Pros: The fund manager’s primary aim is to make a tangible, positive impact on the environment or society. They proactively support & 'encourage' companies either through stock selection, responsible engagement, or an impact focus.

Cons: These managers will choose investments based on their ethical criteria above all else - and financial considerations may be secondary to ethical requirements. This may result in the investment being more volatile and less likely to match the performance of standard indices over time.

How Ethical Are Ethical Funds?

An ethical investment policy that is ideally suited for one person will be inappropriate for another. Interactive Investors list of categorised funds goes some way in helping investors to find funds that best suit their personal aims and opinions.

While some funds avoid oil stocks, others may include them if the company is believed to be transitioning towards focusing on renewable energy. Another example is where environmentally friendly companies need to use certain metals such as cobalt for electric car batteries or silver for solar panels. These minerals are mined - but mining is a sector that is traditionally perceived as controversial.

These conflicts are inherent in the ethical investment world as some fund policies are more pragmatic than others. Some will balance the pros and cons of different business strategies and focus on themes that can help support growth and encourage progress, whereas others have more binary in/out policies. Many also blend all of these elements, particularly in the 'considers' category.

The list of funds in this report have been compiled by fund platform Interactive Investor who used their (ACE) Avoids, Considers, Embraces screening process to identify the funds available on their platform that have an ethical strategy. Although the 3 stages of this process help to segment the funds there is still a wide variation between funds within each of these stages.

Download the full report here >>

Further Screening For Ethical Funds

To help add further clarity the list of funds features 2 additional categories that have been produced by independent sustainable and responsible investment specialists SRI Services, and data provider Morningstar.

Fund EcoMarket (FEM) Category

Quality information relating the ethical aspects of investments is difficult to find but the Fund EcoMarket category helps investors to understand and compare the many different ‘sustainable, responsible and ethical investment’ (SRI) fund options. The Fund EcoMarket tool categorises ethical investments based on the following 8 themes:

Ethically Balanced funds combine a wide range of, sometimes complex, positive and negative ethical screening policies as part of their investment strategies and may apply ‘best in sector’ strategies – which means they may invest in most sectors.

Negative Ethical funds use clear, sometimes strict and extensive, negative ‘ethical’ screens as their core strategy. They may avoid a significant number of areas on ethical grounds (eg armaments, tobacco, gambling) or may focus on avoiding a smaller number of areas.

Faith-Based investments invest in line with specific religious principles (eg Shariah Law)

Funds which focus on ‘thematic’ strategies, often alongside screening strategies:

Sustainability Themed funds focus on sustainability related issues and opportunities as part of their investment strategy, often alongside ethical criteria. Their focus is often around longer term societal and environmental trends.

Environmental Themed funds significantly integrate environmental issues into their investment strategies, sometimes alongside ethical avoidance criteria. Their focus is often around longer term environmental and resource related issues.

Social Themed funds focus on ‘people issues’ (such as employment and basic necessities of life). Social themed fund managers focus significantly on societal benefits when analysing companies for investment.

Strategies that may apply to an individual fund or across all fund manager assets:

ESG Plus can be a ‘fund theme’ or a ‘corporate’ (fund management company-wide) strategy. Fund managers with strong ESG strategies consider ‘Environmental, Social and Governance’ risks (and opportunities) as part of their investment research process. Applied on its own ESG does not normally indicate that there is additional SRI activity (screening or stewardship/responsible ownership), however, the Fund EcoMarket ‘ESG Plus’ listing indicates that that the fund has a strong ESG strategy PLUS addition SRI/ethical/stewardship related activity.

Responsible Ownership is a ‘corporate-level’ strategy – applying across all or most of a fund manager’s assets. Fund managers with Responsible Ownership or Stewardship strategies work with the companies they invest in to encourage better environmental, social and governance practices – when change is in the best interest of (all) longer-term investors. (This strategy often forms a significant part of SRI-screened and themed fund activity.)

Morningstar Sustainable Fund Type

To add further clarity, data provider Morningstar, has identified investments that, by prospectus, either state that they use ESG criteria as a key part of their security-selection process or indicate that they pursue a sustainability-related theme or seek measurable positive impact alongside financial return. These 5 categories are:

ESG Focus: Funds committed to using specific ESG (Environmental Social Governance) criteria in security selection. It is common for ESG Focus funds to use exclusionary screens. These typically avoid investing in companies involved in “sin” sectors such as tobacco, gambling, and pornography, as well as weapons and companies that violate international norms and conventions such as the UN Global Compact principles.

Impact: Funds aiming to deliver positive and measurable social or environmental impact alongside financial returns. Impact funds are often focused on specific themes, such as low carbon, gender equality, or green bonds. Some use the 17 UN Sustainable Development Goals as a framework for evaluating the overall impact of their portfolios.

Sustainable Sector: Funds focused on activities that participate in the green economy. Offerings that focus on “green economy” industries like renewable energy, energy efficiency, environmental services, water infrastructure, sustainable food production, and green real estate are grouped as Sustainable Sector funds.

Shariah Focus: Funds focused on compliance with Islamic law for investment practices. Under Islamic law, there are rules that govern the payment of interest and fees, etc.

Ethical Funds Can Deliver Better Returns

Ethical investing has been notoriously difficult to assess but Interactive investors long list of funds has helped investors to gain a thorough understanding of 140 funds with an ethical approach. The funds listed have varying ethical strategies which investors can assess using the criteria as defined by the interactive investors, SRI services, and Morningstar’s ethical categories.

Each of these Ethical funds covers a wide range of asset classes and the majority are classified within specific sectors. In order to gauge how competitive they are, we completed a comprehensive performance analysis of each fund.

For each featured fund we analysed their recent 1, 3 & 5-year performance and provide each with a rating between 1 and 5 stars based on how their performance ranked when compared to their competitors within the same sector.

Our analysis identified that almost half of the funds analysed had disappointing performance by consistently ranking within the bottom half of their sectors. These funds, although ethical, have been unable to match the performance of the majority of other funds in their sector - the majority of which have no ethical mandate. These findings support the perception that ethical funds lag behind their rivals when it comes to performance. But to counter this perception our analysis also identified a proportion of ethical funds that have managed to consistently outperform at least three-quarters of competing funds within the same sectors over the past 1, 3 & 5 years. These top performers show that ethical funds can not only compete with funds with no ethical mandate, but they can consistently outperform them.

With more companies and sectors adopting an ethical strategy, the greater the quality of opportunities available to ethical fund managers. For investors, investing in ethical funds no longer means they have to sacrifice growth as there are now options available that not only meets ethical requirements but consistently deliver returns above and beyond their competitors.